There are three basic ways that Life Settlement investments are bought and sold:

- Direct Purchases of Life Insurance policies. This requires a large outlay of cash, along with the expertise to buy the right policies. ...

- Direct Fractional Life Settlements. With Direct Fractional life settlements, larger policies are divided up into smaller portions and sold individually to investors. ...

- A Life Settlement Private Equity Fund. ...

- Direct Purchases of Life Insurance policies. This requires a large outlay of cash, along with the expertise to buy the right policies. ...

- Direct Fractional Life Settlements. ...

- A Life Settlement Private Equity Fund.

How do I invest in life settlements?

To decide, consider the following:

- Life settlements typically are mid- to long-term investments.

- If the fund plans to frequently resell policies, rather than buying and holding them, the investments may be subject to fluctuations in investor demand, among other things.

- Capital is required to purchase the policy and pay the premiums while the policy is in force.

What are the risks of life settlement investments?

The greatest risk with life settlements is that the insured lives longer than expected and investors end up paying more in premiums than they receive from the death benefit. Premiums aren't the only costs to consider.

Are life settlements a good idea?

Life settlements may sound appealing, but there are several potential drawbacks. A growing number of Americans are selling their life-insurance policies to get cash for retirement expenses and long-term care. These transactions are commonly called "life settlements," "senior settlements," or—if the person is terminally ill—"viatical settlements."

Should you invest in life settlement funds?

There are plenty of reasons to invest in life settlements. This alternative investment has developed due to a unique necessity. In fact, it has caused a positive impact for both institutional investors and the insured individual.

Is life settlement a good investment?

For investors, life settlements provide the potential for low-risk, high return investing with low market correlation. Potential for high yield returns relative to investment grade fixed income classes. Insurance carrier's credit is nearly always investment grade and insurance policies remain a senior obligation.

Who can buy life settlements?

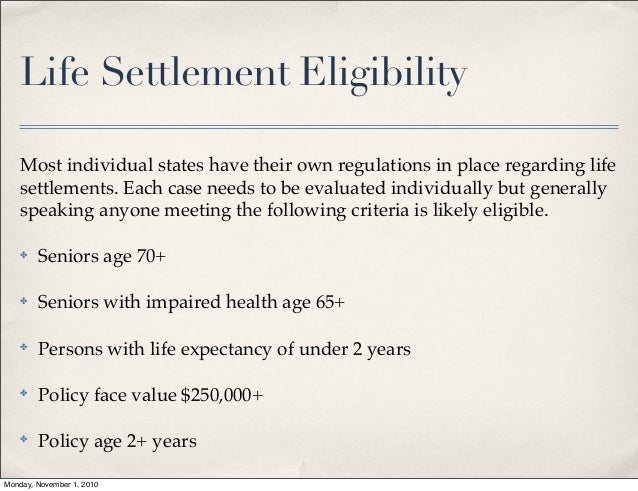

Candidates for life settlements typically are 65 or older or have one or more underlying health issues. Most own policies with face amounts exceeding $100,000, also according to LISA.

How much can you get from a life settlement?

It's typical for a life settlement to pay anywhere from 10% to 25% of the policy benefit amount. So if you were to sell a $200,000 policy you may get anywhere from $20,000 to $50,000 in cash. But there's a catch. Any money you receive from a life settlement would be subject to taxation at your ordinary income tax rate.

How do I invest in viatical settlements?

How do people invest in viatical settlements? Investment options for viatical settlements are more limited than they are for life settlements. Accredited investors can purchase a book of life insurance policies from brokers or from providers who receive cases from life insurance agents.

Is a life settlement tax Free?

Is A Viatical Settlement Taxable? Most of the time, viatical settlements are not taxable. Settlement proceeds for terminally ill insureds are considered an advance of the life insurance benefit. Life insurance benefits are tax-free, and so it follows that the viatical settlement wouldn't be taxed, either.

Are life settlements safe?

Some clients who hear about the idea of a life settlement may ask you: Are life settlements safe and secure? The answer is yes: Life settlement transactions are among the safest and most secure financial transactions in both the insurance and financial services markets. One reason is regulation.

How much can you sell a $100 000 life insurance policy for?

Pros and Cons to Selling your Life Insurance Policy On average, if you have a $100,000 life insurance policy, you will be receiving about $25,000. The next big advantage is that you won't have to make any more premium payments on your insurance policy.

Who buys life insurance the most?

More than 8 in 10 families in the United States have some form of life insurance coverage today. Most people who own life insurance are family breadwinners who want to make sure that in the event they die, the future financial needs of dependents, such as a spouse, children or elderly parents, are met.

Can I sell my life insurance for cash?

Selling an insurance policy through a viatical settlement is one option that may be used to provide cash to help with current medical and living expenses. Like life settlements, viatical settlements involve the sale of a life insurance policy to a third party.

Is it legal to buy someone's life insurance policy?

Can you buy life insurance for anyone? You can only buy life insurance on someone that consents and in whom you have an insurable interest. You'll need them to sign off on the policy and prove that their death could have a financial impact on you.

How do you make money with life insurance?

It's usually very simple. Just call your life insurance company and say you're interested in making a trade: You'd like to increase the death benefit in exchange for the cash value on your policy. Because the company doesn't want to lose your business, it will more than likely accept your request.

Can you buy out a life insurance policy?

Life Insurance Policy Purchasing If you agree to sell your life insurance policy to a life settlement company, for example, the company is effectively purchasing the right to receive the death benefit that the insurer will pay at your passing.

Are life settlements legal?

Life settlements are legal for the most part in the U.S. Because life settlements involve a transfer by the policy owner, they do not amount to stranger-owned life insurance (STOLI), which is illegal.

How much do life settlement brokers make?

Life Settlement Broker Salary According to ZipRectuiter, the average salary is around $65,000 per year. For reference, that is about $31 per hour or $5300 per month, pre-tax. However, top earners can make over six figures, and even the 75th percentile are bringing home upwards of $75,000 annually, or $6000 per month.

How are life settlements regulated?

Under the terms of California Insurance Code, sections 10113.1 through 10113.3, life settlement brokers and providers are required to obtain a license from the California Insurance Commissioner to transact life settlement business in California and are subject to both licensing and consumer disclosure requirements.

How do life insurance settlements work?

A life settlement is the sale of a life insurance policy by the policy owner to a third party. The seller typically gets more than the cash surrender value of the policy but less than the amount of the death benefit.

Who invests in life settlements?

Both accredited investors and institutional investors can invest in life settlements and life settlement funds. Accredited investors are federally qualified by their size, net worth, and other characteristics to invest in non-registered securities. Institutional investors, such as mutual funds, hedge funds, financial institutions, and endowments, pool money to invest on behalf of others and include.

What is a life settlement?

In a life settlement, a senior policyowner sells his or her life insurance for more than its surrender value. The buyer in this transaction is an investor who realizes a return when the insured passes away and the policy’s death benefit is paid. While the circumstances surrounding life settlements are somber, these arrangements do add value on both sides of the transaction. The selling policyholder generates extra retirement income by cashing out the life insurance asset for a good price. And the investor secures a fairly low risk, high return asset.

Why would someone sell their insurance through a life settlement?

Life settlements do have a negative stigma, because the investor’s return is associated with the insured’s end of life. But the immediate outcome of a life settlement is an improvement to the policyholder’s quality of life. Sellers may be motivated to pursue a life settlement to pay off debt, retire early, cover living expenses, establish an emergency fund, pay for medical procedures, or even take a trip around the world. There are no legal restrictions on how the cash is used, though a portion of the proceeds may be taxable. Interestingly, there is no negative stigma around surrendering a life insurance policy for cash, a more common transaction that results in lower proceeds for the policyholder and a better return for the insurance company.

How does a life settlement fund work?

Alternatively, investors can purchase shares of a life settlement fund, which owns and maintains hundreds of life insurance policies. Life settlement funds have the advantage of diversity, which limits the portfolio impact of, say, a single insured who far outlives the life expectancy estimate. On the other hand, the investor has no insight into the individual policies that make up the portfolio. For that reason, investors should carefully research the fund’s screening process and investment approach to make sure they are aligned with his or her investment goals. Also, life settlement funds, like mutual funds, charge management fees which reduce shareholder returns.

What is the most popular source of retirement income?

One increasingly popular source is the life settlement, or the sale of life insurance to a third-party investor for cash.

How much does a life settlement yield?

Research indicates that life settlement investments can yield double-digit returns for investors. A study by the London Business School, for example, found that the average expected return among institutional life settlement investors was 12.4% annually — that’s competitive, considering the stock market’s long-term average annual return is about 9%. Another analysis done by the Journal of Risk and Insurance estimates the average returns on life settlement investments are 8% annually, which is still a very competitive yield for an alternative investment.

Why are people not getting enough income in retirement?

The primary culprit is a lack of savings, exacerbated by longer lifespans and rising healthcare costs.

Things to Know Before Investing

All expenses associated with the investment must be paid using the funds in your IRA account, and all revenue must go back to the IRA account.

Remember

An IRA Club Self Directed IRA may make almost any investment for your future. IRA Club provides our members with a no-cost review to help you avoid making one of the few prohibited transactions. Contact IRA Club today or check out our unique investing process.

Who Can Invest?

You have to be an accredited advisor. In short, this means you have to be able to prove to the government that you have the financial sums to back up these pricey investments. If something doesn’t go as planned with your investments, it’s an effective way to scan investors to ensure that they will still be financially sound.

What is viatical settlement?

Viatical settlements are commonly taken out by people who have grim medical outcomes. This usually means they have a few years left to live. If you’re investing in a viatical settlement, you are purchasing to own their policy. You can purchase some or all of it, depending on the funds you have available. You might be thinking that this is a somber settlement to invest in, but in reality, the owner of the policy is aware of their outcomes. You’re considered the beneficiary, which means it’s a consensual relationship between you and the owner.

What to do before investing in viatical settlements?

Before investing in viatical settlements, talk with an expert in the field, weigh the positives and negatives, and then make your viatical investment decision. You should also consult the SEC and any other regulating bodies that oversee this type of investment.

How is the rate of return determined for a settlement investor?

Rate of return is determined by the difference between the face value of the policy and the purchase amount of the policy. It also factors in any premiums or other expenses that may need to be paid and the time it takes to receive payment on the policy.

What is viatical settlement?

A viatical settlement is a financial transaction where the owner of a life insurance policy (Viator) sells the policy of an insured to a buyer ( viatical settlement provider) in the secondary market for life insurance. The seller receives a lump sum payment based on the value of his or her policy, which is less than the face value of the policy, ...

What do you need to know before selling a policy?

Before a policy is sold, buyers must do their due diligence to have the policy valued as accurately as possible. Actuarial tables, and the underlying health of the insured, allow the interested buyer to make projections about the life expectancy of the insured. Investors provide liquidity based upon the valuation assigned to the policy. Calculations are made to come up with an offer that will be attractive to the seller and also leave enough room for the buyer to earn an appropriate risk-adjusted rate of return.

What is the lump sum payment for a seller?

The seller receives a lump sum payment based on the value of his or her policy, which is less than the face value of the policy, but substantially higher than the surrender value that the seller could get by exercising that option with his or her insurance company.

Who is responsible for paying premiums on a life insurance policy?

The buyer of the policy becomes the new owner and beneficiary of the policy and is responsible for making any premium payments due on the policy to keep the policy in force until the death of the insured. Upon the death of the insured, the death benefit is paid to the owner (s) of the insurance policy.

Is life expectancy an exact science?

Determining life expectancy is not an exact science and that is why it is impossible to project a rate of return with certainty. If it takes longer to collect on a policy and/or costs more to maintain and keep the policy in force, than projected, that will have the effect of lowering the rate of return. At the same time, if an insured dies earlier ...

What happens when you purchase a life settlement?

When you purchase a life settlement as an investment, "you forfeit the tax-free benefit of insurance , which is one of the best things that life insurance has going for it." (Getty Images)

Where does life settlement money come from?

This money can come from policies that have matured – in other words, policies that have paid out their death benefits because the insured died.

Why do insurance companies sell policies?

An insured may choose to sell his policy instead of surrendering it to the insurance company because an investor will typically pay more for the policy, usually 10 to 25 percent of the death benefit.

What are the risks of life settlements?

The risks and costs can add up. And there is considerable risk in life settlements, whether you buy them individually or through a fund. For instance, investors risk lawsuits that challenge their right to the death benefit. Insurers, especially, are scrutinizing life settlements to determine if any insurance laws were violated.

Why is AM Best not rating life settlements?

Other reasons include pools that are too small to generate predictable cash flow, or too many parties involved in the securitization process. Most funds use third-party underwriters to value the policies.

Should life settlement investors go in with their eyes wide open?

Checking the funds out. In short, life settlement investors need to "go in with their eyes wide open," Modu says. Post suggests reviewing the disclosure documents closely to get an idea of the portfolio's best and worst case scenarios.

Is life insurance taxed?

Taxes are another consideration. When you purchase a life settlement as an investment, "you forfeit the tax-free benefit of insurance, which is one of the best things that life insurance has going for it," says Scott Witt, a fee-only insurance advisor at Witt Actuarial Services in New Berlin, Wisconsin. For investors, distributions from a life settlement fund and the death benefit are taxed as ordinary income.