- Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. ...

- Review all the details of your transaction. Make sure you remember what both parties have agreed upon.

- Carefully lay down the points needed to be discussed in the settlement statement. This includes all terms, conditions, standards, and all important details regarding your transaction.

- Write in an understandable manner. You need to write clearly. Use simple words, phrases, and language. Specify all the things that need to be specified.

- Be honest. You need the other party to trust you until the last moment, so be honest in writing all the contents of your settlement statement.

- Make it short. Do not include unnecessary information which would make your settlement statement unnecessarily long.

- Go over your settlement statement many times before sending it to the other party. You first need to check if all the information you included are accurate. ...

What is settlement and examples of settlement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client. For example, a seller sends the buyer a settlement statement containing the summed up costs with regards to the buyer’s purchase. Or a lender sends a settlement statement to a borrower containing all ...

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

How do you write a letter of settlement?

Settlement Agreement Letter Writing Tips. The letter should specify the important details. The letter should also specify how the settlement can be tackled. The letter should specify the amount. The letter should be clear and simple. The letter should express the terms & conditions from the standpoint of both the parties.

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is the most commonly used form for settlement statements?

HUD-1 formA HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

How many pages is a settlement statement?

Typically, the borrower will receive a settlements statement copy three business days after the borrower applies for a mortgage loan. Note that the form has three pages containing the information which includes: Type of mortgage. The loans total payment amount.

What is a full settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is a settlement statement in a business?

A settlement statement is a document that summarizes the terms and conditions of a settlement agreement between parties. Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller.

What is the primary purpose of the settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Who prepares the closing statement?

In real estate transactions, a closing agent prepares the closing statement which reflects the cost of the property for both the buyer and the seller. It is important that closing statements reflect the agreement of both buyers and sellers of properties, as well as a mortgage loan that backed up the home purchase.

What is a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

What are settlement documents?

Definition. A settlement document records the vendor data that is created when settlement is performed for home delivery or agency services for each employee or service company. Each settlement document comprises a document header and at least one document item.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

What is a settlement statement vs closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

Is settlement and closing the same thing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

What are settlement documents?

Definition. A settlement document records the vendor data that is created when settlement is performed for home delivery or agency services for each employee or service company. Each settlement document comprises a document header and at least one document item.

Is a settlement statement and closing disclosure the same thing?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

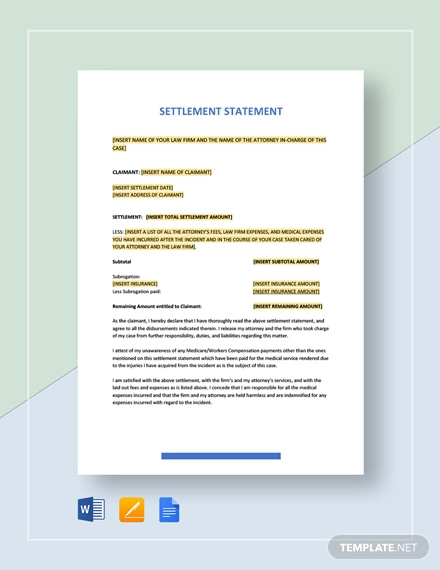

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is a RESPA?

The Real Estate Settlement Procedures Act (RESPA) govern s the formulation of both closing disclosures and HUD-1 statements for the mortgage lending market. RESPA has been revised and updated throughout history to help manage mortgage lending disclosures and protect borrowers. RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure.

How many pages are required for HUD-1?

The HUD-1 is a three-page form generally required to be provided to a borrower one day before closing. The mortgage closing disclosure is a five-page form generally required to be provided to a borrower three days before closing.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

What is a legal settlement statement?

Legal Settlement Statement Example. Once the Legal Settlement gets signed by both parties, it will take its form. Legal Settlements bear all the necessary details like date, place, lease amount, etc and filling the form is as easy as writing with a pen.

What is the difference between a lease agreement and a settlement statement?

But in reality, there is a big difference between the two. A lease agreement is a contract between two parties (the lessor and the lessee) about land and/or property for a specific period of time, whereas, a settlement statement templates as the name implies, settles the issue without much hassle.

What is vendor settlement?

A Vendor settlement phase occurs between the distributor and vendor. This Vendor Settlement Statement Example contains the details such as name and address of both parties, settlement amount and time. The example entails the details in an organized manner.

Why include confidentiality clauses in settlement agreements?

The purpose of including confidentiality clauses in settlement agreements is to keep both parties away from sharing the details with the World. This Confidential Settlement Statement Example is a well-drafted confidentiality agreement that can settles most potential litigation nightmares.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How to resolve a claim in a settlement agreement?

Negotiate the scope of the release. You must negotiate the scope of the release in the agreement to determine which claims will be resolved, and whether any future claims are also resolved by this settlement agreement. You can negotiate a provision stating that the settlement agreement applies to all claims arising out of the dispute, whether they are current or not yet realized, or the settlement may resolve just one aspect of a suit or a single claim. This will depend on your needs.

What is a settlement agreement?

A settlement agreement is a legally binding contract meant to resolve a dispute between yourself and another party so you do not have to go through the judicial process (or extend the judicial process if you are already in court).

How to settle a dispute between two parties?

1. Decide whether you have the need for a settlement agreement. A settlement agreement is a legally enforceable contract. They can be used in a variety of situations where two parties are in dispute about something and they wish to compromise on how that dispute will be resolved.

How to settle a dispute with a mediator?

1. Agree on a statement of the dispute. Both parties are likely to have a differing view of the dispute. Before writing your settlement agreement, you must come to an agreement of the factual terms of the dispute. A mediator may be helpful in determining this.

What are the situations where a settlement agreement is used?

Some of the most common situations in which a settlement agreement is utilized include: disputes over damaged property; employment disputes between employers and employees; marriage disputes; and medical malpractice disputes.

What does "unconscionable" mean in a settlement agreement?

A settlement agreement must also not be "unconscionable.". This means that it cannot be illegal, fraudulent, or criminal. For example, you could not agree to settle a lawsuit in exchange for six pounds of cocaine, because the sale of cocaine is illegal in the United States. [11]

When parties agree to settle a dispute through a mutual agreement, the party providing the settlement payment will not want to?

Oftentimes, when parties are agreeing to settle a dispute through a mutual agreement as opposed to going through the judicial process, the party providing the settlement payment will not want to admit any liability or fault.

What is a settlement statement in Western Australia?

The Western Australia Settlement Statement allows for the generation of the Seller Statement, Buyer Statement and Adjustment Statement. Various adjustments can be entered in either statement including unlimited entries for Time Related items (apportionable), Rental, Miscellaneous Items (non-apportionable), Penalty Interest and Cheques. Items can be re-calculated easily with a keystroke and re-ordering items is equally simple with a click of the mouse.

How many tiers are there in a settlement statement?

The Settlement Statement caters for up to 3 tier water usage calculations and different tier counts (residential, strata, commercial), as well as settlement periods that span two financial years with a water price increase. Multiple separate water usage adjustment are possible on the one statement.

How are water usage adjustments calculated?

The water usage adjustments can be calculated either based on average daily consumption, last 2 readings or manual entry of adjustments. You also have the ability to add customised miscellaneous adjustment and any additional comments within the statement.

What is the New South Wales Settlement Adjustment Sheet?

The New South Wales Settlement Adjustment Sheet includes a toolbar which contains a button for each of the adjustment options (including council rates, water/sewerage rates, strata levies, insurance premium, land tax, water usage, default interest, rent/occupation fees). As you create each of the adjustments, the form will automatically recalculate the figures as you go.

What are the three statements of a company?

The 3 statements are: Purchaser Statement, Vendor Statement and Adjustment Statement - the adjustment figures will re-calculate to suit the statement chosen.

Can you save miscellaneous adjustments?

You can also create customised miscellaneous adjustments as a one off, or you can save them for future use by your firm. Other features include entry of comments, as well as the option to alter adjustments easily within the document.

What is the purpose of a settlement statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest.

Who prepares the settlement statement?

The settlement statement is prepared by an impartial third party to the transaction, usually an officer with the title or escrow company that performs the closing.

What are closing costs on settlement statement?

In California, as a rule of thumb, closing costs amount to approximately 11 percent of the total sales price of a home. They usually include a real estate commission, loan fee, escrow charge, title insurance premium, a pest inspection and the like.

Does seller get check at closing?

Sellers receive their money, or sale proceeds, shortly after a property closing. It usually takes a business day or two for the escrow holder to generate a check or wire the funds.

When should I get a settlement statement?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Is a settlement statement the same as a closing statement?

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person’s estimated closing costs.

When should seller Get settlement statement?

It is usually handed out at least three days before the closing, so that the seller and their agent can review it. The document is usually prepared by a lawyer, escrow firm, or a title company.