- Bank information -- if there is no bank logo, or a post office box rather than a street address, suspect fraud.

- Check edging -- real checks generally have at least one rough edge or perforation. An entirely smooth check is suspicious. ...

- Check numbers -- legitimate checks have nine routing numbers, the initial numbers on the Magnetic Ink Character Recognition line on the bottom. ...

- Make sure the check is issued by a legitimate bank and doesn't have a fake bank name. ...

- Look for check security features, such as microprinting on the signature line, a security screen on the back of the check, and the words “original document” on the back of the check.

How do I receive a settlement check?

Your check is part of a legally binding agreement. Each case is different, but there are certain key steps involved in receiving a settlement check. If both parties agree to a settlement agreement before trial, the lawyers will report the settlement to the court. Next, the court issues an Order of Settlement.

How does the settlement of a personal injury check work?

The settlement of the check will reach your attorney’s office by the insurance company. The attorney will submit the check-in of the escrow account, where it will remain until the bank clears the payments and funds.

How do I know if a check I received is real?

If you don’t mind getting cash for the check rather than depositing it directly to your bank account, visit the bank that issued the check and try to cash it in person. If you go to the same bank that issued the check, they should be able to confirm whether it is real right away.

How long does it take for a settlement check to clear?

When your attorney receives your settlement check, your lawyer will submit the check into the law office trust account. Once the check clears and has been dropped to the trust account your attorney will issue the check and will take 1 to 3 days to clear. How does a settlement check works?

How do you tell if a check is real or fake?

Every legitimate check contains a number that appears in two places: in the upper-right corner and in the magnetic ink character recognition (MICR) line at the bottom. If the numbers don't match, it's a bogus check. And be wary of low numbers, such as 101-400 on a personal check or 1,000-1,500 on a business check.

Can you get scammed by depositing a fake check?

Fake checks can look so real that it's very hard for consumers, or even bank employees, to detect. Fake bank checks are typically used in scams where the scammer tries to get you to cash or deposit the check.

What happens if you deposit a fake check?

Generally, if your bank credited your account, it can later reverse the funds if the check is found to be fraudulent. You should check your deposit account agreement for information on the bank's policies regarding fraudulent checks. Fraudulent checks may be part of an overpayment/money order scam.

How do you tell if a cashier's check is real or fake?

Cashier's checks often include a distinct feature specific to the bank and often tell you what to look for. If the check states there is a watermark or microprint, look for that on the check. If it's missing, the check might not be valid.

How do I verify if a check is good?

To verify a check, you need to contact the bank that the money is coming from.Find the bank name on the front of the check.Search for the bank online and visit the bank's official site to get a phone number for customer service. ... Tell the customer service representative that you'd like to verify a check you received.More items...

How do banks verify checks?

Banks can verify checks by checking the funds of the account it was sent from. It's worth noting that a bank will not verify your check before it processes it, meaning you may face fees for trying to cash a bad check. The bank checks if there are funds in the account, and if not, the check bounces.

Can you cash a fake cashier's check?

If you cash a fake cashier's check, you can lose thousands of dollars or face criminal charges for check fraud. Not only do you have to pay back the amount of the check, but you also may need to pay additional fees to cover overdraft charges if there's not enough money in your account to cover the check.

Can someone steal your bank info from depositing a check?

Scammers know the simple fact, if they can trick you into depositing into your account, you will be responsible for the loss and theft of your money. Knowing who is conducting business and what transactions are happening in your account is an important part of transacting deposits at the credit union.

Can someone steal your bank info from a check?

If they simply toss the check into the garbage without shredding it, it could be very easy for a criminal to dig it out and steal your account number, routing number and personal information.

How long does it take for a fake check to bounce?

Their goal is for you to cash it, then send them something. Two weeks later their fake (but realistic looking) check will bounce.

How much is a fake check?

It's for less than $100. Scammers never bother to send you a phony check for $25, as it's not worth their time.

What companies are being warned about checks?

The Consumer Federation says beware checks and letters showing legitimate logos like Walmart, Costco, and Best Buy.

Is a class action settlement legit?

Consumers are inundated with mailings about class actions settlements that could bring you money, such as cash back for overpriced tuna fish, or a settlement over moldy front loading washing machines. Those are very legit, and if you get a check form them, go ahead and cash it.

How do you know if a check is fake?

Urgency. One of the surest signs of a fake check is urgency. If the person who gave you the check is urging you to deposit it as quickly as possible, that’s a reason to be wary. In most cases, this forces you into making bad decisions while you're hyped up on the prospect of easy money. Remember:

What happens if a bank deposited a fake check?

When the bank discovers that a fake check has been deposited, it will refuse to credit your account for the amount. If you’ve already been given the money, the bank will take that money back.

How to cash a check in person?

If you don’t mind getting cash for the check rather than depositing it directly to your bank account, visit the bank that issued the check and try to cash it in person. If you go to the same bank that issued the check, they should be able to confirm whether it is real right away.

What happens if you get caught in a scam?

If you get caught by one of these scams, you’ll send your own money along, expecting for the check to clear, only to find that you don’t receive the funds that you’re expecting. You’ll have sent someone else your own money while the deposited check is not backed by real funds.

What is a mystery shopping scam?

Mystery shopping scams involve a fake company hiring you to help retailers gauge the quality of their customer service, the cleanliness of their stores, and how customers interact with their products.

How long does it take for a check to show up in your bank account?

While it might take just a day or two for the money from a check to show up in your account, the process of getting funds moved from the bank that issued the check to your bank is a long one. It can take weeks for your bank to figure out that the check that you deposited is fake or bad. Eventually:

What are the most common scams?

Lottery scams are among the most common scams for online fraudsters.

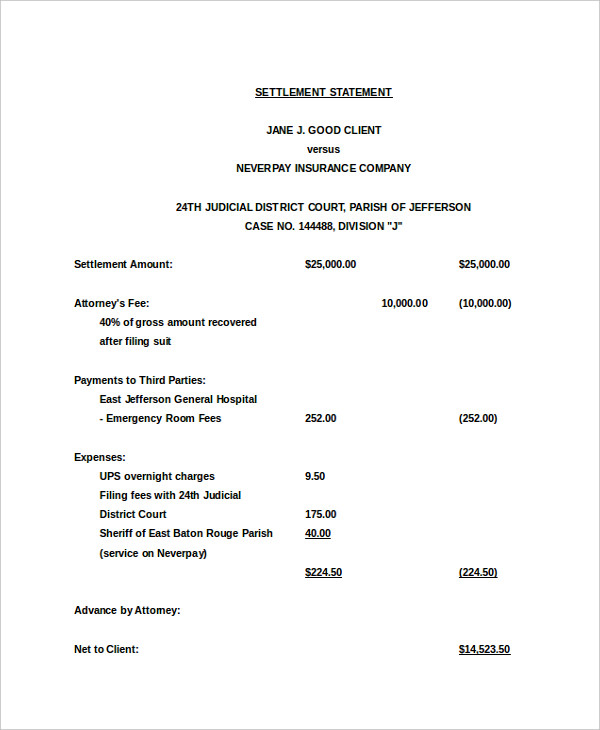

What is settlement check?

A settlement check refers to an amount of money that you expect to receive in the form of a check following the resolution of a lawsuit.

What is the first step to get a settlement check?

For you to receive a settlement check, you must first be in a legal proceeding of some form such as a motor vehicle accident claim lawsuit, personal injury lawsuit, medical malpractice lawsuit, defective product lawsuit, or any other type of legal action.

How to settle a case?

To settle a case, you’ll generally need to sign a settlement agreement and release so the defendant or insurance company makes a deposit in your attorney’s escrow account who will then need to pay you in return

What happens when a person files a lawsuit for personal injury?

For example, when a person files a lawsuit for personal injury claiming damages, the case may eventually settle where the defendant (or insurance company) agrees to pay a certain amount of money to prevent further litigation.

Why does a defendant accept to pay the plaintiff?

The reason why a defendant (or party to a lawsuit) accepts to pay the plaintiff (or the injured party) a sum of money compensating it for damages and , in return, gets the plaintiff to dismiss the lawsuit.

When a claim is filed against an insurance company, can you expect to receive a check for the settlement?

When a claim is filed against an insurance company, you can also expect to receive a check for the settlement of the claim.

What is the next step in a settlement?

Once both parties have reached a settlement, the next step is to submit the settlement to the court and obtain a settlement order.

How long does it take to get a settlement check?

Once you have signed the completed release, it generally takes about six weeks to receive a settlement check; however, it can also take much longer. The timing depends on the defendant’s policy, the type of personal injury case involved, and other circumstances.

Who pays for a settlement?

Typically, as part of the settlement, the defendant must pay the plaintiff compensation for resulting losses. However, the parties may have very different perspectives on the case. They may disagree about issues of fault or the amount of compensation warranted.

What Is a Legal Settlement?

According to the Bureau of Justice, only 4 percent of personal injury cases go to trial. The majority settle out of court, by mutual agreement between the parties. This resolution is called a settlement.

What are the advantages and disadvantages of settling a case?

For both parties, there are potential advantages and disadvantages to settling the case. By settling, both parties know the terms of the agreement and avoid the unpredictability of a trial. Settlement allows both parties to resolve the matter more quickly. The settlement is not final until the plaintiff or the plaintiff’s attorney receives the check, and it clears.

What is the most important settlement document?

The most important settlement document is the release . This document absolves the other party of any further liability. The attorney for the defendant prepares a release form, which should clearly and accurately outline the terms and conditions of the settlement.

What is settlement in litigation?

A settlement is an agreement that ends a dispute and results in the voluntary dismissal of any related litigation. It may happen during the early stages of litigation, or in some cases, even before the injured person files a lawsuit. Settlements usually happen when the defendant and the plaintiff agree to the plaintiff’s claims rather than going to trial.

What happens before a trial?

Before a trial begins, there are investigations, pre-trial motions, insurance claims, medical evaluations, and more. Many accidents result in significant injuries, expenses, and lost wages, so victims often feel anxious about when they can expect to receive a settlement check for financial losses.

How do I know if this check’s real or a scam?

If you would like to verify whether a check from the CFPB is real, you can view our payments by case and click on the link for the case for which you received a check. You should then contact the payments administrator using the contact information listed. The administrator should be able to verify your check and determine if it’s real or a scam.

What if I think I should have received a check?

You can check here or call (855) 411-2372, 8 a.m. to 8 p.m. ET, Monday through Friday, to learn more about our recent enforcement actions. Keep in mind that even if an enforcement action was brought against a company that harmed you, you might not be eligible to receive compensation. You can learn more about the process on our website .

When do you receive a claim form?

A claim form is used when we need additional documentation to verify that you are eligible for a redress payment.

Is a check from a payment administrator a scam?

You should then contact the payments administrator using the contact information listed. The administrator should be able to verify your check and determine if it’s real or a scam. If anyone claims that they can get you compensation, but asks for money upfront, it could be a scam.

Can I still take legal action?

Cashing the check you receive in the mail doesn’t stop you from making any further legal claims that may be available to you. While we can’t give you legal guidance, you may want to look for an attorney for advice.

What happens if you deposit a fake check?

If you deposit a fake check, it will be returned due to fraud. However, that can sometimes take weeks to discover. If you've already spent the money, then you'll owe it back to the bank. 7

How to verify funds in a check?

How to Verify Funds. If you’re holding onto a check that’s suspect, you can try to verify funds in the account. To do so, contact the bank that the check is drawn on and ask to verify funds. Some banks, in the interest of privacy, will only tell you whether or not the account is valid, or they will not provide any information at all. 3 .

What happens if you don't verify funds?

If you can’t verify funds (or if you want to be especially cautious), take the check to a branch of the bank that the funds are drawn on.

How to tell if a check has been altered?

Make sure there aren't any smudges or discoloration, which can indicate that the check was altered.

How to prepare for a check?

Be prepared by getting contact information from everybody who pays by check. Verify that you have a current phone number and address, and check identification to be sure that everything matches.

Where is the original document on a check?

Look for check security features, such as microprinting on the signature line, a security screen on the back of the check, and the words “original document” on the back of the check .

Who can use check verification?

Check verification services are only available to merchants and businesses.