How to read the top of the settlement statement

- Debits vs. credits on the closing statement. The settlement statement is arranged in the same way as a traditional...

- “Financial”. The first section of the form, called “Financial,” contains information on the price your buyer is paying,...

- “Prorations/Adjustments”. You may find out how much you could owe in property taxes...

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is settlement statement same as Closing Disclosure?

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

How to generate a daily settlement report?

Settlement occurs for all batches submitted within the 24-hour "settlement day". For example, for a particular processor, all transactions from 9 PM Monday night through 9 PM Tuesday night occur during that "day". Generating a Settlement Report. To access the Settlement Report page, navigate to Reports-> Standard-> Settlement.

What is a HUD-1 Settlement Statement?

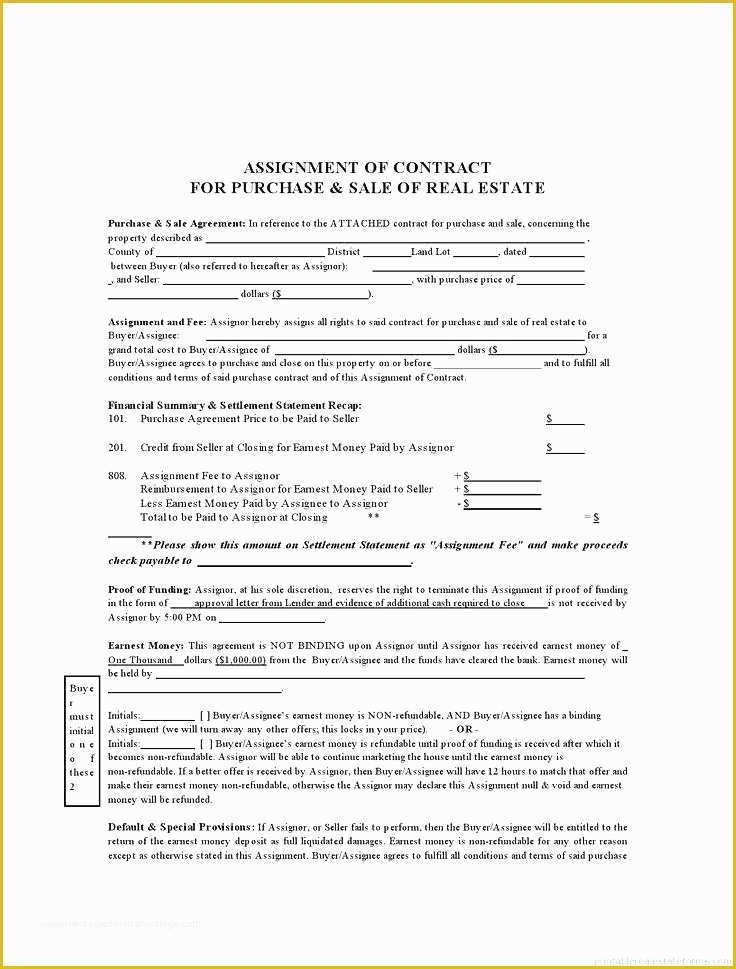

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

How do you read a home settlement statement?

4:3813:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyerMoreSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyer and seller. And then all of the numbers are added and subtracted at the very bottom.

What is the purpose of a settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What is final settlement statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What comes after closing disclosure?

What happens after the closing disclosure? Three business days after you receive your closing disclosure, you will use a cashier's check or wire transfer to send the settlement company any money you're required to bring to the closing table, such as your down payment and closing costs.

What is debit and credit in settlement statement?

A debit is money you owe, and a credit is money coming to you. The debit section highlights items that are part of the total dollar amount owed at closing. This includes the amount due for closing and title costs, which are generally split between the buyer and the seller- who pays how much is generally negotiable.

What is the purpose of the closing statement?

The purpose of a closing statement is to summarize the transaction. The sales contract negotiated between the seller and buyer controls all aspects of the closing. Virtually every item in a closing is subject to negotiation and all costs and charges will be allocated on the basis of that negotiation.

Is purchase price a debit to the buyer?

2:344:45Real Estate Exam Prep: Debits vs Credits | Key Topics - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd buyers receive a credit proration insurance proration x' at the time of closing. Sellers. MayMoreAnd buyers receive a credit proration insurance proration x' at the time of closing. Sellers. May find they'll get money back for prepaid insurance.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

What is a settlement statement quizlet?

Uniform Settlement Statement. Under RESPA, a lender must use HUD's Form 1 Uniform Settlement Statement to disclose settlement costs to the buyer. This form covers all costs that the buyer will have to pay at closing, whether to the lender or to other parties.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What form contains a settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

Who pays for personal property?

Personal Property. These costs are paid by the buyer provided they want to purchase appliances or any furnishings along with the property. The amount is credited to the seller’s account and debited from the buyer’s.

What are points in a mortgage?

Points. Mortgage points are given to the lender for which they reduce the interest rate for the buyers. This amount is paid upfront during closing.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is appraisal fee?

Appraisal Fee to. Paid to the lender or an appraisal company to determine the current value of the property.

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is a RESPA?

The Real Estate Settlement Procedures Act (RESPA) govern s the formulation of both closing disclosures and HUD-1 statements for the mortgage lending market. RESPA has been revised and updated throughout history to help manage mortgage lending disclosures and protect borrowers. RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure.

How many pages are required for HUD-1?

The HUD-1 is a three-page form generally required to be provided to a borrower one day before closing. The mortgage closing disclosure is a five-page form generally required to be provided to a borrower three days before closing.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

What is a mortgage payoff?

Mortgage Payoff. The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. Title Insurance (Owner’s Policy) Typically paid for by the seller, however the contract gives the option for either buyer or seller to pay.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

Does lending tree include all lenders?

LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

What is a settlement agreement?

A property settlement agreement is that essential piece of document which fundamentally is a written agreement between two parties involved in the division of a property. For example, a married couple who looks forward in dividing their property into two legal entities has to abide by the policies mentioned there in a property settlement agreement.

What is a marital property settlement agreement?

Marital Property Settlement Agreement. A Marital Property Settlement Agreement is a type of contract that often exists in uncontested divorces. The same agreement divide the assets, property and the debts of a marriage. Fortunately, it spells out the valid terms and all the rights for both the parties.

What is a settlement agreement for a divorcing party?

If the divorcing parties agree to how they decide to dive their assets, a formal property settlement agreement is prepared in this case to suffice the purpose. The settlement constitutes a list of details and all the individuals who will benefit from the same.

Is a property settlement agreement a real estate deal?

Property settlement agreement exists since the time trade in real estate started up . Today, Real Estate is one of the most prominent industry in a lot of countries where the same promote the overall economic growth of the country and opens newer employment possibilities. In that case, there has been a rise in individual investors looking to trade in real estate properties every now and then.

Is a property settlement a prenuptial agreement?

Property settlement agreements typically come alive before marriage as a prenuptial document or even during a marriage as a post-nuptial agreement. Some other terms for Property Settlement include Property Agreement, Separation Agreement however all refer and surrounds around the same idea.