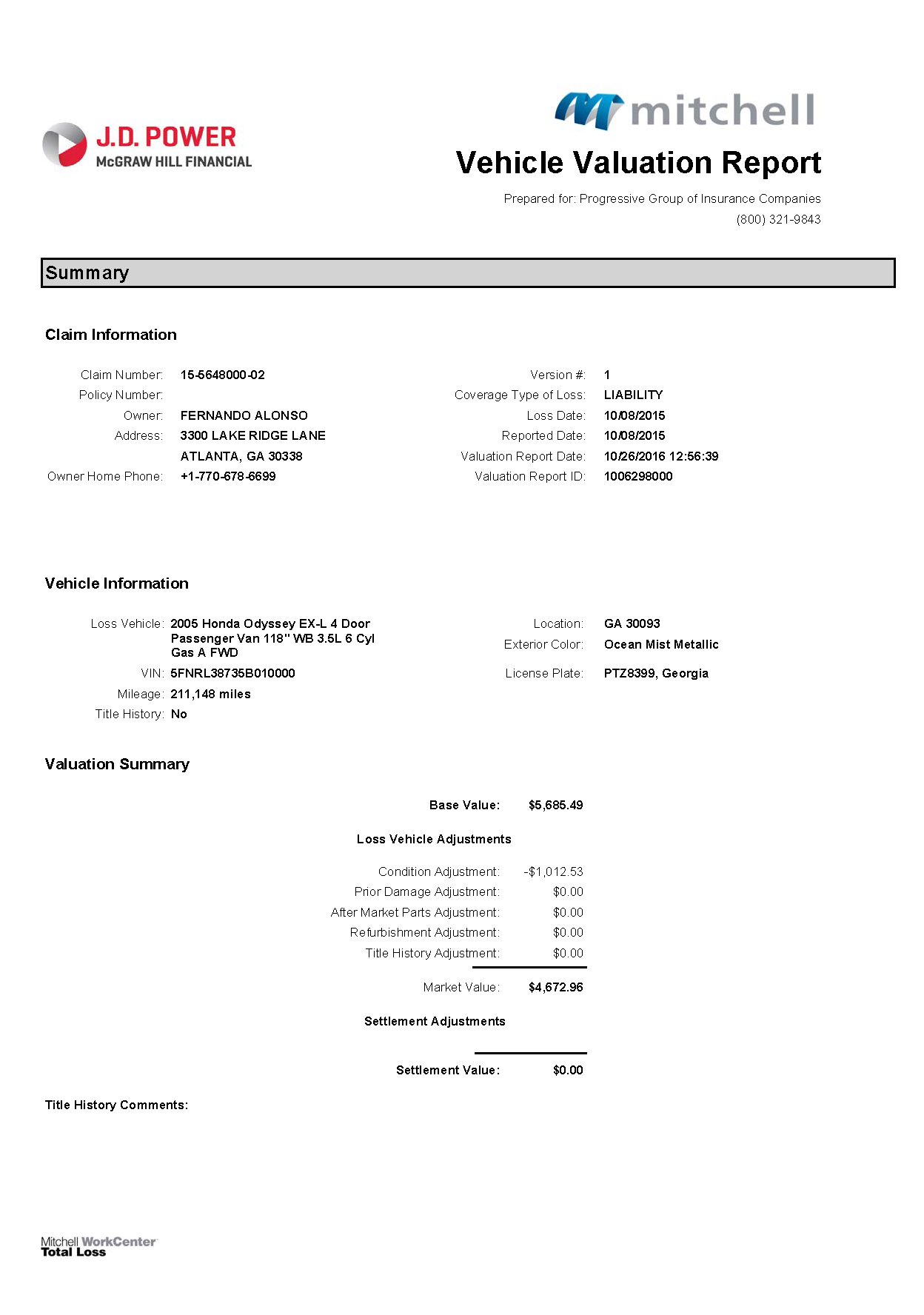

Reading an insurance claim settlement is easy as 1-2-3 using this basic formula:

- Recoverable Cost Value (RCV)

- – Depreciation

- = Actual Cash Value (ACV)

What is Claim Settlement Ratio in life insurance?

Simply explained, claim settlement refers to the process whereby a life insurance company pays out the sum assured and other benefits as laid out in the policy document. Every company uses a metric called claim settlement ratio to record the percentage of these claims it has settled or paid during a financial year from the total claims received.

What is a claim summary?

Please click here to view one of our YouTube videos. A claim summary is an insurance adjuster’s estimate of the expected cost to repair your damages. In this blog I will only address a property claim, not automobile claims.

How does the first claim work?

The first one (net claim) is just to get the work started. Once an invoice for work completed is submitted to the insurance company, the rest of the funds are released. Think of it as their own insurance that the money will be spent on the repairs and not a family vacation.

What is a claim settlement?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury. Tools exist that allow you to automate the entire process.

How do you read an insurance claim form?

How to Read Your Insurance ClaimClaim Summary.Line Item 1: This is your line item total for materials and labor. ... Line Item 2: Line number two is the material sales tax. ... Line Item 3: Number three is the important number that we want you to pay close attention to.More items...•

How is an insurance claim settled?

In many cases, they will file the claim for you. The other driver's insurance company should contact you to initiate the claims process. At some point, after it has gathered information about the accident, vehicle damage, and any injuries, the company will offer a settlement amount to cover your claim.

How do you read an insurance adjuster?

0:226:11How to Read an Insurance Roof Claim Summary - YouTubeYouTubeStart of suggested clipEnd of suggested clipIf you see right there point out through the priceless. And that shows right there for the pricingMoreIf you see right there point out through the priceless. And that shows right there for the pricing to be generated for the Xactimate. Estimate that's what they use for their software.

How do insurance payouts work?

Insurance companies use your beneficiaries' ages when they file the claim and the amount of the death benefit to determine the payment amount. The amount of the death benefit remaining (if any) when your beneficiary passes away goes back to the insurance company unless they opt to receive an annuity for a set period.

What are the 4 steps in settlement of an insurance claim?

Negotiating a Settlement With an Insurance Company. ... Step 1: Gather Information Needed For Your Claim. ... Step 2: File Your Personal Injury Claim. ... Step 3: Outline Your Damages and Demand Compensation. ... Step 4: Review Insurance Company's First Settlement Offer. ... Step 5: Make a Counteroffer.More items...

What are the stages of a claim?

However, in addition to being somewhat complicated, an injury claim can take some time to complete as it potentially consists of three main processing stages: filing, fact-finding and response, and trial.

Can I keep extra money from insurance claim?

Homeowners can keep the leftover money if there is nothing in writing saying that they must return the unused claim money. Make sure to be truthful when explaining your situation to the insurance company for the claim payout, as lying is considered insurance fraud for which the consequences are harsh.

What is the net claim amount?

The Net Claim is the amount paid to you, minus the deductible. You are responsible for meeting your home insurance deductible prior to any claims being paid out.

What happens if you don't use insurance money for repairs?

You must keep your home up to your home insurance company's standards. If you don't make required repairs, you could have future claims denied and even lose your policy altogether. If you have a mortgage on your home, your claims checks may be payable to both you and your mortgage lender.

How is insurance payout calculated?

Key Takeaways. A car insurance payout is determined by the value of the vehicle you were driving before the accident that wrecked it. A standard insurance policy does not pay you the cost of an equivalent new model. Nor does it guarantee a payment equal to the amount you may still owe on the car.

Do insurance companies send you check?

Car insurance companies may send a check as a tactic to avoid paying higher compensation for your injuries. Oftentimes, when you cash a check from an insurance company, you are waiving your right to any future claims or compensation.

What is claim settlement process?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury. Tools exist that allow you to automate the entire process. Claim Genius too has a wide array of AI-based tech for automating the claims settlement process.

How long do insurance claims take to pay out?

As a very rough guide, a claim may take 6 to 12 months if liability is accepted by the treatment or care provider immediately. If liability is disputed, it could take 12 to 18 months for more complicated claims. Very complex cases can take significantly longer.

What are the methods of claim settlement?

They are as follows:1) Cashless facility: Under this method, the insurer settles your hospitalization bills directly with the hospital. ... 2) Reimbursement: You pay for hospitalization expenses upfront and get reimbursed by the insurer on discharge from hospital and submission of necessary documents. ... You May Also Watch:More items...•

What happens when someone makes a claim on your insurance?

They'll speak to any third party reps such as insurers or solicitors and check over the documents from both parties – as long as the statements match up they will then pay out the claim as soon as the bill is received.

What happens when you make an insurance claim?

Once your insurance company receives your claim, they will send out an adjuster to look at the property damage. They will determine if you will get funds (a settlement) to make repairs or reimburse you for a total loss.

How to figure out how much insurance to pay for roofing?

A quick rule of thumb for determining exactly how much your insurance company will be paying you in total, is to add together the amount of your first check (A.C.V) to any recoverable depreciation amount being held back. Those 2 amounts added together is how much you will be getting in total from the insurance company after the work is complete. Compare that amount to your written roofing estimates to ensure you have been paid enough. If the roofing company was honest in their estimate and was not just trying to get all your insurance money, then you should have been paid enough to cover their estimate.

What is deductible insurance?

DEDUCTIBLE: The Deductible is your insurance companies way of saying “Hey, wait a minute Mr/Mrs. Homeowner, out of the R.C.V. amount that we owe you….,you are responsible for the deductible amount, so we are backing the deductible amount out of the R.C.V. money and we are keeping it.”

Is insurance money your contractor's money?

Long story short, your insurance money is your insurance money. Not your contractors. Contractors are banking on the fact that you do not understand your claim and are hoping you will just let them do everything for you. Do not be fooled. Claims area easy. They are just written confusing.

What is claim settlement?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury.

Why do you need to be well-versed with the Claims Settlement Process?

If you’re an insurance carrier, you know clients who’ve been in vehicle accidents will be rattled after the experience. The last thing they need is delays from their insurer. But as we’ve all experienced, the claims settlement process can sometimes become a drag.

What happens at the accident site after an accident?

At the accident site, immediately after the accident has taken place, the victim contacts the insurer directly or through the insurance broker agency.

What is an adjuster in insurance?

Adjusters handle the many groups that branch out to study medical reports, investigate the accident scene, talk to witnesses if present, assess the vehicle damage, and start off the process of vehicle repairs and medical recuperations (known in the claims settlement process as ‘indemnification’).

What is the criteria for determining fault?

Typically, there are two broad criteria for determining fault. If both parties share an equal blame (50-50) or nobody was to blame, then the insurance agencies of both parties pay their respective clients. If one party was more at fault (say 60-40), then the policy pay-out is in proportion, with the larger share shouldered by the driver more at fault.

What happens if you get injured by just one driver?

If the accident was caused wholly by just one driver, the claim settlement becomes much simpler, as that driver’s insurance agency pays in full.

How many stages are there in a claim settlement process?

These were the 4 primary stages of a typical claim settlement process. Depending on the insurance agency, there maybe additional intermediate steps.

What is claim summary?

A Claim Summary is Basically a Collection of Spreadsheets. 1. The claim summary is sectioned off into separate spreadsheets; generally there is one for the roof, the front of the house, the left side of the house, the rear of the house and the right side of the house and the interior. All of these areas are classified as the dwelling.

What is another section on a claim summary?

2. Another section on the claim summary may be listed as an appurt, other structure or detached structure.

What is net claim?

The net claim reflects the amount of the check given to you to get the work started. You can assume that the recoverable depreciation will be paid later, but the deductible is never paid by the insurance company. It is the predetermined amount that is deducted and the homeowner has to pay out of pocket.

How long is a hail claim?

The average length for a hail claim is 5-15 pages. Most claim summaries are formatted pretty similarly, because nearly all of the insurance companies now use Xactimate to generate their estimates. Each company has their own twist on how it is presented, but the overall per unit pricing is fairly consistent.

Is integrity roofing an insurance adjuster?

Integrity Roofing and Painting, LLC is an insurance restoration contractor. As one of the premier roofers Colorado Springs, CO has to offer, we have a former insurance adjuster on our team. We don’t provide insurance adjusting services for that is the responsibility of the insurance company. We are more than willing to share our insurance restoration experience with you. It is illegal for a contractor to act as an insurance adjuster. The information that has been provided is not legal advice, nor are we acting as insurance experts, we are only sharing our experience in the insurance restoration industry. Please contact Integrity Roofing and Painting, LLC for your roofing in Denver or Colorado Springs, Colorado.

Does the loss statement cover repairs?

The biggest concern I hear from clients is that the check they received with the loss statement, or the claim summary, “is not enough to cover the repairs.” The insurance companies attempt to explain this in a paragraph usually found on the second or third page of the claim. The payment for the repairs is broken up into two payments. The first one (net claim) is just to get the work started. Once an invoice for work completed is submitted to the insurance company, the rest of the funds are released. Think of it as their own insurance that the money will be spent on the repairs and not a family vacation. In the end, everything ends up being paid for except the deductible.

Does Xactimate have a separate summary?

Some insurance companies use a version of Xactimate that creates separate Summaries for the Dwelling (the main house), the Other Structures, the Contents and in some cases Loss of Use. If there are code upgrades, there could be a separate summary for just the code upgrades.

Breaking Down a Roof Claim Summary

On a roof insurance claim, there is a headline across the top that might read like this, “Summary for Coverage A – Dwelling – 35 Windstorm and Hail”. This headline marks the start of the financial summary of the claimed damages.

Understanding Your Initial Estimate

We had a family contact our team and ask for one of our members to come out to their home and assess their roof after a severe hail storm had damaged their property. They had already had their insurance company out and the adjuster had an estimate.

How to Get the Most Out of Your Roof Insurance Claim

One of the best ways to get the most out of your roof insurance claim is to hire a quality roofing contractor who will help guide you through this process.

How are insurance claims disclosed?

Insurance claims received are disclosed properly in the financial statement. A journal entry is posted for the amounts received from insurance companies by crediting the actual figures of lost assets against which we claimed insurance.

What happens if a claim is valid and comes under the insurance terms?

If the loss is valid and comes under the insurance terms, then a payment is made to the aggrieved party for the loss.

How to account for Insurance proceeds?

Insurance providers analyze the amount of loss and then compensate companies according to their policies.

What is insurance policy?

An insurance policy is purchased to cover the risk on the assets and operations of the business. In case of a loss, an insurance claim is filed. In other words, insurance claims are received when a policyholder faces an unfortunate circumstance and requests the insurance company to compensate for his loss provided that the loss is covered under the policy of the Insurance Company.

What is the first debit recorded in an insurance company?

The first debit recorded is receivable, which will be removed from the business books once cash is received from the insurance company.

What happens to insurance proceeds when they are received?

Once insurance proceeds are received, it’s removed from the books, and cash is shown in its place (that’s like a normal accounting operation).

Why do companies need insurance?

Companies get insurance cover on the property, plant, and equipment, It’s because these assets carry higher worth, and businesses cannot survive if something goes wrong with these assets.

Why Do You Need to Be Well-Versed with The Claims Settlement Process?

The 4 Stages of The Claims Settlement Process

- <picture class="aligncenter wp-image-12897 size-full" title="The Claims Settlement Process - St…

1. At the accident site, immediately after the accident has taken place, the victim contacts the insurer directly or through the insurance broker agency.Your job as a carrier at this stage is to take down all the facts as an unbiased third party. A carrier takes detailed notes, either in a note…

Can We Help You?

- These were the 4 primary stages of a typical claim settlement process. Depending on the insurance agency, there maybe additional intermediate steps. But keep these broad-level steps in mind to have an overview of how the claims settlement is progressing. Claim Genius has tools and mobile-based apps that can fast-track the claims settlement process. Our AI can speed up d…