- Use the official online tool you can use to check if you were part of the Equifax breach.

- Enter your last name and last six digits of your social security number to see if your data was part of the hack.

- If you and your data were part of the breach, head to the Equifax Data Breach Settlement website to file a claim to...

- You can mail your claim or have a cl...

What you should do after Equifax data breach?

- Everyone should monitor their bank and credit card accounts to spot unauthorized activity. ...

- You should also place a fraud alert with each of the three major CRAs. ...

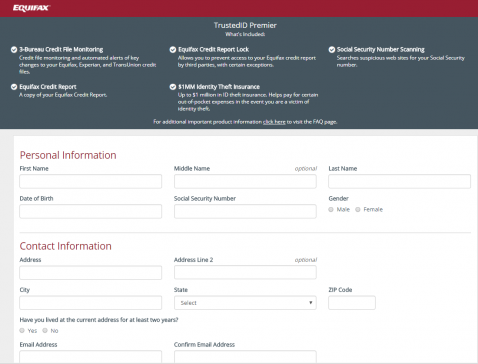

- You can consider signing up for Equifax’ credit monitoring service. ...

- You may want to take an additional step: placing a security freeze. ...

What should I do after the Equifax data breach?

What to do if your account is compromised

- Least sensitive — change your password. If you’re notified that one of your online accounts has been compromised, change your password immediately.

- Moderately sensitive — notify your bank. If your card payment numbers have been stolen, notify the bank or company that issued the card immediately.

- Most sensitive — notify Equifax and TransUnion. ...

How to fill out claim for Equifax data breach settlement?

- Check if you’re eligible. The Equifax data breach was one of the largest in history, with about 56% of Americans affected. ...

- Start the claim process. If your information has been affected, then you can start the claims process by clicking on the “File a Claim” button.

- Fill out your information. This step is pretty basic — simply fill out your name, current address, phone number, email and year of birth.

- Choose between credit monitoring and cash payment. Affected consumers have the opportunity to receive at least four years of credit-monitoring services through Experian.

- File for time spent. Consumers can submit claims for any time they had to spend dealing with the data breach — $25 per hour, up to 20 hours, ...

- Claim any losses or reimbursement. Consumers will be able to claim up to $20,000 for any losses or fraud that were the results of the breach or any ...

- Choose how you want to be paid. Once you’ve selected what claims you want to file, you’ll have to pick a payment option: check or prepaid card.

- Confirm everything is correct & submit. You’ll be prompted to double check that all your information is correct and certify that all your statements are true.

- Save your claim number. If the form is processed correctly, you’ll receive a claim number. ...

How to protect yourself from the Equifax data breach?

Your guide to surviving the Equifax data breach

- Enroll in Equifax's program (or just move on to step 2) Equifax's identity protection program, Trusted ID, is being offered to anyone who wants to enroll. ...

- Check your credit reports. More than three months passed between the time the breach may have started and now. ...

- Freeze your credit. ...

- Set a fraud alert. ...

- Repeat the process for your loved ones. ...

See more

Has anyone received money from Equifax?

After a data breach in 2017 exposed personal data of more than 147 million consumers, including in some cases Social Security and driver's license numbers, credit bureau Equifax agreed to pay hundreds of millions in compensation to help affected consumers.

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

Will I get $125 from Equifax?

Equifax denied any wrongdoing and no judgment or finding of wrongdoing was made. If you are a Class Member, the deadline to file Initial Claims Period claim(s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020. The Settlement is now effective.

Who qualifies for the Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

How long does a data breach claim take?

In reality, how long a data breach claim takes simply comes down to the circumstances of the case. Some cases could be resolved in a few months, whereas others may end up being pursued for several years.

How much can you get from a data breach settlement?

The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

How do I know if Equifax breach affected me?

Equifax has created a website where you can find out if you have been affected by the breach. The website will ask you for the last six digits of your social security number and your last name, and then will tell you if you have been affected. You can also call 1-833-759-2982.

What happened to Equifax after the data breach?

In the wake of Equifax's 2017 data breach, which compromised the personal information of roughly 147 million consumers — including names, birthdates and Social Security numbers — the company ended up as the target of multiple lawsuits and reached a settlement in 2019 with the FTC, the Consumer Financial Protection ...

How much can you expect from a class action lawsuit?

A class action usually ends in a settlement as opposed to going to trial. Settlements in recent years have averaged $56.5 million.

How much will I get from the Bank of America lawsuit?

What does the Settlement provide? Bank of America has agreed to establish a Settlement Fund of $27.5 million from which Settlement Class Members will receive payments or Account credits. The amount of such payments or Account credits cannot be determined at this time.

How are class action settlements divided?

Class action lawsuit settlements are not divided evenly. Some plaintiffs will be awarded a larger percent while others receive smaller settlements. There are legitimate reasons for class members receiving smaller payouts.

Where is my Equifax settlement check?

Status of financial reimbursement For more details and to check your claim status, visit EquifaxBreachSettlement.com . If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022.

How much did Equifax pay for the data breach?

As part of its $700 million settlement with the commission, Equifax set aside more than $500 million to compensate the millions of victims of the data breach.

How much money can you claim for identity theft?

If you were the victim of identity theft and it cost you a significant amount of money, it makes sense to gather the receipts and other supporting documents required for a claim that approaches the $20,000 individual limit.

How to find out if your Social Security number was exposed?

Step 1: Use this link to access the claim process . Then scroll down to "Find Out if Your Information Was Impacted" and click on that link. After entering your last name and the last six digits of your Social Security number, you'll instantly get an answer about whether your data was exposed and you're eligible to make a claim.

Is Equifax doing credit monitoring?

For consumers skeptical about accepting the credit monitoring, Lacey explains, "it’s not Equifax doing the work; it’s their competitors doing it on their behalf."

Can you report credit monitoring expenses?

In a Monday press conference, the FTC announced that consumers would be able to report some credit monitoring expenses and the time they spent resolving issues raised by the breach without having to submit receipts or other records.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

How much time can you spend on a data breach?

You may be eligible for the following reimbursement cash payments for: Time Spent during the Extended Claims Period recovering from fraud, identity theft, or other misuse of your personal information caused by the data breach up to 20 total hours at $25 per hour.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Is the Equifax settlement final?

By order of the Court, the Settlement cannot become final until the appeals of the remaining objectors are resolved. In September of 2017, Equifax announced it experienced a data breach, which impacted the personal information of approximately 147 million people.

How much can you get for a breach of contract?

If you suffered losses as a result of the breach and can provide documentation of your out-of-pocket costs, you may be eligible for cash payments up to $20,000.

What happened to the Social Security numbers in 2017?

In 2017, the personal information of over 145 million Americans was exposed by one of the largest data breaches in recent times. The breach occurred at Equifax, one of the three credit reporting bureaus entrusted with some of the most sensitive personal data, including Social Security Numbers. If you are one of the individuals impacted by the breach (hint: you probably were), you can now file a claim as part of a settlement that Equifax is finalizing to resolve claims.

Can you file a claim if your personal information was compromised by the breach?

You are eligible to file a claim if your personal information was compromised by the data breach. There is a dedicated page - https://www.equifaxbreachsettlement.com/ - with important information about the proposed settlement.

How much can you get if your Equifax account was compromised?

If your information was compromised during the massive 2017 Equifax data breach, you could be entitled to up to $20,000.

What is the phone number to call for a fraud settlement?

If you believe you’ve been a victim of fraud caused by the breach, call the settlement administrator at 1-833-759-2982.

What does the claim cover?

There are four types of relief you can claim from Equifax under the terms of the settlement:

What happens if you don’t file a claim?

Under the terms of the settlement, there are services that you are entitled to — even if you don’t file an official claim, the FTC says.

How long can you claim free credit monitoring?

Submitting a claim can be “overwhelming,” so take it slow, Lacey says. At the very least, you should claim the free credit monitoring for up to 10 years. “There should be no reason whatsoever not to file, especially the basic claim — the credit monitoring — or if you have credit monitoring, the claim for $125,” says Jack Gillis, executive director of the Consumer Federation of America. This is probably what most consumers will file for, Gillis adds.

How much can you claim for a credit breach?

Monetary loss: Consumers will be able to claim up to $20,000 for any losses or fraud that were the results of the breach or any out-of-pocket expenses they may have incurred, such as paying to freeze and unfreeze their credit reports. You’ll need to attach supporting documents, such as receipts, to show how much money you spent.

What happens if you don't have good records?

“If you don’t have good records, you may not be able to see the full benefit of what the settlement is providing ,” Lacey says.

How much did Equifax pay for the security breach?

The Federal Trade Commission and Equifax reached an agreement at the end of July for Equifax to pay at least $575 million and up to $700 million to compensate those whose personal data was exposed with the breach of the Equifax servers. As part of the settlement, you can file a claim to be compensated for the costs of recovering from the security breach -- including any costs associated with the theft of your identity and freezing and unfreezing your account-- and compensation of unauthorized charges to your banking accounts. The agreement caps payouts at $20,000 per person.

What information was stolen from Equifax?

The data breach of Equifax resulted in hackers accessing personal information on the credit report servers of 147 million consumers, including driver's license information, social security numbers and birthdates.

Can discussion threads be closed?

We delete comments that violate our policy, which we encourage you to read. Discussion threads can be closed at any time at our discretion.