If you lose the originals, you can get a certified copy of these documents from your closing agent or your real estate agent. All of the official charges and credits of your home purchase are included in the closing statement. Also, where can I obtain a copy of my HUD statement? The bank, the Title Company (also known as settlement company), and possibly the real estate agent may have copies of it.

What is a HUD settlement statement?

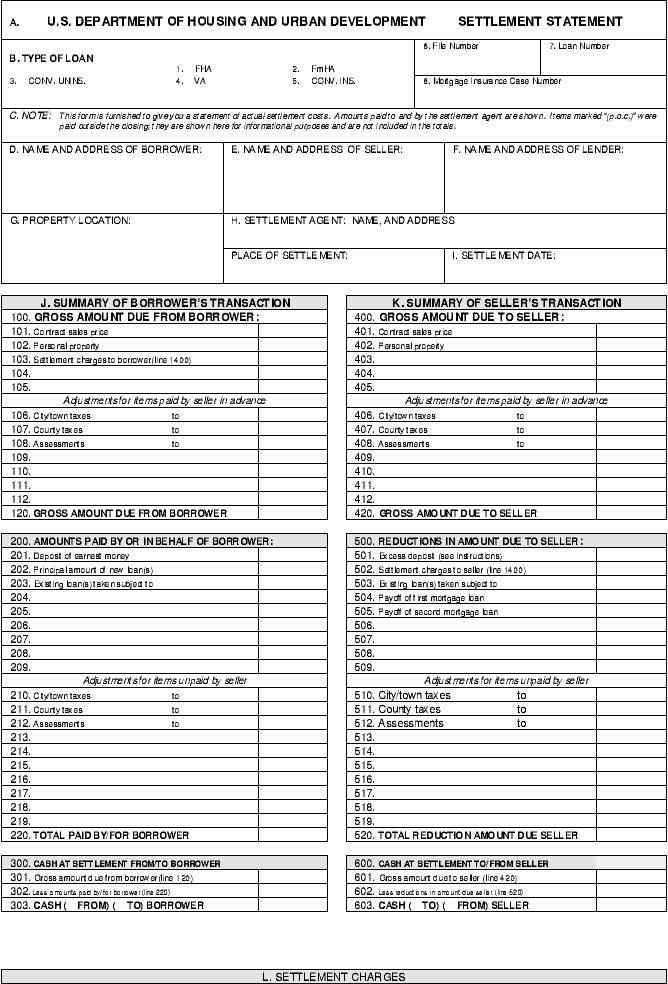

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Can I get a copy of my HUD-1 if my title company?

Subject: Can you get a copy of your HUD 1 settlement statement if your title company has closed? Go to the land records office and get a copy of the Deed. If you don't want to, pay an attorney a few hundred dollars to get a copy. HUD-1 is irrelevant.

How do I get a copy of a settlement sheet?

Settlement sheets are not filed documents at the Recorder of Deeds like Deeds, Mortgages, etc. If the title agency or attorney that handled the closing doesn't have a copy, check with your real estate agency. The brokers are required to retain all the transaction documents for X number of years.

Is the HUD-1 Settlement Statement still used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

What is HUD-1 Settlement Statement?

What is HUD-1 form?

When Is a HUD-1 Used in 2020?

When Is the HUD-1 Distributed?

When did the closing disclosure change?

What is the 701 and 702 section?

What is line 805 on credit report?

See 4 more

About this website

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Is a HUD statement the same as a settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

When should I receive the HUD 1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

Can a HUD loan be forgiven?

A: FHA-insured borrowers are currently eligible for extensive loss mitigation assistance to prevent foreclosure and make mortgage payments more affordable. FHA is currently prohibited by statute from offering explicit principal forgiveness to FHA-insured loans.

What is HUD statement called now?

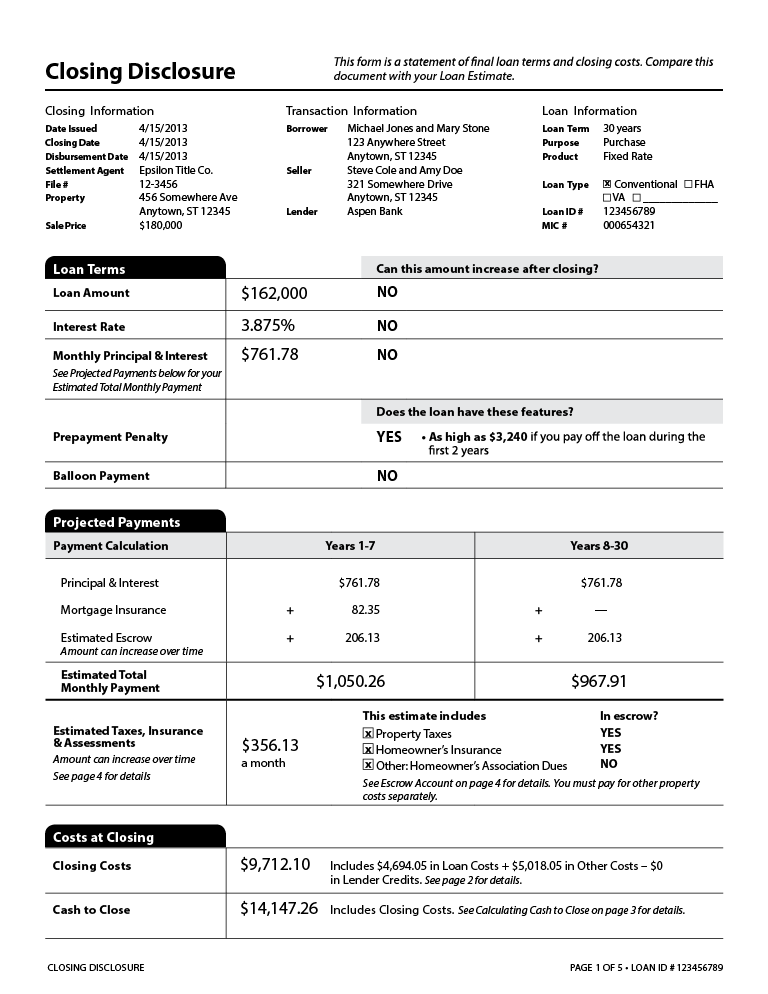

If you applied for a mortgage after October 3, 2015, for most kinds of mortgage loans you receive a form called the Closing Disclosure instead of a HUD-1.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

When did the CD replace the HUD?

Oct. 3, 2015The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

What is the difference between a closing disclosure and a HUD?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

What is a final HUD statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Is closing disclosure same as HUD statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is a payoff disclosure?

A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. The payoff amount isn't just your outstanding balance; it also encompasses any interest you owe and potential fees your lender might charge.

Free Fillable HUD-1 Settlement Statement Form | PDF | Word | FormSwift

Most Common Uses of a HUD 1 Form. The HUD-1 settlement statement is a standard government real estate form that used to be used as the standard real estate settlement form in all transactions in the United States which involve federally related mortgage loans.

A. Settlement Statement (HUD-1)

A. Settlement Statement (HUD-1) Previous edition are obsolete Page 1 of 3 HUD-1 B. Type of Loan J. Summary of Borrower’s Transaction 100. Gross Amount Due from Borrower C. Note:

How Long Prior to Closing Does RESPA Require That the HUD-1 Be Provided ...

The HUD-1 Settlement Statement is a standard form used by lenders and title companies that details the costs associated with getting a loan on a home. The document itemizes the costs ahead of the closing so there is full disclosure and so the buyer gets no surprises. The Consumer Finance Protection Bureau requires a ...

What is a HUD-1 Settlement Statement?

If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.

HUD-1 Form: What Is It And When Is It Required? - Inman

HUD-1 is the settlement statement that is used for most residential closings. HUD stands for the Department of Housing and Urban Development.

Home Buyers: How to Read Your HUD-1 Statement | Nolo

Note: This article refers to a form that is in use until October 3, 2015. For those who submit a mortgage application on or after this date, two new forms, called a "Loan Estimate" and a "Closing Disclosure," replace the HUD-1 Settlement Statement, the Good Faith Estimate, and the Truth-in-Lending disclosure form that were formerly required in mortgage loan closings.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is line 805 on credit report?

The amount would be shown, but it would not be included in the total fees you bring to settlement. Line 805 is used to record the cost of the credit report if it's not included in the origination fee.

Who would have your copy of your home purchase?

the real estate attorney who handle d your home purchase would have it if you can not find your copy. I found it was one of those items that kind of got buried in ALL the paperwork.

Do mortgage settlements have to be filed at the recorder of deeds?

Your mortgage lender would have it and also the attorney who handled your settlement should have it. Settlement sheets are not filed documents at the Recorder of Deeds like Deeds, Mortgages, etc.

Do HUD 1 statements have to be recorded?

Otherwise, the lawyer who handled the escrow settlement is the place to go. HUD 1 Statements are not a matter of public record, they are not recorded with the county. Comment.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is line 805 on credit report?

The amount would be shown, but it would not be included in the total fees you bring to settlement. Line 805 is used to record the cost of the credit report if it's not included in the origination fee.