Address the letter to the proper office. Find out which office of the credit card company handles settlement offers. You can usually discover this by looking up the company online or calling the customer-service number on the back of the card itself.

Full Answer

How do I settle my HDFC credit card balance?

Call the customer care and notify them that you want to settle the card. But pay the total outstanding amount. If you pay the discounted amount, your CIBIL score drops drastically (Which I did and regretted, its still haunting me every time i request for loan / credit card) After the settlement you will get a letter from the HDFC bank.

What happens if I pay the discounted amount to HDFC Bank?

But pay the total outstanding amount. If you pay the discounted amount, your CIBIL score drops drastically (Which I did and regretted, its still haunting me every time i request for loan / credit card) After the settlement you will get a letter from the HDFC bank. Sorry for my bad English, I am still learning how to write good answers. cheers!

How much can a credit card company settle for?

Sometimes the credit card settlement process is effective, and consumers can settle their debt for anywhere between 25% and 80% of the original amount they owed. But other times, credit card companies may refuse to settle and may take consumers to court instead.

How does the credit card settlement process work?

The credit card settlement process looks like this: You stop paying your monthly credit card bills. The money that you would have paid your creditors goes into a savings account, usually managed by a debt settlement agency.

How can I get HDFC settlement letter from credit card?

The first step in this process is contacting HDFC directly – try calling them up and explaining your situation. If that doesn't work out then consider hiring an agency that specializes in debt settlements (they'll negotiate with creditors on behalf of clients).

Can we do settlement For HDFC credit card?

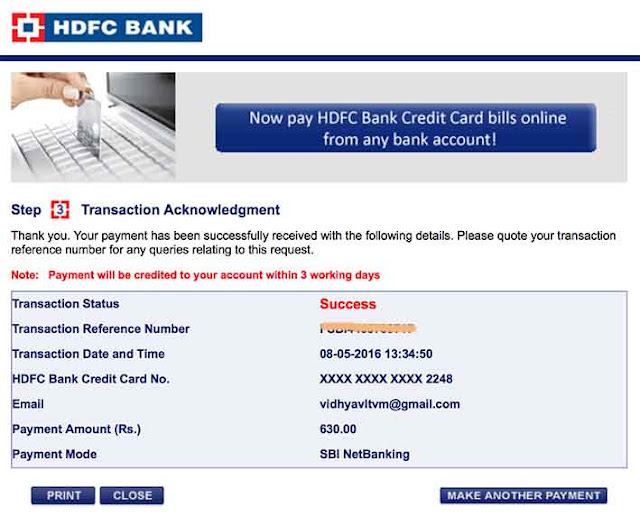

Even If you don't have an HDFC Bank account, you don't have to worry when it comes to paying your HDFC Bank Credit Card bill. You can settle it via the NetBanking facility of your current bank account, NEFT, or any other payment options offered.

How do I clear my credit card settlement?

What is the credit card settlement processVisit the issuer or a debt settlement agency.Explain your inability to make payments via a credit card settlement letter and mention that you're open to negotiating other repayment terms.Offer a lump sum or inform the issuer of your plans to file for bankruptcy.

How can I close my HDFC credit card after settlement?

How to Cancel or Close an HDFC Credit Card?By calling Helpline Number: HDFC Bank credit card holders can cancel their credit cards any time by calling the toll-free number 61606161/6160616. ... Carholders can download the Credit Card Closure Form from www.hdfcbank.com and fill it up.More items...

Is settlement good for credit?

Loan settlements impact on the CIBIL score When a loan is termed settled, it is viewed as a negative credit behaviour and the borrower's credit score drops by 75-100 points. The CIBIL holds this record for over 7 years.

What is credit card settlement process?

One option may be a credit card settlement, which is when your credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. The remaining amount can be repaid in a single payment or over a series of payments.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

How do I raise my credit score after a settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

What happens if I settle my credit card?

When you settle an account, its balance is brought to zero, but your credit report will show the account was settled for less than the full amount. Settling an account instead of paying it in full is considered negative because the creditor agreed to take a loss in accepting less than what it was owed.

Does credit card increase CIBIL score?

It is best to pay the full credit card bill instead of the minimum amount to improve the CIBIL score. An individual who repays full credit card bills will build a steady repayment history that will boost the CIBIL score significantly.

Can I close HDFC credit card online?

If you have lost your HDFC Bank Credit Card or it has been stolen, you can hotlist or cancel it by calling our PhoneBanking numbers, blocking it online through NetBanking or visiting an HDFC branch.

How do I close a credit card account permanently?

Submit a request in writing: You can send a credit card closure letter/written request to the manager of the respective bank that you hold the card. In the request, you need to mention important details that include credit card number, cardholder's name (as mentioned on card), address and contact details.

How do I write a letter to settle a credit card?

Dear Sir/Madam, I'm writing this letter in regards to the amount of debt on the account number stated above. As a result of financial hardship, I am unable to pay back the amount in full. [Here, take the time to explain your hardship so the creditor has a better picture of what's going on].

How can I transfer money from my credit card to my bank account?

How to transfer money from a credit card using Net BankingLog in to your bank's Net Banking website.Visit your credit card section within the website.Now choose the transfer option that seems the most preferable for you.Next, you can proceed to enter the amount that you wish to transfer to your bank account.More items...•

How can I talk to HDFC credit card customer care directly?

1800 202 6161 / 1860 267 6161 Now you can get access to your Bank Accounts, Credit Cards, Loans, Demat Account services over the call.

What is loan settlement?

Loan settlement is the process of negotiating with your lender to pay off your loan for a lesser amount than what you originally borrowed. This can be done for various reasons, such as financial hardship or wanting to get out of debt quicker.

What is a credit card settlement process?

Advertisements from credit card debt settlement companies suggest that you can use the credit card settlement process to get out of debt for just pennies on each dollar owed. But like all things that sound too good to be true, there are many potential downsides to credit card settlement that you should be aware of before entering a credit card settlement process.

How much can a credit card company settle?

Sometimes the credit card settlement process is effective, and consumers can settle their debt for anywhere between 25% and 80% of the original amount they owed. But other times, credit card companies may refuse to settle and may take consumers to court instead.

How to settle credit card debt without damaging credit?

When consumers want to know how to settle with credit card companies without damaging their credit rating, we typically recommend a debt management program . Debt management involves setting a budget you can live with while you continue to pay down your debt over time. For a small fee, we’ll take responsibility for paying all your bills on time – you just have to make one payment to an account with ACCC each month and we’ll take care of the rest. We’ll also work to seek reductions in interest rates, finance charges, and late fees to help you pay down your debt more quickly.

What happens if you stop paying your credit card bills?

You stop paying your monthly credit card bills. The money that you would have paid your creditors goes into a savings account, usually managed by a debt settlement agency. After several months, when your credit card account is significantly overdue, your settlement agency approaches your credit card company and proposes to settle your debt ...

Does the credit card settlement process affect your credit rating?

Because you must stop paying your bills in order to make debt settlement more attractive to your creditors, your credit rating will inevitably be severely damaged. In fact, it may take as long as seven years before you can apply for loans, credit cards, mortgages, and credit.

What happens if you settle a credit card?

Impact on credit history: If you go for credit card settlement it can create negative impact on your credit history.

How to settle credit card debt?

Steps for credit card debt settlement 1 Give a call to the customer care of the credit card issuing bank and request them to send all your monthly statements, including your payments till now, to your e-mail ID. 2 Subsequent to receiving the statements, checking the payment details like how much you have paid, the interest charged by the bank and the total outstanding amount so far. 3 Deduct the amount paid from the total outstanding. Afterwards calculate the interest and if it seems much more than it should be. Then, you can talk to the bank for reducing it. You must take bank into confidence that you will be paying the bill. But tell them that it would be comfortable to you if the interest amount being charged gets reduced. Depending upon how strongly you put forth your words, bank can get ready to lessen the interest amount. After interest getting lessened, the resultant amount is expected to be lower and within your capacity to pay. Once the deal gets reached, the bank will issue the debt settlement letter.

How can you check the authenticity of credit card settlement letter?

There is a growing possibility of fake settlement letters being issued to you. In order to check the authenticity of the letter, please consider the below mentioned points.

What to check after receiving a bank statement?

Subsequent to receiving the statements, checking the payment details like how much you have paid, the interest charged by the bank and the total outstanding amount so far.

Can credit cards make you splurge?

The convenience that credit card brings invariably makes an individual to splurge around. But there comes a time when it becomes difficult to cope with the bills and one starts defaulting on the payment of bills and ends up going absolutely nowhere.

Is it easy to improve your credit score?

Difficulty in improving credit history: It is not easy to improve the credit history. It takes time to build a good credit history as you need to pay more attention to your outstanding and payments on time. It will take another few years for you to improve your CIBIL score and build a good credit history.

Can you settle debt?

Well, you can get the debt settled taking the steps advised in the article. But there are a few pitfalls associated with the move. Find out below which are those.