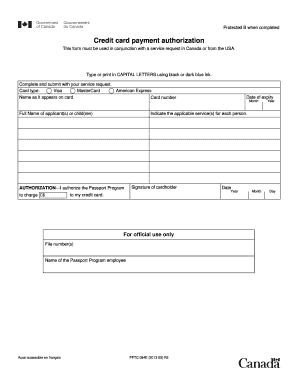

You’re able to make the payment card settlement claim yourself by filling out appropriate forms. Some lawyers and business consultants offer to handle claims paperwork on a business owners’ behalf, but keep in mind that they often do so in exchange for a portion of your class action settlement proceeds.

Should I accept a credit card settlement?

You should, however, avoid debt settlement companies. To get the ball rolling, you (or your attorney) should contact the creditor and make an offer to settle the debt. A credit card company might accept a settlement if you're very delinquent on your payments.

What is the credit card settlement process?

- Drop in credit score (up to 100 points)

- You need enough cash on hand for a settlement payment

- Only available for unsecured debt

- You pay tax on the forgiven portion of debt

- Risk of lawsuit

- Creditors might not settle

- Settlement stays on credit history for 7 years

- Calls and notices from collections increase (during process)

Are credit card settlements good?

Settlements generally provide you with a cheaper way of paying the creditor an amount that will make the credit disappear, by closing the credit card or loan account. But having a settled status against a credit card or a loan account has a very negative impact on your credit score.

Can I negotiate credit card settlement by stopping payments?

Pursuing debt settlement is a last resort because it involves stopping payments and working with a firm that holds that money in escrow while negotiating with your creditors to reach a settlement, which can take up to four years. Withholding payments from your creditors can seriously damage your credit score.

What is payment card settlement?

One option may be a credit card settlement, which is when your credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount.

What is MC settlement?

The settlement is the result of a class action lawsuit against Visa and Mastercard. Under its terms, Visa and Mastercard will pay between $5.54 and $6.24 billion dollars to businesses that accepted Visa and Mastercard between 2004 and 2019.

How does Visa settlement work?

0:201:27Visa Direct - Merchant Settlement - YouTubeYouTubeStart of suggested clipEnd of suggested clipWith no need for bank routing or account numbers while traditional methods can take days or weeks toMoreWith no need for bank routing or account numbers while traditional methods can take days or weeks to process visa Direct enables real-time payments 24/7 even on nights weekends.

How much will I get from Bank of America settlement?

What does the Settlement provide? Bank of America has agreed to establish a Settlement Fund of $27.5 million from which Settlement Class Members will receive payments or Account credits. The amount of such payments or Account credits cannot be determined at this time.

What was the outcome of the 2013 class action lawsuit against Visa and Mastercard?

In December 2013, U.S. District Court Judge John Gleeson approved a settlement in the case that amounted to $7.25 billion. The settlement lowers interchange fees for merchants and also protects credit card companies from being sued over the issue again in the future. That settlement was reversed.

What activity occurs during the settlement step of the payment process?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

How do settlement accounts work?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

How do you calculate net settlement?

In banking, net settlement is simply the sum of the day's credits and debits.

What is the difference between clearing and settlement?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

Where is my Bank of America settlement check?

Class members can expect settlement awards to be received by April 30, 2022. To view your check status, click here. Questions? Contact the Settlement Administrator at 1-855-654-0890.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

What happened to Bank of America class action lawsuit?

Update: Bank of America agreed to pay $8 million to end class action claims it hit customers with multiple fees on the same checks in violation of their account agreements. Plaintiff Steven Checchia filed a motion June 9 in a Pennsylvania federal court, asking a judge to grant approval to the deal.

How can I get $400 on Facebook?

You must have filed a claim form by November 23, 2020 to receive a payout. If you do not remember whether you filed, or if you think there has been a mistake, you can contact one of the following: Settlement Administrator: 1-844-799-2417. Edelson PC, lawyer appointment to the case: 1-866-354-3015.

What does MSC mean in legal terms?

The purpose of a Mandatory Settlement Conference (or “MSC”) is to encourage parties in a divorce, legal separation or nullity case to settle their matter in whole or in part. Accordingly, all parties must attend this court appearance.

What happens at a MSC hearing?

A MSC is a meeting of the parties as part of a case resolution plan. The purpose of the MSC is for the parties to discuss the disputed issues and facts of the case in an effort to resolve their matter by agreement.

What happens after mandatory settlement conference?

If a settlement is reached, the settlement documents are prepared, signed by all parties, and thereafter submitted to a judge for approval. The judge will then review the settlement to determine whether it is fair and reasonable. If so, the judge will then issue an Award and/or Order approving the settlement.

What is interchange fee?

Interchange fees typically account for the greatest part of the fees paid by merchants for accepting Visa and Mastercard cards. Visa and Mastercard set interchange fee rates for different kinds of transactions and publish them on their websites, usually twice a year. Back to Top.

What happens if you don't exclude yourself from the settlement?

If you did not exclude yourself from the Rule 23 (b) (3) Settlement Class, you cannot be part of any other lawsuit against Defendants and other released parties listed in the Rule 23 (b) (3) Class Settlement Agreement for released conduct. You will be bound by the Rule 23 (b) (3) Settlement Class Release, except that as to the declaratory and injunctive relief claims asserted in the pending proposed Rule 23 (b) (2) class action captioned Barry’s Cut Rate Stores, Inc., et. al. v. Visa, Inc., et al., MDL No. 1720, Docket No. 05-md-01720-MKB-JO, you will continue to have all rights pursuant to Rule 23 of the Federal Rules of Civil Procedure which you have as a named representative plaintiff or absent class member in that action, except the right to initiate a new separate action before five (5) years following the court’s approval of the settlement and the exhaustion of all appeals. The July 23, 2019 deadline for requesting exclusion from the Rule 23 (b) (3) Settlement has now passed.

When will the settlement fund be paid?

The amount paid from the settlement fund will be based on your actual or estimated interchange fees attributable to Visa and Mastercard card transactions (between you and your customers) from January 1, 2004 through January 25, 2019.

What is the hearing about in the settlement?

The hearing was about whether or not the settlement is fair, adequate, and reasonable.

What is class action?

In a class action, people or businesses sue not only for themselves, but also on behalf of other people or businesses with similar legal claims and interests. Together all of these people or businesses with similar claims and interests form a class, and are class members.

How to contact Judge Brodie?

1-800-625-6440. 1-800-625-6440 - toll-free. If you do not get a Claim Form in the mail or by email, you may download one at this website, or call: 1-800-625-6440. Please Do Not Attempt to Contact Judge Brodie or the Clerk of Court With Any Questions.

What is the rule 23 B 3?

For work done through Final Approval of the settlement by the district court, Rule 23 (b) (3) Class Counsel was granted an attorney fee equal to 9.56% of the settlement fund, which is now under appeal . For additional work to administer the settlement, distribute the settlement fund, and through any appeals, Rule 23 (b) (3) Class Counsel may seek reimbursement at their normal hourly rates.

Who is eligible to get money from the settlement?

Business owners that accepted Visa and/or Mastercard at any point between 2004 and 2019 are eligible to file a claim.

Why was Visa sued?

Visa and Mastercard were sued for allegedly violating antitrust laws. That is, they were accused of putting rules into place that would prevent competition or incentive to lower interchange rates. The lawsuit claims that if Visa and Mastercard had not engaged in that behavior, businesses would have paid lower interchange fees.

What is the settlement for Visa?

What is the Payment Card Settlement? The settlement is the result of a class action lawsuit against Visa and Mastercard. Under its terms, Visa and Mastercard will pay between $5.54 and $6.24 billion dollars to businesses that accepted Visa and Mastercard between 2004 and 2019. By settling, the lawsuit will not go to trial.

Why do businesses overpay for credit card processing?

Even after this settlement, many businesses will still overpay for credit card processing. That’s because there are multiple fees that make up the final cost, and most businesses aren’t sure where they can save .

What is a markup fee?

The markup includes any of the fees tacked on after interchange – monthly fees, statement fees, batch fees, PCI compliance fees. The lower you can get those fees, the less you’ll pay overall. And – unlike interchange – those fees are in your processor’s control. Focus your negotiation efforts on processor’s markup, or join a wholesale processing club to have experts do it for you.

What is fairness hearing?

The Fairness Hearing is, as the name implies, a chance for the Court to get information on whether the settlement is fair. At that time, the Court will consider objections to the settlement and listen to any class members who have requested to speak / appear at the hearing.

Can you lower interchange fees?

Let the lawyers argue about interchange fees. Until and unless they come to an agreement to lower those fees, there’s nothing you can do about them. Instead, focus on the fees you CAN lower: your processor’s markup.

Why did the Visa case start?

The case started in 2005 by retailers that objected to the processing rates set by Visa, MasterCard, and others. The ensuing lawsuit claimed that merchants paid excessive fees for accepting Visa and MasterCard because of an alleged conspiracy among the defendants. In a 55-page ruling, U.S. District Judge John Gleeson said ...

When did Visa and MasterCard start charging a surcharge?

As part of the preliminary settlement in November 2012, Visa and MasterCard were required to allow merchants to surcharge certain credit card transactions beginning January 27, 2013. The surcharge was called a “Checkout Fee.”

How many funds are in a settlement?

The monetary portion of the settlement is broken down into two funds.

What did Judge John Gleeson say about the settlement?

In a 55-page ruling, U.S. District Judge John Gleeson said the settlement will encourage competition. I do not feel the settlement went far enough in adding transparency, preventing rate creep, and policing the misleading tactics used by some providers.

Can checkout fees be added to debit cards?

The checkout fee cannot be added to debit card or prepaid card transactions. Now that the settlement is finalized, merchants need to be careful as some providers and salespeople may use the checkout fee as a way to manipulate savings analyses or convince merchants to change providers.

When did the second fund start?

The second fund is based on a portion of interchange fees incurred by certain merchants that accepted Visa or MasterCard for an eight-month period which began July 29, 2013.

Is surcharging good for merchants?

I do not believe that surcharging will benefit most merchants. In fact, it can cause more harm than good for merchants. Also, keep in mind that surcharging is not allowed in all states and Visa and MasterCard have very strict rules on surcharge signage and other aspects associated with surcharging.

Why did Visa and Mastercard file a lawsuit?

The lawsuit is about claims that merchants paid excessive fees to accept Visa and Mastercard cards because Visa and Mastercard, individually, and together with their respective member banks, violated the antitrust laws.

Can settlement money be owed?

If you want to help businesses win settlement money they may be owed, then please reach out to us for information. If you have clients that are business owners then this is a way to help your clients and earn some extra money.

Can a merchant file a claim without an attorney?

It is important to know that every merchant can file their claim with the Claims Administrator and Class Council during the claim-filing period without using the services of an attorney or a third-party claiming service in order to participate in any monetary relief at no-cost.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.

Who Can File A Claim?

Official Settlement Website

- The purpose of this article is to briefly provide Practical Ecommerce readers with information on the settlement. However, I encourage you to visit the official website set up for this settlement — PaymentCardSettlement.com— regularly to learn more about the settlement and how to file a claim. The claim forms have not yet been approved by the court nor has the deadline for filing th…

Provider and Third Party Offers to File Your Claim

- Some merchant account providers have already notified their merchants that they will automatically file the claim for the merchant unless the merchant tells them otherwise. I have seen some provider notices and their fees range from 15 to 25 percent of the merchant’s settlement portion. In addition, I have seen some provider notices state they will charge a fixed f…

Another Important Note

- As part of the preliminary settlement in November 2012, Visa and MasterCard were required to allow merchants to surcharge certain credit card transactions beginning January 27, 2013. The surcharge was called a “Checkout Fee.” The checkout fee is a surcharge of up to 4 percent, which merchants can add to the sale to cover credit card processing costs. The checkout fee cannot b…

Summary

- The suit against Visa, MasterCard, others has been finalized.

- You must file a claim to be paid.

- Use the official websiteas the source of information.

- Understand the claim process before allowing a third party to file for you.