User connects QuickBooks and Amazon FBA marketplaces. Data from Amazon (last 90 days) will be processed automatically. There is literally a single button operation. Just click "Submit" on a reporting period and your revenue, expenses and fees will be properly recorded in QuickBooks Online.

- Download your settlement report from Amazon: Sign into your Amazon Pay account on Seller Central. Click on the reports menu, and then click payments. ...

- Create a journal entry in QuickBooks Online. Click on the + NEW button at the top left, and then click on Journal Entry.

How do I download my settlement report from Amazon Pay?

Download your settlement report from Amazon: Sign into your Amazon Pay account on Seller Central. Click on the reports menu, and then click payments. On the Statement View tab, a view of your current open settlement appears.

How can I see how much Amazon deposited into my account?

I start the process by going to Payments > Statement View. This report shows the amount Amazon deposited into my account. For example, in the sample period between January 7 to January 21, my Amazon account generated $583.57 in sales. After the company took off their fees, my total deposit came out to $405.19.

How do I integrate Amazon with QuickBooks Online?

Go to your Apps in QuickBooks Online. Type in Amazon and it’ll bring up a list of applications that integrate with Amazon and QuickBooks Online. Two of our favorites are Webgility and A2X ( view our A2X video here ), though there are lots of others, too.

Does QuickBooks sync with Amazon payouts?

My QuickBooks setup automatically synchronizes with my business checking account. I have the Amazon payout categorized as FBA Sales Income. The big problem is when you load up the summary view report, you don't get a breakdown of the fees that are taken off your total sales.

How do I record Amazon income in QuickBooks?

5:598:09How To Record Amazon Payments in Quickbooks - YouTubeYouTubeStart of suggested clipEnd of suggested clipPage you go to the upper right and you press the plus button and in there it gives you some optionsMorePage you go to the upper right and you press the plus button and in there it gives you some options and one of them is to create a journal entry.

How do I reconcile Amazon payments in QuickBooks online?

1:042:38How To Record Amazon Payments In QuickBooks Online with ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo as you can see here we have our amazon statement on the right side and quickbooks journal entryMoreSo as you can see here we have our amazon statement on the right side and quickbooks journal entry on the left side now you want to select your currency on the top left and enter your journal date.

How do I record Amazon purchases in QuickBooks?

You can connect it to QuickBooks with the Amazon Business Purchases app. It's a great way to save time and keep your books up to date. The app brings your Amazon Business purchases into QuickBooks with all the details, so QuickBooks can categorize and link them to your bank or credit card records.

How do I categorize Amazon expenses in QuickBooks?

Here's how:Go to the Plus Icon.Choose Expense.Select Amazon as the Payee.In the Category Details section, list down all the items you've purchase. Under the Category column, choose the specific expense account. Enter the Description and the rest of the expense details.Click Save and Close.

How do I reconcile my Amazon account?

Reconciling an Amazon Settlement DepositLog onto your Amazon Seller Central dashboard and navigate to Reports > Payment.Select the report for the proper Settlement amount you are going to reconcile.c.Print the statement as a PDF.

How do I reconcile my 1099 K on Amazon?

Reconciling your Amazon Date Range Transaction Report or your Amazon Summary Statement to your Amazon 1099K....Amazon 1099K ReportLogin to your Amazon Seller Account.Hover over reports.Select “Tax Document Library“Download the PDF of your Amazon 1099-K form for the applicable tax year.

How do I record online sales in QuickBooks?

You'll use this template every time you need to record total daily sales.Select the Gear icon on the Toolbar.Under List, choose Recurring Transactions.Select New at the top right.From the Transaction Type dropdown, choose Sales Receipt.Name your template "Daily Sales" and make sure the Type is Unscheduled.More items...•

How do I integrate Amazon seller with QuickBooks online?

Step 1: Install Amazon in QuickBooks CommerceSign in to QuickBooks Commerce.Go to Browse Apps, then select Amazon.Select Install Amazon.Select your Primary Marketplace ID from the dropdown menu.Grant permission to allow QuickBooks Commerce to connect with Amazon. ... Set up your Amazon stock locations.More items...•

How do I connect QBO to Amazon?

0:163:37How to connect your Amazon Business account to QuickBooks ...YouTubeStart of suggested clipEnd of suggested clipThis app only works if you use an amazon business account it is not available for amazon.comMoreThis app only works if you use an amazon business account it is not available for amazon.com accounts to start select apps then search for amazon business purchases. And start the connection.

What type of accounts does Amazon have?

There are two different types of seller accounts on Amazon: individual and professional. Each has its own costs and set of perks. For example, an individual plan is best if you plan on selling fewer than 40 items a month, and it comes with no monthly subscription fee.

What are the different types of expense transactions QBO?

You can categorize these types of transactions as other expenses:Memberships/subscriptions.Printing.Uniforms.Apps/software/web services.Computers.Copiers.Furniture.Other tools and equipment.More items...

Where can I find my Amazon Seller ID?

How to find your Amazon Seller ID and MWS informationLog into Amazon seller central.Follow Settings - User Permissions → Visit Manage Your Apps → Authorize a Developer.Enter relevant developer name and developer ID. Platform. ... Check the checkbox and Next button.Your seller ID and MWS authorization token will be displayed.

How do I categorize an expense in QuickBooks?

Categorize a transactionGo to the Transactions menu.Find a transaction on the list.Select Business if the transaction was for business, or select Personal for personal. ... Review the category in the Category column. ... If you need to change the category, select the category link. ... When you're done, select Save.

How do I categorize non business expenses in QuickBooks?

How do you categorize personal expenditures?From the Transactions menu, find the transaction on the list.Select Personal under the Type column.Choose or review the category in the Category column. Select a general type, and select a more detailed category.When you're done, select Save.

How do I label expenses in QuickBooks?

In the Tags field, enter the preferred label to categorize your money. In the Category details section, enter the expense info. In the Category dropdown, select the expense account you use to track expense transactions. Then enter a description.

How do I categorize services in QuickBooks?

Categorize the products and services you sellGo to Get paid & pay or Sales, then select Products and services (Take me there).Find the product or service you want to categorize.Select Edit from the Action column.Select the Category ▼ dropdown, then select one that fits this item. ... Select Save and close.

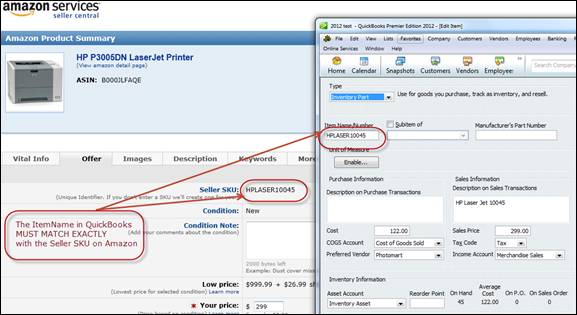

How to I set up the Connex account settings to sync the Amazon Settlement Report to QuickBooks?

The steps to set-up the settlement report are similar to the steps to set-up our regular Amazon integration. You will see a seller ID and MWS token. Read one of these guides:

Where are sales synced in QuickBooks?

Sales are synced under the Amazon summary customer , which Connex will create:

How do I add Amazon Fees?

Connex will export the fees by default under an item called Amazon fees. To use a different item, follow these steps:

How far back can I set the sync dates?

Amazon only allows reports available in the last ninety days, using a date sync. If you require older sales, upload the reports manually. You can upload reports manually one at time through Connex.

How to see how much Amazon deposited into my account?

I input my Amazon data at the conclusion of the Amazon payment cycle. I start the process by going to Payments > Statement View. This report shows the amount Amazon deposited into my account.

What does Amazon FBA cover?

Amazon FBA, of course, covers handling, picking out a product and packing it, referral fees, and weight handling of each sale.

What does the red number on Amazon check mean?

After completion, whatever number shows up in red indicates the amount of money Amazon would have deposited to my checking account. I have to reverse this because if not, QuickBooks is going to indicate an excess of FBA sales for that same amount.

Can you itemize Amazon fees?

This can with just a single entry. You can also choose to itemize and break down the entry between the fees that you owe and the sum Amazon owes you, like reimbursements, taxes, and sales amount.