What is the tobacco Master Settlement Agreement (MSA)?

The Tobacco Master Settlement Agreement (MSA) | NAAG In 1998, 52 state and territory attorneys general signed the Master Settlement Agreement (MSA) with the four largest tobacco companies in the U.S. to settle dozens of state lawsuits brought to recover billions of dollars in health care costs associated with treating smoking-related illnesses.

How much did the Master Settlement Agreement cost?

Under the Master Settlement Agreement, seven tobacco companies agreed to change the way they market tobacco products and to pay the states an estimated $206 billion. The tobacco companies also agreed to finance a $1.5 billion anti-smoking campaign, open previously secret industry documents,...

What happens if tobacco companies enter into a better settlement agreement?

If tobacco companies, before October 1, 2000, enter into an agreement with better overall terms, settlement states will get the benefit of that agreement. (This does not apply to any agreement reached after the seating of a jury or commencement of trial.)

Can a settling company benefit from a state’s settlement?

If a settling state enters into an agreement with a company not participating in this settlement and the terms are more favorable to the industry, settling companies can benefit, but only within that state.

Where did the tobacco settlement money go?

This year (fiscal year 2020), the states will collect $27.2 billion from the 1998 tobacco settlement and tobacco taxes. But they will spend less than 3% – just $739.7 million – on programs to prevent kids from using tobacco and help smokers quit - less than a quarter (22.4%) of the total funding recommended by the CDC.

How much was the tobacco Master settlement?

Under the Master Settlement Agreement, seven tobacco companies agreed to change the way they market tobacco products and to pay the states an estimated $206 billion.

What was the result of the 1998 tobacco settlement?

In the largest civil litigation settlement in U.S. history, the states and territories scored a victory that resulted in the tobacco companies paying the states and territories billions of dollars in yearly installments.

What did the master settlement agreement that cigarette companies agreed to in 1998 do?

In 1998, 52 state and territory attorneys general signed the Master Settlement Agreement (MSA) with the four largest tobacco companies in the U.S. to settle dozens of state lawsuits brought to recover billions of dollars in health care costs associated with treating smoking-related illnesses.

Can I sue tobacco companies for COPD?

Yes, you can still sue tobacco companies in certain cases. You may be able to bring an action as an individual or, in some cases, as a representative of a class in a class action.

What states are part of the Master Settlement Agreement?

Adoption of the "Master Settlement Agreement" (Florida, Minnesota, Texas and Mississippi had already reached individual agreements with the tobacco industry.) The four manufacturers—Philip Morris USA, R. J.

What year was tobacco settlement?

1998The tobacco Master Settlement Agreement (MSA) is an accord reached in November 1998 between the state Attorneys General of 46 states, five U.S. territories, the District of Columbia and the four largest cigarette manufacturers in the United States.

When did the Big Tobacco lawsuit start?

The first big win for plaintiffs in a tobacco lawsuit occurred in February 2000, when a California jury ordered Philip Morris to pay $51.5 million to a California smoker with inoperable lung cancer. Around this time, more than 40 states sued the tobacco companies under state consumer protection and antitrust laws.

What is MSA reporting for tobacco?

MSA Multicat Mandatory Data Multicat reports are weekly reports filed electronically by tobacco, candy, drinks, and grocery distributors to report sales and inventory floor counts to brand manufacturers as part of participating in their trade programs.

Does the government get money from cigarettes?

State and local governments collected $19 billion in revenue from tobacco taxes in 2019, which was 0.6 percent of state and local general revenue.

What is Macookies settlement?

The $18.4 million settlement will cover attorneys' fees and other expenses, and class members are eligible to receive a payment of up to $100, based on the number of claims filed. Author: Steve Alder has many years of experience as a journalist, and comes from a background in market research.

What was the Big Tobacco lawsuit?

In 2006, the American Cancer Society and other plaintiffs won a major court case against Big Tobacco. Judge Gladys Kessler found tobacco companies guilty of lying to the American public about the deadly effects of cigarettes and secondhand smoke.

How much money has the tobacco industry lost?

US$ 1.4 trillion lost every year to tobacco use - New tobacco tax manual shows ways to save lives, money and build back better after COVID-19.

How much does the tobacco industry spend on lobbying?

Tobacco companies spend millions of dollars lobbying in the U.S. every year. In 2020, while we faced a global respiratory pandemic, tobacco companies spent $28,156,312 at the federal level attempting to weaken public health and tobacco control policies (source).

Does the government get money from cigarettes?

State and local governments collected $19 billion in revenue from tobacco taxes in 2019, which was 0.6 percent of state and local general revenue.

What is the NAAG Center for Tobacco and Public Health?

The NAAG Center for Tobacco and Public Health works with the Settling States of the MSA to preserve and enforce the MSA’s monetary and public-health mandates, including: Representing, advising, and supporting the Settling States in MSA-related legal matters , including litigation and arbitrations.

How does MSA work?

The MSA’s purpose is to reduce smoking in the U.S., especially in youth, which is achieved through: 1 Raising the cost of cigarettes by imposing payment obligations on the tobacco companies party to the MSA. 2 Restricting tobacco advertising, marketing, and promotions, including:#N#Prohibiting tobacco companies from taking any action to target youth in the advertising, promotion or marketing of tobacco products.#N#Banning the use of cartoons in advertising, promotions, packaging, or labeling of tobacco products.#N#Prohibiting tobacco companies from distributing merchandise bearing the brand name of tobacco products.#N#Banning payments to promote tobacco products in media, such as movies, televisions shows, theater, music, and video games.#N#Prohibiting tobacco brand name sponsorship of events with a significant youth audience or team sports. 3 Eliminating tobacco company practices that obscure tobacco’s health risks. 4 Providing money for the Settling States that states may choose to use to fund smoking prevention programs. 5 Establishing and funding the Truth Initiative, an organization “dedicated to achieving a culture where all youth and young adults reject tobacco.”

What law gave the FDA the power to regulate tobacco products?

In 2009, the Family Smoking Prevention and Tobacco Control Act gave the FDA the power to regulate tobacco products. State attorneys general have been active participants in helping the FDA shape its regulatory authority.

How does the MSA affect smoking?

The MSA continues to have a profound effect on smoking in America, particularly among youth. Between 1998 and 2019 , U.S. cigarette consumption dropped by more than 50%. During that same time period, regular smoking by high schoolers dropped from its near peak of 36.4% in 1997 to a low 6.0% in 2019. As advocates for the public interest, state attorneys general are actively and successfully continuing to enforce the provisions of the MSA to reduce tobacco use and protect consumers.

What is the prohibition on tobacco companies?

Prohibiting tobacco companies from taking any action to target youth in the advertising, promotion or marketing of tobacco products.

What is the purpose of the MSA?

The MSA’s purpose is to reduce smoking in the U.S., especially in youth , which is achieved through: Raising the cost of cigarettes by imposing payment obligations on the tobacco companies party to the MSA.

How many tobacco companies have settled under the MSA?

Eventually, more than 45 tobacco companies settled with the Settling States under the MSA. Although Florida, Minnesota, Mississippi, and Texas are not signatories to the MSA, they have their own individual tobacco settlements, which occurred prior to the MSA.

What is the Master Settlement Agreement?

The Master Settlement Agreement (MSA) imposes major restrictions on tobacco company marketing practices and prohibits advertising aimed at youth. The MSA restricts the participating tobacco companies in the following ways: Prohibits direct or indirect targeting of youth in advertising, marketing and promotions.

Who represented California in the tobacco litigation?

The Attorney General represented the State of California in the tobacco litigation. The Attorney General established the first full-time state tobacco enforcement unit in the country and provided consumers with a complaint line, 916-565-6486, for reporting suspected violations of the MSA.

What is the purpose of the escrow statute in Kentucky?

Another result of the MSA, the escrow statute, was passed in 2000 by the legislature ( KRS 131.600 – 131.602) and is designed to ensure that companies selling cigarettes in Kentucky fulfill their financial obligations to the state. This is done by setting up an escrow fund or joining the MSA and making payments to the states in return for a release of liability for cigarette sales. In other words, manufacturers of tobacco products should bear financial burdens related to and arising from cigarette smoking.

What are the restrictions on tobacco products?

The MSA contains three main categories of restrictions: advertising restrictions, brand name restrictions, and give-away restrictions . The first set of restrictions ban outdoor and transit advertising of tobacco products, any advertising targeted at youth (under 18 years of age), and any use of cartoons in advertising, promoting, packaging, or labeling tobacco products. There are two main exceptions to the advertising prohibitions. First, manufacturers may advertise tobacco products on the property of retail establishments, subject to certain size restrictions (generally, no larger than fourteen square feet). Additionally, manufacturers may advertise tobacco products at adult-only facilities or adult-only events.

What is Chapter 131?

Because of the MSA, the legislature amended and created new sections in Kentucky Revised Statutes, Chapter 131 intended to ensure that only legally-compliant cigarettes are sold in Kentucky. Provisions of the law include:

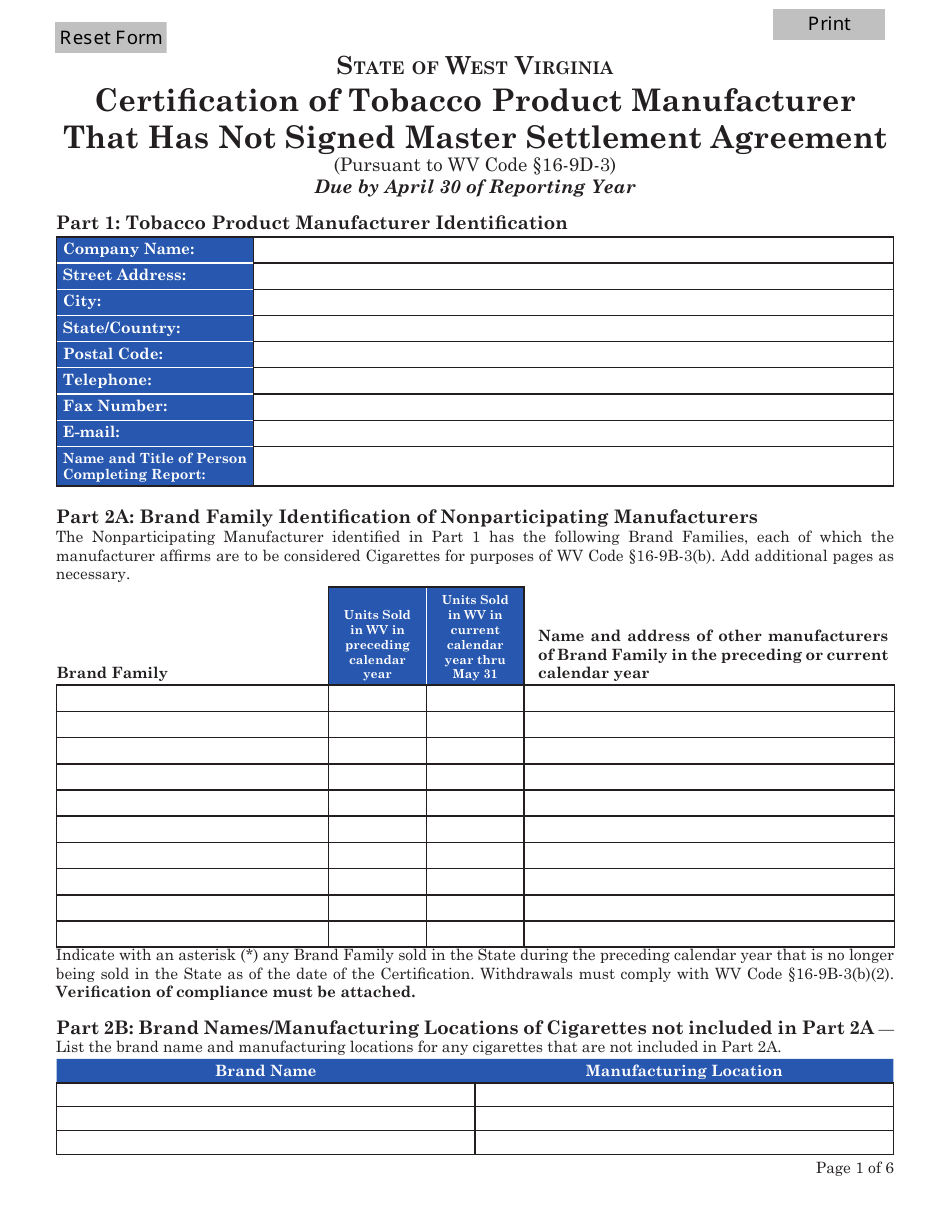

When do you get your Kentucky tobacco certification?

The certification must be completed and delivered to our office on or before April 30th each year. The directory of compliant manufacturers is available on the Revenue Cabinet website and is updated as necessary. If a manufacturer or brand is not found on the directory, tax stamps may not be placed on packages of those cigarettes. Please contact our office should you have any questions regarding the certification or directory.

Can you give a free sample to an underage person?

The give-away restrictions deal with free samples and proof of purchase gifts. The manufacturers cannot distribute free samples, except in adult-only facilities and cannot provide proof of purchase gifts to underage persons (those persons younger than the legal age to purchase cigarettes). To comply with this provision, the manufacturers must require sufficient proof that a recipient of a proof of purchase gift is an adult.

What is the purpose of the smoking ban?

Prohibits the industry from making any material misrepresentations regarding the health consequences of smoking.

What is the ban on cartoons?

Limits tobacco companies to only one brand name sponsorship per year (after current contracts expire or after three years’ whichever comes first). Prohibits brand name sponsorship of events with a significant youth audience.

How long does a tobacco company have to maintain a website?

Requires tobacco companies to maintain for ten years, at their expense, a Website which includes all documents produced in state and other smoking and health related lawsuits.

What happens after state specific finality?

After state specific finality, tobacco companies will be prohibited from opposing proposed state or local laws or administrative rules which are intended to limit youth access to and consumption of tobacco products.

How long does it take to remove transit ads?

Bans transit advertising of tobacco products. Tobacco billboards and transit ads must be removed within 150 days after the Master Settlement Agreement Execution Date. Allows states to substitute for the duration of billboard lease periods, alternative advertising which discourages youth smoking.

What is a prohibition on lobbying?

Prohibits lobbyists from supporting or opposing state, federal, or local laws or actions without authorization of the companies.

How long after master settlement agreement is it required to stop smoking?

Beginning 180 days after the Master Settlement Agreement Execution Date, companies must: Develop and regularly communicate corporate principles that commit to complying with the Master Settlement Agreement and reducing youth smoking.

How long does it take to file a claim against a tobacco company?

You file a claim against the tobacco Co. If they don't answer or respond within 30 days, it becomes law.

Why do people quit smoking?

And they’ve done it without “hitting bottom” through jail, horrible accidents, killing people in fights, overdosing, extreme medical consequences, or waking up in the gutter — usually quitting just because of social pressure, relatively mild financial expenditure (at least when compared to most illegal drugs), or concerns about far future possibilities of health consequences.

Where does MSA money go?

In most States (49 of them in fact) the MSA funds go directly to the State, and are used for whatever purpose they wish. In theory the money is for treating ill smokers and funding local tobacco control - but as often as not it goes into whatever they have a current financial problem with, such as funding the State employee pensions. Indeed, the impression is that less than 2% of the MSA funds, overall, are assigned to their original purpose.

Where do the tobacco protection funds go?

The payments go directly from smokers’ pockets to the State treasuries after being “laundered” through the tobacco companies that were basically forced to pay “protection money” to the Mob or face the consequences. I’m pretty sure there are no provisions for individual citizens to touch the funds in any State, though I’d be interested in knowing about it if I’m wrong.

When did Michigan sign the MSA?

Michigan signed the MSA in 1998 so I don’t see any way in which a resident can claim.

Is Michigan a signatory to the tobacco master settlement?

It is impossible for individuals to obtain any of the funds paid by the tobacco companies. In addition, Michigan was a signatory to the MSA in 1998. As a result, it provides a huge barrier agains suit by individuals against Big Tobacco. Florida was not a signatory and as a result most cases against Big Tobacco wer...

Can smokers sue a cigarette manufacturer?

In States that did not sign up to the Master Settlement Agreement, individual smokers (or their surviving families or estates) have successfully sued a cigarette manufacturer, sometimes as individuals and sometimes in a class action. Recent cases include Florida’s Robinson/RJR case, which resolved to a $17m award. Florida has several cases outstanding, more on that here: Tobacco giants settle smoking lawsuits for $100M. Some of these cases can be found by searching ‘tallahassee tobacco suit’ and similar.

What is a non-hospital district hospital?

For non-hospital district public hospitals owned, sold, or leased by a political subdivision, they are defined as “the total unreimbursed amount of political subdivision funds paid to such public hospital by any political subdivision during that year.”.

What expenses are included in a deputy sheriff's salary?

Expenditures for services such as transportation of inmates to doctor appointments can be included. The relevant portion of the salary and benefits of a deputy sheriff who transports inmates to doctor appointments can also be included. Also any medications, dental appointments, nursing time, etc., are eligible.

What are the services that are not counted in the septic system?

Health care education, outreach, screening, laboratory services, counseling, and case management may be counted. However, environmental services such as mosquito control, water testing, and septic tank inspection may not be counted.

What is a hospital district in Texas?

These include “a hospital district, another local political subdivision owning or maintaining a public hospital, or a county of the State of Texas responsible for providing indigent care to the general public.”.

Is tobacco settlement based on pro rata?

Yes, because all pro rata shares, beginning in 2000, are based on unreimbursed health care expenditures, as defined in the settlement agreement and health care expenditures made with tobacco settlement proceeds are treated as unreimbursed. See #12.

Is jail health care claimable?

Only jail health care expenditures out of the county’s budget are claimable. A county not wholly located within a hospital district may report the county’s unreimbursed expenditures for jail health care services on the county expenditure statement. Last updated October 4, 2018.

Can a foundation give money to a county?

However, if the foundation gave the money to the county as a general donation, giving the county clear authority to use the money at the county’s discretion, and the county used the money on health care, then the county could count the use of such funds as an unreimbursed health care expenditure.