Present Debt,” we will need to document the Full Current Debt the Debtor is obligated to pay the Creditor. Use the blank line placed after the dollar sign in this statement to record this amount of money. The third item, “III. Settlement Debt,” calls for the adjusted Debt Amount set for the purposes of this document supplied to the blank line.

Full Answer

How does a debt settlement company work?

The borrower engages with a debt settlement company, who advises the borrower to withhold debt payments to her creditor and to instead make debt payments to the debt settlement company. The debt payment schedule proposed by the company is as follows:

How much does it cost to settle a debt?

A debt settlement company may charge fees totaling 15% to 25% of the settled amount. So, if you’re settling a $10,000 debt for $5,000, you could be hit with a fee as high as $1,250 or even more. If you choose to negotiate a DIY debt settlement, you don’t relinquish your personal control over the timing of the process.

Should I ask a debt settlement company to negotiate my settlement?

However, consumer protection experts advise that asking a debt settlement company to negotiate your debt settlement can be risky. Unfortunately, some debt settlement companies may overpromise and underdeliver, perhaps leaving you in the same financial hole you’re trying to escape. As an alternative, you can settle the debt on your own.

How do I formalize a debt settlement agreement with a creditor?

After you have negotiated a debt settlement with a creditor, such as a credit card company, you will need to formalize your agreement in writing. You can write the agreement yourself and send two copies to your creditor so that they can send a signed copy back to you. Or it may be easier to have your creditor draft up a letter and send it to you.

How do I write a debt settlement?

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

What is a settlement in debt collection?

Debt settlement is when your debt is settled for less than what you currently owe, with the promise that you'll pay the amount settled for in full. Sometimes known as debt relief or debt adjustment, debt settlement is usually handled by a third-party company, although you could do it by yourself.

Is debt relief the same as debt settlement?

Debt settlement, also called “debt relief” or “debt adjustment” is the process of resolving delinquent debt for far less than the amount you owe by promising the lender a substantial lump-sum payment. Depending on the situation, debt settlement offers might range from 10% to 50% of what you owe.

Are debt settlement companies for profit?

According to the Consumer Financial Protection Bureau (CFPB), credit-counseling organizations are usually non-profit organizations whose counselors are certified and trained in the areas of consumer credit, money and debt management, and budgeting.

What happens when you settle a collection?

When you settle an account, the creditor (in this case the collection agency) will update the account on your credit report to show it has been settled in full for less than the total balance owed. This indicates that the account is closed and that there is no longer a balance due.

Are debt settlement fees tax deductible?

Legal fees associated with debt settlement are considered personal expenses, and therefore are not tax deductible.

What is the difference between settlement and consolidation?

Debt consolidation and debt settlement are strategies for making debt manageable, but they are different methods and bring different results. Debt consolidation reduces the number of creditors you'll owe. Debt settlement tries to reduce the amount of debt you owe.

What is the disadvantage of debt settlement?

You May End Up with More Debt Than You Started Stopping payment on a debt means you could face late fees and accruing interest. Additionally, just because a creditor agrees to lower the amount you owe doesn't mean you're free and clear on that particular debt.

What is snowball effect in debts?

The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were putting toward that payment and roll it onto the next-smallest debt owed. Ideally, this process would continue until all accounts are paid off.

How much do debt settlement companies make?

Debt settlement companies typically charge a 15% to 25% fee to tackle your debt; this could be a percentage of the original amount of your debt or a percentage of the amount you've agreed to pay. Let's say you have $10,000 in debt and settle for 50%, or $5,000.

How Much Do debt consolidators make?

$50,169 a yearHow much does a Debt Consolidation make? As of Aug 26, 2022, the average annual pay for a Debt Consolidation in the United States is $50,169 a year. Just in case you need a simple salary calculator, that works out to be approximately $24.12 an hour. This is the equivalent of $964/week or $4,180/month.

What is the average debt settlement percentage?

According to the American Fair Credit Council, the average settlement amount is 48% of the balance owed. So yes, if you owed a dollar, you'd get out of debt for fifty cents.

What are the disadvantages of a debt settlement?

Disadvantages of Debt SettlementDebt Settlement Fees. Many debt settlement providers charge high fees, sometimes $500-$3,000, or more. ... Debt Settlement Impact on Credit Score. ... Holding Funds. ... Debt Settlement Tax Implications. ... Creditors Could Refuse to Negotiate Your Debt. ... You May End Up with More Debt Than You Started.

How do I remove a settled account from my credit report?

Review Your Debt Settlement OptionsDispute Any Inconsistencies to a Credit Bureau.Send a Goodwill Letter to the Lender.Wait for the Settled Account to Drop Off.

How settlement affect your credit?

When a loan is termed as settled, it will subtract a few points from your CIBIL score. The borrower's credit score will drop by 75-100 points and will hold this record for the next 7 years. So, if the borrower is planning to take a loan during this period, no lender will allow him to do so due to his CIBIL score.

How much should you offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What is Martindale Nolo?

Nolo is a part of the Martindale Nolo network, which has been matching clients with attorneys for 100+ years.

Why is it important to be a certified debt professional?

It is important that both the debtor and the creditor trust you and your judgment for you to be able to negotiate a deal successfully. These certifications help toward building this trust.

Is a debt settlement business recession proof?

It is a great business to be in as it is recession proof and you charge a percentage of the debt you help settle as your fee. In other words, the greater the debt, the more you earn from your clients.

Do you need a license to negotiate a debt?

So it is best if you tie up with a back end debt negotiator that will meet these legal requirements. These companies will then open a bank account and collect the fees to compensate you for your services. This system works best at least in the initial stages of your business. In case you want to do away with back end companies, consult an attorney and get the requisite licenses.

What is Business Debt Settlement?

Business debt settlement is the process of successfully negotiating and settling business accounts for lower payoff amounts than the total balance owed on them. These lower amounts are agreed to by the creditor or collection agency and are fully documented in writing. Terms are often settled in the form of a lump sum payment, though there also are instances – depending on the lender and the circumstances involved – in which a reduced payoff amount can be paid off over an extended period of time.

What happens after a settlement agreement is reached?

The good news is that after a settlement agreement is reached in writing and eventually paid – the business, its guarantors and any liens attached to personal assets or business get released. The business and business owner become free to get back on firm footing without the looming strain of debt collection efforts from creditors.

Why is it important to pursue business debt settlement?

In situations such as these in which a business owner also wishes to remain open, it becomes critically important to successfully pursue business debt settlement when making continued timely payments on the debt has become too difficult.

What is a personal guarantee for a business loan?

Many small business loans and other forms of business debt come with personal guarantees attached to the debt, meaning that the personal assets of the business owner become at risk in the event of default. Additionally, when a business owner provides a personal social security number when initially pursuing the debt, it will often result in a personal guarantee being attached to the debt.

Can a business borrow money?

It is common for a business to borrow some quantity of debt. Whether it be unsecured credit card debt, unsecured debt owed to vendors, secured debt owed to a bank, merchant cash advances, IRS payroll debt, some form of landlord debt or leasing debt…the various types of business debt take on many forms. And, just as in the case of the consumer, a business can fall into the position of becoming saddled with overly burdensome debt.

Does Wells Fargo have a personal guarantee?

Lenders such as Wells Fargo, Chase, Capital One and American Express commonly include personal guarantees with their forms of business debt. Many merchant cash advance and unsecured debt providers such as OnDeck, CAN Capital, Quarterspot, BizFi, Kabbage, Everest, and LoanMe often attach personal guarantees as well.

Is debt settlement the right choice?

However, if your business has already fallen behind on payments by four or five months and there still isn’t much light showing at the end of the tunnel – or you’ve already closed or are in the process of closing, then there is less to think about. Debt settlement could easily represent the right choice. Check out our free business debt calculator on United Settlement and see how much you can save.

What Do Business Debt Settlement Companies Do?

Business debt settlement companies work with unsecured business debts such as merchant advance loans, business lines of credit and business credit cards. They attempt to settle these debts with the lenders or creditors directly through a negotiation process. This process can be long and stressful because a settlement is not agreed to at the beginning of the program.

Why is it less stressful to get a restructuring loan?

Less stressful because you are not hanging in default with your lenders during a restructuring program. They will typically agree to stretch your term out by double or triple, significantly lowering your payment and freeing up your business revenue. Typically, they will also agree to receiving payments weekly instead of daily.

How much does a business debt settlement company charge?

This fee will sometimes be capped to a certain percentage based on state regulations. MCA debt relief companies can charge upwards of 25% of your enrolled debt amount with no guarantee on effectively settling your debt.

What determines how much you will save?

The severity of ones financial hardship will be the biggest determiner in how much you will ultimately save.

Why is restructured terms better?

Safer because restructured terms are agreed to in the beginning of the program and your lenders are paid as you go. Your lenders are also not being asked to accept less than you owe. They are only being asked to legally restructure your term.

What happens if a business closes down?

Your business has closed down and you no longer have a revenue stream from it. This would most likely justify bankruptcy more than debt relief .

Is it easier to get a business debt restructuring?

Qualifying for business debt restructuring is easier as well. This is because you do not need to prove hardship to the same degree as with a relief option.

Should You Do It Yourself?

If you decide that a debt settlement is the right move, the next step is to choose between doing it yourself or hiring a professional debt negotiator. Keep in mind that your credit card company is obligated to deal with you and that a debt professional may not be able to negotiate a better deal than you can. Furthermore, the debt settlement industry has its fair share of con artists, ripoffs, and scams, which is why many people choose to try it on their own first.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What is a credit card unsecured loan?

Credit cards are unsecured loans, which means that there is no collateral your credit card company—or a debt collector —can seize to repay an unpaid balance.

Why do credit cards keep putting you on a debt?

It is usually because the lender is either strapped for cash or is fearful of your eventual inability to pay off the entire balance. In both situations, the credit card issuer is trying to protect its financial bottom line—a key fact to remember as you begin negotiating.

Why would a credit card company drop you?

In other words, your lender may drop you as a client because of your poor track record of paying back what you owe.

How much can you cut your credit card balance?

With a little bit of knowledge and guts, you can sometimes cut your balances by as much as 50% to 70%.

How long to cut down on credit card spending?

To raise your chances of success, cut your spending on that card down to zero for a three- to six-month period prior to requesting a settlement.

Why Work with a Debt Settlement Company?

Often there’s a good reason – a layoff or reduction in pay, big medical bills, an unexpected emergency expense. No matter what the reason, it can be difficult to get out from under overwhelming debt on your own. This is particularly true for credit card debt or other revolving debt, that never seems to decrease, even if you’re paying monthly.

What is debt settlement?

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly. Get Debt Help.

How long does it take for a debt settlement to pay?

Meanwhile, the company will negotiate with your creditors to settle for a lower amount. Once you’ve paid the amount the agreement is for into the escrow account, the debt settlement company will pay your creditor. This process can take 2-3 years.

What do debt settlement companies have to explain?

Debt settlement companies must explain price and terms, including fees and any conditions on services.

How much does a debt settlement company charge?

Debt settlement companies charge a fee, generally 15-25% of the debt the company is settling. The American Fair Credit Council found that consumers enrolled in debt settlement ended up paying about 50% of what they initially owed on their debt, but they also paid fees that cut into their savings. The report gives an example of a debt settlement client whose $4,262 account balance was reduced to $2,115 with the settlement. So, at first it would seem she saved $2,147, the different between what she owed and what the settlement amount was. But she also paid $829 in fees to the debt settlement company, so she ended up saving $1,318.

What happens when you settle a debt?

In debt settlement, the company will instruct you to stop making payments to the creditors. Your accounts become delinquent, and the debt settlement company tries to negotiate a settlement on your behalf. In the meantime, you give your money to the debt settlement company, who also is not paying the creditor with it.

How much money did a debt settlement save?

The report found that debt settlement clients settled an average of about 50% of what was originally owed, but realized savings of about 30%.

What are the downsides of DIY debt settlement?

Downsides of DIY Debt Settlement. Regardless of whether you take on the task yourself or reach out to a debt settlement company, you may face a tax burden if you do reach a settlement. If at least $600 in debt is forgiven, you’ll likely pay income taxes on the forgiven amount. Another downside to either DIY or professional debt settlement is ...

What to ask when entering a payment plan?

If you do enter a payment plan, ask whether the creditor will lower the interest rate on the debt to ease your financial burden. During your negotiations, maintain a written record of all your communication with a creditor. Last but not least, keep your cool and be honest.

Why do you do it yourself debt settlement?

A DIY settlement avoids the fees you might pay to a professional debt settlement company .

How many steps to take when you head down the DIY road of debt settlement?

Here are seven steps you can take when you head down the DIY road of debt settlement.

How do debt collectors make money?

Debt collectors make money by collecting past-due debts that originated with a creditor, such as a credit card company. When dealing with debt collectors, be patient. It may take several attempts to get the type of settlement you’re comfortable with.

Why is debt settlement considered a last resort?

Debt settlement is considered a last resort strategy because of the damage it does to your credit. Other options that require you to pay back the full principal debt amount—and thus do not negatively affect your credit score—include debt consolidation and debt management plans.

Is DIY debt settlement worth it?

DIY debt settlement negotiations almost certainly will consume a fair amount of your time and energy, and it could take a while to reach an agreement. In the end, though, all of your work may be worth it—especially if you’ re able to position yourself for a better financial future.

What a Debt Settlement Agreement Must Include

After you have negotiated a debt settlement with a creditor, such as a credit card company, you will need to formalize your agreement in writing. You can write the agreement yourself and send two copies to your creditor so that they can send a signed copy back to you. Or it may be easier to have your creditor draft up a letter and send it to you.

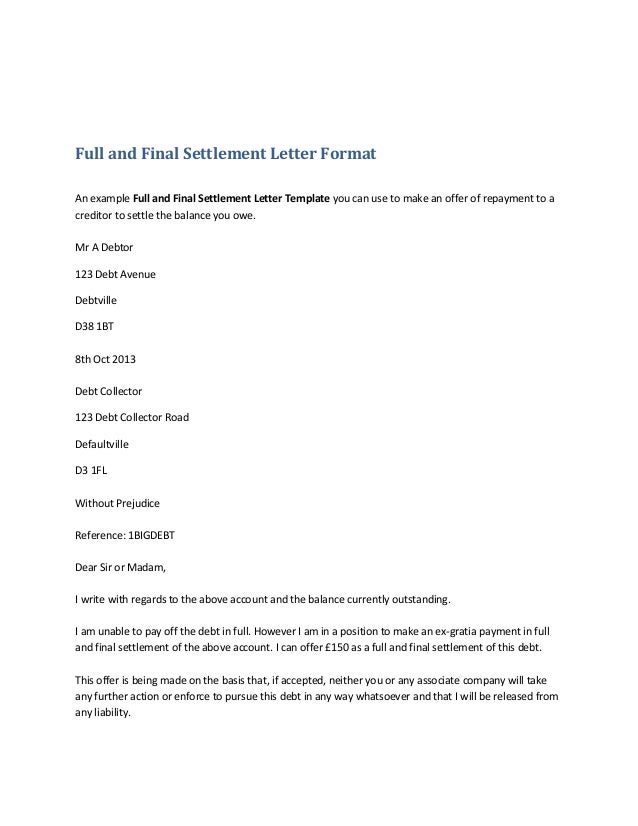

Sample Debt Settlement Letter Template

Here is a general template that you can use to draft your debt settlement agreement. You can add to, remove, or modify the information contained in this agreement to match your circumstances. The agreement letter can be either simple or complex, depending upon your specific financial situation and the type of debt that you owe.

How to get a debt settlement license?

Apply for your debt settlement services provider license with your Department of Commerce and pay the registration fee.

What is debt settlement?

Customers who have fallen behind on their credit payments often turn to debt settlement companies for relief. These companies provide debt relief by acting as an intermediary between the debtor and his creditor in order to reduce the original debt amount or help him save enough money to pay off the debt. These companies are highly regulated and must adhere to strict regulations about collecting methods and financial advising.

Who is Shanika Chapman?

She holds a Bachelor of Science in social science from the University of Maryland University College. Chapman also served for four years in the Air Force and has run a successful business since 2008.

The Basics of Debt Settlement

The Downsides of Debt Settlement

- Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before. First, debt settlement generally requires you to come up with a substantial amount of cashat one time. This is what makes the debt settlement attract…

Should You Do It Yourself?

- If you decide that a debt settlement is the right move, the next step is to choose between doing it yourself or hiring a professional debt negotiator. Keep in mind that your credit card company is obligated to deal with you and that a debt professional may not be able to negotiate a better deal than you can. Furthermore, the debt settlement industry has its fair share of con artists, ripoffs, …

Appearances Matter

- Whether you use a professional or not, one of the key points in negotiations is to make it clear that you’re in a bad position financially. If your lender firmly believes that you’re between a rock and a hard place, the fear of losing out will make it less likely that they reject your offer. If your last few months of card statementsshow numerous trips to five-star restaurants or designer-boutique sh…

The Negotiating Process

- Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.” Explain how dire your situation is. Highlight the fact that you’ve scraped a little bit of cash together and are hoping to settle one of your accounts before the money gets used up elsewhere. By mention…

The Bottom Line

- While the possibility of negotiating a settlement should encourage everyone to try, there’s a good chance you’ll hear a “no” somewhere along the way. If so, don’t just hang up the phone and walk away. Instead, ask your credit card company if it can lower your card’s annual percentage rate(APR), reduce your monthly payment, or provide an alternative payment plan. Often your cre…