Start the negotiation by offering a payment lower than what you really want to pay. The debt collector will probably counter with an amount higher than your offer or may even insist that you pay the full amount. The goal is to eventually get the debt collector to agree to an amount at or less than what you've decided you can afford to pay.

Full Answer

Can a borrower send a counter offer on a debt settlement?

If this is the case, the borrower may send a debt settlement counter offer of a lower amount. The letter should explain the reason the borrower cannot pay the amount offered by the creditor. In general, debt settlement is usually about half of the total amount of money owed.

What should I do if I receive a debt settlement offer?

If you receive a settlement offer: Always insist that the collector send you the offer in writing. Make sure the debt is yours and that the collector has a legal right to collect BEFORE you acknowledge any obligation to pay. To do this, ask the collector to send you paperwork that verifies the debt. Only correspond with the collector by mail.

Is a debt settlement offer legit?

Don’t get too excited about the prospect of finally being rid of this debt, though. Before you pay or even speak to anyone about the settlement (particularly a debt collector), you need to be sure the settlement offer is legitimate.

How does debt settlement work with debt collectors?

Debt settlement works differently depending on the status of the debt and who initiates contact to begin the settlement negotiation. But there are three basic ways that debt settlement can work. You can: Respond to a debt settlement offer from a collector

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do you negotiate a settlement debt?

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

How do you respond to a debt settlement offer?

Two Options for Taking the Settlement Offer Read the settlement offer carefully or have an attorney review the offer to be sure it's legally binding – that the creditor or collector can't come after you for the remaining balance at some point in the future. Or, you can even try to negotiate a lower settlement.

Can I negotiate a settlement offer?

If the offer is reasonable, you can immediately make a counteroffer that is a little bit lower than your demand letter amount. This shows the adjuster that you, too, are being reasonable and are willing to compromise. A little more bargaining should quickly get you to a final settlement amount you both think is fair.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Is it good to accept a settlement offer?

It is not in your best interest to accept a settlement offer without speaking with an attorney. The initial settlement offer from the insurance company is probably not fair. The offer may be much lower than the value of your damages. If the insurance company sends you a check, do not cash the check.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Are settlement offers good?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

How do you respond to a low ball settlement offer?

Here's a quick summary of the steps you and your attorney will follow when responding to a low settlement offer: Remain calm and analyze the offer even if you feel like the adjuster is trying to take advantage of you. Ask questions to find out how the adjuster came to the conclusion that they did.

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

How do you evaluate a settlement offer?

A variety of factors can affect what a reasonable settlement offer might be, including the following:Whether the injured plaintiff is partially liable.The extent and severity of the victim's injuries.The past and future likely costs of treatment.Whether the plaintiff is likely to fully recover or has fully recovered.More items...

What percentage will credit card companies settle for?

Credit card companies may settle for a negotiated amount equal to roughly 40% to 60% of the balance owed, according to the BBB. Credit card companies tend not to publicize settlements, so there are no hard statistics on success rates or settlement amounts.

Is it better to settle a debt or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

Is it worth it to settle debt?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you're able to offer a lump sum of money to settle your debt. If you're carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you.

How Much Do debt settlement companies charge?

a 15% to 25%Debt settlement companies typically charge a 15% to 25% fee to tackle your debt; this could be a percentage of the original amount of your debt or a percentage of the amount you've agreed to pay.

How to write a counter offer letter?

You could say that you only have a certain amount of money that you’re able to use to settle the account. Ask the creditor to sign and return a copy of the agreement if they accept. You should send your letter via certified mail with return receipt requested and wait for an answer. If you have a fax machine, include the fax number so the creditor can send the agreement back faster if the creditor accepts.

How long does it take for a debt collector to send out a settlement offer?

Some creditors and debt collectors automatically send out settlement offers on accounts. Creditors may do this when the account reaches 90 days past due. Collection agencies may make the offer as soon as they assume responsibility for collecting on the debt. A letter including the offer may not specifically use the word settlement, but there could be some language to indicate that you can pay a lump-sum amount that’s less than the full balance due and the creditor will cancel the rest of the debt. Once you receive the offer, you have to decide if it’s worth taking.

What to do if you reach an acceptable settlement?

If you and the creditor reach an acceptable settlement amount, then make the payment and keep a copy for your records. Making a counteroffer or just negotiating could be intimidating so you could always hire a debt settlement company to help you through the process.

What is the biggest part of debt settlement?

The biggest part of debt settlement is probably negotiation. You want to pay the smallest amount possible to satisfy your debt (or nothing at all!) and the creditor would prefer if you paid the full balance of the account. Somewhere in the middle there’s an amount that could work well for both of you. Sometimes you could be the one making the initial offer and your creditor will respond with an acceptance or a counteroffer. But, there may be times when you’re on the receiving end of the initial offer and you’re faced with a choice to accept or reject the offer.

Can you settle a lump sum?

A letter including the offer may not specifically use the word settlement, but there could be some language to indicate that you can pay a lump-sum amount that’s less than the full balance due and the creditor will cancel the rest of the debt. Once you receive the offer, you have to decide if it’s worth taking.

Who is Latoya Irby?

LaToya Irby is an expert blogger in personal finance. She is passionate about helping others understand the value of good credit and debt management. LaToya has experience working as a collection specialist in the financial services industry.

What happens when you make a counter offer to a debt settlement?

When making a counter offer, the borrower should be absolutely sure they cannot meet the offer given. When a counter offer is made, it voids the original offer. The creditor could withdraw the original debt settlement offer ...

What happens if a counter offer letter is arrogant?

If the counter offer letter is arrogant in tone or too full of misery, the creditor may not take it seriously and think that the borrower is just trying to pay as little as possible. It should be professional and accurate. When creditors make a debt settlement offer, they have decided to accept a lower amount.

What is debt settlement?

In general, debt settlement is usually about half of the total amount of money owed. If the original debt settlement offer from the creditor was less than this, the borrower may want to send a counter offer that is about half of what he or she owes. This amount has a good chance of being accepted by the creditor because it is still within ...

What is debt settlement counter offer?

If this is the case, the borrower may send a debt settlement counter offer of a lower amount. The letter should explain the reason the borrower cannot pay the amount offered by the creditor. In general, debt settlement is usually about half of the total amount of money owed. If the original debt settlement offer from the creditor was less ...

Why is it important for a borrower to always be courteous and polite?

The borrower should remember that he or she is not entitled to have their debt reduced. It is up to the creditor whether they are willing to negotiate. This is why it is important for the borrower to always be courteous and polite and have a genuine reason for financial difficulty.

What happens if a creditor negotiates with a borrower?

If a creditor is willing to negotiate with a borrower for a lower amount in order to have a debt paid off, the creditor may send a debt settlement offer to the borrower. This settlement amount may still be more than the borrower can pay due to circumstances beyond his or her control. If this is the case, the borrower may send a debt settlement ...

What does it mean when a creditor thinks a debt is overdue?

This means they either need to forget the debt or they need to give it to a collection agency.

Offer letter -1

This is to inform you that I am attorney Margaret and working for Mr. Neil. He has received your settlement letter yesterday and asked me to let you know about the matter. You have stated that you are not able to pay the debt and you can pay X$ instead of X$. So, this is to inform you that Mr. Neil wants you to pay X$ instead of X$.

Offer letter -2

I am Wesley, the lawyer of Mr. Coleridge. I am writing this to you in response to your debt settlement letter. He has told me to ask you if you have sent a settlement letter of paying the amount X$ instead of X$. But let me tell you that Mr. Coleridge has not accepted your amount. He wants you to pay xxx$ instead of X$.

Should You Do It Yourself?

If you decide that a debt settlement is the right move, the next step is to choose between doing it yourself or hiring a professional debt negotiator. Keep in mind that your credit card company is obligated to deal with you and that a debt professional may not be able to negotiate a better deal than you can. Furthermore, the debt settlement industry has its fair share of con artists, ripoffs, and scams, which is why many people choose to try it on their own first.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What is a credit card unsecured loan?

Credit cards are unsecured loans, which means that there is no collateral your credit card company—or a debt collector —can seize to repay an unpaid balance.

Why do credit cards keep putting you on a debt?

It is usually because the lender is either strapped for cash or is fearful of your eventual inability to pay off the entire balance. In both situations, the credit card issuer is trying to protect its financial bottom line—a key fact to remember as you begin negotiating.

Why would a credit card company drop you?

In other words, your lender may drop you as a client because of your poor track record of paying back what you owe.

How much can you cut your credit card balance?

With a little bit of knowledge and guts, you can sometimes cut your balances by as much as 50% to 70%.

How long to cut down on credit card spending?

To raise your chances of success, cut your spending on that card down to zero for a three- to six-month period prior to requesting a settlement.

What is debt settlement?

Debt settlementis a debt relief option that focuses on getting you out of debt for a percentage of what you owe. It’s also commonly called debt negotiationbecause you negotiate to only pay back a portion of the outstanding balance. In exchange, the creditor or collector discharges whatever is left.

What is the advantage of debt settlement?

Cost savings is the other big advantage of debt settlement. While other debt reliefsolutions focus on reducing the interest rate applied to your debt, debt settlement makes APR a complete non-issue. With debt settlement, you only pay back a percentage of principal – that’s the actual debt you owe.

How to settle a medical bill?

With this method, you contact a company first and make a settlement offer. You offer a certain percentage of what you owe and request for the remaining balance to be discharged. You can use this method with debt collectors, medical service providers for unpaid medical bills, or with a credit card company if your account is behind but still with the original creditor.

How long does it take to get out of debt?

Unless you file for Chapter 7 bankruptcy, which can take as little as six months to complete, debt settlement is typically the fastest way to get out of credit card debt. Debt settlement programs can be completed in as little as 12 months, depending on your financial situation. Even if you have limited funds for generating settlement offers, a good debt settlement company may be able to help you set up a plan that would have you out of debt less than 48 months. That’s equal to the average term you’d face with a debt consolidation loan, and you’ll likely eliminate your debt for half the cost!

How long does a settlement stay on your credit report?

The settlement remains on your credit report seven years from when the account first became delinquent.

How much does it cost to file Chapter 7?

The filing fee for Chapter 7 is $335, then you’ll also have fees for your attorney. This is why it’s important to have the right filing expectationsbefore you take your case to the courts. Let a certified debt relief specialist help you weigh the pros and cons of debt settlement based on your needs, credit, and budget.

How much does it cost to file for bankruptcy?

Keep in mind that bankruptcy isn’t free. The filing fee for Chapter 7 is $335, then you’ll also have fees for your attorney. This is why it’s important to have the right filing expectations before you take your case to the courts.

Why do creditors accept settlement offers?

Creditors can either send your accounts to collections, sue you for nonpayment, or sell the debt to a third-party debt buyer or collector.

What to do if a creditor doesn't settle?

If the creditor doesn't agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency.

How to settle debt for less than what you owe?

While many creditors might agree to settle your debt for less than what you owe, there’s no guarantee that debt settlement will work. If you’re considering trying it on your own, here’s a rough guide to the steps you may want to take: 1. Assess your situation. Create a list of your past-due accounts with the creditors’ names, how much you owe, ...

How long do you have to be late to settle a credit card?

For example, you may need to be at least 90 days late on an account before a creditor considers settling. Or, some creditors might not settle at all, and you’ll have to wait until the debt is sold to another company. Some creditors might also be more likely to sue you to collect an unpaid debt than others.

What to do if you feel like you're drowning in debt?

If you feel like you’re drowning in debt, the idea of settling for less money than you owe can be appealing. You could hire a debt settlement company that will work on your behalf to negotiate settlements with your creditors.

How good is MMI?

MMI is rated as “Excellent” (4.8/5) by reviewers on Trustpilot, a global, online consumer review platform dedicated to openness and transparency. Since 2007, Trustpilot has received over 116 million customer reviews for nearly 500,000 different websites and businesses. See what others are saying about the work we do.

What to do if you think you have enough money to settle an account?

Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. In some cases, the creditor may have already sent you a settlement offer. You could accept the offer, or respond with a lower counteroffer.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

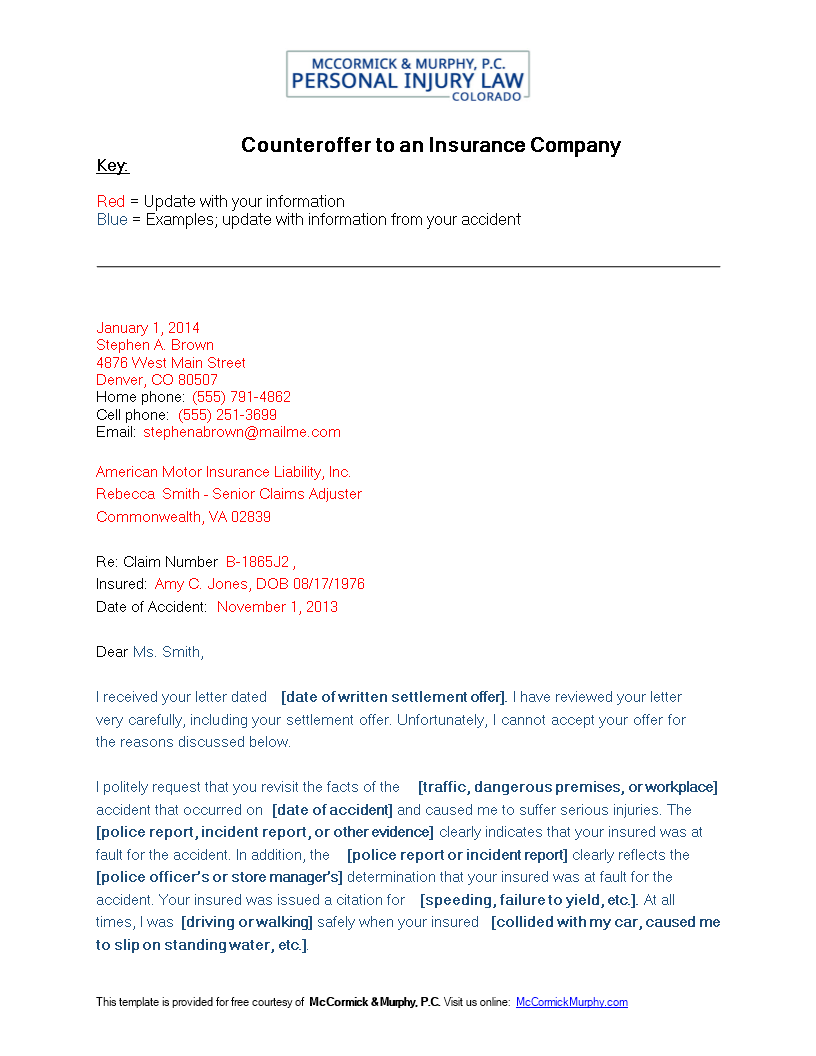

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]