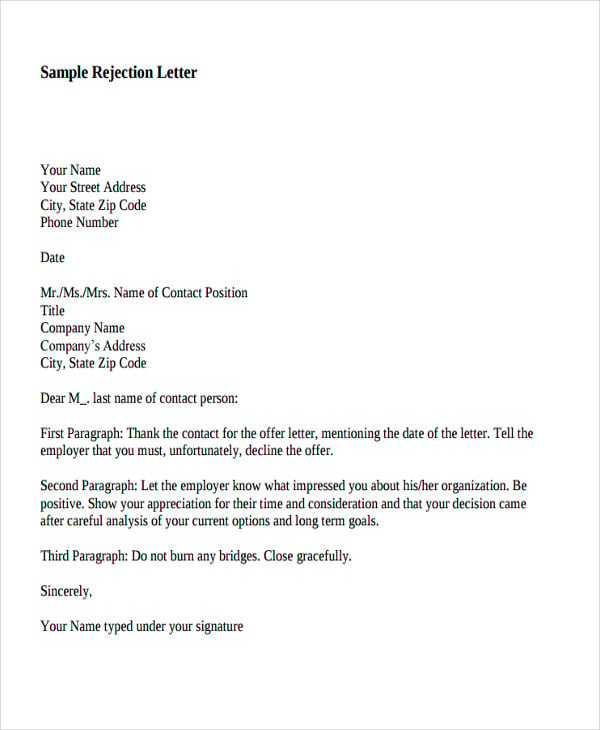

How to Counter-Offer an Insurance Settlement. From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

- State that the offer you received is unacceptable.

- Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.

- Re-state an acceptable figure.

- Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.

How to deal with a counter offer?

How to Negotiate a Counteroffer

- Know your value and the industry rate for your position. The best negotiation tactics are rooted in facts, not emotion, so spend some time researching. ...

- Don't rush it. Since you need to have a lot of information to make a reasonable counteroffer, it's worth taking some time before you begin negotiations. ...

- Don't forget non-salary benefits. ...

How to write a counter offer settlement letter?

- You start by stating that you do not accept the offer by them

- Reject any statements that are in offer letter that might be damaging or inaccurate about your claim. ...

- Rewrite the amount for the claim you would be accepting, then go ahead to state why you believe that your counteroffer is right. ...

How should I respond to settlement offer?

How Should I Respond to the First Workers Comp Settlement Offer? Here are some tips for handling the insurer’s opening offer: #1: Ask the Insurer How it Calculated the Offer . A reasonable workers comp settlement should include fair amounts for: Unpaid medical expenses. Future medical bills. Lost wages. The potential for lost earnings in the ...

How to reject an insurance offer?

Rejecting an Insurance Settlement Offer After a Car Accident

- Analyze Your Injuries in Dollars and Cents. Before you can tell whether a settlement offer is “fair,” you need to know how much your injuries are worth.

- Compare the Amount Offered to What Your Injuries are Worth. ...

- Draft a Counteroffer. ...

- Waiting to Hear Back. ...

- Speak with a Denver Car Accident Lawyer. ...

Can you negotiate a settlement offer?

If the offer is reasonable, you can immediately make a counteroffer that is a little bit lower than your demand letter amount. This shows the adjuster that you, too, are being reasonable and are willing to compromise. A little more bargaining should quickly get you to a final settlement amount you both think is fair.

How do you respond to a settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How long does it take to get a counter offer for a settlement?

Typically, it can take anywhere from one to two weeks for the insurance company to respond to your demand letter. Then it can take anywhere from weeks to months until you reach a settlement that you will accept. Some people accept the first or second offer, while others may accept the third or fourth counteroffer.

How do I write a counter offer for car insurance settlement?

What To Include In Counter Offer. In the letter, you will need to refer to the offer made by the insurance company and when it was made. You will then need to reiterate why you think you are owed damages from the other party and why you think that offer was low.

What is a Rule 49 offer to settle?

Rule 49 is a self-contained scheme containing cost incentives and penalties designed to encourage litigants to make and accept reasonable offers to settle. [3] An “offer to settle” is the term used for a written offer made by one party to another party to resolve one or more claims in a proceeding.

How do you decline a low settlement offer?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

Should I accept first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

How much should I offer in a settlement agreement?

The rough 'rule of thumb' that is generally used to determine the value of a settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary.

Is it good to accept a settlement offer?

Never accept a settlement offer until your doctor understands the full impact of your injuries. Maximum medical improvement is the milestone in your recovery where the doctor acknowledges that there is nothing more they can do for you.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

Can you negotiate a car settlement figure?

Even if the offer seems reasonable at first glance, you should always negotiate. After you research the value of your car, come up with a number that you feel is fair for a settlement. It should be the absolute minimum you are willing to accept.

How long does an insurance company have to respond to a counter offer?

In the best-case scenario, the insurance company will respond to your demand letter within 30 days. However, you generally have to wait anywhere from a few weeks to a couple of months because no law sets a deadline.

Is it good to accept a settlement offer?

Never accept a settlement offer until your doctor understands the full impact of your injuries. Maximum medical improvement is the milestone in your recovery where the doctor acknowledges that there is nothing more they can do for you.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

What is a formal offer to settle?

Making an Offer to settle is a tactic that a Claimant or Defendant can use to encourage settlement of a lawsuit without the need to go to trial. The tactic is set out in Rule 10.1 of the Small Claims Court rules. To make an offer to settle, an Offer to Settle form is used.

Why make a counter-offer?

So, if you don’t maker a counter-offer, you may find you’re missing out on money that they’re willing to pay you.

Should it be without prejudice and/or as part of a protected conversation?

The without prejudice rule is that any discussions which you intend to lead to resolving a dispute are off the record. This means that neither party can use those communications in evidence. However, the problem with the without prejudice rule is that it only applies if there’s an existing dispute.

Do you need legal advice before making a counter-offer?

Although the law requires you to get legal advice on your settlement agreement before signing it, you’re going to be better off speaking to a solicitor at an early stage.

Should you make the counter-offer in writing or verbally?

Whether you respond verbally or in writing depends on your negotiation strategy.

How long is a free consultation?

Many advisers offer a free initial consultation of up to half an hour, so you’ve got nothing to lose. Letting your employer know that you’ve spoken to a solicitor can add weight to your counter-offer.

Why is the without prejudice rule important?

That’s why protected conversations are important. They enable employers and their staff to have settlement discussions, even when there’s no existing dispute.

Why is it better to have a face to face conversation?

In these circumstances, a face to face conversation may be best because it helps to maintain a constructive relationship. Meanwhile, emails can often be misunderstood or come across as threatening. Nevertheless, if you’re negotiating on the basis of your legal rights, then it’s often better to set that out in writing.

How to counter an insurance settlement offer?

When you receive the initial settlement offer in writing, examine the reasons the insurance adjuster has given for the low settlement amount . Each of these points will become a part of your counteroffer letter, and you should respond to each and every one. Your counteroffer letter will reassert your original position described in your demand letter, as well as respond to each of their low-offer reasons in turn. Keep your emotions out of the letter and stick to facts, such as the extreme pain and suffering you have had to endure and the frustration and hassle of attending medical treatments. Be professional, courteous, and confident, and never attack the claims adjuster personally in your counteroffer letter.

What is a lowball offer from an insurance adjuster?

The initial offer you receive from the insurance adjuster will almost always be a "lowball" offer. They may defend their low offer by claiming that you were partially at fault for the accident that caused your injuries, or that the injuries you suffered weren't severe enough to warrant a greater amount. They may also question the amount of pain and suffering you experienced. They will aggressively defend their position of a low offer because this will often intimidate people into simply accepting the low offer. Do not ever accept the initial offer unless it is a fair offer.

How to reject an insurance offer?

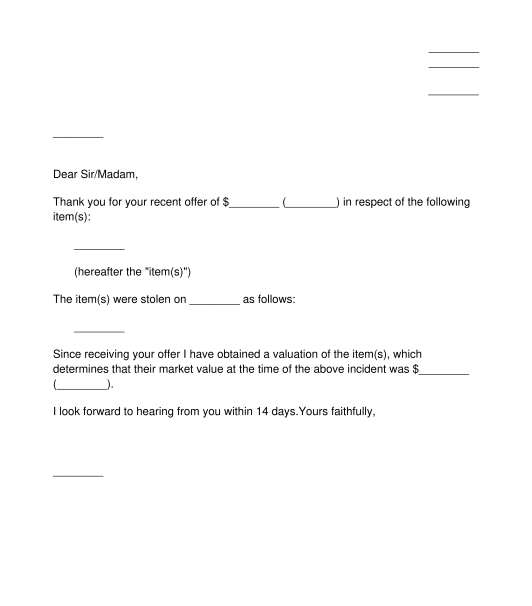

To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state:

How to reject a settlement offer?

To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state: 1 That you will not accept the initial settlement offer; 2 The reasons why you feel you deserve a higher settlement amount; 3 Each of their low-offer reasons, and your responses; 4 The higher settlement amount that you will accept.

What happens after an insurance adjuster investigates a personal injury claim?

After the insurance company has fully investigated your personal injury claim, they will make their first offer of settlement. Their investigation may include witness interviews, examination of the police reports and medical records pertinent to your case, and the demand letter you've forwarded to them. By the time the insurance adjuster presents an offer, they will feel confident about who was liable for the injuries you've suffered and property damage incurred, and what those are worth as a dollar amount.

What to do in a counteroffer letter?

Your counteroffer letter will reassert your original position described in your demand letter, as well as respond to each of their low-offer reasons in turn. Keep your emotions out of the letter and stick to facts, such as the extreme pain and suffering you have had to endure and the frustration and hassle of attending medical treatments.

How long does it take to get a settlement offer from insurance?

The initial settlement offer that comes from the insurance company can come at any time after you've filed your claim . Some personal injury claimants have to wait weeks to receive the offer, and some receive it rather quickly. Unfortunately, there is no set time in which the initial offer must be made.

How an insurance settlement offer is determined

An insurance settlement offer from your insurance company is prepared by a claims adjuster. There are strict protocols that these adjusters follow to determine a value for a claim. By understanding the way a settlement offer is prepared, you can better judge its fairness and make an argument for a counter offer to your insurance company.

Identify what parts of the low insurance offer are unfair

When the need to counter a low insurance offer from your insurance company arises, you must provide proof that you deserve more compensation. Think over the process employed by the claims adjuster. Is fault clearly determined? Have the severity of losses been thoroughly documented?

Prepare and submit your counter offer to your insurance company

Before you draft a written counter offer to the low insurance settlement offer you received, give some thought to the following three things:

What To Do About a Personal Injury Claim?

You have had great legal backing in making your insurance claim for a car accident, and you have considered the monetary damages you are willing to accept to settle your injury claim. What is the settlement process when you have received a low initial settlement offer? What happens if you want to put a counteroffer together for the insurer.

Overview of the Settlement Process in Personal Injury Lawsuit

The first thing you would do is to send the insurers a demand letter. Allow a lawyer with experience to send your demand letter.

How Ehline Law Firm Will Help You

Ehline Law personal injury lawyers are trained negotiators who can give you legal advice about if, when, and how to settle your injury claim.

How does an insurance adjuster settle a claim?

The settlement process usually begins after you or your attorney sends the insurance company a demand letter . The insurance adjuster will either accept the offer or make a counter offer. This claims adjuster (also called an appraiser, examiner, or investigator) is the person in charge of deciding whether or not an insurance company must pay a claim and, if so, how much. Oftentimes, there will be a lot of back and forth between you (or your attorney) and the insurance company with regard to the value of your accident claim, until an agreement is reached.

What is general pain and suffering?

General, or Pain and Suffering, Damages Are Usually The Point of Contention. When you are injured in a car accident caused by another driver, you're entitled to some compensation for your pain and suffering. The idea being that because someone else's negligence caused you undue pain, discomfort, or even emotional damage or stress, ...

What to do if you have been involved in a car accident?

If you've been involved in a car accident and have already received a settlement offer, make sure you take the time to review and counter before you accept . If you're making an insurance claim following a car accident, at some point you need to consider how much money you would be willing to accept to settle your claim ...

How to write a counter offer letter?

Start by summarizing the offer that was made to you. State that the offer is too low and explain why it is too low by drawing on your research. You might want to consider attaching some documents, such as bills, as exhibits. Finally, end by detailing the amount for which you would settle the claim.

What are general damages?

Calculate general damages. General damages are non-economic losses such as pain and suffering, shock and mental anguish, emotional distress, etc.

What is the first step in making a counter offer?

The first step in making a counter offer is to determine the value of your claim. To do this, simply:

What is the sum of special damages and general damages?

Add special and general damages together. The sum of your special and general damages is a good ballpark estimate of the value of your claim.

Why do insurance companies make low offers?

The first offer given by the insurance company will most likely be very low and not be their last offer. They may purposefully make a low offer to see if the claimant knows what he or she is doing. This is why it is recommended to negotiate for a higher offer.

What should an insurance adjuster do if the first offer is very close to the claimant's minimum amount?

If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

What happens when you submit a claim letter to an insurance company?

When a person submits a claim letter to an insurance company, whether it’s for a car accident, medical malpractice, personal injury or other reason, the insurance company will respond with a first offer. At this point, the claimant has the right to make a counter offer, and in most cases, this is the best thing to do.

What to do if a claimant wants to lower the amount?

If the claimant wants, they can enter into negotiations and send several letters that gradually lower the amount they will accept. It is also important for the claimant to mention any emotional suffering. This will not have a dollar value, but it is strong support of a higher settlement.

Who does a letter go to when a claimant is at fault?

In most cases, the letter goes to the at-fault party’s insurance company to make it clear that the claimant suffered injuries because of the fault of the company’s insured person.

Is an insurance company required to give a fair settlement?

The insurance company is not required by law to give a claimant a fair settlement. There are some adjusters who want to treat claimants fairly and some who take advantage of the claimant’s naiveté to offer a less than fair amount.

Should the claimant decide on the lowest amount they have calculated is fair for their claim?

The claimant should decide on the lowest amount they have calculated is fair for their claim and keep it in mind during negotiations, but not reveal it to the insurance company. If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

The Initial Settlement Offer

Evaluating The Initial Offer

- When you receive the initial settlement offer in writing, examine the reasons the insurance adjuster has given for the low settlement amount. Each of these points will become a part of your counteroffer letter, and you should respond to each and every one. Your counteroffer letter will reassert your original position described in your demand letter, as well as respond to each of the…

Rejecting The Initial Offer and Making A Counteroffer

- To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state: 1. That you will not accept the initial settlement offer; 2. The reasons why you feel you deserve a higher settlement amount; 3. Each of their low-offer reasons, and your responses; 4. The higher settl...

Fair Initial Settlement Offer

- Though it doesn’t happen often, if the insurance adjuster thinks that you have a very strong case against their insured (the at-fault party), their initial settlement offer may be fair. Don’t simply reject the initial offer because it is the first offer you’ve gotten. Measure what you’ve asked for in your demand letter against what the insurance adjuster has offered, and then you and your attor…

Let Us Help You

- The process of settlement offers and counteroffers can be complex and overwhelming. We understand, and we want you to know that you can call us anytime to schedule a free, no-obligation consultation. With one of our skilled attorneys on your side, you can rest assured you’ll receive fair compensation for the damages you’ve suffered. You can reach us by phone at (916) …