Carefully lay down the points needed to be discussed in the settlement statement. This includes all terms, conditions, standards, and all important details regarding your transaction. Write in an understandable manner. You need to write clearly. Use simple words, phrases, and language. Specify all the things that need to be specified. Be honest.

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is settlement statement same as Closing Disclosure?

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

How to generate a daily settlement report?

Settlement occurs for all batches submitted within the 24-hour "settlement day". For example, for a particular processor, all transactions from 9 PM Monday night through 9 PM Tuesday night occur during that "day". Generating a Settlement Report. To access the Settlement Report page, navigate to Reports-> Standard-> Settlement.

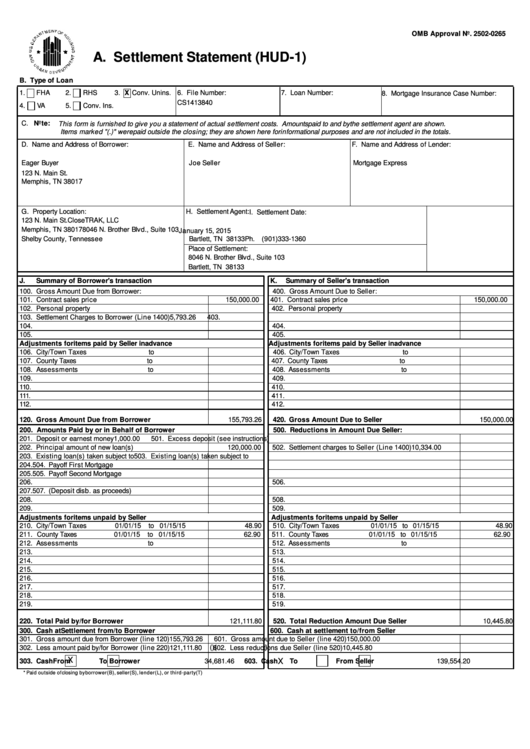

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

How do you record a settlement statement?

How to Record a HUD Settlement StatementCredits – will list the gross amount owed to the seller at the time of settlement closing:Debits – will list the charges of the seller at the time of settlement closing:Debits – will list the gross amount owed by the buyer at the time of statement closing:More items...•

What is the most commonly used form for settlement statements?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

Who prepares the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

Who typically prepares the closing statement?

Typically, closing agents are real estate attorneys, title companies or escrow officers. Unlike the HUD-1, which closing agents generally provided to buyers and sellers on the day of a real estate closing, closing statements must be issued at least three business days before closing.

How do you write a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

What a closing statement looks like?

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

Are HUD-1 settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What is a settlement statement quizlet?

HUD-1 Settlement Statement itemizes: All charges imposed upon the borrower and the seller by the loan originator.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

When should I receive the HUD-1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

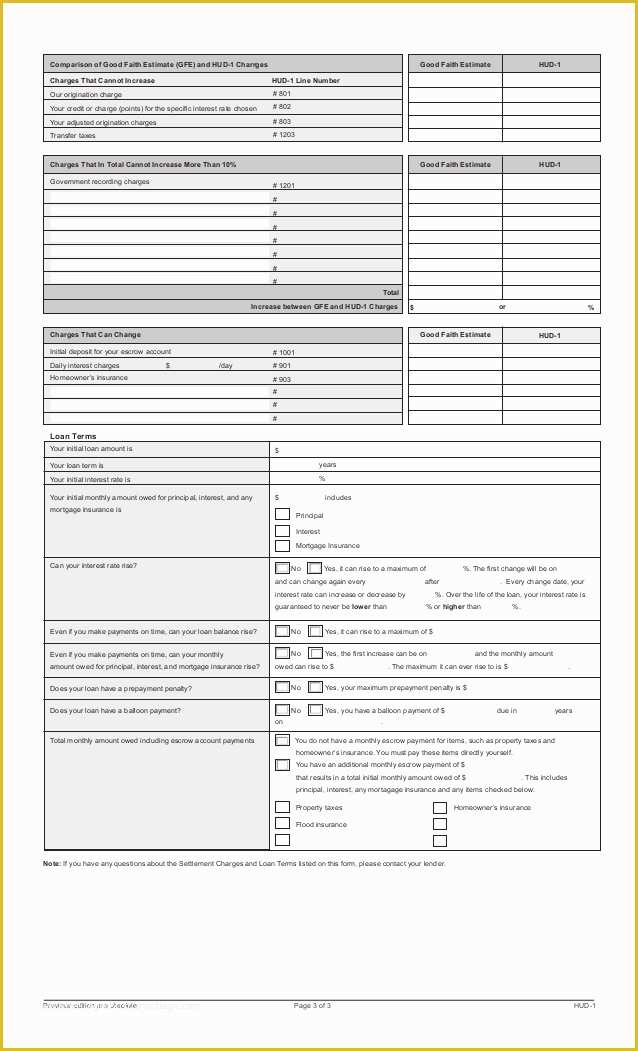

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

What to consider when writing a settlement statement?

Either way, one needs to consider many things when writing a settlement statement. Here are some of those things: Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. If you don’t have one, don’t write it.

What Is a Settlement Statement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client.

Why do both parties need to check the contents of a document?

Both parties need to check the contents of the document thoroughly in order to avoid future conflicts and lawsuits. This will serve as one of the final agreements both parties will undergo upon the completion of their transaction. The process, however, might vary from one service provider to another, so the client also need to review the process properly.

Why do people use financial statements?

People involved in business also make use of statements in conducting their business operations. Financial statements express a company’s financial status, operations, and plans over a certain time period. This goes to show that statements are reliable even in the world of business.

Is a statement a reliable source of information?

Most of us are aware that statements are reliable sources of information. Statements vary from being accounts of people about certain topics (as in statement of purpose ), to being used as an evidence in the court of law (as in witness statements ). These, among other things prove that statements are useful sources of facts and information.

How is a Settlement Statement Used?

When closing on a mortgage loan package, it is mandatory for the borrower to review and sign a settlement statement. With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive. A settlement statement consists of things such as:

How long does it take to get a settlement statement?

Typically, the borrower will receive a settlements statement copy three business days after the borrower applies for a mortgage loan. Note that the form has three pages containing the information which includes:

What are the charges on a loan settlement statement?

The second section has all the charges imposed on the buyers loan and the fee paid by the buyer before the loan closing. Note that any fee paid before or outside closing, are have the initials POC. Some of the charges in this section include the title policy, document preparation, title research, and attorneys fees. The third section highlights research, transfer, survey, and inspection fees.

When to use HUD-1 settlement statement?

Significance - According to RESPA, it is mandatory to use the HUD-1 settlement statement when closing real estate deals. It is on this page that all the mortgage loan terms are stated. The page consists of the following:

Who prepares the settlement statement for closing?

In most cases, it is the third party in the transaction that prepares the settlement statement for closing. The third-party can be the officers that deal with this kind of documents and usually have a title. It could also be an escrow company presiding over the closing. The cost of preparing the document varies depending on the state. Note that states have different customary practices, and this includes fees charged for settlement services. In the state of California, both the seller and the buyer usually sign the document at closing.

Do you need a settlement statement for a mortgage?

With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive. A settlement statement consists of things such as:

How to resolve a claim in a settlement agreement?

Negotiate the scope of the release. You must negotiate the scope of the release in the agreement to determine which claims will be resolved, and whether any future claims are also resolved by this settlement agreement. You can negotiate a provision stating that the settlement agreement applies to all claims arising out of the dispute, whether they are current or not yet realized, or the settlement may resolve just one aspect of a suit or a single claim. This will depend on your needs.

What are the situations where a settlement agreement is used?

Some of the most common situations in which a settlement agreement is utilized include: disputes over damaged property; employment disputes between employers and employees; marriage disputes; and medical malpractice disputes.

How to settle a dispute between two parties?

1. Decide whether you have the need for a settlement agreement. A settlement agreement is a legally enforceable contract. They can be used in a variety of situations where two parties are in dispute about something and they wish to compromise on how that dispute will be resolved.

What is a settlement agreement?

A settlement agreement is a legally binding contract meant to resolve a dispute between yourself and another party so you do not have to go through the judicial process (or extend the judicial process if you are already in court).

How to settle a dispute with a mediator?

1. Agree on a statement of the dispute. Both parties are likely to have a differing view of the dispute. Before writing your settlement agreement, you must come to an agreement of the factual terms of the dispute. A mediator may be helpful in determining this.

What does "unconscionable" mean in a settlement agreement?

A settlement agreement must also not be "unconscionable.". This means that it cannot be illegal, fraudulent, or criminal. For example, you could not agree to settle a lawsuit in exchange for six pounds of cocaine, because the sale of cocaine is illegal in the United States. [11]

When parties agree to settle a dispute through a mutual agreement, the party providing the settlement payment will not want to?

Oftentimes, when parties are agreeing to settle a dispute through a mutual agreement as opposed to going through the judicial process, the party providing the settlement payment will not want to admit any liability or fault.

Closing Disclosure

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Cash For Closing

Sometimes, cash is required in the closing process. The settlement statement you receive will let you know how much if any, cash is needed at the closing table. However, the term “cash for closing” can be a little misleading. It does not necessarily mean bringing paper money to the closing. In fact, it usually requires a check.