You can contact the debt collection agency in writing and offer a settlement figure. Generally, you should start the negotiation by offering approximately 25 percent of the debt. You can make a counter offer if the agency's settlement offer is too high or it rejects your offer.

Full Answer

How do I negotiate a settlement with a debt collector?

Before negotiating a settlement with a debt collector, learn about the debt and plan for making a realistic proposal. All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords.

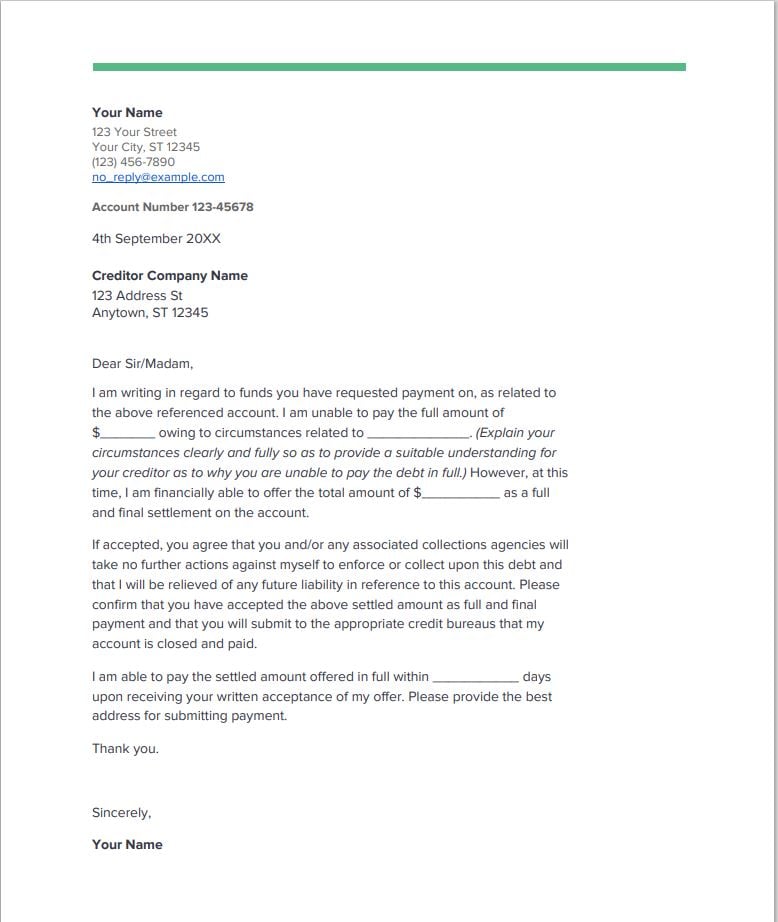

Do you need a settlement letter to settle a debt?

Negotiating debt and paying the new agreement requires a settlement letter. In the wacky world of debt collection, debt buying, and credit reporting, paying off a debt you settle without having a documented agreement, is a mistake.

What should be included in a settlement letter?

The settlement letter must reference that the account being satisfied in full i.e. “settled”, “settlement of this account”, “accepted as settlement in full”, “paid in full”. The letter will have other general information, such as disclosures about settling debt. Creditors and collectors put this information in to cover themselves.

How to respond to a debt collector who is trying to collect?

The CFPB has prepared sample letters that you can use to respond to a debt collector who is trying to collect a debt. The letters include tips on how to use them. The sample letters may help you to get information, set limits or stop any further communication, or exercise some of your rights.

How do you write a letter asking for a settlement?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How do I ask for a settlement in collections?

To get ready to negotiate a settlement or repayment agreement with a debt collector, consider this three-step approach:Learn about the debt. ... Plan for making a realistic repayment or settlement proposal. ... Negotiate with the debt collector using your proposed repayment plan.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

What is a letter of settlement?

Put simply, a settlement note is a formal letter that asks your creditors if they would be willing to accept a debt settlement on your account. It specifies the amount of money that you can offer them as a settlement and explains why you cannot pay your debt in full.

How much should I offer to settle a collection?

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. The debt collector may still demand to collect the full amount that you owe, but in some cases they may also be willing to take a slightly lower amount that you propose.

Will debt collectors settle for half?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do I write a final payment letter?

Dear Sir/Madam [or “To Whom It May Concern”], I am attaching my final payment for the account referenced above. I request a written confirmation from you that this account is [paid in full/settled in full] according to the terms of our agreement on [insert date of agreement].

How do I write a debt letter?

What do you include in a debt collection letter?The amount the debtor owes you, including any interest (attach the original invoice as well);The initial date of payment and the new date of payment;Clear instructions on how to pay the debt (banking details, etc);An indication to make contact if payment has been made;More items...•

What is a final settlement document?

Final settlement often refers to a settlement agreement, which is an agreement to some resolution of the dispute and to stop future litigation.

What percentage will a collection agency settle for?

Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

Is it better to pay off collections in full or settle?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

How can I settle a collection on my credit report?

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureau's website.

When should a collection account be settled?

When you settle an account, the creditor (in this case the collection agency) will update the account on your credit report to show it has been settled in full for less than the total balance owed. This indicates that the account is closed and that there is no longer a balance due.

What to do if you agree to a settlement?

If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed these payments. Get it in writing before you make a payment.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

What happens if the statute of limitations is passed?

If the statute of limitations has passed, then your defense to the lawsuit could stop the creditor or debt collector from obtaining a judgment. You may want to find an attorney in your state to ask about the statute of limitations on your debt. Low income consumers may qualify for free legal help.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

What to do if you don't recognize the creditor?

If you don’t recognize the name of the creditor, you can ask what the original debt was for (credit card, mortgage foreclosure deficiency, etc.) and request the name of the original creditor. After you receive the debt collector’s response, compare it to your own records.

What to write when you settle a debt?

7 Things to Get in Writing When You Settle a Debt. When settling a debt for a lower amount, don’t pay until you’ve got these details in hand. When settling a debt for a lower amount, don’t pay until you’ve got these details in hand.

What happens if you miss a payment on a settlement?

For example, depending on settlement terms, if you miss a payment or pay late, the full amount may be due immediately or the creditor may resume collection efforts.

How to report a debt as paid in full?

Ask the entity accepting payment to report the debt as “paid in full” rather than “settled” or “account paid in full for less than the full balance,” two signs of a settled debt that show up as negative marks on your credit history. Then get the promise to report as “paid in full” or “paid as agreed upon” in writing.

How long does it take to get a debt validation letter?

You can use a sample letter from the Consumer Financial Protection Bureau to request debt validation. If you don’t dispute the debt within 30 days after receipt of the notice, the debt is assumed to be valid. Don’t make any payments or discuss the debt with the collector until you receive the written validation notice.

What to do when you negotiate a lower payment?

If you negotiate a lower amount with installment payments, get the agreement in writing with the exact amount of each payment expected and dates due. Also, obtain in writing the creditor’s or collector’s promise that the debt will be satisfied when the lower negotiated amount is paid in full. 4.

How long does negotiating debt affect credit?

However, even after you pay the debt, it can still negatively affect your credit score for up to seven years. [3]

Can a collection agent authorize a settlement?

Unfortunately, the debt collection industry is rife with deception, so don’t take the collection agent’s power to authorize a settlement for granted. [4] Make sure the person signing a settlement agreement is authorized to stand behind settlement promises and terms.

How to settle a debt with a debt collector?

Here’s how to settle with a debt collector. The first thing you should know is that you can negotiate. Debt settlement is one option you have, which means offering to pay a portion of your debt in return for the creditor or debt collector forgiving the rest. You might either pay it back in one lump sum or in installments.

How long does a settlement last?

One big issue with many settlement companies is that their programs can last as long as 36 to 48 months. During that time, they ask you to stop paying your creditors to save up money for a lump sum settlement payment. But in the meantime, you keep racking up interest charges and fees.

What to do if you hire a debt settlement company?

If you hire a debt settlement company, they should handle the back-and-forth negotiations with a debt collector. But if not, you’ll be in charge. Before you make a settlement offer, you’ll need to figure out how much you can afford to pay and whether you can pay in installments or as a lump sum.

What time can debt collectors call you?

Debt collectors can only call you between 8 a.m. and 9 p.m. You can send a letter asking debt collectors to stop contacting you. The Consumer Financial Protection Bureau has a sample letter you can download. But be careful using this type of letter if there is still time for the collector to sue you in your state.

How long can a debt collector sue you?

There is a statute of limitations ( it varies by state and type of debt) for how long a debt collector has to sue you. Most statutes are three to six years. If the delinquent debt is past the statute of limitations in your state, it’s considered expired. But admitting that the debt is yours, or paying a portion of it, ...

How much does a debt settlement company charge?

Check out the company’s ratings with the Better Business Bureau. Ask them what fee they will charge you (some can be as high as 20 to 25%) and whether their fee is based on your total debt or just the portion that is forgiven. Legally, they can’t charge you any fees upfront.

How long does it take to get a no obligation offer from a creditor?

Get your first no-obligation offer from your creditor in just a few days. It’s up to you if you want to accept it. If you’ve fallen behind on a debt, and the debt collectors are calling, you’re probably under a lot of stress. It’s important, though, not to panic and to come up with a plan of action. Here’s how to settle with a debt collector.

How long does it take to reach a settlement?

Reaching a settlement agreement can take one phone call, or it may take several calls over a period of days, weeks, or even months. When a deal is struck, you know that no deal is a real deal until it is documented, and then paid in accordance with the agreement.

How long does it take for a settlement letter to be sent?

Schedule your first (or only) payment for a future day that gives enough time for the settlement letter to reach you by mail. 10 days or longer would be best. Make payments on the settlement from your bank account that you set up specifically for saving and funding the agreements.

How to settle a debt?

Negotiating and agreeing on an amount you will settle a debt for is primarily going to be done over the phone. Once you have a verbal agreement, it must be followed up with documentation. The settlement letter should meet certain requirements before you remit payment in full, or make a partial payment. If you do not receive a settlement letter, or a letter does not include what is standard information to protect you, it’s okay to walk away from the deal. You can receive settlement letters via fax and mail (sometimes even email). No settlement letter means you don’t have a deal. Keep all settlement letters in a safe place with all of your other important documents.

What is the importance of verbal communication in a debt settlement letter?

It’s important that you understand the deal is not done until it is documented and fully funded, consistent with the terms and payment timelines laid out in a debt settlement letter. Verbal communication with creditors and debt collectors are a necessary part of the debt negotiation process.

What does it mean to settle with a third party debt collector?

Settling with a third-party debt collector means you must get the above details documented before remitting any payment towards the agreement. If the above bulleted items are missing from your settlement letter, you should request a different letter be sent to you that meets the above specifications.

What does it mean when a debt settlement letter says no?

No settlement letter means you don’t have a deal. Keep all settlement letters in a safe place with all of your other important documents. Almost done. The final step in our Debt Settlement Guide is paying debt collectors after the negotiations are done.

What happens if you don't receive a settlement letter?

If you do not receive a settlement letter, or a letter does not include what is standard information to protect you, it’s okay to walk away from the deal. You can receive settlement letters via fax and mail (sometimes even email). No settlement letter means you don’t have a deal.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

What to do if your proposal is not read?

If that happens, your proposal will never be read, let alone acted upon. You should send a letter to the person you’ve been dealing with at the company. If there’s no specific individual, make a phone call and get the name of a person likely to be in a capacity to work with your proposal.

Can a letter to a company end up in a dead letter?

If you simply address the letter to the company, it may never find its way to an individual who will act on your proposal. In a very large organization, correspondence not directed to a specific individual can easily end up in the dead letter file.