Credit Karma

Credit Karma is an American multinational personal finance company, founded on March 8, 2007, by Kenneth Lin, Ryan Graciano and Nichole Mustard. It is best known as a free credit and financial management platform, but its features also include free tax preparation, monitoring of u…

Full Answer

How do I contact Credit Karma money™ spend?

For questions about Credit Karma Money™ Spend, you can contact us using the phone number on the back of your Credit Karma Visa® Debit Card. If you’re experiencing one of our most common questions, you may be able to to resolve it yourself. Here are links to the most common questions and how to resolve them:

How do I get my past tax returns from Credit Karma?

The best way to get your past tax returns from Credit Karma Tax is to start using Cash App Taxes. This helps us verify some of your info in advance and lets us know it’s you. If you haven't already, download Cash App and create an account. Here's how to get your past tax returns: Click here to get your past tax returns or follow the steps below -

How do I get a settlement loan?

To take out a settlement loan, you apply for a loan after filing an eligible lawsuit. The lawsuit loan company evaluates your case’s merit, weighs your chances of winning the suit or the case being settled, and estimates how much you can expect to receive.

How do debt settlement companies make money?

Once the debt settlement company and your creditors reach an agreement — at a minimum, changing the terms of at least one of your debts — you must agree to the agreement and make at least one payment to the creditor or debt collector for the settled amount. And then the debt settlement company can begin charging you fees for its services.

See more

Can Credit Karma be trusted?

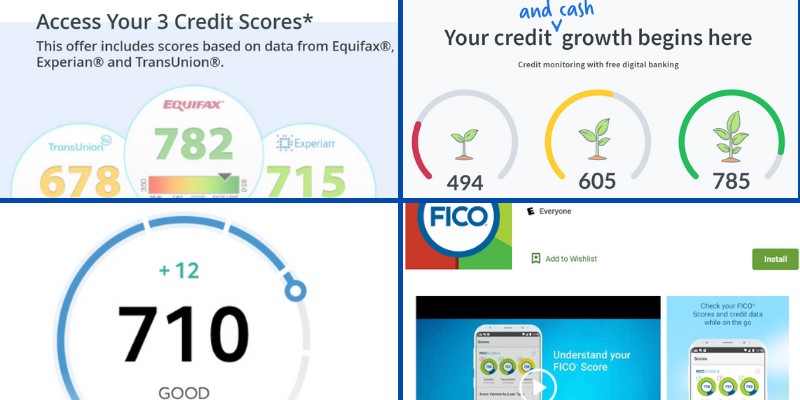

The credit scores and credit reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. They should accurately reflect your credit information as reported by those bureaus — but they may not match other reports and scores out there.

Can Credit Karma help you fix your credit?

While Credit Karma doesn't fix errors on your credit reports, Credit Karma's Direct Dispute™ tool can help you through the process of disputing an error on your TransUnion credit report in just a few clicks.

How does Credit Karma get money?

Credit Karma offers free access to TransUnion and Equifax credit data, as well as offering tax preparation assistance, and other services. It makes money by receiving a fee every time a user purchases a product or service it recommends.

How much is a lot of Credit Karma?

AppCost1Credit KarmaFreeCredit SesameBasic: Free Premium: $19.95 per monthExperian Credit ReportBasic: Free Premium: $19.99 per monthmyFICOBasic: $19.95 per month Advanced: $29.95 per month Premier: $39.95 per month1 more row•Oct 1, 2021

How can I raise my credit score 200 points in 30 days?

How to Raise Your Credit Score by 200 PointsGet More Credit Accounts.Pay Down High Credit Card Balances.Always Make On-Time Payments.Keep the Accounts that You Already Have.Dispute Incorrect Items on Your Credit Report.

What is the credit score loophole?

"The 609 loophole is a section of the Fair Credit Reporting Act that says that if something is incorrect on your credit report, you have the right to write a letter disputing it," said Robin Saks Frankel, a personal finance expert with Forbes Advisor.

What bank owns Credit Karma?

MVB Bank, Inc.Credit Karma is not a bank. We partner with MVB Bank, Inc. to provide banking services supporting Credit Karma Money™ Spend and Credit Karma Money™ Save accounts. When you open a Credit Karma Money™ Spend account, your funds will be deposited into an account at MVB Bank, Inc. and its deposit network.

What is the highest credit score you can have?

850If your goal is to achieve a perfect credit score, you'll have to aim for a score of 850. That's the highest FICO score and VantageScore available for the most widely used versions of both credit scoring models.

Is 650 a good credit score?

A FICO score of 650 is considered fair—better than poor, but less than good. It falls below the national average FICO® Score of 710, and solidly within the fair score range of 580 to 669.

What is a Good credit score to buy a house?

A conventional loan requires a credit score of at least 620, but it's ideal to have a score of 740 or above, which could allow you to make a lower down payment, get a more attractive interest rate and save on private mortgage insurance.

How many credit cards should the average person have?

fourWhile there's no perfect answer to how many credit cards you should have, the 2019 Experian Consumer Credit Review found that the average American has four. If you can responsibly manage multiple credit cards, you can maximize rewards, annual statement credits and interest-free financing.

How many points is Credit Karma off?

Credit Karma touts that it will always be free to the consumers who use its website or mobile app. But how accurate is Credit Karma? In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

How can I raise my credit score by 100 points in 30 days?

Learn more:Lower your credit utilization rate.Ask for late payment forgiveness.Dispute inaccurate information on your credit reports.Add utility and phone payments to your credit report.Check and understand your credit score.The bottom line about building credit fast.

What is the fastest way to improve your credit score?

4 tips to boost your credit score fastPay down your revolving credit balances. If you have the funds to pay more than your minimum payment each month, you should do so. ... Increase your credit limit. ... Check your credit report for errors. ... Ask to have negative entries that are paid off removed from your credit report.

How many points is Credit Karma off?

Credit Karma touts that it will always be free to the consumers who use its website or mobile app. But how accurate is Credit Karma? In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

How can I raise my credit score 100 points?

Here are 10 ways to increase your credit score by 100 points - most often this can be done within 45 days.Check your credit report. ... Pay your bills on time. ... Pay off any collections. ... Get caught up on past-due bills. ... Keep balances low on your credit cards. ... Pay off debt rather than continually transferring it.More items...

How much interest do settlement loans cost?

Most notably, they can come with very high costs. Settlement loans typically have high interest rates. Interest rates commonly range from 20% to 60% a year. A study by University of Texas School of Law researchers found the average interest rate for settlement loans is 44%. Lawsuits can take years to settle.

How long does it take to get a settlement loan?

You can generally get the loan quickly. Some settlement lenders may be able to approve and fund your advance within hours or days.

How do settlement loans work?

To take out a settlement loan, you apply for a loan after filing an eligible lawsuit. The lawsuit loan company evaluates your case’s merit, weighs your chances of winning the suit or the case being settled, and estimates how much you can expect to receive. Based on that information, it may offer you an advance.

What is settlement loan?

Settlement loans give you a cash advance against an expected legal settlement. While you can get the cash you need to pay for necessary expenses right away, there are significant drawbacks to keep in mind.

What are some alternatives to settlement loans?

If you need cash, there may be other ways to get the money without resorting to a lawsuit advance. Consider a personal loan. If you have good credit, taking out a traditional personal loan can be a smart option.

What does a lawsuit advance cover?

You’ll get money for living expenses. With a lawsuit advance, you’ll get cash to cover your necessary expenses, which can help you keep up with your bills.

Is a lawsuit loan regulated?

Lawsuit loans are not heavily regulated. Many types of loan products are heavily regulated, but settlement loans are primarily regulated at the state level, meaning each state has its own rules regarding settlement loans. If you have issues with your settlement loan, you should contact the attorney general in your state.

Can I call you?

For questions about Credit Karma Money™ Save and Spend accounts, you can contact us using the phone number on the back of your Credit Karma Visa® Debit Card.

Common questions

If you’re experiencing one of our most common questions, you may be able to to resolve it yourself. Here are links to the most common questions and how to resolve them:

Plaid settlement: You might be owed money

In 2021, Plaid settled a class-action lawsuit for $58 million. The payouts will likely be rather modest. Plaid noted in a blog post that “hundreds of millions of people across North America and Europe have used Plaid” to connect their accounts to the apps they use.

How to get your money from Plaid

The court will decide whether or not to approve the settlement on May 12th, 2022. If you used an app that supports Plaid and you want to receive compensation, you’ll need to submit a claim by April 28th, 2022. If you never received an email (or accidentally deleted it), but think you may still be eligible, visit this page on the settlement website.

Why Was Credit Karma Sued?

Credit Karma was sued by the FTC because they disabled SSL for multiple years, which is a security certificate used to verify that data safe and secured from third parties. This leaves credit card data, social security numbers, full names and addresses vulnerable to attacks.

Was Any Information Leaked?

According to Credit Karma no information was leaked due to this security vulnerability, but it’s difficult to know for certain with the types of attacks hackers could perform as they are by design discreet.

What Does This Mean To You?

If you are or were a Credit Karma customer, it means that whilst they claimed “industry-leading security precautions” and that they used SSL, this was in fact not the case for a long time on their iOS & Android apps. It isn’t clear if SSL was also not used on their website.