How to Negotiate With Insurance Companies: Our 6 Step Guide For Success

- 1. File a Claim The first step is always to file a claim. ...

- 2. Get Your Records Ready One of the best ways to build your case is to have good records. ...

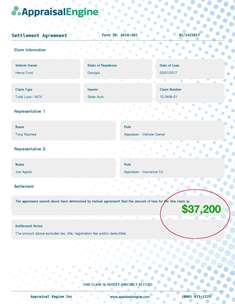

- 3. Estimate Your Claim’s Value ...

- 4. Send the Insurance Company a Demand Letter ...

- 5. Expect a Lowball Offer or Outright Denial ...

- 6. Hire an Attorney to Settle Your Case ...

- Step 1: File An Insurance Claim. ...

- Step 2: Consolidate Your Records. ...

- Step 3: Calculate Your Minimum Settlement Amount. ...

- Step 4: Reject the Claims Adjuster's First Settlement Offer. ...

- Step 5: Emphasize The Strongest Points in Your Favor.

Can you sue after accepting an insurance settlement?

You cannot sue after accepting an insurance settlement. The agreed-upon sum will be the total amount you receive, even if you realize later that your damages were more than the settlement amount. There may be limited exceptions to this general rule.

Should I accept an insurance settlement?

You need not accept an initial settlement offer from insurance companies. Don't accept any settlement offers until you speak with an experienced attorney. The goal of insurance companies is to give the lowest amount of money they can because they want to make a profit. Therefore, insurance providers often offer a settlement that isn't fair.

Should I accept a settlement offer from an insurance company?

You do not have to accept an auto insurer’s settlement offer, let alone the first one. Insurance companies want to reduce what they pay you. They will encourage or even pressure you to accept the first offer despite this actually being a negotiation. They will not say this.

What is the best way to negotiate a settlement?

What is the best way to negotiate a divorce settlement?

- Focus On Interests Not Positions. ...

- Be Careful Of “Hard Bargaining” ...

- Be Careful Not To Destroy The Relationship With The Other Side. ...

- Recognize The Other Side's Perceptions & Emotions. ...

- Take Control Of Your Own Emotions.

Is an insurance settlement negotiable?

Even if the offer seems reasonable at first glance, you should always negotiate. After you research the value of your car, come up with a number that you feel is fair for a settlement. It should be the absolute minimum you are willing to accept.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

How do insurance companies negotiate higher settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How do I counter offer an insurance settlement?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

How do you respond to a low settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

Do insurance companies want to settle quickly?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

What should you not say to an insurance adjuster?

Never say that you are sorry or admit any kind of fault. Remember that a claims adjuster is looking for reasons to reduce the liability of an insurance company, and any admission of negligence can seriously compromise a claim.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease or eliminate payments for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

What happens if insurance doesn't pay enough?

Most insurance companies will do anything to increase their profits. When the vehicle insurance company refuses to pay, you may need to threaten them with something that will put their profits at risk. To do this effectively and in the right way you require an insurance lawyer.

Should you accept first compensation offer?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

Why do insurance companies lowball?

Lowball offers occur when an insurance company offers less for a claim than you reasonably need to secure compensation for your medical bills, lost wages and other covered damages. Many companies in the insurance sector claim they do not lowball.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What is the best thing to do with settlement money?

There are many options including (but not limited to): Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want. Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.

Do you get taxed on settlement money?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What is the usual result of a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How to negotiate a settlement with insurance?

One of the keys to remember in insurance claim settlement negotiation is to say no to the first offer. The first offer is almost never as high as the insurance company is willing to go. Insurance companies offer low initial offers because they know many accident victims won’t discuss their rights with a lawyer or learn the true value of their claims. Many claimants will agree to the first offer without realizing they have the power to negotiate a higher amount. Ignore an adjuster that says it is the “top” or “final” offer. Talk to a Denver personal injury lawyer before saying yes.

How to maximize insurance claim value?

The first action you can take to optimize the value of your insurance claim is to report your accident to the insurer as soon as possible. Most insurance companies have rules in place that require prompt reporting. Waiting too long could hurt your ability to recover damages at all, much less to negotiate a fair settlement. Follow all the rules for dealing with an injury and reporting your claim. This includes seeking medical attention, following the doctor’s orders, and providing the insurance company with all necessary information and documentation.

Why do insurance companies undervalue claims?

It is generally an insurance company’s goal to save money and convince the claimant to settle for as little as possible – not to maximize the claimant’s recovery. It is the claimant’s job, therefore, to negotiate with the insurance company for a fairer amount. Use these tips for how to negotiate an insurance settlement to improve your odds of obtaining maximum recovery.

What does a claims adjuster call you?

Someone called a claims adjuster or claims analyst will generally call you from the at-fault party’s insurance company to gather more information about your accident. Before you answer a call from a claims adjuster, prepare yourself for a potentially difficult conversation. The adjuster will ask you questions and seek details about what happened. The law does not obligate you to agree to give a recorded statement, so politely decline to do so.

Do you have to negotiate an insurance settlement?

You don’t have to negotiate your insurance settlement on your own. After an accident, hire a lawyer to represent you during settlement negotiations. Using an attorney during negotiations can greatly improve the odds of convincing an insurance company to offer more.

What to do if your insurance company offers a lower settlement?

However, if the insurance company offers a lower amount and makes a point that weakens your claim, you might need to reconsider the minimum amount you want to settle for or counter their offer with even stronger support for your claim. You have the ability, in this case, to write another demand letter with any new auto accident evidence or injury development that can increase your settlement amount to what you believe is fair.

What to ask when analyzing a car accident settlement offer?

It is wise, therefore, to examine your first offer with care and consult a car accident lawyer if you believe necessary. Refer back to your demand letter and fair compensation amount in your mind when analyzing your first settlement offer, asking yourself, “Does the insurance company’s dollar amount cover all my expenses? Is my case potentially worth more than what they are telling me?”

What happens after a car accident?

After a tragic auto accident, you can feel disoriented and lost as you recover from physical injuries and deal with vehicle repairs. These are struggles in of themselves, in addition to the financial burdens they add to any pre-existing penny pinching you were doing. It can be confusing to obtain your personal injury settlement, especially if this is your first car accident and you have never dealt with insurance adjustors.

What is the number to call for a personal injury lawyer?

We would be happy to answer any questions you have by calling our law firm at (334).269.3230.

What should be included in a demand letter for insurance?

There are several key elements of demand letters that you should include to make an impression on the insurance adjuster, such as what injuries you sustained, what the medical treatment/vehicle repair costs were , etc. However, these claims cannot stand without copies of original documentation that the insurance company can evaluate, aiding your negotiation process.

Can you negotiate a settlement with your insurance company?

It can feel impossible to negotiate with the insurance company for a settlement that covers all your injuries and vehicle expenses, especially when you are the victim of a severe car crash. In addition to the physical pain and emotional suffering you dealt with during the accident, these often develop and increase over time. Your traumatic situation progressively gets worse in the long term and you also carry the responsibility of dealing with the opposing party’s insurance company.

Do you have to repeat the points you made in your first reply during the negotiation process?

You do not need to keep repeating the points you made in your first reply during the negotiation process: you only need to emphasize the strongest points in your favor. For instance, if you missed work because of the accident, provide the estimated current and future wages you will lose and drive home why you deserve your fair settlement amount.

How to negotiate with insurance company?

As you prepare for your negotiation with the insurance company, it's helpful to follow a few tips. The first is to avoid taking the first offer made. According to Nolo, Sutliff & Stout, and Findlaw.com, an insurance adjuster will often make an extremely low first offer to determine whether you know how to negotiate or understand the value of your car. Even if the offer seems reasonable at first glance, you should always negotiate.

What should you consider when calculating a fair settlement?

When calculating the fair settlement amount, be sure to consider: Any suffering and pain caused by the accident. The cost of any required medical care and other related expenses.

Why do drivers get entangled with insurance companies?

In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. Dealing with the aftermath of a car accident can be a stressful situation. In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. If you're wondering how to negotiate an ...

What to do when an adjuster comes in near your minimum?

Additionally, if the first offer from an adjuster comes in near your minimum amount, you may want to consider increasing that amount .

What does a claims adjuster do?

A claims adjuster will make a determination of what it will cost to perform repairs to your vehicle but knowing its value can assist you in your negotiation. The two main types of claims in this situation are first-party and third-party and which type depends on who is found to be at fault in the accident.

How much do personal injury attorneys take?

Most personal injury attorneys take a cut of one-third of the settlement amount, so it has to be a high amount to make it worthwhile to hire an attorney. If you're negotiating a settlement, use these tips to increase your chances of a positive outcome.

What happens when you get involved in a car accident?

When you are involved in a car accident that causes significant damage to your vehicle, the next step is getting compensated by the insurance company that provides the policy on the car. However, getting a fair price for the damage is often a challenge, as an insurance company loses money when it has to pay out following an accident.