Steps Download Article

- 1 Validate the debt collection agency claims. ...

- 2 Check the statute of limitations. ...

- 3 Know the method of payment. ...

- 4 Know how much money to pay. ...

- 5 Negotiate a settlement with the debt collection agency. ...

- 6 You should write an offer of acceptance or request a letter from the agency if it accepts your offer.

How to negotiate with collection agencies?

Steps Download Article

- Validate the debt collection agency claims. You should send the debt collection agency a letter requesting that it send you proof you owe the debt.

- Check the statute of limitations. Each state has a statute of limitations on how long a creditor has to collect on a debt.

- Know the method of payment. ...

- Know how much money to pay. ...

What is the best collection agency?

- Atradius Collection

- Summit Account Resolution

- PRA Group

- The Kaplan Group

- Rocket Receivables

- Rozlin Financial Group

- Encore Capital Group

- ACA International

- Consumers Financial Protection Bureau

- National Consumer Law Center

How much do collection agencies charge?

Most debt collection companies will charge a 20% to 25% commission of the debt collected. An agency may charge up to 50% commissions if the debt is older or more difficult to collect. If your invoice letters and calls are going unanswered then it might be time to hire a professional debt collection agency.

Do collection agencies negotiate?

Some debt collectors will agree to negotiate with you to score at least a partial repayment instead of nothing. Debtors may be able to negotiate an alternate repayment plan or repay a lump sum,...

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Can you negotiate a settlement with a collection agency?

Believe it or not, though, it's possible to negotiate with a collection agent and end up paying less than you owe. Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit.

How do I ask for a settlement in collections?

To get ready to negotiate a settlement or repayment agreement with a debt collector, consider this three-step approach:Learn about the debt. ... Plan for making a realistic repayment or settlement proposal. ... Negotiate with the debt collector using your proposed repayment plan.

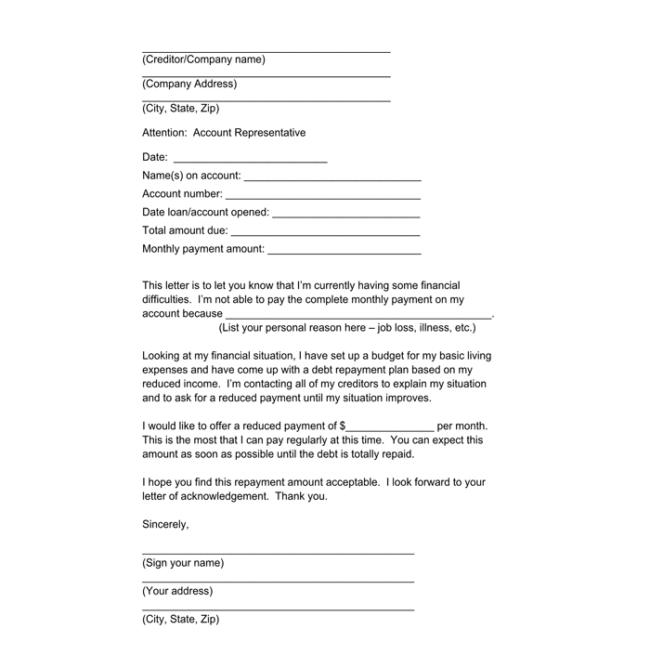

How do I write a settlement letter to a collection agency?

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

Will debt collectors settle for half?

Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

What should you not say to debt collectors?

9 Things You Should (And Shouldn't) Say to a Debt CollectorDo — Ask to see the collector's credentials. ... Don't — Volunteer information. ... Do — Make a preemptive offer. ... Don't — Make your bank account accessible. ... Maybe — Ask for a payment-for-deletion deal. ... Do — Explain your predicament. ... Don't — Provide ammunition.More items...

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

How do you draft a settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How much should I offer as a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

Can you dispute a debt if it was sold to a collection agency?

Can you dispute a debt if it was sold to a collection agency? Your rights are the same as if you were dealing with the original creditor. If you don't believe you should pay the debt, for example, if a debt is statute barred or prescribed, then you can dispute the debt.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

What to do if you agree to a settlement?

If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed these payments. Get it in writing before you make a payment.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

What to do if you don't recognize the creditor?

If you don’t recognize the name of the creditor, you can ask what the original debt was for (credit card, mortgage foreclosure deficiency, etc.) and request the name of the original creditor. After you receive the debt collector’s response, compare it to your own records.

When will debt collectors have to give notice of eviction moratorium?

All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords. Starting on May 3, 2021, a debt collector may be required to give you notice about the federal CDC eviction moratorium.

How to settle a debt with a debt collector?

Here’s how to settle with a debt collector. The first thing you should know is that you can negotiate. Debt settlement is one option you have, which means offering to pay a portion of your debt in return for the creditor or debt collector forgiving the rest. You might either pay it back in one lump sum or in installments.

What to do if you hire a debt settlement company?

If you hire a debt settlement company, they should handle the back-and-forth negotiations with a debt collector. But if not, you’ll be in charge. Before you make a settlement offer, you’ll need to figure out how much you can afford to pay and whether you can pay in installments or as a lump sum.

What time can debt collectors call you?

Debt collectors can only call you between 8 a.m. and 9 p.m. You can send a letter asking debt collectors to stop contacting you. The Consumer Financial Protection Bureau has a sample letter you can download. But be careful using this type of letter if there is still time for the collector to sue you in your state.

How long does a settlement last?

One big issue with many settlement companies is that their programs can last as long as 36 to 48 months. During that time, they ask you to stop paying your creditors to save up money for a lump sum settlement payment. But in the meantime, you keep racking up interest charges and fees.

How long can a debt collector sue you?

There is a statute of limitations ( it varies by state and type of debt) for how long a debt collector has to sue you. Most statutes are three to six years. If the delinquent debt is past the statute of limitations in your state, it’s considered expired. But admitting that the debt is yours, or paying a portion of it, ...

How much does a debt settlement company charge?

Check out the company’s ratings with the Better Business Bureau. Ask them what fee they will charge you (some can be as high as 20 to 25%) and whether their fee is based on your total debt or just the portion that is forgiven. Legally, they can’t charge you any fees upfront.

How long does it take to get a no obligation offer from a creditor?

Get your first no-obligation offer from your creditor in just a few days. It’s up to you if you want to accept it. If you’ve fallen behind on a debt, and the debt collectors are calling, you’re probably under a lot of stress. It’s important, though, not to panic and to come up with a plan of action. Here’s how to settle with a debt collector.

Why do collections agencies settle?

Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don’t have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount.

How does a collection agent work?

The collection agent is incentivized to get you to pay as much money as possible with the least amount of effort on their part. The agent works on commission and gets a portion of whatever you pay.

How does a credit bureau agent work?

The agent works on commission and gets a portion of whatever you pay. The best outcome is to get this debt off your back by paying a lump sum and getting a receipt and a commitment from the agency to update the status of your account on your credit report to reflect payment. Here’s how to do it.

What to say when an agent makes an offer?

If the agent makes an offer, for example to waive interest, reduce payments or let you skip a payment, you can respond by saying, “I see,” without committing immediately. The agent may then ask for something in exchange such as paying higher interest. Don’t give up more than you get.

What to do if an agent keeps playing hardball?

If the agent keeps playing hardball, insisting that you pay a certain amount you can’t afford, don’t let them trap you. It’s fine to politely hang up and call back a day later. Successful negotiations may take weeks. As you continue to negotiate, tell the agent you want them to report the bill as paid in full.

What to do if you get a no?

If you get a “no,” ask to speak to a supervisor. The supervisor may say no also, or make a counter-offer. Try to figure out the amount he or she really wants. For example, if the supervisor offers to waive two months’ interest if you pay the principal that’s due on a loan, perhaps the agency would actually waive three or four months of interest. Try making a counter-offer.

What does it mean when a debt is charged off in 2009?

A debt that was charged off in 2009 just means the original creditor followed the Generally Accepted Accounting Principles (GAAP), in order to account for the loss on their books. The account is still out there and collectable. You can be sued on unpaid debts after charge off, so settling is a good idea when it makes sense for you financially. A collection agency making an offer you did not solicit often means there is room to negotiate an even better outcome.

Is enforced collection a good experience?

Court enforced collections after a judgment are not ever a good experience , so avoiding that is a key consideration. In order to help you better evaluate the offer to settle the debt you received please answer the following questions using the comment box below:

Can you settle a collection account with a collection agency?

Settling with a collection agency when they send you debt settlement offer in the mail. If the offer you receive to settle an old collection account for less than the balance owed is a good one, and the debt is still inside the statute of limitations to sue you, you should definitely consider taking advantage of it.

Can you negotiate better debt?

Depending on who is collecting, and who the debt is owned by, your ability to get a better deal through negotiations can change.

Is it better to settle a debt now or later?

Sometimes it is better to make every effort to settle a debt now, while there is an offer on the table, when the collection agency or debt buyer has a history of using the courts in order to collect. Court enforced collections after a judgment are not ever a good experience, so avoiding that is a key consideration.

What kinds of settlements does Navient offer?

Navient may accept settlement for charged-off loans, including those in default or extremely delinquent. However, they won't settle loans in deferment, repayment, or forbearance. The same also applies to loans that have an interest-rate only repayment plan.

How to negotiate a settlement with Navient

Here are some tips to help you negotiate a settlement offer with Navient.

The settlement agreement process explained

After defaulting on the student loan, Navient will send your loan account to a collection agency. The collection agency will buy the account and try to reach out to you about paying what you supposedly owe.

What next after settling a student loan with Navient?

When you settle a student loan with Navient, you'll receive a debt clearance letter approximately six weeks after your final payment. The letter states that you no longer owe that loan.

The bottom line

There's no guarantee that Navient will accept your settlement offer, but it's always worth giving it a try. However, given that you need to default your loan to stand a chance to negotiate settlement, it's always advisable to talk to your cosigner about your options. You can also contact a debt management expert for further advice.

Guides on how to beat every debt collector

Being sued by a different debt collector? Were making guides on how to beat each one.

Win against credit card companies

Is your credit card company suing you? Learn how you can beat each one.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

What is a counteroffer letter?

This template letter makes a counteroffer when an original creditor offers you an initial settlement amount. The goal is to offer a lower amount and negotiate for a removal of the negative information from your credit history.

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!