To get a copy of your closing statement of your home purchase in 2006, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your Settlement Documents .

What do you need to know about a settlement statement?

(Solved) A settlement statement is a document given to borrowers at closing that itemizes services and fees charged to the borrower by the lender or broker. 1 What is the purpose of a settlement statement? 2 What is a seller’s settlement statement? 3 Who prepares the settlement statement? 4 What are closing costs on settlement statement?

Where can I Find my Final Settlement Statement?

Final settlement statements can be accessed in the Modus platform, under the “Closed” tab. After buying or selling a home, many buyers and sellers need the final settlement statement for tax purposes, so keep this important document handy for all your past transactions.

What is a seller’s settlement form?

However, the seller’s settlement form developed by the trade group ALTA (American Land Title Association) is widely used across the nation for real estate transactions, and lists the main terms you’re likely to see on your statement (so we use it as an example here).

Who prepares the settlement statement when closing?

Depending on what state you’re in, the settlement statement, a separate document, will be prepared by either an attorney, a title company, or an escrow firm, and the actual closing will be held at the offices of one of these three locations.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

When should I receive the HUD-1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

What is HUD statement called now?

If you applied for a mortgage after October 3, 2015, for most kinds of mortgage loans you receive a form called the Closing Disclosure instead of a HUD-1.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

What is the purpose of a HUD-1 statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Who prepares the closing statement?

In real estate transactions, a closing agent prepares the closing statement which reflects the cost of the property for both the buyer and the seller. It is important that closing statements reflect the agreement of both buyers and sellers of properties, as well as a mortgage loan that backed up the home purchase.

What is loan settlement?

The settlement of a loan is the act of paying back the amount of money owed to the lender. If you've ever been out on the town and had to settle your tab before leaving an establishment, you're familiar with the notion.

What is settlement in real estate?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Is a closing disclosure the same as a HUD?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

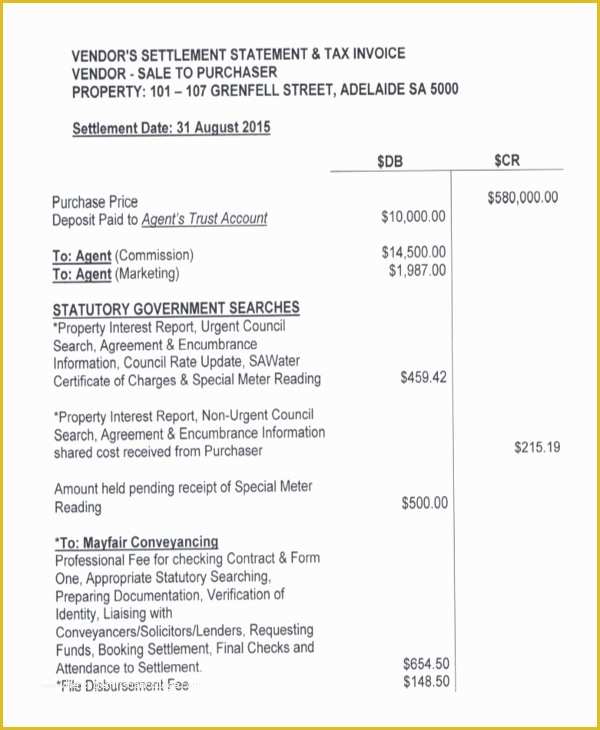

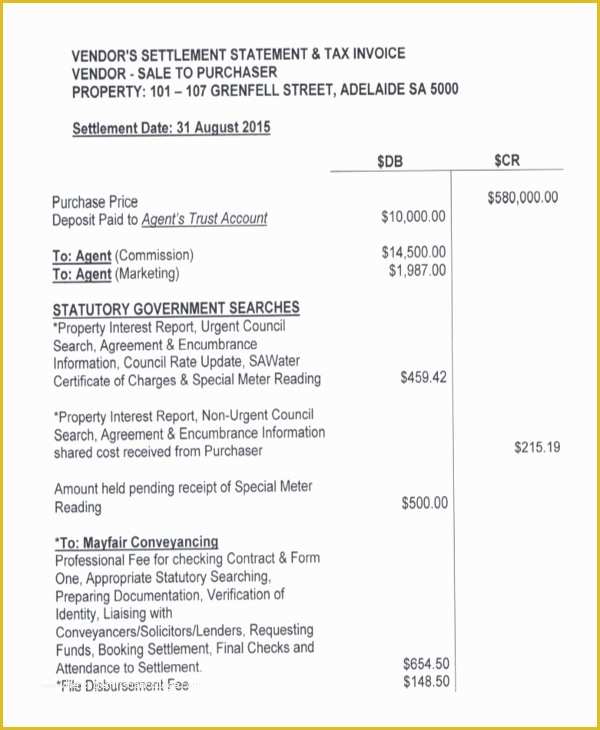

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

Do you get a copy of closing disclosure?

Sellers do not typically receive a copy of the Closing Disclosure. In a cash transaction, there is no need for a Closing Disclosure since no one is borrowing money — however, buyer and seller would still receive a settlement statement summarizing their costs and any payouts.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

What to consider when writing a settlement statement?

Either way, one needs to consider many things when writing a settlement statement. Here are some of those things: Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. If you don’t have one, don’t write it.

What Is a Settlement Statement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client.

Why do both parties need to check the contents of a document?

Both parties need to check the contents of the document thoroughly in order to avoid future conflicts and lawsuits. This will serve as one of the final agreements both parties will undergo upon the completion of their transaction. The process, however, might vary from one service provider to another, so the client also need to review the process properly.

Why do people use financial statements?

People involved in business also make use of statements in conducting their business operations. Financial statements express a company’s financial status, operations, and plans over a certain time period. This goes to show that statements are reliable even in the world of business.

Is a statement a reliable source of information?

Most of us are aware that statements are reliable sources of information. Statements vary from being accounts of people about certain topics (as in statement of purpose ), to being used as an evidence in the court of law (as in witness statements ). These, among other things prove that statements are useful sources of facts and information.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

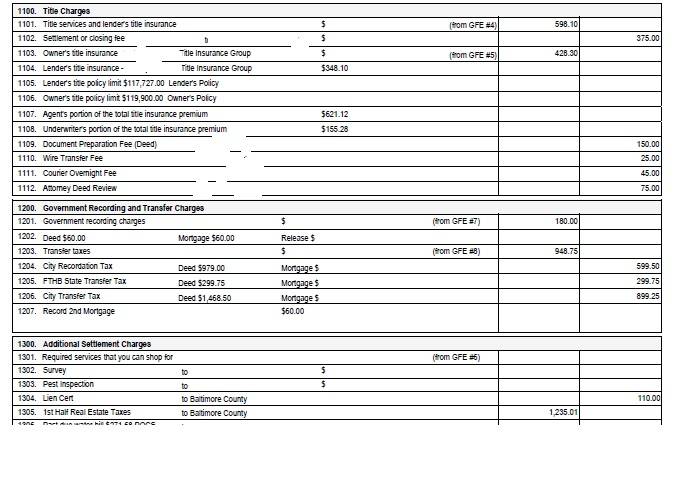

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

Who pays for personal property?

Personal Property. These costs are paid by the buyer provided they want to purchase appliances or any furnishings along with the property. The amount is credited to the seller’s account and debited from the buyer’s.

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.