Full Answer

How can I settle my credit card debt?

Some people work with debt settlement companies to handle settling debts with creditors or collectors. But you can contact credit card companies, other lenders or debt collectors on your own and set up a payment plan directly.

How far behind on your credit card payments can you settle?

In other words, you have to be around 180 days behind on your credit card payments to even qualify for consideration. With that said, there are two basic types of debt settlement: 1) do it yourself debt settlement; and 2) service-assisted debt settlement. You can also attempt to settle the following types of debt:

Can a business negotiate a credit card debt settlement?

If the credit card company is willing to entertain the idea of a debt settlement, the odds are high that they will want one of the following arrangements. A Lump-Sum Credit Card Debt Settlement. This is probably the easiest to negotiate as a lot of businesses will be willing to walk away with a pile of cash, cutting their losses.

What is credit card settlement?

Credit card settlement is a mutual agreement between the credit card issuer and the borrower. Here, the borrower has defaulted in paying credit card dues to settle the debt at an amount less than the outstanding amount, where the borrower promises to pay a certain agreed amount.

How do I remove a settlement from my credit report?

To clear the “Settled” status from your CIBIL report, you need to pay the outstanding amount on your loan and get a NOC (No Objection Certificate) from the lender. The next step is to raise a dispute on the CIBIL website.

What percentage will credit cards settle for?

40% to 50%Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation. 5.

How long does it take to recover from credit card settlement?

The truth is that the credit repair process takes time and a settlement can stay on your credit report for as little as two years or for as long as seven years. But, while those debts will be part of your credit history for years, that's no reason to give up on repairing your credit.

Will credit card settlement affect my credit score?

Yes, settling a debt instead of paying the full amount can affect your credit scores. When you settle an account, its balance is brought to zero, but your credit report will show the account was settled for less than the full amount.

Is it better to settle or pay in full?

Paid in full means the remaining balance of your debt, including interest, was paid off. Paying in full is an option whether your account is current, past due or in collections. It's better to pay in full than settle in full when it comes to paying off debt.

Is it true that after 7 years your credit is clear?

Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

Are Settlements good for your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

How many points does a settlement affect credit score?

Does Debt Settlement Hurt Your Credit? Debt settlement affects your credit for up to 7 years, lowering your credit score by as much as 100 points initially and then having less of an effect as time goes on. The events that typically lead up to debt settlement will affect your credit score, too.

What is the process of credit card settlement?

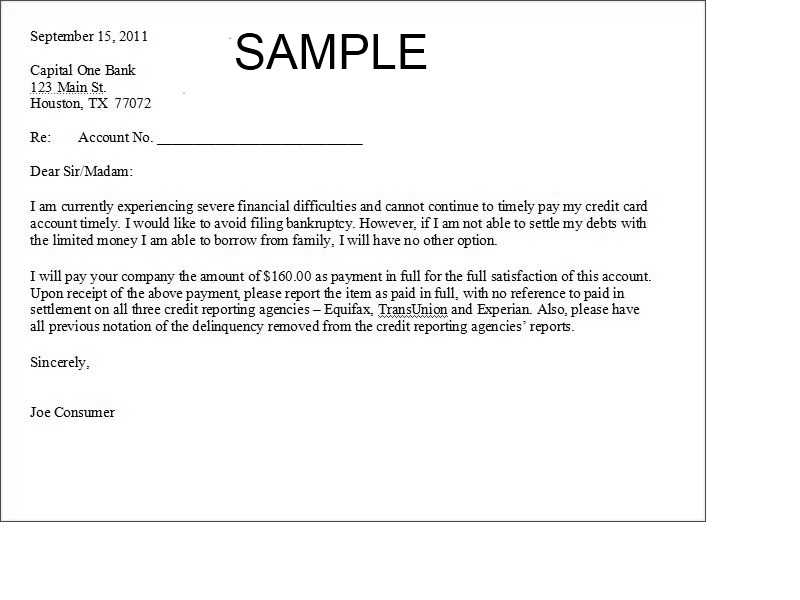

What is the credit card settlement processVisit the issuer or a debt settlement agency.Explain your inability to make payments via a credit card settlement letter and mention that you're open to negotiating other repayment terms.Offer a lump sum or inform the issuer of your plans to file for bankruptcy.

How do credit card settlements work?

As stated above, a credit card settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. The remaining amount can be repaid in one single payment or as a series of payments, as determined through the specific agreement.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

How much less will debt collectors settle for?

Offer a Lump-Sum Settlement Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What percentage will Portfolio Recovery settle?

Since Portfolio Recovery likely purchased your debt for less than 8% of its original values, they would still profit if you settled to a pay a percentage of the cost. Most debt collection agencies are will settle for 1%–60% of the original debt amount.

How many points will paying off credit cards raise my credit score?

If you're already close to maxing out your credit cards, your credit score could jump 10 points or more when you pay off credit card balances completely. If you haven't used most of your available credit, you might only gain a few points when you pay off credit card debt.

What is clearing a card?

Clearing: Through this process Issuing Bank exchanges transaction information with the Acquiring Bank. After successful reconciliation with the merchant, Acquiring Bank generates outgoing settlement file for various Card schemes/networks (MasterCard ,Visa etc.).These Card networks then further break these files into clearing files and is sent to different Issuing banks.

What is transaction count in acquirer batch?

Transaction count in Acquirer batch is more than the merchant batch: This situation primarily arises when there has been a reversal on the transaction performed and it fails to synchronize on the acquirer side and thereby still appearing in their logs. These additional transactions won't be settled with the merchants.

What is credit card 101?

Credit card 101: Clearing and settlement While the first article covered the basics of authorization process ,this article delves into the second leg of credit card transaction lifecycle :Clearing and settlement which essentially involves reconciliation and transfer of funds among Issuer, Acquirer and merchant. #payments #creditcardtransactionprocessing

What is clearing and settlement?

So to start with, clearing and settlement in financial service industry refers to all activities from the time a commitment is made for a transaction until it is settled. So the transactions which has been successfully authorized by Issuing Bank has to be settled before sales can be deposited into the merchant’s bank account. When it comes to Credit card settlement, this is usually being done in three stages:

What happens when acquiring bank receives a merchant batch?

Once the Acquiring Bank receives the merchant batch, it performs the reconciliation with their own transaction log for this merchant. If the information is validated, then the Acquiring Bank sends a confirmation message to the merchant.

What is a transaction submitted?

Generally transactions are submitted electronically and all POS /virtual payment handling systems are modified to naturally do that at pre-characterized stretches. Generally toward the finish of the business day, the vendor terminal makes a batch of the multitude of transactions finished during the day and sends the equivalent to the acquirer.

What is the second leg of the credit card life cycle?

I ended the previous article by mentioning that obtaining an authorization is just the first step and in this article I would be explaining the second leg of the Credit card transaction life cycle, that is Clearing and Settlement. Technically, the authorization leg is also called BASE 1 and clearing/settlement leg is called BASE 2 .If you haven't read the article on authorization process, I would recommend you to go through that first. Here is the link for the same.

Why Does the Debt Snowball Method Work?

Dave Ramsey explains: “The debt snowball works because it’s all about behavior modification, not math. When it all boils down, hope has more to do with this equation than math ever will. If you start paying on the student loan first because it’s the largest account, it could take you years to get rid of that first debt. You’ll see numbers going down on the balance, but pretty soon, you’ll lose steam and stop paying extra. Why? Because it’s taking forever to get a win! And you’ll still have all your other small, annoying debts hanging around too.”

What is the best way to get out of credit card debt?

The debt snowball method is the best way to get out of credit card debt for anyone who can comfortably pay more than minimum payments.

Why is Chapter 7 bankruptcy important?

The reason is that Chapter 7 bankruptcy wipes away credit card debt so that it doesn’t have to get paid.

How long does it take to clear credit card debt?

If you can’t afford to stay current on your credit card payments, debt settlement can reduce the balances and allow you to clear credit card debt in around three to four years.

What to do if you can't pay off credit card balance?

If you can’t pay off credit card balances due to high-interest rates, consumer credit counseling could be your best solution.

What is debt avalanche?

The debt avalanche method is similar to the debt snowball method, but the difference with the debt avalanche is that you order your debts by their interest rate. So instead of paying off your smallest balance first, you would pay off the credit card balance with the highest interest rate first, the one costing you the most.

How long does it take to get approved for hardship credit?

Steps to get approved for your bank’s credit card hardship program without a negative effect on credit scores. The trick is to call your creditor in 7-10 days after you miss the monthly payment. Late payment history doesn’t get reported to the credit reporting agencies until you’re more than 29 days past due.

How to finalize a settlement?

Release the settlement funds. To finalize the settlement, you need to deliver the settlement funds on or before the expiration date. Most settlement funds are remitted via ACH bank draft (aka "check by phone"). Make sure you write down who you spoke with that processed your payment. Every once in a blue moon a creditor or collection agency might require you to overnight a cashier's check to finalize a settlement. But the vast majority of settlements are finalized via ACH bank draft.

How many credit card accounts are delinquent?

Whether we're in a good economy or not, a certain percentage (approx. 2-5%) of credit card accounts are delinquent. For credit card companies, it's just the cost of doing business — and they know it.

How long does it take to settle a debt?

In fact, some may lose patience and sue you. Certain debt settlement companies advertise "debt settlement plans", implying you can take several years to get through the process. In my opinion, that's a recipe for disaster. Generally speaking, I recommend completing the debt settlement process in 12 months or less (18 months tops).

What is the biggest determinant of successfully negotiating settlements for less than full balance?

Perhaps the biggest determinant of successfully negotiating settlements for less than full balance is making sure you meet the minimum criteria.

Is credit card debt unsecured?

Remember, credit card debt is unsecured debt. If a credit card account becomes delinquent there's no property to repossess or put a lien on.

Can you send a cease and desist letter to a creditor?

With certain credit card companies, a cease and desist letter is an automatic trigger to fast-track your account for litigation. Besides, if your goal is to negotiate a settlement with a creditor, you need to keep an open line of communication. For these reasons, I never recommend sending a cease and desist letter.

Is debt settlement a viable alternative to bankruptcy?

Although the debt settlement process can be a viable alternative to bankruptcy, it isn't perfect.

What Happens to Credit Card Debt When You Die?

Credit card debt is paid off by your estate after you die. In other words, the debt will be subtracted from anything you intend to pass onto heirs. Your estate executor will use estate assets to pay down the debt. After your debts are settled, your remaining assets will be passed onto your heirs.

How Do You Consolidate Credit Card Debt?

There are many ways you can consolidate credit card debt. The key is to get a single debt instrument that you can transfer all of your existing debt into. It could be a personal loan, a home equity loan, or even another credit card known as a " balance transfer card ."

What is the worst scenario for a credit card company?

Absent some sort of unique set of circumstances, a bankruptcy filing would be the worst-case scenario for the credit card company because it stands to lose everything it has extended you. It means that they may be willing to forgive a large portion of the debt balance in hopes of getting back something rather than nothing.

How to negotiate with credit card companies?

Be Persistent and Document Everything. If you want to negotiate with a credit card company, the process usually begins with a phone call. However, it may require long conversations with multiple people over days or weeks.

Why do credit card companies have priorities?

Credit card companies, many of which are owned by banks, have several priorities. The first is to generate profit for the parent company and its shareholders. When it becomes evident that someone may be unable to pay his or her balance, a shift in the credit card company's priorities happens that can work to your advantage.

How long does it take to settle a debt?

Pursuing debt settlement is a last resort because it involves stopping payments and working with a firm that holds that money in escrow while negotiating with your creditors to reach a settlement, which can take up to four years.

What to know before calling a bank?

Before you call, make sure you know exactly how much you owe, what your interest rate is, and any other important account details.

What is Credit Card Settlement?

Credit card settlement is a mutual agreement between the credit card issuer and the borrower. Here, the borrower has defaulted in paying credit card dues to settle the debt at an amount less than the outstanding amount, where the borrower promises to pay a certain agreed amount.

What is the Credit Card Debt Settlement Process

Credit card companies advertise credit card settlement as a process to eliminate your pending debt for pennies. However, it isn’t as straightforward as it sounds. Here’s the process of settling credit card debt:

Does Credit Card Settlement affect Your Cibil?

Credit card settlement is a sign that you cannot manage your debts, and most lenders wouldn’t extend credit facilities to such borrowers. Credit card settlement could dent your CIBIL score and reduce it to a range where no lender would consider lending to you in the near future.

Alternatives to Credit Card Settlement

Settlement of credit cards should be opted when you have run out of all viable options. It might ease your hardships in the short term but will surely give you pain in the long term.

Ways to Avoid Credit Card Settlements

Try to abide by the following habits to avoid landing into such tricky situations:

Final Word

Credit cards are a valuable financial asset, provided the user maintains financial discipline. Use credit cards only to that extent you are financially capable of repaying. At no point in time should your credit card expenses exceed your monthly income.

How long does it take to rebuild credit after debt settlement?

Your overall credit history will play a role in how fast your credit bounces back after settling a debt. If you otherwise have a solid credit history and have successfully paid off loans or are in good standing with other lending institutions, you could rebuild your credit more quickly than if you have a larger history of late payments, for example.

How to get a debt collector to delete your credit report?

As part of your debt settlement negotiation, you may be able to get the creditor or debt collector to agree to report your account as paid in full or have them request to have it deleted from your report. You can suggest this in exchange for paying some of your debt or upping the amount you’re offering to pay. This is not all that likely to work with credit card banks and other lenders, but can be effective with medical and utility collections, and is also now part of the credit reporting policies at three of the largest debt buyers in the nation: Midland Credit Management (MCM), Portfolio Recovery Associates (PRA) and Cavalry Portfolio. You can learn more about each of these companies’ pay for delete policies here .

What percentage of credit score is based on unpaid debt?

If you have unpaid debt, then your credit score has already been affected. According to FICO, 30% of your credit score is based on the amount you owe on existing accounts. Late payments get reported to credit bureaus by lenders and then the delinquency is reflected in the credit score.

What is the purpose of settling debt?

Settling debt is essentially coming to an agreement with your creditors to pay back part of what you owe and be forgiven for the rest. If you’re at the stage of considering settling debt, then you’ve already missed several payments, probably months worth, which takes a toll on your credit. So how can you settle debt and minimize ...

How to avoid a lawsuit?

To avoid a lawsuit, try to settle your debts before a charge-off occurs. Call the creditor or the debt collector and see if you can negotiate a settlement. If you have more than one debt, try to target one or two accounts to settle first, prioritizing those that are most likely to sue you.

What to do if you sell your debt to a third party?

If your debt has been sold to a third-party debt collector, you’ll have to contact the new debt owner, or the collection agency they’re using, in order to resolve the debt. Be clear about your financial situation. If they know you can’t afford to pay much, that could make them more willing to accept a lower settlement offer. Before you send them any money, get your agreement in writing.

What happens if you pay your credit card balance in full?

Keep in mind however, that if you pay your balances in full each month — meaning, you aren’t paying interest charges — your credit utilization will remain low no matter how much you borrow month to month. 3. Don’t close credit card accounts, even if you don’t use them.

What Happens When an Account Is Closed?

When you pay off or close an account it’s not available for purchases or payments.

How Will You Attack Your Settled Account?

You know what a settled account is and how it can affect your credit score.

What happens if you close a credit card?

If you close an account like a credit card and it has been paid off, then your credit score can also be negatively affected. Your credit score is based on available credit, payment history, and the age of your accounts.

What to do if you feel like going to a credit bureau?

If you feel like going directly to a credit bureau isn’t the right attack, then you can send the lender a goodwill letter directly. This letter is a polite way to ask if a lender will remove the settled account from your credit history.

How long does it take for a missed payment to drop off your credit report?

In at most 7 years from the first date of your missed payment or the date you paid the account in full, it will drop from your report. By reviewing your credit report you can see how much time is left on the settled account and from there determine how long it will still appear on your account.

What happens if a settled account is faulty?

If the settled account was faulty, it will then be removed from your account. The only way it will appear again is if the creditor proves it was accurate. This is a great way to not have the account affect your score negatively but in most cases, it will still remain on your report.

How long does a credit card account stay on your credit report?

These accounts can appear on your credit report for up to 7 and a half years from the date it was paid in full.

When is Debt Settlement a Good Idea?

People often wonder why they should even bother with a debt settlement given that they’ll already be in default and the damage to their credit standing will already be done. However, debt settlement can be a wise decision for two reasons: 1) It eliminates the threat of a lawsuit, which might force you to pay your full balance; and 2) Paying what you owe is simply the honest thing to do.

What is a credit card settlement?

Credit card debt settlement is an agreement between an indebted consumer and a creditor that entails the consumer submitting a lump-sum payment for the majority of what they owe in return for the company that owns the debt forgiving part of the outstanding balance as well as certain fees and finance charges.

Why do you need a debt settlement company?

Advantages: A debt settlement company is likely to know which creditors are more inclined to settle and for how much. A debt settlement program will provide you with the discipline to save money every month that you can use as leverage when negotiating.

How long does a default stay on your credit report?

It’s also important to note that since you are likely to have defaulted on your account prior to reaching a debt settlement agreement, information about the default will remain on your major credit reports for seven years from the date that you became 180 days late. Your credit score will suffer during that timeframe.

How long do you have to be behind on credit card payments to settle?

you’re experiencing serious financial hardship). In other words, you have to be around 180 days behind on your credit card payments to even qualify for consideration.

What are the two types of debt settlement?

With that said, there are two basic types of debt settlement: 1) do it yourself debt settlement; and 2) service-assisted debt settlement. You can also attempt to settle the following types of debt:

What is debt settlement?

Debt settlement is an amended payment agreement that entails submitting a one-time payment for part of what you owe in return for the creditor/debt collector forgiving the rest. Your account must be in default (or close to it) in order for you to qualify for debt settlement.

What to do if you owe more on credit card?

If you owe more on a credit card than you can afford to pay, you may wish to negotiate a settlement with the card company. In a settlement you agree to pay some lesser amount, and the company agrees to accept that amount. You both avoid the trouble and expense of going to court, and you can protect your credit rating at the same time.

How to settle credit card debt?

Decide what you can offer to pay. Before trying to settle your credit card debt, you need to decide what you can afford. Review all of your outstanding debts, and compare these to your regular income and any other funds you have available.

How to send a letter to a credit card company?

Address the letter to the proper office. Find out which office of the credit card company handles settlement offers. You can usually discover this by looking up the company online or calling the customer-service number on the back of the card itself. When you reach someone at the company, say that you would like to make an offer to settle your debt, and ask what address you should use for sending a letter.

What does "in full settlement" mean?

An offer of this type could say something like, “I am able to make an immediate payment of $4,000 in full settlement of my outstanding credit card debt.” Be sure to use the phrase “in full settlement,” so it is clear that you mean this as a full and final payment and not as part of a payment plan.

Why do we need a credit report?

Many people focus on their credit score, but your credit report is much more than just a score. It will provide a list of all outstanding debts that you owe, open accounts that you have, and ongoing collection efforts against you.

What happens if you pay less than the amount due?

If you pay anything less than the full amount due, your credit score is likely to drop. However, you can try to minimize the damage by modifying the way the company reports the settlement. Ask them to report your account as "paid.". This is best for you.

How to explain why you need to settle your debt?

Explain your predicament. Avoid getting emotional about the problems in your life, but you should explain your reason for needing to settle your debt. It will help your case if you can refer to a particular cause, such as an accident, divorce, or something else that is not likely to repeat. If you've simply overspent, the company will be less inclined to settle, because they have no assurance that your spending habits will change in the future.