Select Federal Taxes>Deductions & Credits. Enter interest, points, mortgage insurance and property taxes in the Your Home section. Items on HUD settlement statement that may be deductible:

Full Answer

How do I record a HUD settlement statement?

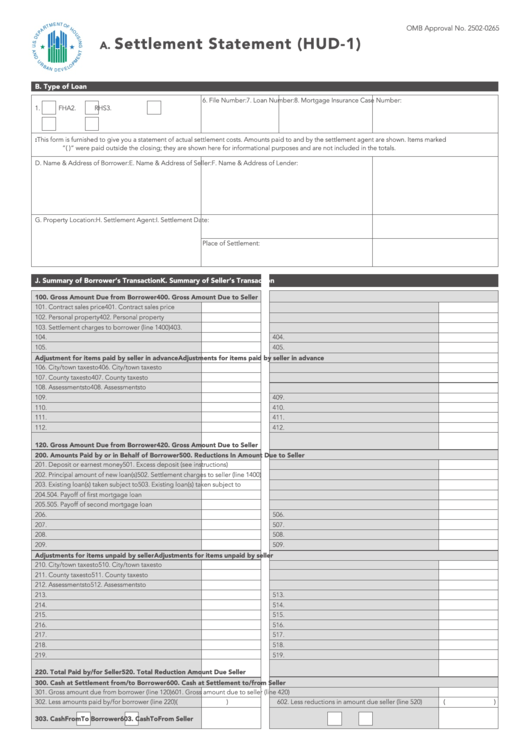

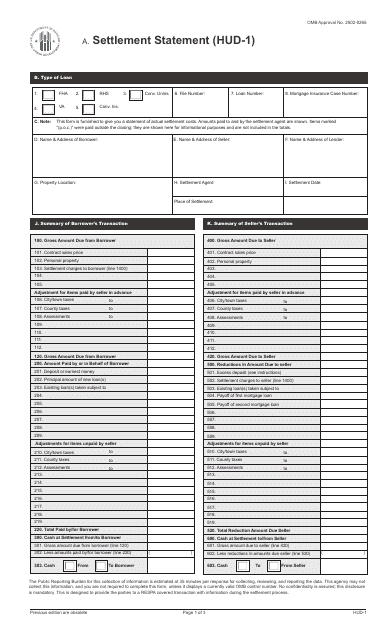

To record a HUD Settlement Statement, it is essential to understand what this statement entails. The HUD Settlement Statement consists of vital financial and personal information of the parties involved, such as the buyer and seller, property details, settlement agent details, and the figures (numerical data).

How are tax credits entered in a HUD settlement statement?

Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement Lastly, any additional credits to the buyer will be entered here, be it from any source, if not from the seller. Now that both parties’ debits and credits have been identified in the HUD Settlement Statement, these will be entered.

Do I need A HUD-1 Settlement Statement for a mortgage?

However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate, or a reverse mortgage, you may be asked to review a HUD-1 settlement statement before heading to the closing table.

What is a HUD-1 form used for in real estate?

The Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federal mortgage loans. 2 It was formerly used for nearly all transactions that involved a buyer and seller, including cash closings .

How do I record settlement charges?

How to Record a HUD Settlement StatementCredits – will list the gross amount owed to the seller at the time of settlement closing:Debits – will list the charges of the seller at the time of settlement closing:Debits – will list the gross amount owed by the buyer at the time of statement closing:More items...•

How do I enter a HUD statement in Quickbooks?

4:0022:25How to Use QuickBooks Online to Record a HUD 1 Final Settlement ...YouTubeStart of suggested clipEnd of suggested clipSo let's go to the quick create plus sign. And we'll go over to journal entry. And we're going toMoreSo let's go to the quick create plus sign. And we'll go over to journal entry. And we're going to enter a bunch of debits and credits. So the purchase price on the surface looks like 43,000.

What are some of the transactions recorded on the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Is a HUD statement the same as a settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

How do I record settlement proceeds in QuickBooks?

First, we have to record the exact amount you've received from your client and apply it to the invoice.Open the affected invoice and click Receive payment.Enter the payment date and where to deposit the amount.Mark the invoice and enter the exact amount you've received ($3k).Click Save and close.

How do I record the sale of a building in QuickBooks?

1:259:16Recording Sale Of House For Landlords And Property OwnersYouTubeStart of suggested clipEnd of suggested clipSo very simple in the chart of accounts list chart of accounts.MoreSo very simple in the chart of accounts list chart of accounts.

Is a HUD-1 the same as a closing statement?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

What does POC on a settlement statement mean?

Amounts paid to and by the settlement agent are shown. Items marked “(p.o.c.)” were paid outside the closing; they are shown here for informational purposes and are not included in the totals.

What is a final HUD statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Are HUD-1 Settlement Statements still used?

While the HUD-1 Settlement Statement is largely replaced by the Closing Disclosure these days, it is still used to settle cash transactions, reverse mortgages, and other loans that need not be RESPA-compliant. This is why it is important to understand the HUD-1 Settlement Statement.

How do I create a header in QuickBooks?

This feature works the same in versions 2011–2016 of QuickBooks. From the report window, click Customize Report . In the Modify Report dialog box, select the Header/Footer tab. Modify the desired settings.

How do I enter a real estate purchase in QuickBooks?

How to register the purchase of a house?Go to Accounting on the left panel, then choose Chart of Accounts.Click on the New tab.In the Account Type drop-down, select Fixed Asset.Choose the appropriate Detail Type.Enter the cost in the Balance field.Click on click Save and close.

How do I create a custom management report in QuickBooks online?

Create a new reportSign in to QuickBooks Online as an administrator.Go to Business overview then select Reports (Take me there), or go to Reports (Take me there).Select Create new report.Enter the name of your report.Select a date range from the dropdown.Select Customize.More items...

How do I create a custom report in QuickBooks desktop?

From the Reports menu, select Custom Reports > Transaction Detail.Click Customize Report then go to the Display tab.In the Display tab: ... Go to the Filters tab and from the Filter List, select Transaction Type.Select the transaction type associated with the Vendor purchases (i.e. Bill).Click OK to display the report.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is line 902 on a mortgage?

Line 902 shows mortgage insurance premiums that are due at settlement. Escrow reserves for mortgage insurance are recorded later. It should be noted here if your mortgage insurance is a lump sum payment that's good for the life of the loan.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is the basis of HUD-1?

The HUD-1 has no clue what your basis is in property being sold. But starting with the price received as first entry against the asset account followed by adjustments for new costs of sale, recovery of any depreciation expense taken and addition of land value back to asset at the bottom , once the asset value itself is reduced to zero should be a figure that represents either the gain or the loss on the sale.

What is settlement charge?

Settlement charges are split between basis (added to fixed asset) and loan amortization if directly loan related and not actual purchase (think of difference if you had won the mega-millions and were paying cash). Loan costs can be amortized over the life of the loan which is usually shorter than the depreciation life of the property.

Is a prior down payment a credit?

Prior Down Payment in Escrow is a credit (previously should have posted to Escrow for Purchase) Loan from bank is credit (brand new liability, bank = vendor/supplier) any cash provided at closing is credit. Once you get down through it the debits and credits should be equal and you can save it.

Can you add a sub account for accumulated depreciation?

You can add a sub account for accumulated depreciation or you can keep just a single Accumulated Depreciation account, which can keep your Balance Sheet from becoming cluttered

What is a HUD-1?

The HUD-1 is a settlement statement and full of helpful and important information. HUD-1s may be simple and contain small amounts of information, while others may be complicated and jammed pack with data. When buying investment property (buy-and-hold), all HUD-1s have one thing in common, and that is the tax treatment of each line item.

What is the 804. appraisal fee?

804. Appraisal Fee: If required to obtain a loan, the cost is amortized over the life of the loan. If an appraisal is not required, the cost is added to the basis of the property and depreciated over the life of the property.

What is 102 in real estate?

102. Personal Property: The price of any personal property included in the sale. This must be depreciated.

Is a 1001 escrow account deductible?

1001. Initial Deposit for Your Escrow Account: This amount will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

Is a line item amortized over the life of the loan?

All of these line items are amortized over the life of the loan.

Is 1002-1004 a current expense?

1002-1004 are deposited with your lender and will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement: This form lists both the buyer’s and seller’s side of the transaction and is signed by both parties. It is published by the US Department of Housing and Urban Development. You’ll want to look at the buyer’s side, which is separated into credits and debits.

How to find property tax assessment?

If you don’t have this information already, property tax assessments can usually be found on the website of your local government. The assessment will be broken into the land value and value of buildings/improvements. You will need to determine the ratio of the buildings/improvements value to the total property value.

WHAT IS MY BUYER'S CLOSING STATEMENT?

Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete the transaction. Different forms are used depending on the requirements of the transaction and the lawyers involved. The three most common are:

What expenses are deductible on a closing statement?

These include property taxes, prepaid mortgage interest, assessments from an HOA, and insurance. There is no difference in reporting for these expenses when they occur as part of closing than in any other case.

Why is it important to record closing statements?

Getting it right is important because the journal establishes your basis for the lifetime of your property and may contain substantial deductible expenses.

Why do buildings and land appear as debits in your journal?

Both buildings and land appear as debits in your journal to establish them as assets on the balance sheet. Calculating this split is important because the building value will depreciate over the course of your ownership of the property while the land will not.

What happens if the prior owner left bills outstanding?

If the prior owner left bills outstanding, there may be adjustments for items unpaid by the seller, which decrease the total you owe at closing. Add a credit line (or reduce the existing debit) for the account of any amounts shown.