The Body of the Letter

- First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount.

- Second Paragraph. You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

- Final Paragraph. In this paragraph, you’re making the assumption that the creditor is accepting your settlement proposal.

- Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt.

Full Answer

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

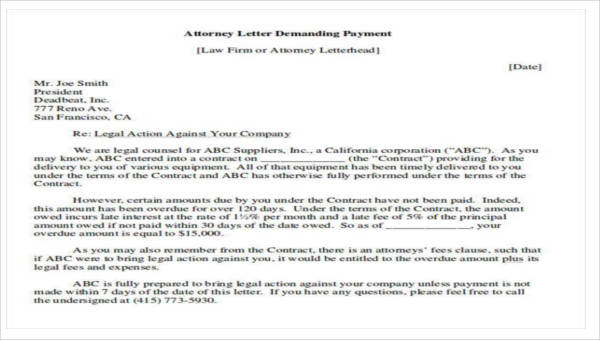

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How to write a simple disagreement letter?

How to Write a Disagreement Letter. by WriteExpress Staff Writers. Consider diffusing the situation by using love and humor. Clearly describe the disagreement and explain what you want done to resolve it. Avoid accusations and threats, particularly in a first letter. (Generally, the intent is to strive to resolve the problem, not simply disagree.)

How to write a good credit dispute letter?

When writing your letter to a credit bureau, please remember these simple guidelines:

- In most cases, it’s unnecessary to mention laws, procedures, court rulings, or threaten lawsuits, etc. ...

- Similarly, remember to be kind. ...

- Include copies of information that supports your claims, but remember, anything you send them can also be used against you. ...

- Make and send copies, but always keep the originals for your records.

How to settle debt on your own?

To settle debt on your own you will need to:

- Learn the steps to settle debt on your own – What to say when negotiating, what to send to creditors in writing, and the overall order of operations.

- Obtain debt settlement letter templates, negotiating letters, counteroffers, settlement acceptance letters and much more. ...

- Understand the pros and cons when settling debt on your own. ...

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

What should a debt settlement letter include?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

How do I write a final payment letter?

Dear Sir/Madam [or “To Whom It May Concern”], I am attaching my final payment for the account referenced above. I request a written confirmation from you that this account is [paid in full/settled in full] according to the terms of our agreement on [insert date of agreement].

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How much should I offer creditors to full settlement?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Is it better to pay a debt in full or settle?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What is a good settlement percentage?

Offer a Lump-Sum Settlement Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

How much is a full and final settlement?

India's new labour reforms directs a company to pay that the full and final settlement to employees within two days of an their last working day. The full and final settlement consist of clearance of dues towards an employee upon their exit from the company.

How do I ask for a final settlement?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How do I write a debt collection letter?

A debt collection letter should include the following information:The amount the debtor owes you.The initial due date of the payment.A new due date for the payment, whether ASAP or longer.Instructions on how to pay the debt.More items...

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

What is a Settlement Demand Letter?

The settlement demand letter is a document written when asking for compensation due to persona injury. This letter is usually addressed to the plaintiff who has already sent you a demand letter asking for payment for the sustained injuries or any other damages suffered. In this settlement demand letter, a counteroffer is usually included to persuade the defendant to settle instead of this matter proceeding to court.

What to write after a personal injury?

After suffering a personal injury, claimants often write a demand letter asking for compensation from the responsible party for their injuries and other damages. If you’re the defendant, the right thing to do would be to write them a settlement demand letter . With this formal letter, you’ll be able to fight against the accusations being placed upon you. If you didn’t know how to write this document, highlighted above is everything you need to know about the settlement demand letter .

What is a summary of legal standards?

A summary of all the appropriate legal standards applicable to the issue.

When did Meadow Selgado get her letter?

Dear Mrs. Meadow Selgado, I got your letter, dated May 10, 2021, where you detailed an account of the vehicle accident you were involved in on March 14, 2021, plus demanded payment summing up to $1500 for injuries suffered due to the incident.

Should you include a deadline for a settlement?

You should include a clear deadline within when a reply should be made. It’s advisable you provide enough time but ensuring it doesn’t exceed a certain duration. Moreover, make sure to observe a tight timeline for your settlement to be considered seriously.

What should be hammered out before writing a settlement agreement?

For example, payment arrangements and logistics should be hammered out before you write the settlement agreement.

How to resolve a claim in a settlement agreement?

Negotiate the scope of the release. You must negotiate the scope of the release in the agreement to determine which claims will be resolved, and whether any future claims are also resolved by this settlement agreement. You can negotiate a provision stating that the settlement agreement applies to all claims arising out of the dispute, whether they are current or not yet realized, or the settlement may resolve just one aspect of a suit or a single claim. This will depend on your needs.

How to settle a dispute between two parties?

1. Decide whether you have the need for a settlement agreement. A settlement agreement is a legally enforceable contract. They can be used in a variety of situations where two parties are in dispute about something and they wish to compromise on how that dispute will be resolved.

What is a settlement agreement?

A settlement agreement is a legally binding contract meant to resolve a dispute between yourself and another party so you do not have to go through the judicial process (or extend the judicial process if you are already in court).

How to settle a dispute with a mediator?

1. Agree on a statement of the dispute. Both parties are likely to have a differing view of the dispute. Before writing your settlement agreement, you must come to an agreement of the factual terms of the dispute. A mediator may be helpful in determining this.

What are the situations where a settlement agreement is used?

Some of the most common situations in which a settlement agreement is utilized include: disputes over damaged property; employment disputes between employers and employees; marriage disputes; and medical malpractice disputes.

What does "unconscionable" mean in a settlement agreement?

A settlement agreement must also not be "unconscionable.". This means that it cannot be illegal, fraudulent, or criminal. For example, you could not agree to settle a lawsuit in exchange for six pounds of cocaine, because the sale of cocaine is illegal in the United States. [11]

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

Why do you need to sign a letter?

Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt. If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

What is the second step in negotiating a debt?

The second step is deciding what terms you’ll agree to. During negotiations, the biggest item to discuss will be how much of the debt you need to pay. But don’t overlook another important term: how the debt will show up on your credit report.

Before you download these debt settlement templates

We offer debt settlement letter template downloads here. But before you download and customize these letters, it’s important to know what you’re getting into, especially if you’re dealing with a collections agency.

Downloadable debt settlement letters

Use this debt settlement letter to offer a creditor less than the amount they claim you owe. In exchange for your payment, this letter asks the creditor to agree to discontinue pursuit of the debt, and to label the debt as “paid in full” on your credit reports.

How to write a debt settlement letter (with examples)

A good debt settlement letter will ask your creditor or debt collector to empathize with you regarding the financial hardships or honest mistakes that resulted in your unpaid debt. Here’s an example debt settlement offer letter with an explanation of how to write each section, what it should say, and why it’s needed.

Debt settlement counter-offer letters

Your creditor or debt collector might not agree to your initial settlement offer but they may be willing to negotiate with you. In this case, you can make a counteroffer to their proposal for a lower amount.

Pros and cons of debt settlement

It’s important to consider the pros and cons before sending a debt settlement letter:

sidebar

Mark Slack is an expert in credit, credit card processing and payment, as well as personal and business loans. He’s managed content for, or contributed credit-related articles for several websites, including LegalTemplates and ResumeGenius. His advice has also been featured in the Chicago Tribune, The Philadelphia Inquirer, and NYDailyNews.

What does "in full settlement" mean?

An offer of this type could say something like, “I am able to make an immediate payment of $4,000 in full settlement of my outstanding credit card debt.” Be sure to use the phrase “in full settlement,” so it is clear that you mean this as a full and final payment and not as part of a payment plan.

How to explain why you need to settle your debt?

Explain your predicament. Avoid getting emotional about the problems in your life, but you should explain your reason for needing to settle your debt. It will help your case if you can refer to a particular cause, such as an accident, divorce, or something else that is not likely to repeat. If you've simply overspent, the company will be less inclined to settle, because they have no assurance that your spending habits will change in the future.

What to do if you owe more on credit card?

If you owe more on a credit card than you can afford to pay, you may wish to negotiate a settlement with the card company. In a settlement you agree to pay some lesser amount, and the company agrees to accept that amount. You both avoid the trouble and expense of going to court, and you can protect your credit rating at the same time.

How to settle credit card debt?

Decide what you can offer to pay. Before trying to settle your credit card debt, you need to decide what you can afford. Review all of your outstanding debts, and compare these to your regular income and any other funds you have available.

How to send a letter to a credit card company?

Address the letter to the proper office. Find out which office of the credit card company handles settlement offers. You can usually discover this by looking up the company online or calling the customer-service number on the back of the card itself. When you reach someone at the company, say that you would like to make an offer to settle your debt, and ask what address you should use for sending a letter.

How long does it take to respond to a letter from a company?

Provide a date for a response. At the end of your letter, ask the company to respond to you by a particular date. You should allow at least two weeks for the response. However, even if you do not receive a reply by that date, do not assume that your offer has been rejected.

How to state account number in letter?

Clearly identify the account that you are discussing. At the top of your letter, below the address, you should state the account number . Especially if you have more than one account with the institution, it is important to state clearly which account you are trying to settle.