Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is settlement statement same as Closing Disclosure?

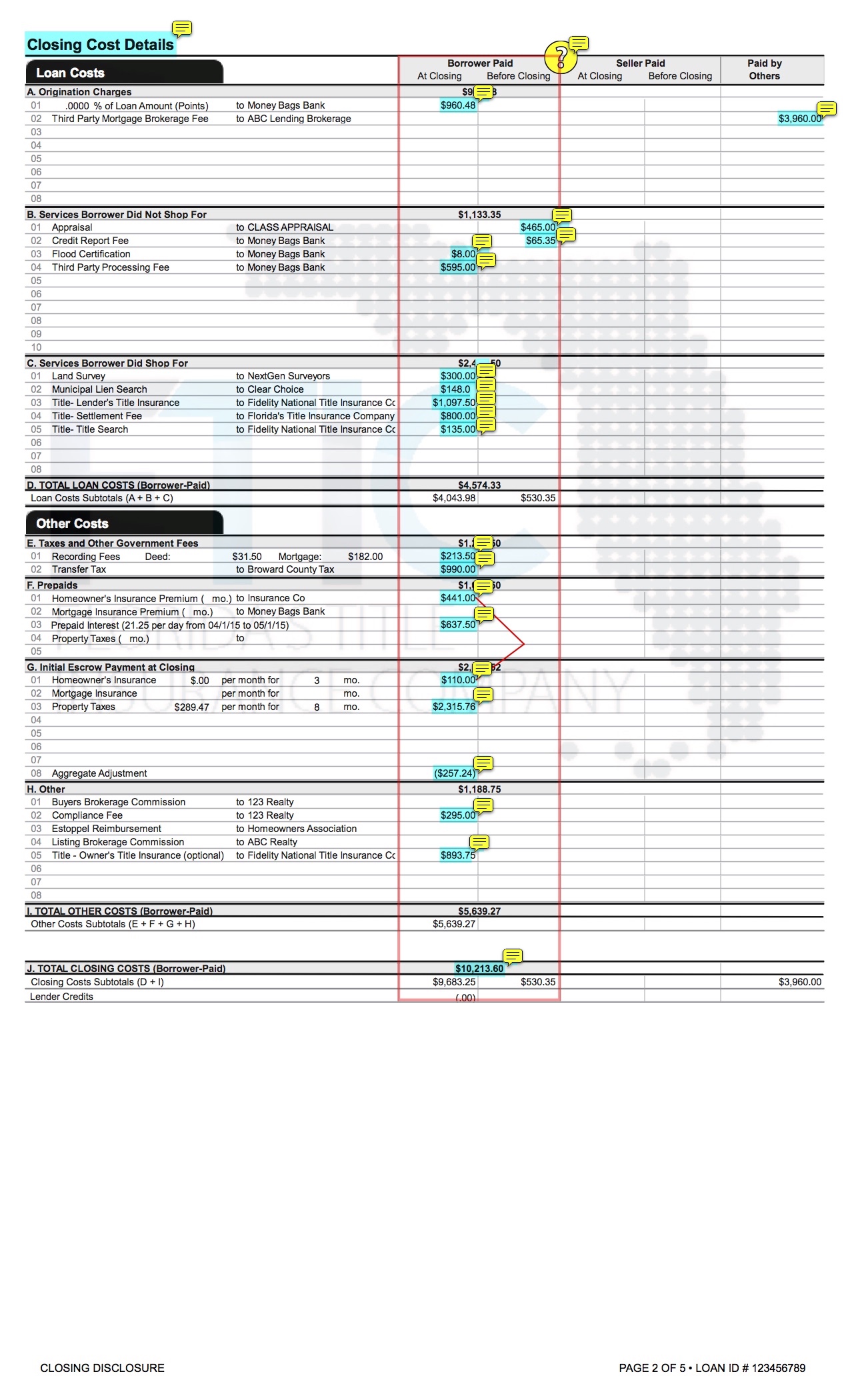

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is the aggregate adjustment on the settlement statement?

The aggregate escrow adjustment appears on Line 1007 of the HUD settlement statement. In this manner, what is the aggregate adjustment on closing disclosure? The term “aggregate adjustment” refers to a calculation the lender uses to make sure the correct amount of money is collected in the escrow account.

How do you read estimated closing statements?

1:3813:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipNow this shows the sale price and a breakdown of the fees. And expenses for both buyer and seller asMoreNow this shows the sale price and a breakdown of the fees. And expenses for both buyer and seller as well as funds needed from the buyer to close and the exact proceeds going to the seller.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

How do you read a borrower's settlement statement?

4:567:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo the first part of that left side is showing you what you owe which is usually your sale priceMoreSo the first part of that left side is showing you what you owe which is usually your sale price plus closing costs plus any pro rated items like hoa dues.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What is a good faith estimate in real estate?

A Good Faith Estimate, also called a GFE, is a form that a lender must give you when you apply for a reverse mortgage. The GFE lists basic information about the terms of the mortgage loan offer. The GFE includes the estimated costs for the mortgage loan.

What does HUD statement mean?

Housing and Urban DevelopmentWhat is the HUD-1 Settlement Statement? HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

Is loan estimate and closing disclosure the same?

The Loan Estimate and Closing Disclosure are two forms that you'll receive during the homebuying process. The Loan Estimate comes at the beginning, after you apply, while the Closing Disclosure comes at the end, before you sign the final paperwork for your mortgage.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

Is settlement the same as closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

Are HUD-1 settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

What does escrow charge?

The escrow or title company charges buyers for settlement charges and escrow costs. These costs are debited from the buyer’s side.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is appraisal fee?

Appraisal Fee to. Paid to the lender or an appraisal company to determine the current value of the property.

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

What is an estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

When will the buyer receive a final settlement statement?

The buyer and seller will receive an updated final settlement statement once the transaction has closed along with the proceeds due to seller or any refund due to buyer.

Why are title and escrow charges grouped together in SF?

Title and escrow charges are grouped together in SF because it’s a title company usually provides escrow services in addition to title insurance. Your two typical costs are your owner’s title insurance policy, and the escrow fee. The cost of the title insurance policy is based on the cost of the home, while the lender’s policy (see buyer loan charges) is based on the size of the loan.

What is the top of a title document?

The top of the document will contain the relevant information for each party, as well as the property location (people have sold the wrong house before, believe it or not) estimated settlement date (no joke) and your escrow officer at the title company. The documents will also both generally start with the same item – the sales (purchase) price, and from there each document diverges to share the relevant information to each party. We begin the the estimate for the buyers, feel free to skip ahead to the seller estimate.

What is the estimated balance due on escrow?

Once the buyer’s deposits and loans have been credited to the escrow, and all the debits added up as well, the estimated balance due from the buyer shows the remaining money needed to close the transaction. The balance due is equal to the remainder of your down payment and all of the closing costs as listed on the estimated settlement statement.

What are the mandates for point of sale?

There are a variety of point of sale mandates and reports that are required by city, county, state and federal laws related to real estate. In this example, payments for the SF water ordinance, state natural hazard disclosure report, city of SF 3R report, and a visual tank inspection (not a technical mandate, often a good idea) are collected from seller and reimbursed/paid to appropriate provider.

Who prepares escrow statements for a real estate transaction in San Francisco?

In San Francisco, title insurance companies typically act as the escrow agent for a residential real estate purchase/sale, and the escrow officer prepares the statement with input from the buyer’s lender (if applicable) and other parties with financial interest in the closing. Estimated settlement statements look pretty similar between escrow/title ...

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

Do you need to review a HUD-1 settlement statement before closing?

If you’re getting ready to close on a mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate or a reverse mortgage, you’ll need to review a HUD-1 settlement statement before you head to the closing table.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

When are prior year taxes due?

Prior year taxes are not due and payable until the next calendar year. Amounts due for any prior year taxes will be collected from the seller. Typically, any closings after June 15th should already have their taxes for the prior year paid.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is a RESPA?

The Real Estate Settlement Procedures Act (RESPA) govern s the formulation of both closing disclosures and HUD-1 statements for the mortgage lending market. RESPA has been revised and updated throughout history to help manage mortgage lending disclosures and protect borrowers. RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure.

How many pages are required for HUD-1?

The HUD-1 is a three-page form generally required to be provided to a borrower one day before closing. The mortgage closing disclosure is a five-page form generally required to be provided to a borrower three days before closing.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Two Separate Views of The Same Transaction

Buyer Estimated Settlement Statement – Highlighted by Closing Cost Type

- An easy way to understand your closing costs is to group them: 1. lender loan charges (lavender) 2. tax and insurance pre-payments (purple) 3. title and escrow charges (light green and green) 4. other costs, fees, or credits (pink) It’s an overwhelming document, so let’s break it down with each section highlighted for ease of understanding.

Buyer Loan Charges

- Money isn’t cheap! All of the charges associated with the new loan will be summarized in this section. For a buyer with one loan, this is a pretty typical set of charges. If you are paying any points for your loan, that fee will be included in this section. This buyer did not choose an impound account (the bank will pay their insurance and taxes on their behalf), which is typical. San Franci…

Taxes and Insurance

- Regardless of the number of days in the month the deal closes, escrow companies prorate costs based on a 30-day month. Property taxes and HOA fees in condos are the two items most likely to be prorated on a buyer’s settlement statement. The buyer and seller will either be credited or debited for property taxes based on when the closing falls in the tax year.

Title and Escrow Charges

- Title and escrow charges are grouped together in SF because it’s a title company usually provides escrow services in addition to title insurance. Your two typical costs are your owner’s title insurance policy, and the escrow fee. The cost of the title insurance policy is based on the cost of the home, while the lender’s policy (see buyer loan charges) is based on the size of the loan. Th…

Other Fees, Costs, and Credits

- Finally, we’ve got everything else. From estimates to recording fees, charges from building or community homeowner’s associations (HOAs), to miscellaneous charges, insurance policies, home warranties, and anything else that doesn’t fit elsewhere.

Balance Due from Buyer

- Once the buyer’s deposits and loans have been credited to the escrow, and all the debits added up as well, the estimated balance due from the buyer shows the remaining money needed to close the transaction. The balance due is equal to the remainder of your down payment and all of the closing costs as listed on the estimated settlement statement.

Real Estate Commissions

- Regardless of the agency relationship (buyer/seller/dual agency), sellers typically pay the entire real estate commission for both the buyer’s real estate brokerage and the seller’s real estate brokerage.

Other Seller Charges

- Sellers typically have a few miscellaneous charges for reporting, signing, and other admin/compliance fees that are usually no more than several hundred dollars.

It’S Just An Estimate!

- Finally, it is important to remember that all of the charges in the closing statement are estimates! Things often adjust based upon the actual closing date (namely, tax prorations and accrued interest). Escrow agents can close a transaction with excess funds, but they cannot close a transaction that does not have enough money in escrow to cover all costs, so escrow agents wil…