- Use the official online tool you can use to check if you were part of the Equifax breach.

- Enter your last name and last six digits of your social security number to see if your data was part of the hack.

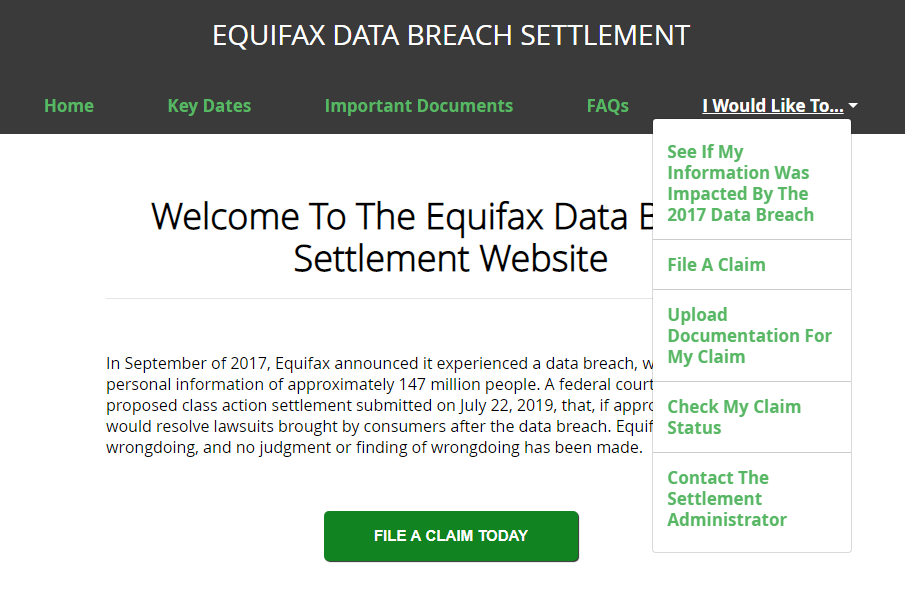

- If you and your data were part of the breach, head to the Equifax Data Breach Settlement website to file a claim to get back money.

Full Answer

When will Equifax pay settlement?

Settlement benefits for eligible time spent and out-of-pocket losses are likely to begin issuing in fall 2022. The Equifax Data Breach Settlement website will provide updates. If you still have your claim number, you can enter it on the website and check the status of your claim.

Does Equifax owe me money?

JACKSON, Miss. (WLBT) - It’s been two years since the Equifax data breach and now they may owe you money. Depending on how involved you got after initial word of the Equifax breach, financial advisor Nancy Anderson says you could qualify for even more than the $125 dollar minimum, even without receipts.

How to sue Equifax in Small Claims Court?

- If Equifax doesn’t answer within the timeframe, you can file a notice of default, and ask the court to grant a default judgment. ...

- Equifax can also file a counterclaim. In this case, you are the one that needs to file a response within twenty days. ...

- Equifax might also just send you the money you claimed in response to your first demand letter. ...

Can I sue Equifax?

You can sue Equifax if your data was exposed – Here’s how. Step 1. Complete the small claims paperwork. You can have the form completed for you by Chatbox or find you local court forms. Step 2. File your court forms with the small claims court and pay the filling fee. Step 3.

See more

How do I claim my Equifax settlement?

For more details and to check your claim status, visit EquifaxBreachSettlement.com . If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022. Claims are due by January 22, 2024.

Who qualifies for Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

Did Equifax pay settlements?

The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach.”

How much will Equifax settlement be?

Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

Has anyone received money from Equifax?

After a data breach in 2017 exposed personal data of more than 147 million consumers, including in some cases Social Security and driver's license numbers, credit bureau Equifax agreed to pay hundreds of millions in compensation to help affected consumers.

What happened to the Equifax lawsuit?

More Information About the Settlement In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories.

How much can you get from a data breach settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person. The company also has to pay government fines and legal fees.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

How long does it take Equifax to unfreeze credit?

If you send your request to thaw your report by mail, we recommend you allow up to three days for it to be thawed once Experian receives your request. Equifax and TransUnion, the two other national credit reporting companies, may have different processes and policies for requesting a credit file thaw.

How do I unfreeze my credit with Equifax?

Security freezes can be temporarily lifted At Equifax, you can use your myEquifax account to lift a security freeze for a date range you specify. You can also lift a security freeze by phone by calling our automated line at (800) 349-9960 or calling Customer Care at (888) 298-0045.

How do I contact Equifax?

(888) 378-4329Equifax / Customer service

How do I unfreeze my Equifax without a PIN?

By phone: Call us at (888) 298-0045. You'll have the option to verify your identity by providing certain personal information, and receiving a one-time PIN by text message (data charges may apply) or answering questions based on information in your Equifax credit report.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Is the Equifax settlement final?

By order of the Court, the Settlement cannot become final until the appeals of the remaining objectors are resolved. In September of 2017, Equifax announced it experienced a data breach, which impacted the personal information of approximately 147 million people.

When is the extended claim period for out of pocket loss?

To be eligible, your claim for Out-of-Pocket Losses or Time Spent must occur between January 23, 2020 and January 22, 20 24(the “Extended Claims Period”).

How to file a claim with Equifax?

There are two ways to file a claim. You can file online at www.equifaxbreachsettlement.com or by mail. If by mail, you can download and print the claim form, fill it out and mail it with any supporting documentation. You also can request a claim form be mailed to you by calling 1-833-759-2982 or emailing them at [email protected]. ...

How to request a claim form from Equifax?

You also can request a claim form be mailed to you by calling 1-833-759-2982 or emailing them at [email protected].

How much did Equifax pay for the 2017 breach?

The credit-reporting company has agreed to pay between $575 million and $700 million to settle state and federal investigations related to a massive security incident that exposed the personal information of more than 147 million Americans ...

What expenses are included in a settlement?

Other expenses like notary fees, document shipping fees and postage, mileage and phone charges. In some cases, documentation may be requested to show proof of "fraud, identity theft, or other alleged misuse of your personal information fairly traceable to the data breach,” the settlement website notes.

When was Equifax breach settlement announced?

The settlement, which was announced July 22 and is considered the largest ever for a data breach, has preliminary court approval. The official settlement website, www.equifaxbreachsettlement.com, has been posted and is accepting claims. To confirm you're eligible to file a claim, enter your last name and the last six digits ...

How much can you get for ID theft?

If you spent time or money dealing with an ID theft issue that occurred after the hack and involved personal data that was exposed by the breach, you can get compensated up to $20,000 per person . You can be reimbursed for the following:

How much did Equifax pay for the security breach?

The Federal Trade Commission and Equifax reached an agreement at the end of July for Equifax to pay at least $575 million and up to $700 million to compensate those whose personal data was exposed with the breach of the Equifax servers. As part of the settlement, you can file a claim to be compensated for the costs of recovering from the security breach -- including any costs associated with the theft of your identity and freezing and unfreezing your account-- and compensation of unauthorized charges to your banking accounts. The agreement caps payouts at $20,000 per person.

What information was stolen from Equifax?

The data breach of Equifax resulted in hackers accessing personal information on the credit report servers of 147 million consumers, including driver's license information, social security numbers and birthdates.