How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

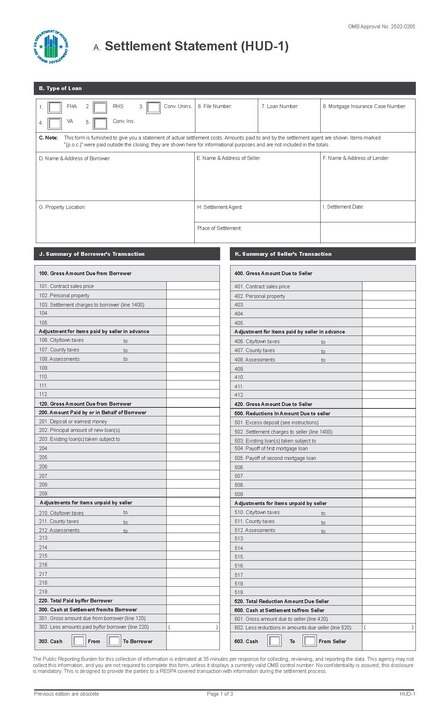

What does a HUD statement look like?

What does a HUD-1 look like? The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller. The breakdown of the pages is as follows: Page One

What is form HUD 1?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is a HUD settlement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception—reverse mortgages.

Who prepares the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is the difference between HUD-1 and settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is a HUD 1A settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is the HUD-1 called now?

The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

How do you read a settlement statement for taxes?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

What is a tax HUD statement?

HUD uses this information to update its records of the mortgagor's real estate taxes, the location (lot and block numbers) of the property, taxes due dates, and penalty dates. The information information can be used to verify the last taxes paid during an audit for insurance benefits.

What is a closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

HUD-1 Sections A, B, C, D, E, F, G, H, and I

Sections A through I are very general. They contain basic information about the type of loan being used to pay for the property, as well as personal information (i.e. addresses, date of transaction, location of the property, etc.).

HUD-1 Section J

Section J on a HUD-1 Settlement Statement contains details and information that pertain primarily to the borrower. The borrower’s costs, credits, and net amount owed for the purchase of the property are carefully outlined in section J. The following sub-sections related to the borrower’s responsibilities are important parts of section J:

HUD-1 Section K

Section K on a HUD-1 Settlement Statement contains details and information that pertain to the seller. It is basically a summary of the seller’s transaction. Here you will find a figure that is the gross amount due to the seller, as well as adjustments that have been made for items like past due taxes or taxes paid in advance.

HUD-1 Section L

Section L on a HUD-1 Settlement Statement contains detailed information about the financing and processing of the sale or refinancing of the home. The following sub-sections related to the settlement charges are important parts of section J:

Good Faith Estimate

One final note. Mortgage lenders or brokers are required to provide borrowers with a Good Faith Estimate as required by RESPA. The Good Faith Estimate is documented on a form that matches the HUD-1 Settlement Statement. The HUD-1 is then required to be provided to the borrower at least one day before closing.

What is HUD Settlement Statement?

The Housing and Urban Development Settlement Statement refers to a document issued when a borrower takes out a loan to purchase real estate. Furthermore, The HUD Settlement Statement lists all charges and credits to the buyer and the seller in a real estate settlement or all ...

Who will list the amount paid by the buyer on the HUD Settlement Statement?

Credits will list the amount paid by the buyer or those paid on behalf of the HUD Settlement Statement buyer:

What are other credit entries to the seller's account?

Other credit entries to the seller’s account may be made for adjustments that have been settled by the seller in advances such as prepaid taxes, homeowner association dues, and expenses of the sort

What is a HUD 1 settlement statement?

This form is to be used as a statement of actual charges and adjustments paid by the borrower and the seller, to be given to the parties in connection with the settlement. The instructions for completion of the HUD–1 are primarily for the benefit of the settlement agents who prepare the statements and need not be transmitted to the parties as an integral part of the HUD–1. There is no objection to the use of the HUD–1 in transactions in which its use is not legally required. Refer to the definitions section of the regulations (12 CFR 1024.2) for specific definitions of many of the terms that are used in these instructions.

Who completes HUD-1?

The settlement agent shall complete the HUD–1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement.

What is line 101 in a mortgage?

Line 101 is for the contract sales price of the property being sold, excluding the price of any items of tangible personal property if Borrower and Seller have agreed to a separate price for such items.

Where to find charges on HUD?

As a general rule, charges that are paid for by the seller must be shown in the seller's column on page 2 of the HUD–1 (unless paid outside closing), and charges that are paid for by the borrower must be shown in the borrower's column (unless paid outside closing). However, in order to promote comparability between the charges on the GFE and the charges on the HUD–1, if a seller pays for a charge that was included on the GFE, the charge should be listed in the borrower's column on page 2 of the HUD–1. That charge should also be offset by listing a credit in that amount to the borrower on lines 204–209 on page 1 of the HUD–1, and by a charge to the seller in lines 506–509 on page 1 of the HUD–1. If a loan originator (other than for no-cost loans), real estate agent, other settlement service provider, or other person pays for a charge that was included on the GFE, the charge should be listed in the borrower's column on page 2 of the HUD–1, with an offsetting credit reported on page 1 of the HUD–1, identifying the party paying the charge.

When to use line 503?

Line 503 is used if the Borrower is assuming or taking title subject to existing liens which are to be deducted from sales price.

What to do if there is no street address?

If there is no street address, a brief legal description or other location of the property should be inserted . In all cases give the zip code of the property. Section H. Fill in name, address, zip code and telephone number of settlement agent, and address and zip code of “place of settlement.”.

Which lines and columns in section J are left blank on the copy of the HUD–1?

Lines and columns in section K which relate to the Seller's transaction may be left blank on the copy of the HUD–1 which will be furnished to the Borrower.