- Use the official online tool you can use to check if you were part of the Equifax breach.

- Enter your last name and last six digits of your social security number to see if your data was part of the hack.

- If you and your data were part of the breach, head to the Equifax Data Breach Settlement website to file a claim to get back money.

Full Answer

What happens if the Equifax settlement becomes effective?

If the Settlement becomes effective, you will give up your rights to sue Equifax separately for claims relating to the Data Breach or to continue to pursue any such claims you have already filed. The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

Where do I get emails about the Equifax breach settlement?

Legitimate emails about the settlement will come from Equifax Breach Settlement Administrator < [email protected] >. The settlement administrator also recently sent emails and letters to people who filed valid claims requesting free credit monitoring services from the settlement.

What is the deadline to file a claim in the Equifax settlement?

The initial deadline to file a claim in the Equifax settlement was January 22, 2020. After January 22, 2020, you can still file a claim for expenses you incur between January 23, 2020, and January 22, 2024, as a result of identity theft or fraud related to the breach, such as:

What happened to Equifax?

In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories.

See more

How do I claim my Equifax settlement?

For more details and to check your claim status, visit EquifaxBreachSettlement.com . If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022. Claims are due by January 22, 2024.

What happened to my Equifax settlement?

You filed a claim in the Equifax Data Breach Settlement and chose to receive free, three-bureau (Equifax, Experian, and TransUnion) credit monitoring from Experian for four years. Implementation of the Settlement was delayed by appeals; however, the Settlement is now effective because appellate courts have affirmed it.

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

Who qualifies for the Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

How much was the Equifax settlement?

$425 millionEquifax data breach class action lawsuit settlement updates: On June 3, 2021, the 11th Circuit Court of Appeals upheld the $425 million Equifax data breach settlement.

How much can you get from a data breach settlement?

The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

How do I know if I was a victim of Equifax data breach?

If you want to check whether your data was exposed, the FTC and official settlement site have an online tool you can use to check if you were part of the Equifax breach. You'll need to enter your last name and last six digits of your Social Security number to see if your data was part of the hack.

How long does a data breach claim take?

In reality, how long a data breach claim takes simply comes down to the circumstances of the case. Some cases could be resolved in a few months, whereas others may end up being pursued for several years.

Has Equifax settlement been approved?

The Settlement received final approval from the Court on January 13, 2020. You may review the Final Approval Order and Final Order and Judgment by clicking here. Settlement appeals have been resolved and the Settlement is now effective.

Can I go to Equifax in person?

Equifax Phone number: While Equifax's official customer service phone number is 1-800-846-5279, I found the easiest path to reach a real human is to call this number: 1-866-640-2273. How to reach a real person: Press 4, then press 1.

What happened to Equifax after the data breach?

In the wake of Equifax's 2017 data breach, which compromised the personal information of roughly 147 million consumers — including names, birthdates and Social Security numbers — the company ended up as the target of multiple lawsuits and reached a settlement in 2019 with the FTC, the Consumer Financial Protection ...

How do I know if I was affected by the Equifax breach?

If you want to check whether your data was exposed, the FTC and official settlement site have an online tool you can use to check if you were part of the Equifax breach. You'll need to enter your last name and last six digits of your Social Security number to see if your data was part of the hack.

Where is my Yahoo settlement check?

If you are still not sure whether you are a Settlement Class Member, you may go to the Contact page of this Settlement Website or call the Settlement Administrator toll free number at 844-702-2788, to see if you are a Settlement Class Member.

What did Equifax do after the breach?

Specifically, he says, Equifax's most important post-breach initiatives included: Improving systems monitoring; Enhancing the security team's communication with the C-suite; Changing the corporate culture by getting employees to recognize the importance of cybersecurity.

Are you eligible?

Hackers were able to get access to a multitude of consumers’ private information, including names, Social Security numbers, dates of birth, credit card numbers and driver’s license numbers.

What does the claim cover?

There are four types of relief you can claim from Equifax under the terms of the settlement:

What happens if you don’t file a claim?

Under the terms of the settlement, there are services that you are entitled to — even if you don’t file an official claim, the FTC says.

How long can you claim free credit monitoring?

Submitting a claim can be “overwhelming,” so take it slow, Lacey says. At the very least, you should claim the free credit monitoring for up to 10 years. “There should be no reason whatsoever not to file, especially the basic claim — the credit monitoring — or if you have credit monitoring, the claim for $125,” says Jack Gillis, executive director of the Consumer Federation of America. This is probably what most consumers will file for, Gillis adds.

How much can you get if your Equifax account was compromised?

If your information was compromised during the massive 2017 Equifax data breach, you could be entitled to up to $20,000.

How much can you claim for a credit breach?

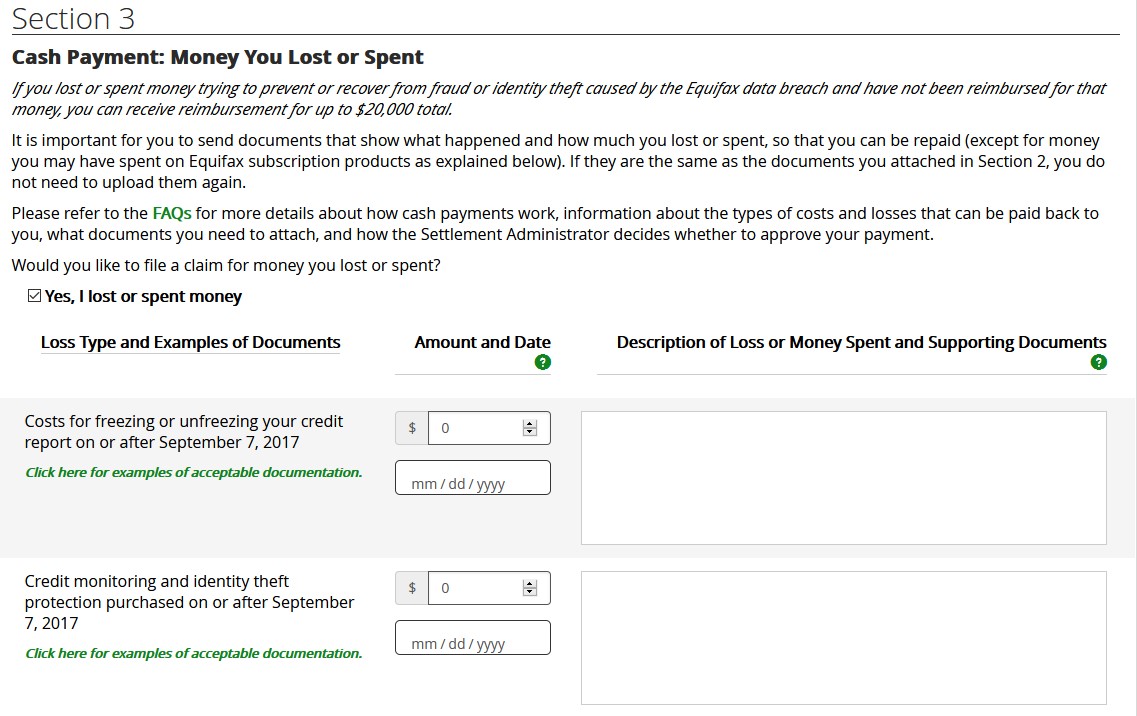

Monetary loss: Consumers will be able to claim up to $20,000 for any losses or fraud that were the results of the breach or any out-of-pocket expenses they may have incurred, such as paying to freeze and unfreeze their credit reports. You’ll need to attach supporting documents, such as receipts, to show how much money you spent.

What happens if you don't have good records?

“If you don’t have good records, you may not be able to see the full benefit of what the settlement is providing ,” Lacey says.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

How much time can you spend on a data breach?

You may be eligible for the following reimbursement cash payments for: Time Spent during the Extended Claims Period recovering from fraud, identity theft, or other misuse of your personal information caused by the data breach up to 20 total hours at $25 per hour.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Can you claim out of pocket time spent?

Submit a claim to receive reimbursement for Out-of-Pocket Losses and/or Time Spent. You may claim Out-of-Pocket Losses, Time Spent, and Credit Monitoring Services under the Settlement depending on whether you file claim(s) during the Initial or Extended Claims Period.

Affected consumers can get a check or free credit monitoring

If your personal information was compromised by the 2017 data breach at Equifax, you may be compensated as a result of the credit bureau’s settlement with the government.

Credit monitoring option

Free credit monitoring is being provided by rival Experian for at least four years. It will include monitoring of activity for all three credit bureaus, providing notice of any changes. It also includes free copies of a class member's Experian credit report, updated on a monthly basis, and up to $1,000,000 in identity theft insurance.

How much did Equifax pay for the security breach?

The Federal Trade Commission and Equifax reached an agreement at the end of July for Equifax to pay at least $575 million and up to $700 million to compensate those whose personal data was exposed with the breach of the Equifax servers. As part of the settlement, you can file a claim to be compensated for the costs of recovering from the security breach -- including any costs associated with the theft of your identity and freezing and unfreezing your account-- and compensation of unauthorized charges to your banking accounts. The agreement caps payouts at $20,000 per person.

What information was stolen from Equifax?

The data breach of Equifax resulted in hackers accessing personal information on the credit report servers of 147 million consumers, including driver's license information, social security numbers and birthdates.

Can discussion threads be closed?

We delete comments that violate our policy, which we encourage you to read. Discussion threads can be closed at any time at our discretion.

What are the benefits if I was affected?

If you were affected, you will have access to free credit monitoring and identity theft protection for up to ten (10) years (or up to 18 years if you were under the age of 18 at the time of the breach in 2017). If you already have credit monitoring, you can request a payment of up to $125 instead. If you had other expenses caused by the breach such as losses, account fees, or from freezing credit reports you may get a payment of up to $20,000. It is useful to know that you may also be compensated for any time you spend dealing with the breach at a rate of $25 per hour for up to 20 hours total.

What if I don’t want to give up my right to sue Equifax personally?

If you do not want to be bound by the class action lawsuit, you must “opt-out” and cannot make any claims under the settlement. To do so you must:

How long does it take to get a free credit report from Equifax?

You can get six free credit reports from Equifax in a 12-month period, for seven years beginning January 2020. These are in addition to the free reports you’re already entitled to under the law.

What is the CFPB?

We're the Consumer Financial Protection Bureau (CFPB), a U.S. government agency that makes sure banks, lenders, and other financial companies treat you fairly.

When did Equifax breach?

In September 2017 , Equifax announced a breach that exposed the personal data of approximately 147 million people. If your data was impacted, under a legal settlement, you may claim free services and payments.

Can you request reimbursement for Equifax?

You can request reimbursement if you spent money, for example: For certain Equifax products before the breach. To freeze or unfreeze your credit. For credit monitoring services. Dealing with fraud or identity theft after the breach.