How to Record Amazon settlement data in QuickBooks and Prepare for Reconcilation

- Preparing QB for Amazon orders and fees. ...

- OR. ...

- Important: the date and transfer amount should match the transfer amount (closing balance) in Amazon settlement report.

- Clearing account wrap-up: This is why this is called a clearing account. ...

Full Answer

How do I record purchase of a fixed asset in QuickBooks?

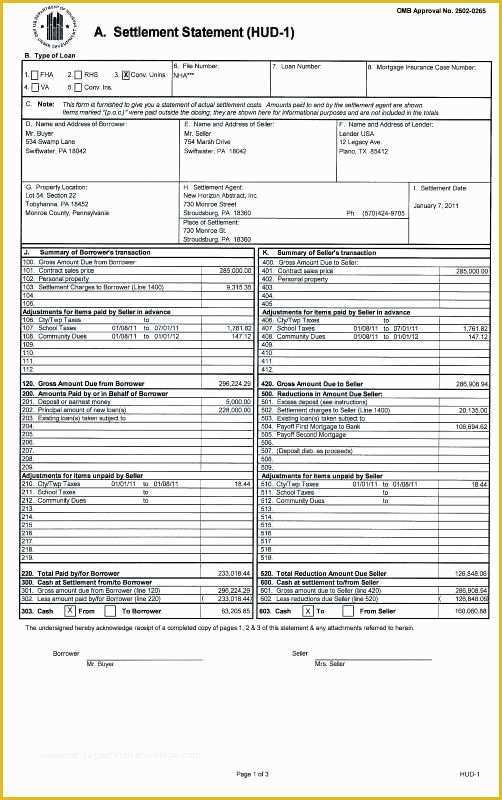

The best way to record the purchase of a fixed asset in QuickBooks is to use the closing documents from the sale. Usually, it is called a Settlement Statement. Others call it a Closing Disclosure (CD). It is often called a HUD statement (because the U.S. Department requires it of Housing and Urban Development).

Why do I need to record settlement of debt in QuickBooks?

Forgoing payment to a particular vendor for an extended period of time may turn into insurmountable debt. The debt may now become a loan, which will require you to record a settlement of debt in QuickBooks to help keep your books balanced.

What is a settlement statement called?

Usually, it is called a Settlement Statement. Others call it a Closing Disclosure (CD). It is often called a HUD statement (because the U.S. Department requires it of Housing and Urban Development). Whatever you call it, what you need for accounting purposes is the breakdown of any money transferred during the transaction.

How to record the purchase of a commercial property in QuickBooks?

First, create two new accounts that will be needed for recording the purchase of a commercial property in QuickBooks. Loan/Notes Payable Account To create a new account, go to Accounting > Chart of Accounts > New. Or go to the NEW button on the top left and click on Journal Entry.

How do you record a settlement statement?

How to Record a HUD Settlement StatementCredits – will list the gross amount owed to the seller at the time of settlement closing:Debits – will list the charges of the seller at the time of settlement closing:Debits – will list the gross amount owed by the buyer at the time of statement closing:More items...•

How do I record a settlement payment in QuickBooks?

How to record Settlement check with commission deductedOpen the affected invoice and click Receive payment.Enter the payment date and where to deposit the amount.Mark the invoice and enter the exact amount you've received ($3k).Click Save and close.

How do I enter a HUD in QuickBooks?

3:4822:25How to Use QuickBooks Online to Record a HUD 1 Final Settlement ...YouTubeStart of suggested clipEnd of suggested clipSo let's go to the quick create plus sign. And we'll go over to journal entry. And we're going toMoreSo let's go to the quick create plus sign. And we'll go over to journal entry. And we're going to enter a bunch of debits and credits. So the purchase price on the surface looks like 43,000.

What form contains a settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

How is a settlement recorded in accounting?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

What is the journal entry for settlement of account?

The journal entry is debiting accounts payable and credit cash. The transaction will remove the accounts payable of a specific invoice from the supplier and reduce cash payment.

How do I account for property purchase?

Add a home's purchase price to the closing costs, such as commissions, to determine the home's total cost. Write “Property” in the account column on the first line of a journal entry in your accounting journal. Write the total cost in the debit column. A debit increases the property account, which is an asset account.

Are closing costs intangible assets?

At closing several different costs are paid and include these groups of costs: A) Financial Lender Required – Benefits the lender; these costs are summed up as financial costs (intangible asset).

Do you capitalize closing costs?

In addition to the capitalized closing costs tied to your property, most costs associated with obtaining a loan must be capitalized rather than immediately deducted. These include loan origination/processing/underwriting fees, purchased points, appraisals, credit reports, etc. Add them up from your closing statement.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

How do I record Amazon settlement data in QuickBooks?

Download your settlement report from Amazon: Sign into your Amazon Pay account on Seller Central. Click on the reports menu, and then click payments. ... Create a journal entry in QuickBooks Online. Click on the + NEW button at the top left, and then click on Journal Entry.

How do I record a debt forgiveness in QuickBooks?

Desktop how to record the PPP Loan ForgivenessClick Accounting.Go to the Chart of Accounts tab, then click New.Under Account Type, select Other Income.Under Detail Type, select Other Miscellaneous Income.Enter the desired name in the Name field.Click Save and Close.

What is loss from lawsuit?

A non-operating or "other" reduction in net income resulting from a judgment against the company. It is shown in the accounting period when the amount is determined to be probable and the amount can be estimated.

How to record a fixed asset purchase in QuickBooks?

The best way to record the purchase of a fixed asset in QuickBooks is to use the closing documents from the sale. Usually, it is called a Settlement Statement. Others call it a Closing Disclosure (CD). It is often called a HUD statement (because the U.S. Department requires it of Housing and Urban Development).

What is title company in QuickBooks?

A title company’s job is to divide the expenses correctly between the two participants in a real estate transaction. The seller will pay their prorated portion of real estate taxes, rent, utilities, etc., based on the transaction date, and the borrower may have some of the expenses. Using the Settlement Statement to set up your new building in QuickBooks provides almost a “cheat sheet” for entering the transaction. We will use the Settlement Statement below as our example for building the Journal Entry in QuickBooks.

What is CAM in QuickBooks?

Line 4-7: Prorations of rent and/or operational expenses or CAM (Common Area Maintenance) are usually part of a commercial real estate transaction. These amounts are normally portions of rent that are “given” to you in the transaction. Typically, it reduces your liability against the asset. This can go into Accounts Receivable. This account requires a “Customer” to attach it to, so you will need to have the new tenants in QuickBooks already.

What is line 10 in closing costs?

Line 10: As far as your title costs, bank fees, legal fees, etc., those can either be broken out into separate accounts or can be lumped together in a “Closing Costs” account. This is entered as a debit as it is part of the initial cost of the building but is not part of the purchase price. For details on how to enter this as separate entries, refer to https://www.youtube.com/watch?v=iR8RoHx3aVA&t=563s.

How to create a journal entry?

To create the Journal Entry, go to the NEW button on the left top corner to create a Journal Entry . NOTE: The information below is how a typical Journal Entry will be recorded. As always, check with your accountant to ensure you are recording it correctly for your particular circumstances.

Why are security deposits transferred?

Line 8 and 9: Security Deposits are often transferred within the transaction because it is common for the leases to transfer with the property. Separating them per unit helps keep them trackable when a deposit needs to be returned to the tenant.

Why is it important to record closing statements?

Getting it right is important because the journal establishes your basis for the lifetime of your property and may contain substantial deductible expenses.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement: This form lists both the buyer’s and seller’s side of the transaction and is signed by both parties. It is published by the US Department of Housing and Urban Development. You’ll want to look at the buyer’s side, which is separated into credits and debits.

WHAT IS MY BUYER'S CLOSING STATEMENT?

Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete the transaction. Different forms are used depending on the requirements of the transaction and the lawyers involved. The three most common are:

What expenses are deductible on a closing statement?

These include property taxes, prepaid mortgage interest, assessments from an HOA, and insurance. There is no difference in reporting for these expenses when they occur as part of closing than in any other case.

Why do you need a journal entry on closing statement?

Creating a journal entry from your buyer’s closing statement is one of the more complex transactions on the way to properly keeping books as a real estate investor. It is also one of the more important - calculating your basis in a new property is the starting point for all future depreciation, capital gains, or 1031 exchanges. Additionally, many expenses that can be immediately deducted as an investor are on the closing statement; if you miss them you’ll be stuck with a higher tax bill than necessary.

Why do buildings and land appear as debits in your journal?

Both buildings and land appear as debits in your journal to establish them as assets on the balance sheet. Calculating this split is important because the building value will depreciate over the course of your ownership of the property while the land will not.

What happens if the prior owner left bills outstanding?

If the prior owner left bills outstanding, there may be adjustments for items unpaid by the seller, which decrease the total you owe at closing. Add a credit line (or reduce the existing debit) for the account of any amounts shown.

What is HUD Settlement Statement?

The Housing and Urban Development Settlement Statement refers to a document issued when a borrower takes out a loan to purchase real estate. Furthermore, The HUD Settlement Statement lists all charges and credits to the buyer and the seller in a real estate settlement or all ...

Who will list the amount paid by the buyer on the HUD Settlement Statement?

Credits will list the amount paid by the buyer or those paid on behalf of the HUD Settlement Statement buyer:

What is a credit at closing?

Credits – will list the gross amount owed to the seller at the time of settlement closing:

What are other credit entries to the seller's account?

Other credit entries to the seller’s account may be made for adjustments that have been settled by the seller in advances such as prepaid taxes, homeowner association dues, and expenses of the sort

What is debit entry?

Debit entries will also consist of closing costs paid by the seller on behalf of the buyer. Lastly, any adjustments for items unpaid by the seller, for instance, pro-ration of property taxes, security deposits, and things that are to be credited to the buyer.