How much money could I get in a settlement agreement?

then a reasonable settlement agreement payment would be between 1 and 4 months’ salary plus notice pay. If you have evidence of discrimination or whistleblowing, you may be able to get more, and the 2 years’ service requirement doesn’t apply.

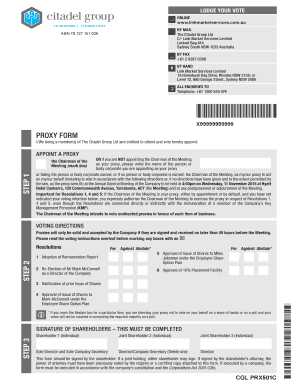

What is a Master Settlement?

The Master Settlement Agreement (MSA) between the states and the major U.S. tobacco companies will direct a lot of money to the states, but it says nothing about how that money should be spent. Accordingly, the agreement will not, by itself, substantially reduce tobacco use unless the state legislatures invest a

What is "Master Settlement payments"?

Savvy investors have been taking advantage of a type of investment that we call " Master Settlement Payments ," which can result in tax-free payments of more than $2,300 every single month. But what are "Master Settlement Payments"? They are the indirect result of legislation against Big Tobacco companies back in November 1998.

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

What is the purpose of the smoking ban?

Prohibits the industry from making any material misrepresentations regarding the health consequences of smoking.

What is the ban on cartoons?

Limits tobacco companies to only one brand name sponsorship per year (after current contracts expire or after three years’ whichever comes first). Prohibits brand name sponsorship of events with a significant youth audience.

How long does a tobacco company have to maintain a website?

Requires tobacco companies to maintain for ten years, at their expense, a Website which includes all documents produced in state and other smoking and health related lawsuits.

What happens after state specific finality?

After state specific finality, tobacco companies will be prohibited from opposing proposed state or local laws or administrative rules which are intended to limit youth access to and consumption of tobacco products.

How long does it take to remove transit ads?

Bans transit advertising of tobacco products. Tobacco billboards and transit ads must be removed within 150 days after the Master Settlement Agreement Execution Date. Allows states to substitute for the duration of billboard lease periods, alternative advertising which discourages youth smoking.

What is a prohibition on lobbying?

Prohibits lobbyists from supporting or opposing state, federal, or local laws or actions without authorization of the companies.

How long after master settlement agreement is it required to stop smoking?

Beginning 180 days after the Master Settlement Agreement Execution Date, companies must: Develop and regularly communicate corporate principles that commit to complying with the Master Settlement Agreement and reducing youth smoking.

What is a Master Settlement Agreement?

A master settlement agreement is a legal contract that helps to resolve multiple disputes among the parties by coming to a mutual agreement on the terms. These can be used in civil law matters, where one party is litigating the same issue in multiple jurisdictions.

Common Sections in Master Settlement Agreements

Below is a list of common sections included in Master Settlement Agreements. These sections are linked to the below sample agreement for you to explore.

Who Helps With Master Settlement Agreements?

Lawyers with backgrounds working on master settlement agreements work with clients to help. Do you need help with an master settlement agreement?

Master Settlement Agreement Fact Sheet

The Master Settlement Agreement (MSA) imposes major restrictions on tobacco company marketing practices and prohibits advertising aimed at youth. The MSA restricts the participating tobacco companies in the following ways:

Smokeless Tobacco Master Settlement Agreement

The Smokeless Master Settlement Agreement details the financial settlement and restrictions smokeless tobacco products, including chewing tobacco.

What were the new limits on cigarettes?

New limits were created for the advertising, marketing and promotion of cigarettes. Tobacco advertising that targets people younger than age 18 was prohibited. Cartoons in cigarette advertising were eliminated. Outdoor, billboard and public transit advertising of cigarettes was eliminated.

What was the 1998 Master Settlement Agreement?

The 1998 Master Settlement Agreement between the major tobacco companies, 46 U.S. states, the District of Columbia and five U.S. territories transformed tobacco control. In the largest civil litigation settlement in U.S. history, the states and territories scored a victory that resulted in the tobacco companies paying the states ...

When did the MSA start?

The Attorneys General of the 46 states, the District of Columbia and five U.S. territories signed the MSA with the four largest U.S. tobacco companies in 1998.

Who was sued by the MSA?

territories in the mid-1990s against major U.S. cigarette manufacturers Philip Morris, R.J. Reynolds, Brown & Williamson and Lorillard, plus the tobacco industry's trade associations.

Can cigarettes be used on merchandise?

Cigarette brand names could no longer be used on merchandise. Many millions of tobacco company internal documents were made available to the public. Since the MSA was signed in November 1998, about 40 other tobacco companies have signed onto the agreement and are also bound by its terms.

Does MSA include individual claims?

This did not include individual claims their citizens may have.

What is a prohibition on advertising?

Prohibits the participating manufacturers from engaging in advertising, marketing, and promotional activities that target minors.

How many sponsorships can you have in a year?

Limits manufacturers to only one brand-name sponsorship of an event per year, and prohibits brand name sponsorship of major team sports (baseball, basketball, football, hockey, and soccer), concerts, events with a significant youth audience, and events where any of the paid participants or contestants are underage.

What is a ban on apparel?

Bans the distribution and sale of apparel and merchandise with brand-name logos ( caps, T-shirts, etc.).

When did the Master Settlement Agreement come into effect?

In November 1998, the attorneys general of 51 U.S. states and territories entered into a landmark settlement as a result of this litigation. Among many other things, and subject to certain exceptions, the Master Settlement Agreement:

Who enforces the Master Settlement Agreement?

The Attorney General’s Office and the attorneys general of other states are taking steps to enforce the terms of the Master Settlement Agreement and to encourage other tobacco companies to join in the settlement.

What is the NAAG Center for Tobacco and Public Health?

The NAAG Center for Tobacco and Public Health works with the Settling States of the MSA to preserve and enforce the MSA’s monetary and public-health mandates, including: Representing, advising, and supporting the Settling States in MSA-related legal matters , including litigation and arbitrations.

How does MSA work?

The MSA’s purpose is to reduce smoking in the U.S., especially in youth, which is achieved through: 1 Raising the cost of cigarettes by imposing payment obligations on the tobacco companies party to the MSA. 2 Restricting tobacco advertising, marketing, and promotions, including:#N#Prohibiting tobacco companies from taking any action to target youth in the advertising, promotion or marketing of tobacco products.#N#Banning the use of cartoons in advertising, promotions, packaging, or labeling of tobacco products.#N#Prohibiting tobacco companies from distributing merchandise bearing the brand name of tobacco products.#N#Banning payments to promote tobacco products in media, such as movies, televisions shows, theater, music, and video games.#N#Prohibiting tobacco brand name sponsorship of events with a significant youth audience or team sports. 3 Eliminating tobacco company practices that obscure tobacco’s health risks. 4 Providing money for the Settling States that states may choose to use to fund smoking prevention programs. 5 Establishing and funding the Truth Initiative, an organization “dedicated to achieving a culture where all youth and young adults reject tobacco.”

What law gave the FDA the power to regulate tobacco products?

In 2009, the Family Smoking Prevention and Tobacco Control Act gave the FDA the power to regulate tobacco products. State attorneys general have been active participants in helping the FDA shape its regulatory authority.

How does the MSA affect smoking?

The MSA continues to have a profound effect on smoking in America, particularly among youth. Between 1998 and 2019 , U.S. cigarette consumption dropped by more than 50%. During that same time period, regular smoking by high schoolers dropped from its near peak of 36.4% in 1997 to a low 6.0% in 2019. As advocates for the public interest, state attorneys general are actively and successfully continuing to enforce the provisions of the MSA to reduce tobacco use and protect consumers.

What is the prohibition on tobacco companies?

Prohibiting tobacco companies from taking any action to target youth in the advertising, promotion or marketing of tobacco products.

What is the purpose of the MSA?

The MSA’s purpose is to reduce smoking in the U.S., especially in youth , which is achieved through: Raising the cost of cigarettes by imposing payment obligations on the tobacco companies party to the MSA.

How many tobacco companies have settled under the MSA?

Eventually, more than 45 tobacco companies settled with the Settling States under the MSA. Although Florida, Minnesota, Mississippi, and Texas are not signatories to the MSA, they have their own individual tobacco settlements, which occurred prior to the MSA.

What is the purpose of Section VII of the MSA?

A: Under Section VII of the MSA, each Settling State may bring an action to enforce the Agreement or the Consent Decree (the settlement contained in a court order) with respect to disputes or alleged breaches within its territory. The court that entered a Settling State’s Consent Decree has exclusive jurisdiction to implement and enforce the MSA with respect to that state. Section VIII(a) of the MSA places responsibility on the National Association of Attorneys General (NAAG) to coordinate and facilitate the MSA’s implementation and enforcement on behalf of the attorneys general of the Settling States . NAAG carries out this mandate through an attorney general-level Tobacco Committee and an Enforcement Working Group, which consists of attorney general office staff working on tobacco issues, and the NAAG Tobacco Project, which is comprised of staff attorneys within NAAG who support state enforcement efforts. (The NAAG Tobacco Project is now known as the NAAG Center for Tobacco and Public Health.) Enforcement typically begins when a state attorney general office or NAAG observes a potential violation of the MSA, or a member of the public or a public organization complains about a Participating Manufacturer’s marketing practices to a state attorney general or NAAG. If the matter is not resolved through negotiation, one or more Settling States may decide to bring an enforcement action against the Participating Manufacturer.

What is the MSA?

] The MSA created the American Legacy Foundation (now known as the Truth Initiative), a research and educational organization that focuses its efforts on preventing teen smoking and encouraging smokers to quit. The foundation is responsible for “The Truth” advertisement campaign,30 which has had success in reducing youth smoking.31

What is MSA settlement?

A: The MSA set up initial, annual, and “strategic contribution” payments from Participating Manufacturers to the Settling States. Each year, an independent auditor calculates the settlement payment to be made by each Participating Manufacturer and the amount to be received by each Settling State.18 If parties disagree with the auditor’s calculations, the matter is submitted to binding arbitration by three neutral arbitrators who must be former federal judges.19

What is MSA in manufacturing?

A: The MSA is a settlement agreement between the Settling States, the Original Participating Manufacturers, and the Subsequent Participating Manufacturers.13 The number of Participating Manufacturers remains fluid as, over the years, some additional manufacturers have settled with the states and others have gone out of business. As of October 2018, there are more than 50 Participating Manufacturers who are bound by the terms of the MSA.14

Does the MSA limit how the settlement states use their funds?

A: As noted above, the MSA does not limit how the Settling States may use their funds. Some state and local governments have securitized their future MSA payments in which they issue a bond backed by future payments. In other words, “By securitizing … the state trades a potentially risky future stream of payments for a certain lump-sum payment,” often to generate short-term cash to cover budget shortfalls.58 Securing bonds has allowed state governments to finance capital improvements, fund health-care projects, and receive an upfront lump sum of cash rather than waiting each year for the MSA payments.59 By 2010, eighteen states, the District of Columbia, and three U.S. territories securitized some or all of their revenue entitlements from the MSA payment schedule into bonds.60 The issued bonds totaled $40 billion and are backed by expected future MSA payments.61

What is a civil claim?

(n) "Claims" means any and all manner of civil (i.e., non-criminal): claims, demands,actions, suits, causes of action, damages (whenever incurred), liabilities of any natureincluding civil penalties and punitive damages, as well as costs, expenses and attorneys'fees (except as to the Original Participating Manufacturers' obligations under sectionXVII), known or unknown, suspected or unsuspected, accrued or unaccrued, whetherlegal, equitable, or statutory.

How long after MSA execution date can you make a payment?

Manufacturer may, beginning 30 days after the MSA Execution Date, make, orcause to be made, any payment or other consideration to any other person or entityto use, display, make reference to or use as a prop any Tobacco Product, TobaccoProduct package, advertisement for a Tobacco Product, or any other item bearing

What is the effect of current or future law?

If any current or future law includes obligations orprohibitions applying to Tobacco Product Manufacturers related to any of theprovisions of this Agreement, each Participating Manufacturer shall comply withthis Agreement unless compliance with this Agreement would violate such law.

How many states have filed injunctive and equitable relief?

WHEREAS, more than 40 States have commenced litigation asserting various claims formonetary, equitable and injunctive relief against certain tobacco product manufacturers andothers as defendants, and the States that have not filed suit can potentially assert similar claims;

What happens after the MSA execution date?

After the MSA Execution Date, the Original Participating Manufacturers and theTobacco-Related Organizations will support an application for the dissolution of anyprotective orders entered in each Settling State's lawsuit identified in Exhibit D withrespect only to those documents, indices and privilege logs that have been produced as ofthe MSA Execution Date to such Settling State and (1) as to which defendants have madeno claim, or have withdrawn any claim, of attorney-client privilege, attorney work-product protection, common interest/joint defense privilege (collectively, "privilege"),trade-secret protection, or confidential or proprietary business information; and (2) thatare not inappropriate for public disclosure because of personal privacy interests orcontractual rights of third parties that may not be abrogated by the Original ParticipatingManufacturers or the Tobacco-Related Organizations.

Can a participant manufacturer provide a coupon after the MSA execution date?

after the MSA Execution Date, no Participating Manufacturer may provide orcause to be provided to any person without sufficient proof that such person is anAdult any item in exchange for the purchase of Tobacco Products, or thefurnishing of credits, proofs-of-purchase, or coupons with respect to such apurchase. For purposes of the preceding sentence only, (1) a driver's license orother government-issued identification (or legible photocopy thereof), the validityof which is certified by the person to whom the item is provided, shall by itself bedeemed to be a sufficient form of proof of age; and (2) in the case of itemsprovided (or to be redeemed) at retail establishments, a Participating Manufacturershall be entitled to rely on verification of proof of age by the retailer, where suchretailer is required to obtain verification under applicable federal, state or locallaw.

Can a manufacturer enter into a contract with a baseball team?

Manufacturer may enter into any agreement pursuant to which payment is made (or other consideration is provided) by such Participating Manufacturer to anyfootball, basketball, baseball, soccer or hockey league (or any team involved inany such league) in exchange for use of a Brand Name.

How do politicians take advantage of the tobacco industry?

Besides politicians’ quintessential habit of spending money on things it was not meant for, there is a more insidious way that they have taken advantage of the never-ending stream of money from the tobacco companies. This is called securitization, and it occurs when a cash-strapped state borrows against promised future MSA payments so that it can get the money immediately. The state issues bonds backed up by the promise of future payments. The term “tobacco bonds” is a reference to this irresponsible practice. The buyers of bonds (the most prominent of which are powerful financial institutions) make a handsome long-term profit. State governments and their taxpayers get a raw deal. As the Campaign for Tobacco-Free Kids warned as early as 2002, states that securitize their tobacco funds get much smaller total payments, “usually for about 40 cents on the dollar or less,” than they would if they let the future revenue come in as planned. Borrowing against future payments in exchange for less money today leads to fewer resources for public health and more money for Wall Street. Yet politicians openly turn to the MSA revenue to cover for their irresponsible spending. For example, in November 2017, as Pennsylvania tried to balance its budget shortfall that had been caused by a refusal to eliminate wasteful spending, securitizing tobacco settlement revenue was the preferred course of all parties. Unfortunately, even some otherwise fiscally responsible politicians like to securitize tobacco revenue, as they consider it a better option than raising taxes.

What was the master settlement agreement between the tobacco companies and the states?

In November 1998, forty-six US states, along with the District of Columbia and five US territories, and the major tobacco companies entered into a contract of an extraordinary nature. (The other four states, Florida, Minnesota, Mississippi, and Texas, had entered similar agreements on their own beginning the year before.) The agreement, known as the Master Settlement Agreement (MSA), represented the culmination of a decades-long argument between the tobacco companies and state governments. After the dangers of smoking became known, the tobacco industry had engaged in extensive efforts to somehow stay in business, deflect and defeat lawsuits, and minimize negative attention. Public healthcare systems—and most of the healthcare in this country is taxpayer-funded or subsidized—had seen an influx of patients with smoking-related diseases, and state governments began filing lawsuits against the tobacco companies, claiming they wanted money to help cover smoking-related healthcare costs. The tobacco companies had lots of money but were nervous about the states’ potential to sue them out of business. So, they decided to talk. The result was the MSA.

What is the Tobacco Master Settlement Agreement?

The Tobacco Master Settlement Agreement simultaneously represents one of the most egregious examples of a government shakedown of private industry and offers a case study of the problems that stem from big government and big business scratching each other’s backs. It has turned the largest tobacco companies into an indispensable cash cow for politicians and bureaucrats, enabled irresponsible state spending, and, amazingly, has resulted in less money for public health and tobacco control while propping up a declining industry. As is the case with discriminatory tobacco taxes, the incentives of the MSA are perverse: the more people smoke, the more money the government gets to spend on whatever it wants. The biggest losers are those with tobacco-related diseases and smokers trying to quit.

How does the amount paid by tobacco companies affect the number of cigarettes sold?

The amount paid by the tobacco companies would directly correlate to the number of cigarettes sold—the more cigarettes sold, the more money the states would get. In exchange for their money, the tobacco companies would not be sued by state and local governments seeking recovery of costs associated with tobacco use.

How much money did tobacco companies pay to the states?

Nearly twenty years later, the tobacco companies have paid a staggering $119.5 billion to the states and territories participating in the MSA and another $25.4 billion to the four states with their own agreements. What have the states done with this huge amount of money?

What is tobacco bonds?

The state issues bonds backed up by the promise of future payments. The term “tobacco bonds” is a reference to this irresponsible practice. The buyers of bonds (the most prominent of which are powerful financial institutions) make a handsome long-term profit. State governments and their taxpayers get a raw deal.

What are the incentives of the MSA?

As is the case with discriminatory tobacco taxes, the incentives of the MSA are perverse: the more people smoke, the more money the government gets to spend on whatever it wants. The biggest losers are those with tobacco-related diseases and smokers trying to quit.