To record a settlement cost, a corporate bookkeeper debits the corresponding settlement expense account and credits the vendors payable account. An operational dilemma may arise if a company cannot precisely determine the amount it will pay to settle a contract or purchase order.

Full Answer

How do you record settlement costs in accounting?

To record a settlement cost, a corporate bookkeeper debits the corresponding settlement expense account and credits the vendors payable account. An operational dilemma may arise if a company cannot precisely determine the amount it will pay to settle a contract or purchase order.

How do I sell a settlement on an invoice?

"Sell" the settlement on an Invoice as other income for $200,000. Only the $100,000 actually received (as Receive Payment) will post as cash basis income this year. To get the remaining 100k onto the balance sheet create a customer credit memo (same name as the payee) for 100k posted to an Other Asset account.

What is the best approach to record proceeds from a sale?

The most reasonable approach to recording these proceeds is to wait until they have been received by the company. By doing so, there is no risk of recording a gain related to a payment that is never received.

How do I record a gain from insurance proceeds?

A gain from insurance proceeds should be recorded in a separate account if the amount is material, thereby clearly labeling the gain as being non-operational in nature. For example, the title of such an account could be "Gain from Insurance Claims."

How do you account for settlement proceeds?

You list it as a liability on the balance sheet and a loss contingency on the income statement. It's possible but not probable you'll lose money. You disclose it in the notes on the financial statement, but you don't include the amount in your statements.

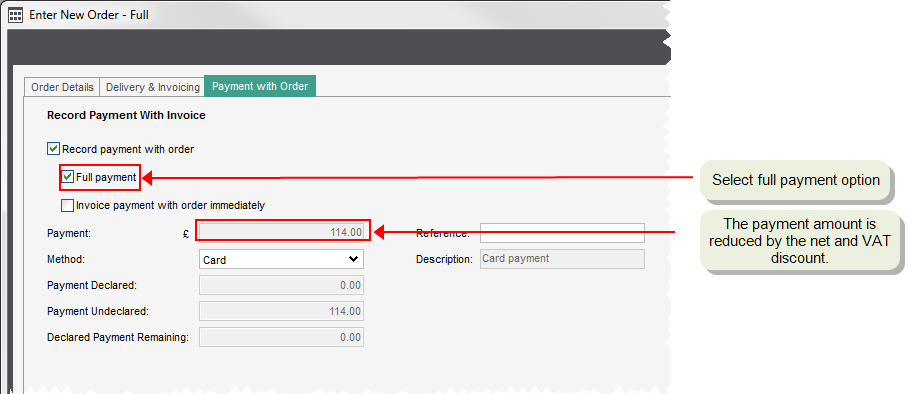

How do I record settlement proceeds in Quickbooks?

First, we have to record the exact amount you've received from your client and apply it to the invoice.Open the affected invoice and click Receive payment.Enter the payment date and where to deposit the amount.Mark the invoice and enter the exact amount you've received ($3k).Click Save and close.

How do you record a settlement?

How to Record a HUD Settlement StatementCredits – will list the gross amount owed to the seller at the time of settlement closing:Debits – will list the charges of the seller at the time of settlement closing:Debits – will list the gross amount owed by the buyer at the time of statement closing:More items...•

Is a legal settlement in other income?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What is the journal entry for settlement of account?

The journal entry is debiting accounts payable and credit cash. The transaction will remove the accounts payable of a specific invoice from the supplier and reduce cash payment.

How do I record the sale of a property?

When you sell land, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount of land from the general ledger. Unless the buyer pays you exactly what you paid for the land, there will also be a gain or loss on sale of the land.

How do you record down payment on fixed assets?

There are different ways to record a down payment for fixed assets....Down Payment for Fixed AssetDown payment request f-47 (a special GL can be defined for fixed assets)Payment for the down payment (f110, f-53, f-58)When the invoice arrives clear the down payment with the invoice using f-54.

How do you record an asset?

To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same amount. For example, a temporary staffing agency purchased $3,000 worth of furniture.

How do I record a property sale in Quickbooks?

0:549:16Recording Sale Of House For Landlords And Property OwnersYouTubeStart of suggested clipEnd of suggested clipYou have to add an account called gain of the sale of property. And that has to be an other incomeMoreYou have to add an account called gain of the sale of property. And that has to be an other income type of account. But just in case you might sell it as a loss.

How do I report a legal settlement on my taxes?

If you receive a settlement, the IRS requires the paying party to send you a Form 1099-MISC settlement payment. Box 3 of Form 1099-MISC will show “other income” – in this case, money received from a legal settlement. Generally, all taxable damages are required to be reported in Box 3.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Where do you report settlement income on 1040?

Attach to your return a statement showing the entire settlement amount less related medical costs not previously deducted and medical costs deducted for which there was no tax benefit. The net taxable amount should be reported as “Other Income” on line 8z of Form 1040, Schedule 1.

How do I record Amazon settlement data in QuickBooks?

Download your settlement report from Amazon: Sign into your Amazon Pay account on Seller Central. Click on the reports menu, and then click payments. ... Create a journal entry in QuickBooks Online. Click on the + NEW button at the top left, and then click on Journal Entry.

How do I record a debt forgiveness in QuickBooks?

How should I record if the PPP loan was fully forgiven?In your QuickBooks account, go to the Accounting tab.Choose Chart of Accounts then click New.Pick Other Income as the Account Type.For the Detail Type, pick Other Miscellaneous Income.Once done, press Save and Close.

What is loss from lawsuit?

A non-operating or "other" reduction in net income resulting from a judgment against the company. It is shown in the accounting period when the amount is determined to be probable and the amount can be estimated.

When does a company record settlement expenses?

In other words, it posts expense entries when service providers have fulfilled their part of the contractual agreement. For example, if a business wants to buy a commercial building and lawyers have finished preparing all legal documents pertaining to the transaction, the company will record legal fees when it receives attorneys' bills -- not when it pays them. To record a settlement cost, a corporate bookkeeper debits the corresponding settlement expense account and credits the vendors payable account.

When do financial managers record settlement costs?

Financial managers record settlement costs when they are both probable and reasonably estimable. If not, managers disclose the extent and nature of the settlement contingencies at the bottom of a corporate balance sheet. They also tell investors whether settlement losses are probable, reasonably possible or remote.

What is settlement expense?

Settlement Expenses. A settlement expense may be associated with a real estate transaction or a charge a business incurs as part of a legal proceeding. Mortgage-related settlement costs refer to cash a borrower pays for things like land surveying, property appraisal, legal work and insurance.

Why are lawsuits a pain for accountants?

Lawsuits are a pain for accountants because they're unpredictable. You can estimate company expenses and income for the next quarter, but you can't say for certain someone won't up and sue you. When you pay legal damages or receive them, you report the result as income or loss on the income statement. In some cases, you have to report the loss ...

Can you lose money on a financial statement?

It's possible but not probable you'll lose money. You disclose it in the notes on the financial statement, but you don't include the amount in your statements. You'll probably lose money but you've no idea how much. Once again, disclose it in the notes. 00:00.

Should you acknowledge the loss of insurance?

Even if you think your insurance will cover the entire payout, you should still acknowledge the loss in your statements. Entering the anticipated loss and anticipated insurance payment as separate items is the most accurate way to portray your situation.

Do you have to record anticipated expenses?

You'll probably pay out money and you have a good idea how much. You have to record the anticipated expense. You list it as a liability on the balance sheet and a loss contingency on the income statement.

Can you report a lawsuit as income?

If the boot is on the other foot and you're suing someone else for damages, it doesn't go on the books until you actually collect. You can mention the lawsuit in notes to the financial statements, but you can't include it as income or an account receivable, even if you think winning damages is a slam-dunk. Accounting standards favor a conservative approach to potential contingent gains. When you finally have the cash in hand, then you report it as income.

How to get 100k on balance sheet?

To get the remaining 100k onto the balance sheet create a customer credit memo (same name as the payee) for 100k posted to an Other Asset account. Now going forward issue an Invoice as often as scheduled payments are posted as a reduction of the asset. What about income? I am getting to that. With a remaining balance of 100k on original invoice, and a new invoice for 10k for asset reduction, apply a portion of the 100k customer credit to that invoice and post received payment against the original invoice which will post as cash income when received.

Can you record income as income?

So you have realized, just record the income as income as it comes in - but I still recommend using a Sales Receipt or Deposit and not a Journal Entry.

Is the whole amount owed an asset?

Regarding entering the whole amount it is an amount owed to the company therefor, much as if the company would have loaned the amount, it is an asset of the company. As the balance is paid there will be an amount of the asset left and it would be nice, but not strictly necessary I suppose, to have that number available on the balance sheet. We are cash accounting for tax purposes so the only income that should be shown on taxes is the amount received.

Is running a business on accrual basis the same as making or not making entries for cash basis?

Running the business on Accrual Basis for reporting and management is not the same as making or not making entries for Cash Basis.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

When does a business recognize a gain in the amount of the insurance proceeds received?

April 16, 2021. / Steven Bragg. When a business suffers a loss that is covered by an insurance policy, it recognizes a gain in the amount of the insurance proceeds received. The most reasonable approach to recording these proceeds is to wait until they have been received by the company.

Is a gain a net loss?

Though a gain is being recorded, the likely total outcome of an insurance claim is a net loss, since the amount of such a claim is offset against the actual loss incurred, net of an insurance deductible.

Do you disclose the amount of the proceeds in an insurance statement?

It may be necessary to disclose in the financial statement footnotes the nature of the events resulting in insurance proceeds, the amount of the proceeds, and the income statement line item in which the resulting gain is recorded.

Is there a risk of recording a gain related to a payment that is never received?

By doing so, there is no risk of recording a gain related to a payment that is never received. An alternative is to record the gain as soon as the payment is probable and the amount of the payment can be determined; however, this constitutes a form of accrued revenue, and so is discouraged unless there is a high degree of certainty regarding ...

Is a gain from insurance a receivable?

If the gain is recorded prior to cash receipt, the offsetting debit to the gain is a receivable for expected insurance recoveries. A gain from insurance proceeds should be recorded in a separate account if the amount is material, thereby clearly labeling the gain as being non-operational in nature.

What happens to insurance proceeds when they are received?

Once insurance proceeds are received, it’s removed from the books, and cash is shown in its place (that’s like a normal accounting operation).

How to account for Insurance proceeds?

Insurance providers analyze the amount of loss and then compensate companies according to their policies.

Why is the second debit of the transaction recorded?

The loss is recorded because the book value of the asset written off is more than the insurance proceeds.

What is the first debit recorded in an insurance company?

The first debit recorded is receivable, which will be removed from the business books once cash is received from the insurance company.

How are insurance claims disclosed?

Insurance claims received are disclosed properly in the financial statement. A journal entry is posted for the amounts received from insurance companies by crediting the actual figures of lost assets against which we claimed insurance.

How does insurance earn money?

The insurance companies earn via policy write-off and payment of the premium. The writing off fee is earned when the policy is written off, and the premium is collected from period to period continuously.

What happens if a claim is valid and comes under the insurance terms?

If the loss is valid and comes under the insurance terms, then a payment is made to the aggrieved party for the loss.