How do I read a HUD statement? Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller’s name and the property address.

Full Answer

What is HUD settlement statement?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is a HUD settlement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception—reverse mortgages.

What is the HUD statement?

by Complete Controller. HUD is short for Housing and Urban Development. The Housing and Urban Development Settlement Statement refers to a document issued when a borrower takes out a loan to purchase real estate. Furthermore, The HUD Settlement Statement lists all charges and credits to the buyer and the seller in a real estate settlement or all the mortgage refinance charges.

How do you read a settlement statement for taxes?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What items on HUD-1 Settlement Statement are tax deductible?

The HUD-1 settlement statement for taxes itemizes closing costs, including prepaid items such as real property taxes and mortgage interest. Since those taxes may have been already been paid by the seller for a period after closing, as the buyer you will repay this amount to the seller at closing.

What is tax deductible on a settlement statement?

The seller of a business or investment property may deduct condo fees, fees paid out of escrow (for utility bills, insurance, etc.), fire/casualty insurance premiums, interest, and real estate taxes. They can also include the same selling expense items as the seller of a principal residence.

What does POC on a settlement statement mean?

Amounts paid to and by the settlement agent are shown. Items marked “(p.o.c.)” were paid outside the closing; they are shown here for informational purposes and are not included in the totals.

What is on a HUD statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

Where do I enter my HUD-1 on my taxes?

To figure the HUD-1 tax deductions for purchasers of real estate, you will have to itemize your tax return using 1040, Schedule A. The only HUD-1 tax deductions t are mortgage interest or real estate taxes. You can't deduct any service fees.

Why do I need Settlement Statement for taxes?

The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the expenses assigned to home sellers and buyers on the HUD-1 form might be tax-deductible, and whether they are depends on the specifics of each transaction.

Do I need HUD-1 for taxes?

The Department of Housing and Urban Development formulates a Settlement Statement or HUD-1. This HUD-1 Serves as your final accounting of all of the costs that are associated with your home purchase or sale. This document is required by law and should be given to your tax person the year you close on your home.

What home expenses are tax deductible 2021?

There are certain expenses taxpayers can deduct. They include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent. Taxpayers must meet specific requirements to claim home expenses as a deduction. Even then, the deductible amount of these types of expenses may be limited.

What home improvements are tax deductible 2021?

"You can claim a tax credit for energy-efficient improvements to your home through Dec. 31, 2021, which include energy-efficient windows, doors, skylights, roofs, and insulation," says Washington. Other upgrades include air-source heat pumps, central air conditioning, hot water heaters, and circulating fans.

What closing expenses are tax deductible?

Generally, deductible closing costs are those for interest, certain mortgage points and deductible real estate taxes. Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including: Abstract fees.

Is a HUD statement the same as a closing disclosure?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is a HUD a closing statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Where is prepaid interest noted on the settlement statement?

You can find your prepaid interest charges in Box 10 of your GFE and on Line 901 of your HUD-1 settlement statement.

HUD-1 Sections A, B, C, D, E, F, G, H and I

Sections A through I are very general. They contain basic information about the type of loan being used to pay for the property, as well as personal information (i.e. addresses, date of transaction, location of the property, etc.).

HUD-1 Section J

Section J on a HUD-1 Settlement Statement contains details and information that pertain primarily to the borrower. The borrowers costs, credits, and net amount owed for the purchase of the property are carefully outlined in section J. The following sub-sections related to the borrowers responsibilities are important parts of section J:

HUD-1 Section K

Section K on a HUD-1 Settlement Statement contains details and information that pertain to the seller. It is basically a summary of the sellers transaction. Here you will find a figure that is the gross amount due to the seller, as well as adjustments that have been made for items like past due taxes or taxes paid in advance.

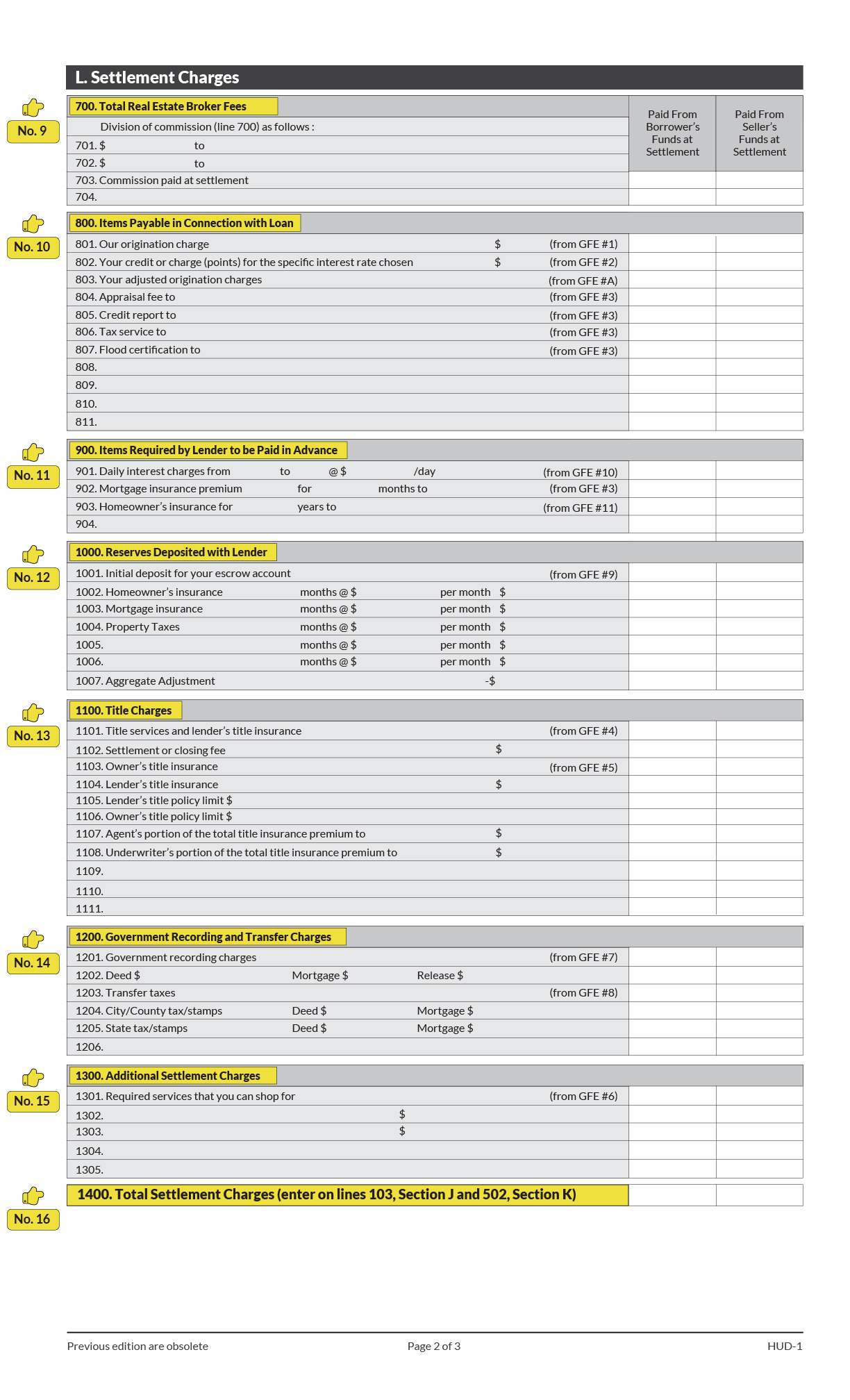

HUD-1 Section L

Section L on a HUD-1 Settlement Statement contains detailed information about the financing and processing of the sale or refinancing of the home. The following sub-sections related to the settlement charges are important parts of section J:

Good Faith Estimate

One final note. Mortgage lenders or brokers are required to provide borrowers with a Good Faith Estimate as required by RESPA. The Good Faith Estimate is documented on a form that matches the HUD-1 Settlement Statement. The HUD-1 is then required to provided to the borrower at lease one day before closing.

What Does the HUD-1 Show?

The HUD-1 is a multi-part form, divided into sections by topic, as described below. It's also divided into the buyer's side and the seller's side. The buyer is referred to as the "borrower" on the form because the HUD-1 was created to explain closings involving lender financing. However, the HUD-1 is sometimes used in cash-only deals when closed by a title insurance company or separate escrow company.

What is on the top of the HUD-1?

The top of the first page of the HUD-1 shows information about the parties, the mortgage, and the closing.

What lines are real estate taxes billed on?

Real property taxes and assessments that are proportionally divided between the borrower and seller as of the closing date are shown on lines 210 through 212 on the borrower's side, and lines 510 through 512 on the sellers side. General real property taxes due, but not yet billed and payable, are credited to the borrower in lines 210 and 211, and debited to the seller in the corresponding 500 series lines.

What line is the face amount of a first purchase money loan?

The face amount of the first purchase money loan is shown on line 202. The amount of a seller's loan assumed by the borrower is shown on line 203. Second purchase money mortgages, or home equity loans that are subordinate to the first purchase money loan, are shown on lines 205 through 209. In states where the seller pays for the owner's title insurance policy, the borrower's credit for the premium for the owner's title insurance policy is shown on line 204, and debited to the seller on Line 507.

What lines are reimbursed for flood insurance?

These reimbursements are shown in lines 106 through 112. Credits that reduce the dollar amount you must bring to the closing are shown in the 200 series.

Can you use HUD-1 to confirm closing charges?

As mentioned, you can use the HUD-1 to confirm that the actual loan and closing charges haven't jumped from the estimated charges you were shown on the Good Faith Estimate (GFE). To make this task easier, the law requires the escrowee to reference line items on the GFE within the corresponding line items on the HUD-1.

What is HUD Settlement Statement?

The Housing and Urban Development Settlement Statement refers to a document issued when a borrower takes out a loan to purchase real estate. Furthermore, The HUD Settlement Statement lists all charges and credits to the buyer and the seller in a real estate settlement or all ...

Who will list the amount paid by the buyer on the HUD Settlement Statement?

Credits will list the amount paid by the buyer or those paid on behalf of the HUD Settlement Statement buyer:

What are other credit entries to the seller's account?

Other credit entries to the seller’s account may be made for adjustments that have been settled by the seller in advances such as prepaid taxes, homeowner association dues, and expenses of the sort

What is a HUD-1?

The HUD-1 is a settlement statement and full of helpful and important information. HUD-1s may be simple and contain small amounts of information, while others may be complicated and jammed pack with data. When buying investment property (buy-and-hold), all HUD-1s have one thing in common, and that is the tax treatment of each line item.

What is the 804. appraisal fee?

804. Appraisal Fee: If required to obtain a loan, the cost is amortized over the life of the loan. If an appraisal is not required, the cost is added to the basis of the property and depreciated over the life of the property.

What is 102 in real estate?

102. Personal Property: The price of any personal property included in the sale. This must be depreciated.

When are loan points deductible?

This is an area for confusion, as loan points are deductible as a current expense when paid in connection with a primary residence.

Is a 1001 escrow account deductible?

1001. Initial Deposit for Your Escrow Account: This amount will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

Is assessment a current expense?

108. Assessments: Deductible as a current expense but only the portion greater than the value found on line 212. If, however, the assessment is specifically labeled as a local improvement district, they must be amortized over the life of the loan.

Is 1002-1004 a current expense?

1002-1004 are deposited with your lender and will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is line 805 on credit report?

The amount would be shown, but it would not be included in the total fees you bring to settlement. Line 805 is used to record the cost of the credit report if it's not included in the origination fee.

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

What is a HUD-1?

The HUD-1 is the financial picture of the real estate closing. It shows all of the money transfers between the buyer and seller, as well as the closing costs, including the escrow and title fees and the costs of the buyer’s loan, if applicable. The HUD-1 is a standardized form that the title company prepares for the closing, as required for all closings involving a federally insured lender under the Real Estate Settlement Procedures Act (“RESPA”). It is important to save your HUD-1 for your tax preparer. You will need it in the year of the purchase, as well as the year the property is sold. The HUD-1 form itself was created by the U.S. Department of Housing and Urban Development (“HUD”) and is updated periodically.

What is section L in a settlement?

Section L contains a long list of settlement charges. Charges shown in the left column are to be paid by the buyer, and charges shown in the right column must be paid by the seller. The settlement charges are grouped into the following line series:

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.