If you cannot agree to settle, your reply should be a formal business letter that makes the case for your higher demand.Your letter should clearly:

- State that the offer you received is unacceptable

- Refute any statements in the adjustor’s letter that are inaccurate and damaging to your claim

- Re-state an acceptable figure

- Explain why your counteroffer is appropriate, including the reasons behind your general damages demands

- Document any special damages you demand by including copies of receipts, bills, confirmation of work absences.

What should I do if I receive a low settlement offer?

Once you receive a written copy of the initial settlement offer, review the settlement amounts and the reasons stated for such a low offer. You should respond to each of the reasons cited by the claims adjuster in a written letter that includes a logical and reasonable counter-offer.

How to reject a settlement offer from an insurance company?

In a written letter, you should reject the initial offer of the insurance company by emphasizing the following points: Clearly state that you do not find the initial settlement offer acceptable; Lists the specific reasons why the initial settlement offer is not acceptable; and Include a demand for a higher settlement offer.

Why was my insurance settlement offer lower than I expected?

If you have been injured in an accident and are expecting an insurance settlement, do not be surprised if the amount offered is less than you anticipated.Many insurance claims adjusters initially make a low settlement offer in hopes that you will simply accept it and go away.

Do I have to settle for what an adjuster offers?

You do not have to settle for whatever paltry sum an adjustor thinks he or she can get away with offering you. You have the right to reject any settlement offer and respond with a counter demand for the payment you deserve. But you have to wait until a settlement offer is made to reject it and submit a counter demand.

How do you respond to a low settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do you counter offer an insurance settlement?

From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

What happens if you ignore a settlement offer?

When someone rejects a settlement offer, it is automatically terminated and can not be accepted at a later time. From here, you can negotiate or make a counteroffer, but will be up to the other party if they want to accept or reject the offer.

Can you negotiate a settlement offer?

If the offer is reasonable, you can immediately make a counteroffer that is a little bit lower than your demand letter amount. This shows the adjuster that you, too, are being reasonable and are willing to compromise. A little more bargaining should quickly get you to a final settlement amount you both think is fair.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

Should you accept first offer insurance claim?

Once the offer is made, you have 21 days to decide whether or not to accept it. You should always take legal advice before accepting a Part 36 offer, especially if you have a conditional fee agreement or are using an insurance policy to cover your legal expenses, as you may find you invalidate your contract.

Do I have to accept a settlement agreement?

Do I have to accept a settlement agreement offered? The short answer is no, you do not have to sign a settlement agreement.

Should I accept the settlement?

Never accept a settlement offer until your doctor releases you from treatment. You cannot know the extent of your injuries until you finish your medical treatments. In addition, your doctor could issue a permanent impairment rating after you complete treatment, which would increase the value of your injury claim.

Do I have to accept my insurance settlement offer?

you don't have to accept any offer that's made to you. If you do accept an offer it might be lower than the compensation you would have got if you'd used a solicitor or gone to court instead. don't feel under any pressure to make a decision quickly.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How much should I offer in a settlement agreement?

The rough 'rule of thumb' that is generally used to determine the value of a settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary.

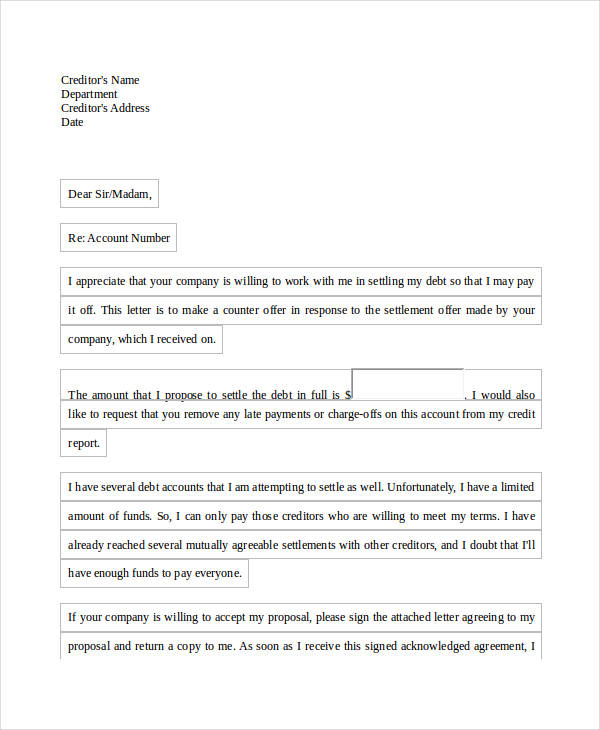

How do you write a counter offer letter for a settlement?

What To Include In Counter Offer. In the letter, you will need to refer to the offer made by the insurance company and when it was made. You will then need to reiterate why you think you are owed damages from the other party and why you think that offer was low.

How do I ask for insurance for more money?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

Can you negotiate with insurance adjusters?

Negotiate with your insurance adjuster However, if you feel that the offer for your vehicle's value is too low, you can begin negotiating with your claims adjuster. If you decide to negotiate, you may want to be prepared to show how you came up with your desired payout number.

How long does an insurance company have to respond to a counter offer?

In the best-case scenario, the insurance company will respond to your demand letter within 30 days. However, you generally have to wait anywhere from a few weeks to a couple of months because no law sets a deadline.

How to prepare for an insurance company offering less than you deserve?

Prepare for the real possibility that the insurance company will offer less than you deserve by keeping a record of your costs and losses related to your accident and injury. Save copies of all bills and receipts and keep a journal of your recovery.

What should an insurance settlement account for?

An insurance settlement should account for all of these losses as they apply to you and your situation, up to the limits of the applicable insurance coverage.

What to do if your insurance is disputed?

You could benefit from the assistance of an experienced personal injury lawyer if your insurance claim is disputed after an accident. Sometimes, just a letter on a law firm’s letterhead helps an insurance company get more serious about responding to a claim.

How do claims adjusters follow up on a claim?

A claims adjuster should follow up on your claim by contacting you and investigating your case. The investigation may include reviewing your medical records, obtaining vehicle repair estimates, reviewing police accident reports, interviewing you and reviewing your initial claim documents.

What to do if insurance company is using delay tactics?

You must also consider how slowly negotiations are going.If the insurance company is using delay tactics, you will need to keep in mind the statute of limitations for filing a personal injury lawsuit. You do not want to let the time limit expire.

What to do after an accident?

After suffering an injury in an accident, you may be able to turn to insurance for coverage of medical costs and other losses. You might file a claim under a policy you hold (e.g., auto collision insurance, homeowners’ insurance, health insurance) or through another person’s liability insurance if he or she was at fault.

What is settlement authority?

A “settlement authority” is just a negotiating tactic. If an adjustor tells you about their authority, he or she is trying to convince you to accept the offer on the table. It’s a tactic to pressure you to accept an offer for less than the fair value of the claim.

How long does it take for an insurance company to offer an insurance policy?

The amount of time it takes to receive an initial offer from the insurance company can widely vary. In more minor accidents, the insurance company may fling an initial offer at you with a few days or a week or two of the accident. Generally, the more complex or severe the accident, the more time it will take for the insurance company ...

Why do insurance companies throw out a single figure?

It is common for the insurance company to throw out a single figure in hopes that the one amount will be enough to fool you into a cheap settlement. By having the adjuster break down the offer, you can identify where the insurance company may be shorting your claim.

What is the phone number for McMillian Law Firm?

The McMillian Law Firm is known for compassionate and effective legal representation. Call us now at (843) 900-1306 or use the online form to schedule your free no-obligation case evaluation today.

How often should I call a claims adjuster?

You should call the claims adjuster regularly, I would say at least once a week, until an initial offer is given! If the claims adjuster contacts you and gives an offer over the phone, please tell them to reduce the offer to writing and sent to you certified mail. Any offer that is received from the insurance company should be broken down into its component parts (medical bills, lost wages, future treatments, pain and suffering, etc.). It is common for the insurance company to throw out a single figure in hopes that the one amount will be enough to fool you into a cheap settlement. By having the adjuster break down the offer, you can identify where the insurance company may be shorting your claim.

What does a claims adjuster do after receiving a claim?

Upon receiving the claim and / or the demand letter and making an initial offer, the claims adjuster will conduct an investigation that in a lot of ways will mirror the investigation done by your personal injury attorney. The claim adjuster will interview witnesses, review police reports, review your medical records, and read the demand letter. In cases that involve more severe injuries and claimed damages, the claims adjuster will visit the scene of your accident. Upon completion of this investigation, the claims adjuster at that point will usually make the initial settlement offer.

What happens if you hold on to your settlement money?

By holding on to your settlement money for a longer period of time, the insurance company is essentially earning income off the money that is rightfully yours and in essence they are mitigating their own payout. You need to take a proactive role in bringing your claim to a close and securing a favorable settlement offer!

What is initial settlement offer?

The initial settlement offer is the insurance company's way of feeling you out. Do not lose your cool over something you can not control. You are, most likely, going to get low-balled on the initial offer. The insurance company's priority is maximizing profit, not looking out for your well-being.

What to do if you reject a low settlement offer?

If you choose to reject the low settlement offer, you must communicate your decision to the claims adjuster. Your legal representative can help you write a letter that states your intentions. Within the letter, you can indicate that you reject the offer and highlight why you deserve a higher settlement amount.

What to do if you reject an initial offer?

Your legal representative can help you write a letter that states your intentions . Within the letter, you can indicate that you reject the offer and highlight why you deserve a higher settlement amount. You should also counter their reasons for providing you with the low-ball initial offer. Your explanation behind these reasons can be critical in getting a much better second offer from the claims adjuster.

When will a claims adjuster present an initial offer?

Your claims adjuster will present you with the initial offer in the weeks after the settlement process has begun. They will use this opportunity to highlight why they’ve presented you with this specific settlement and the factors involved in their analysis. However, this initial offer is usually a low-ball price designed to force you to settle the case quickly and at the lowest possible price. It’s recommended that you never accept this initial offer because there’s usually a better offer available with a little more negotiation.

Can an insurance adjuster see fairness?

On the rare occasion, an insurance adjuster will see the fairness in your position and will provide you with an offer that is acceptable to you given your injuries.

When should you release medical records?

You should only sign off on releasing your medical records if you’re near to the end of your treatment process. Only at the end of this process can you calculate the real pain and suffering that resulted from your injuries. The information provided within your medical records can then be used in your demand letter when requesting a settlement from the insurance company.

Do you have to answer all questions asked by insurance companies?

You don’t have to answer each of the questions presented to you by the insurance company. These questions are designed to find flaws in your case and to ensure they can present you with the lowest possible offer or no settlement offer at all. If you’re unsure of the answer to any question asked, make sure that you speak with your personal injury attorney, South Carolina directly and discuss the question and potential responses.

Who is the Clardy Law Firm?

The experienced legal team at The Clardy Law Firm is here to help you with the process of countering a low settlement in your personal injury case. To discover more about the claims process and the steps to take to succeed in your claim, contact our trusted experts now for a consultation.

What happens if I reject a settlement offer?

Scenario 3: Protect Your Legal Rights by Filing a Lawsuit The most dramatic result of a rejected settlement offer is a lawsuit against the party who injured you, the insurance company, or both.

How do you politely decline a settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

How do you write a letter to reject a settlement offer?

That you will not accept the initial settlement offer; The reasons why you feel you deserve a higher settlement amount; Each of their low-offer reasons, and your responses; The higher settlement amount that you will accept.

How to get a sample from US legal forms?

To get a sample from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and select the document you need and purchase it. Right after buying templates, users can find them in the My Forms section.

What does a preview function do in a form?

In case the form has a Preview function, use it to review the sample.

What to do if an insurance adjuster offers you a settlement?

If an insurance adjuster offers you a settlement in your personal injury claim, you are not obligated to take it. If you think you are entitled to a larger sum, keep negotiating until you get a settlement you feel comfortable with. 1. Be Reasonable.

How to reject a settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

How much does an auto insurance policy cover?

For example, an auto policy could cover up to $50,000 in property damage coverage and $100,000 in medical expenses per injured person.

What is the first rule of settlement negotiation?

The first rule of settlement negotiation is to know the approximate value of your claim, and to work toward a settlement within that range. If the settlement you have been offered is less than you were hoping for, but is still reasonable, you should consider your arguments carefully before rejecting it. 2. Low Settlement Offers are Common.

When negotiating a settlement, do you need to know what the limits of the other party's insurance policy are?

You can request a copy of the insurance policy you are trying to collect under, and the company will send it to you. When you know the policy limits, you know the limits of the insurance adjuster’s ability ...

Can you get a copy of your auto insurance policy?

If you are negotiating for compensation under a home or auto insurance policy, ask for a copy of the policy as soon as you can. Outside of special circumstances the insurance company will not usually pay an injured party more than the liability policy limit.

Can You Reject a Settlement Offer?

Unless you refuse a settlement offer under the advice of your attorney, this is also an unwise and dangerous legal choice.

What is a total loss letter?

Total loss letters are a specialized legal area. Get legal advice before declining an offer on a totaled vehicle. They will protect your interests and provide you with realistic options regarding your car. Whether to reject a settlement offer is an important decision.

What happens when an insurance company offers a settlement?

When an insurance company offers a settlement, how you reply has substantial legal and financial ramifications. Reacting to this offer should not be done in haste. It requires an analysis of several factors and a review by an experienced attorney. An initially offered settlement likely will not fully compensate you.

Why do you need a personal injury attorney?

You need an experienced personal injury attorney to understand the benefits and challenges of rejecting an offer entirely and to ensure that you have an advocate going forward.

What can a lawyer request for reimbursement?

In this counter, your lawyer will be sure to request reimbursement for your medical bills, lost wages, transportation costs, pain and suffering, and other relevant expenses.

Where is Platte River Injury Law?

At Platte River Injury Law, we deal with personal injury cases throughout the state of Wyoming.

Can you accept a settlement offer without a lawyer?

Do not agree orally, via email, letter, or via text to the offer without consulting a lawyer. However, this does not mean you should immediately ...

The Initial Settlement Offer

Evaluating The Initial Offer

- When you receive the initial settlement offer in writing, examine the reasons the insurance adjuster has given for the low settlement amount. Each of these points will become a part of your counteroffer letter, and you should respond to each and every one. Your counteroffer letter will reassert your original position described in your demand letter, as well as respond to each of the…

Rejecting The Initial Offer and Making A Counteroffer

- To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state: 1. That you will not accept the initial settlement offer; 2. The reasons why you feel you deserve a higher settlement amount; 3. Each of their low-offer reasons, and your responses; 4. The higher settl...

Fair Initial Settlement Offer

- Though it doesn’t happen often, if the insurance adjuster thinks that you have a very strong case against their insured (the at-fault party), their initial settlement offer may be fair. Don’t simply reject the initial offer because it is the first offer you’ve gotten. Measure what you’ve asked for in your demand letter against what the insurance adjuster has offered, and then you and your attor…

Let Us Help You

- The process of settlement offers and counteroffers can be complex and overwhelming. We understand, and we want you to know that you can call us anytime to schedule a free, no-obligation consultation. With one of our skilled attorneys on your side, you can rest assured you’ll receive fair compensation for the damages you’ve suffered. You can reach us by phone at (916) …