- A debt collection agency may contact you with a settlement offer.

- You can contact the debt collection agency in writing and offer a settlement figure. Generally, you should start the negotiation by offering approximately 25 percent of the debt.

- You can make a counter offer if the agency's settlement offer is too high or it rejects your offer. The counter offer is an alternative offer. ...

- Accept the terms of the agreement in writing.

Full Answer

How to negotiate with collection agencies?

Steps Download Article

- Validate the debt collection agency claims. You should send the debt collection agency a letter requesting that it send you proof you owe the debt.

- Check the statute of limitations. Each state has a statute of limitations on how long a creditor has to collect on a debt.

- Know the method of payment. ...

- Know how much money to pay. ...

What is the best collection agency?

- Atradius Collection

- Summit Account Resolution

- PRA Group

- The Kaplan Group

- Rocket Receivables

- Rozlin Financial Group

- Encore Capital Group

- ACA International

- Consumers Financial Protection Bureau

- National Consumer Law Center

How much do collection agencies charge?

Most debt collection companies will charge a 20% to 25% commission of the debt collected. An agency may charge up to 50% commissions if the debt is older or more difficult to collect. If your invoice letters and calls are going unanswered then it might be time to hire a professional debt collection agency.

Do collection agencies negotiate?

Some debt collectors will agree to negotiate with you to score at least a partial repayment instead of nothing. Debtors may be able to negotiate an alternate repayment plan or repay a lump sum,...

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Can you negotiate a settlement with a collection agency?

Occasionally, when a debt goes to collections you may be able to negotiate with the collector to accept a smaller amount than what you originally owed. An agent may decide it's worthwhile to accept partial payment now rather than go through a prolonged collection process.

How do I write a settlement letter to a collection agency?

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

How do I ask for a settlement in collections?

To get ready to negotiate a settlement or repayment agreement with a debt collector, consider this three-step approach:Learn about the debt. ... Plan for making a realistic repayment or settlement proposal. ... Negotiate with the debt collector using your proposed repayment plan.

Will debt collectors settle for half?

Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

How do you draft a settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How much should I offer as a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

What should you not say to debt collectors?

9 Things You Should (And Shouldn't) Say to a Debt CollectorDo — Ask to see the collector's credentials. ... Don't — Volunteer information. ... Do — Make a preemptive offer. ... Don't — Make your bank account accessible. ... Maybe — Ask for a payment-for-deletion deal. ... Do — Explain your predicament. ... Don't — Provide ammunition.More items...

Is it worth it to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

Can you dispute a debt if it was sold to a collection agency?

Can you dispute a debt if it was sold to a collection agency? Your rights are the same as if you were dealing with the original creditor. If you don't believe you should pay the debt, for example, if a debt is statute barred or prescribed, then you can dispute the debt.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Was this answer helpful to you?

Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

What happens if the statute of limitations is passed?

If the statute of limitations has passed, then your defense to the lawsuit could stop the creditor or debt collector from obtaining a judgment. You may want to find an attorney in your state to ask about the statute of limitations on your debt. Low income consumers may qualify for free legal help.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

What is CFPB sample letter?

The CFPB has prepared sample letters that you can use to respond to a debt collector who is trying to collect a debt. The letters include tips on how to use them. The sample letters may help you to get information, set limits or stop any further communication, or exercise some of your rights.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

How does a credit bureau agent work?

The agent works on commission and gets a portion of whatever you pay. The best outcome is to get this debt off your back by paying a lump sum and getting a receipt and a commitment from the agency to update the status of your account on your credit report to reflect payment. Here’s how to do it.

What to do if you get a no?

If you get a “no,” ask to speak to a supervisor. The supervisor may say no also, or make a counter-offer. Try to figure out the amount he or she really wants. For example, if the supervisor offers to waive two months’ interest if you pay the principal that’s due on a loan, perhaps the agency would actually waive three or four months of interest. Try making a counter-offer.

How does a collection agent work?

The collection agent is incentivized to get you to pay as much money as possible with the least amount of effort on their part. The agent works on commission and gets a portion of whatever you pay.

Why do collections agencies settle?

Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don’t have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount.

When do you have to pay taxes on a 1099?

This is because if part of your debt was forgiven, you must pay taxes on it come April 15. The creditor will send you a 1099 form at the end of the year with that information, but it’s good to know now, so you can include this amount of money in your tax planning. To learn more.

What to say when an agent makes an offer?

If the agent makes an offer, for example to waive interest, reduce payments or let you skip a payment, you can respond by saying, “I see,” without committing immediately. The agent may then ask for something in exchange such as paying higher interest. Don’t give up more than you get.

What to do if you don't pay your credit card bill?

If the agency doesn’t do so, send any and all written evidence that you paid the bill to the credit bureau. Be sure that you understand how much, if any, of the debt was forgiven.

What does it mean when a debt is charged off in 2009?

A debt that was charged off in 2009 just means the original creditor followed the Generally Accepted Accounting Principles (GAAP), in order to account for the loss on their books. The account is still out there and collectable. You can be sued on unpaid debts after charge off, so settling is a good idea when it makes sense for you financially. A collection agency making an offer you did not solicit often means there is room to negotiate an even better outcome.

Is it better to settle a debt now or later?

Sometimes it is better to make every effort to settle a debt now, while there is an offer on the table, when the collection agency or debt buyer has a history of using the courts in order to collect. Court enforced collections after a judgment are not ever a good experience, so avoiding that is a key consideration.

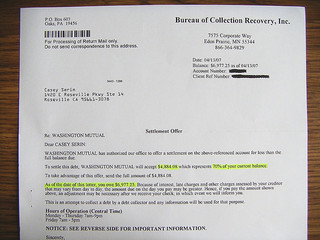

Can you settle a collection account with a collection agency?

Settling with a collection agency when they send you debt settlement offer in the mail. If the offer you receive to settle an old collection account for less than the balance owed is a good one, and the debt is still inside the statute of limitations to sue you, you should definitely consider taking advantage of it.

Can you be sued for unpaid debt?

You can be sued on unpaid debts after charge off, so settling is a good idea when it makes sense for you financially. A collection agency making an offer you did not solicit often means there is room to negotiate an even better outcome. Settling with a collection agency when they send you debt settlement offer in the mail.

Can you negotiate better debt?

Depending on who is collecting, and who the debt is owned by, your ability to get a better deal through negotiations can change.

Is enforced collection a good experience?

Court enforced collections after a judgment are not ever a good experience , so avoiding that is a key consideration. In order to help you better evaluate the offer to settle the debt you received please answer the following questions using the comment box below:

Lawsuits

Unfortunately, when dealing with delinquent debt, either the creditor or collection agency may file a lawsuit if you refuse to pay the money you owe.

Bankruptcy

Filing for bankruptcy is a huge decision that can affect your life for years to come. While there are certainly some situations where it’s a good choice, you should put in a lot of thought and research about the benefits and consequences before making your decision.

Settling Your Debts

Now we know the two worst-case scenarios to avoid: lawsuits and bankruptcies. To do this, you can employ several strategies to settle your debts with a debt collector. Read each one carefully to determine which ones work best for your situation.

Best Type of Debt for Settling

There are two types of debt you can have: secured and unsecured. Secured debt means that personal property is associated with the money you owe, such as a house or a car.

Debt Validation

Your very first step in settling your balance should be to send a debt validation request.

Statute of Limitations

Another basic strategy for settling your debt is checking the statute of limitations in your state. After a certain point, your debt may be too old to even collect on anymore. Because the timeline varies depending on where you live, check specifically for where you live.

How to Negotiate with Debt Collectors

Even if your debt is within the statute of limitations and the debt collector has verified that it does indeed own your debt, you still have several ways to negotiate. Start by offering a lump sum payment of an amount you can afford to pay for the debt.

What is a counteroffer letter?

This template letter makes a counteroffer when an original creditor offers you an initial settlement amount. The goal is to offer a lower amount and negotiate for a removal of the negative information from your credit history.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!