- Determine what the vehicle is worth. One of the first steps in total loss settlement negotiation is determining the value of your vehicle.

- Decide if the initial offer is too low. There may be no need to negotiate with your claims adjuster if the initial payout offer for your vehicle is sufficient.

- Negotiate with your insurance adjuster. However, if you feel that the offer for your vehicle’s value is too low, you can begin negotiating with your claims adjuster.

- Hire an attorney. If your negotiations with the claims adjuster prove unsuccessful, you could hire an attorney. ...

- Obtain a written settlement agreement. Once you reach a settlement with the insurer, you may want to confirm the terms in writing. ...

- Determine what the vehicle is worth. ...

- Decide if the initial offer is too low. ...

- Negotiate with your insurance adjuster. ...

- Hire an attorney. ...

- Obtain a written settlement agreement.

Can I negotiate a total loss settlement for my car?

You’ve been in an accident and your vehicle is a total loss, now what? The insurance company is going to make you a settlement offer. This may sound simple, but knowing how to negotiate a total loss settlement properly may be more complicated than you think. What if you disagree with insurance company’s valuation of the vehicle?

How do you prove a total loss on a car?

Proving a total loss is simple. You'll want to supply the insurance company with the blue book value of your car along with one or two repair estimates. Depending on the carrier they may have an independent adjuster or appraiser review the vehicle.

Can insurer offer a cash settlement for a replacement car?

Insurer may (1) offer a replacement vehicle including all applicable taxes, license fees, or other fees, or (2) offer a cash settlement based on the actual cost of a comparable vehicle including all applicable taxes, license fees, or other fees. Insurance Order No. 11607.

How does the negotiation process work in a car accident claim?

The first step in the negotiation process is figuring out the true value of your vehicle. A claims adjuster will make a determination of what it will cost to perform repairs to your vehicle but knowing its value can assist you in your negotiation.

Can you negotiate price of totaled car?

The total loss negotiation process is straightforward. A vehicle is legally considered a total loss if the cost of repairs and supplemental claims equal or exceed 75% of the fair market value – which, again, can typically be negotiated.

Can you negotiate a car settlement figure?

Even if the offer seems reasonable at first glance, you should always negotiate. After you research the value of your car, come up with a number that you feel is fair for a settlement. It should be the absolute minimum you are willing to accept.

How does insurance decide how much a totaled car is worth?

Key Takeaway: Total loss value is determined by adding up the cost of the repair and associated costs, the value your car loses due to an accident, and the rental reimbursement costs while your vehicle is down for repairs. Then, the value the insurer will sell the damaged car for salvage is taken off.

How do insurance adjusters determine the value of a totaled car?

The insurer will use the actual cash value of your car immediately before the damage to decide whether to declare your vehicle a total loss. You can get an estimate of your car's fair market value from tools like Kelley Blue Book or by checking to see what similar cars are selling for in your area.

How do you respond to a low settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

What should you not say to an insurance adjuster?

Never say that you are sorry or admit any kind of fault. Remember that a claims adjuster is looking for reasons to reduce the liability of an insurance company, and any admission of negligence can seriously compromise a claim.

Does totaling a car affect your credit?

How Can a Totaled Car Affect Your Credit Scores? Car accidents, even those that result in a financed car being totaled, won't directly impact your credit scores. Credit scores are based solely on the information in your credit report and don't include things like your driving record or previous insurance claims.

Is actual cash value the same as fair market value?

Market value and actual cash value are different terms with different uses. Fair market value is the measure appraisers use to set a price on a piece of property. Actual cash value is an insurance standard that may determine how much the insurer pays you if your house or your car gets damaged.

Which is better replacement cost or actual cash value?

replacement cost homeowners insurance. They're different methods used to calculate your claim reimbursements. While actual cash value is cheaper, replacement cost provides better coverage since it includes the recoverable depreciation of your property.

What is the total loss formula?

The total loss formula (TLF) is another common method for determining when a car is a total loss. It equals the fair market value of a vehicle minus its salvage value.

How is total loss on a car calculated?

The total loss threshold is calculated by dividing the vehicle's repair cost by its actual cash value. It is expressed as a percentage. For example, suppose a vehicle will cost $8,000 to repair and its ACV is $10,000. The total loss threshold for the vehicle is 80 percent (8,000 / 10,000).

Is my car totaled If the frame is bent?

In short, the severity of the damage to the frame ultimately determines if the vehicle is to be declared a structural total loss. If the damage is so bad that it is uncertain whether a repair can be performed, the vehicle is considered a total loss.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

Can you negotiate the payoff amount in a lease buyout?

If you've been thinking about purchasing your lease, you may be searching for the answer to the question, “Can you negotiate a lease buyout?” In short, yes. Most leasing agreements include an estimated buyout price in the contract, but in most cases, it's possible to negotiate a better deal.

How do I figure out the payoff on my car?

The fastest and most accurate way to find out what the payoff amount would be to get the quote from your lender. If you have an online account with them, you could locate the payoff amount there, or you could just call a customer service representative and ask over the phone.

How much will my credit score increase if I pay off my car?

Once you pay off a car loan, you may actually see a small drop in your credit score. However, it's normally temporary if your credit history is in decent shape – it bounces back eventually. The reason your credit score takes a temporary hit in points is that you ended an active credit account.

Your Auto Insurance Company vs. Theirs

Don't fret if your state doesn't require auto insurance companies to reimburse you for sales tax. Public policy is generally on your side anyways.F...

Are You First Party Or Third Party?

Drivers unfamiliar with the auto insurance claims process may not know the difference between first party and third party. Here's the difference.Wh...

Sometimes You Have to Ask

State laws vary on the topic of recouping expenses after your car is totaled. There are states that require car insurance companies for both first...

Shop Around For Car Insurance

If you're not totally satisfied with your auto insurer, it's probably time to review Insure.com's annual ranking of the best auto insurance compani...

Definition of Total Loss

A total loss occurs when your vehicle cannot be repaired or when the cost of repairing your vehicle is more than the value of the car. In this instance, for all parties involved it is wiser to merely pay for the cost of the vehicle rather than attempt repairing it.

Valuing Your Vehicle

Your vehicle loses value on a daily basis. Depending on the year, make and model of your car, it may be worth significantly less than when you purchased it. When an insurance company places a value on your automobile, it does so for its cost at the time of the accident, not when it was purchased.

Proving Total Loss

It is not difficult to prove total loss of your car. Merely provide your insurance company, in writing, the blue book value of your car at the time of the accident and two or three repair estimates. Present this information to your initial claim or after you obtain repair estimates, whichever occurs first.

Negotiating the Highest Value

The key to negotiating total loss is to provide factual evidence of your vehicle. Include as many comparisons, valuations and other information regarding the value of your car and the cost of repairing the accident damage. The more information you provide, the more likely it is that you will receive top value for your car.

Getting Legal Help

If you are involved in automobile accident settlement negotiations and believe that your car is not salvageable, speak with an attorney about your options. An attorney will recommend the appropriate means to prove total loss and obtain the highest settlement possible.

What is the first thing you need to understand when you are trying to negotiate a total loss settlement?

When you’re trying to learn how to negotiate a total loss settlement the first thing you need to understand is whose insurance company is going to pay. Will it be yours or the person who hit you?

How to settle a total loss claim?

Don’t let some of the information above make you apprehensive about settling a total loss claim. Sometimes the process is straightforward and smooth. But it’s good to be aware of the pitfalls and understand your position ahead of time. Just remember: 1 A total loss is (generally) when a vehicle is damaged more than 70-80% of its blue book value. Proving it is as simple as collecting a few repair estimates and documenting the blue book value of the vehicle. 2 Figure out whose insurance company should pay. This requires understanding if you live in a fault or no-fault state, figuring out negligence, and then pursuing the appropriate party, etc. 3 Never feel that you must accept an insurance company’s offer. You can always dispute it but be prepared to provide hard reasons for your disagreement if you want to get anywhere. 4 Five tips to keep in mind are: Actual cash value includes taxes and fees, insurance companies are required to settle undisputed portions of a claim, don’t trust your insurance carrier too much, attorneys often don’t help much with total loss settlements, and keep your eyes open for bad faith tactics.

What happens if you settle a total loss claim with another person's insurance company?

Be aware that if you’re dealing with another person’s insurance company to settle your total loss settlement, your claim may be more hostile. They’re more likely to lowball you or employ tactics to reduce your claim value.

Why can't insurance companies withhold payment?

2. An insurance company cannot withhold payment because some percentage of a claim is disputed. For example, you may be haggling over $500 — in the meantime, it is their duty to pay the undisputed portion of the claim in a timely manner.

What to do when you get into a verbal negotiation with an insurance company?

If you get into a verbal negotiation with the insurance company know that they are probably more experienced than you at this. Try to keep your emotions out of it, and stick to the hard facts.

How to prove total loss on car insurance?

Proving a total loss is simple. You’ll want to supply the insurance company with the blue book value of your car along with one or two repair estimates. Depending on the carrier they may have an independent adjuster or appraiser review the vehicle.

What is total loss?

A total loss is (generally) when a vehicle is damaged more than 70-80% of its blue book value. Proving it is as simple as collecting a few repair estimates and documenting the blue book value of the vehicle.

How long does it take to get a loss settlement check?

Generally, once the car has been declared a total loss, you may receive a loss settlement check in just a few days. But - as with all types of settlements, the process could take longer if you disagree with the amount the insurance company is offering or if you were the third party in the accident.

What is the insurance policy for a first party auto total loss?

When the insurance policy provides for the adjustment and settlement of a first-party auto total loss, the insurer must either (1) offer a replacement auto with all applicable “taxes, license fees, and other fees” paid, or (2) make a cash settlement which includes all applicable taxes, license fees, and other fees.

What is total loss car insurance?

To ensure that you can get around if your car is damaged beyond repair, it’ s important to have total loss car insurance coverage.

How to total a car?

If you think your car was totaled in a collision, the first step is to call your insurance company and evaluate the damage. The adjuster can determine whether it’s a total loss or not.

What makes a car totaled?

So, what separates normal damage from a “total loss?” It depends on the cost of repairing the damage and the value of your car.

What is the actual cash value of my car?

You might assume that the actual cash value of your car is whatever you paid for it. Unfortunately, that’s not the case – your vehicle’s ACV is probably much lower. Why?

What is 10902 insurance?

Code § 10902, or (3) vehicle completely stripped or burned. When a carrier elects to repair the car to its pre-accident condition, it’s not required to pay for any loss of value to the vehicle, which can occur after a seriously damaged vehicle is fully repaired.

Who is the best company to work with when dealing with totaled vehicles?

Based on consumer surveys and ratings from reputable sources the top companies to work with when dealing with claims and/or totaled vehicles are USAA, Travelers, Auto-Owners, and Amica.

How much does a car depreciate in the first year?

Note: The average vehicle can depreciate from 17% to 30% in the first year according to NADA. Some depreciate up to 38%. When you are attempting to negotiate with an insurer after a total loss claim you are likely to find out your vehicle is not worth as what you expect.

How do Insurers Determine the Fair Market Value of a Vehicle?

The definition of fair market value is when a buyer or seller can agree on a price.

What does an insurer look at when repairing a vehicle?

Many insurers are going to look at the cost of the repairs, the salvage value of the vehicle, and the cost to the insurer while the vehicle is being repaired.

What is the TLT in insurance?

Some use what is called the Total Loss Threshold or TLT where the damage needs to exceed a certain percentage of the vehicle’s value.

How to gather sales data?

In addition to using the Internet as a resource to gather sales data, contact local dealerships that sell a make and model that is similar to your vehicle.

How to find out what your car is worth?

Instead, consider using any and all of these tactics: 1 Do your own research. 2 Contact local dealerships. 3 Keep detailed records and take into account any extra options and features your car had. 4 Compare your research with that of the insurer. 5 Be courteous. 6 You are attempting to get the fair market value of the vehicle – not what you think it is worth. What the market or unbiased buyer or seller would agree on a price.

How to find out if a car is still on the lot?

Call each of these dealerships and ask them if these vehicles are still on their lot. If they are, confirm the listing price and details. If they have sold, find out when and for how much. Take this information back to your claims representative and address any discrepancies you have uncovered.

What to do after an auto accident?

Following an auto accident, you are often left to depend on many others to navigate your situation. You’ll likely speak with police officers, body shops, insurance adjusters, and claims representatives, each requiring something different from you.

What should be included in a car valuation report?

The more bells and whistles your vehicle has, the greater its value. The valuation report you receive from your insurance company should include a list of features. Go over this list thoroughly to ensure that nothing has been left off. For instance, you may notice that they have forgotten to include leather seats, running boards, or an entertainment package. And, if these items are missing, there is a possibility that the trim package they are both valuating and offering comparable vehicles for is entirely incorrect. Each error, no matter how seemingly insignificant, is important to point out, as it may impact the bottom line.

Can you pull your own NADA value?

However, this doesn’t mean that you shouldn’t pull your own NADA value.

Can you accept a settlement offer for a car accident?

If your car has been determined to be a total loss following an accident, don’t accept the initial settlement offer without question. Conduct your own research, raise your concerns, and you will likely be pleasantly surprised at what a big difference just a little pushback from an educated consumer can make.

Is a valuation report a separate entity from an insurance company?

In addition to these steps, we often encourage our customers to look into the company providing the valuation report, as this is often a separate entity from your insurance provider. In many cases, lawsuits and previous consumer complaints can help you better understand what to watch out for in your own settlement. It’s also a good idea to bring these findings and any concerns regarding trustworthiness up to your claims representative.

What should you consider when calculating a fair settlement?

When calculating the fair settlement amount, be sure to consider: Any suffering and pain caused by the accident. The cost of any required medical care and other related expenses.

What to do when an adjuster comes in near your minimum?

Additionally, if the first offer from an adjuster comes in near your minimum amount, you may want to consider increasing that amount .

How to negotiate with insurance company?

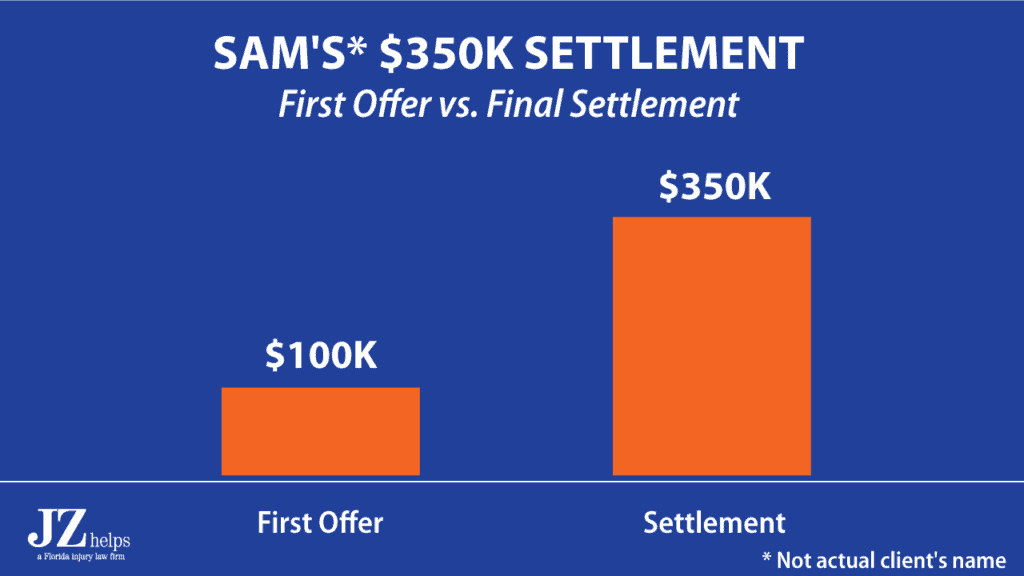

As you prepare for your negotiation with the insurance company, it's helpful to follow a few tips. The first is to avoid taking the first offer made. According to Nolo, Sutliff & Stout, and Findlaw.com, an insurance adjuster will often make an extremely low first offer to determine whether you know how to negotiate or understand the value of your car. Even if the offer seems reasonable at first glance, you should always negotiate.

Why do drivers get entangled with insurance companies?

In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. Dealing with the aftermath of a car accident can be a stressful situation. In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. If you're wondering how to negotiate an ...

What does a claims adjuster do?

A claims adjuster will make a determination of what it will cost to perform repairs to your vehicle but knowing its value can assist you in your negotiation. The two main types of claims in this situation are first-party and third-party and which type depends on who is found to be at fault in the accident.

What happens when you get involved in a car accident?

When you are involved in a car accident that causes significant damage to your vehicle, the next step is getting compensated by the insurance company that provides the policy on the car. However, getting a fair price for the damage is often a challenge, as an insurance company loses money when it has to pay out following an accident.

How much do personal injury attorneys take?

Most personal injury attorneys take a cut of one-third of the settlement amount, so it has to be a high amount to make it worthwhile to hire an attorney. If you're negotiating a settlement, use these tips to increase your chances of a positive outcome.

What happens if the cost of repair is less than the threshold?

If the cost of repair is less than the threshold, then the insurance company cannot declare a total loss and must pay for repairs. The threshold ranges from 100% of the car's value down to 50% in different states. If there is no threshold set by law, then the insurer will total the car if the cost of repair plus the salvage value is greater ...

What happens if my car is totaled?

If they deem your car to be totaled, they will offer you a sum of money based on what they believe the car was worth prior to the collision.

How to get an appraisal on a car?

Your insurance company may or may not have had the vehicle appraised in person. Re-read your insurance policy, or ask if your policy guarantees you the right to an independent appraisal. The insurance company will either hire an appraiser inspect your vehicle, or they may simply offer you more money to settle the claim and avoid the trouble of hiring an appraiser. The adjuster may also want to avoid the possibility that the new appraisal will be substantially higher than the initial valuation.

What happens if there is no threshold for car insurance?

If there is no threshold set by law, then the insurer will total the car if the cost of repair plus the salvage value is greater than the value of the vehicle before the collision. ...

How to dispute a car insurance claim?

If your insurance company undervalued your car when they wrote it off as a total loss, you can dispute their decision by proving its actual value and showing that it was well-maintained. For an accurate value of your car, go to the Kelley Blue Book website to calculate your car’s value depending on its condition and your geographical location. Additionally, gather records like receipts for repairs and upgrades and documents you received from the previous owner. Use this information, along with the average value of several comparable cars in your area, to come up with what you believe is your car’s true value. Finally, submit your calculations along with the supporting documents to your insurance company to have it reviewed by their adjuster. For more advice from our Legal co-author, including how to ask your insurance company for an independent appraisal, keep reading.

What happens if you are in an accident?

If you have been in an auto accident, your insurance company will compare the cost of repairs to the value of your vehicle. If the cost of repair is close to or more than the value, your insurer will declare your vehicle a total loss (or "totaled") and compensate you for the value of your vehicle rather than the cost of repairs.

How to get a copy of my car insurance report?

The insurance company's decision to total your car and offer you a certain sum is based on a written report. Ask the representative to mail or email you a copy of the report. Then review the report for any inaccuracies or missing information.