When to file your claim

- Submit a demand letter The first step on the way to settlement is to submit a demand letter to the responsible party’s insurance company. ...

- Negotiate your claim Keep in mind that insurance adjusters do not want to give you your full compensation amount. ...

- Head to court

What are the steps to an insurance claim settlement?

Steps to an Insurance Claim Settlement. 1. Submit a demand letter. The first step on the way to settlement is to submit a demand letter to the responsible party’s insurance company ... 2. Negotiate your claim. 3. Head to court.

How to negotiate a settlement with an insurance company?

1 Submit a demand letter The first step on the way to settlement is to submit a demand letter to the responsible party’s insurance company. ... 2 Negotiate your claim Keep in mind that insurance adjusters do not want to give you your full compensation amount. ... 3 Head to court

Can a car insurance company offer you a settlement?

The car insurance company may offer you a settlement, but its initial offer may be lower than the amount you feel you are entitled to receive. Continue reading for tips on getting a fair deal when settling your claim. Have everything you need when you submit your claim.

What does it mean to pay the insurance settlement?

paying the insurance settlement. What exactly is a claim? An insurance claim legally notifies the insurance provider that you want to make a claim against the policy that you purchased. This means basically that you are letting your insurance provider know that an accident or unexpected disaster has fallen on you.

Can you ask the insurance company for a settlement?

Once you've made an estimate, you'll need to send a demand letter to the insurance company demanding fair compensation. A Demand Letter is a formal letter that outlines all of the damages you incurred from your accident. The objective with your demand letter is to make a case for the compensation you're entitled to.

How do I write a demand letter for an insurance settlement?

7 Tips for Writing a Demand Letter To the Insurance CompanyOrganize your expenses. ... Establish the facts. ... Share your perspective. ... Detail your road to recovery. ... Acknowledge and emphasize your pain and suffering. ... Request a reasonable settlement amount. ... Review your letter and send it!

How do I talk to my insurance settlement?

Tips for Talking to an Insurance Claims AdjusterRemain Calm and Polite. ... Identify the Person You Are Speaking With. ... Give Limited Personal Information. ... Give No Details of the Accident. ... Give No Details of Your Injuries. ... Resist Initial Settlement Offers. ... Refuse to Give Recorded Statements.

What are the 4 steps in settlement of an insurance claim?

Negotiating a Settlement With an Insurance Company. ... Step 1: Gather Information Needed For Your Claim. ... Step 2: File Your Personal Injury Claim. ... Step 3: Outline Your Damages and Demand Compensation. ... Step 4: Review Insurance Company's First Settlement Offer. ... Step 5: Make a Counteroffer.More items...

How do you request a settlement for demand?

How To Write A Demand Letter To Settle Your ClaimOutline The Incident. You will need to start by outlining the details of the accident. ... Detail Your Injuries. ... Explain All Of Your Damages. ... Calculate Your Settlement Demand. ... Attach Relevant Documents. ... Get Help From An Attorney.

How do you write a good settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What should you not say to your insurance adjuster?

Never say that you are sorry or admit any kind of fault. Remember that a claims adjuster is looking for reasons to reduce the liability of an insurance company, and any admission of negligence can seriously compromise a claim.

How do you negotiate a total loss payout?

Summary: How to negotiate the best settlement for your totaled carKnow what you are selling to your car insurance company.Prepare your counter offer.Determine the comparables (comps) in the area.Obtain a written settlement offer from the auto insurance company.Make your counteroffer for your totaled car.

How do you respond to a low ball settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

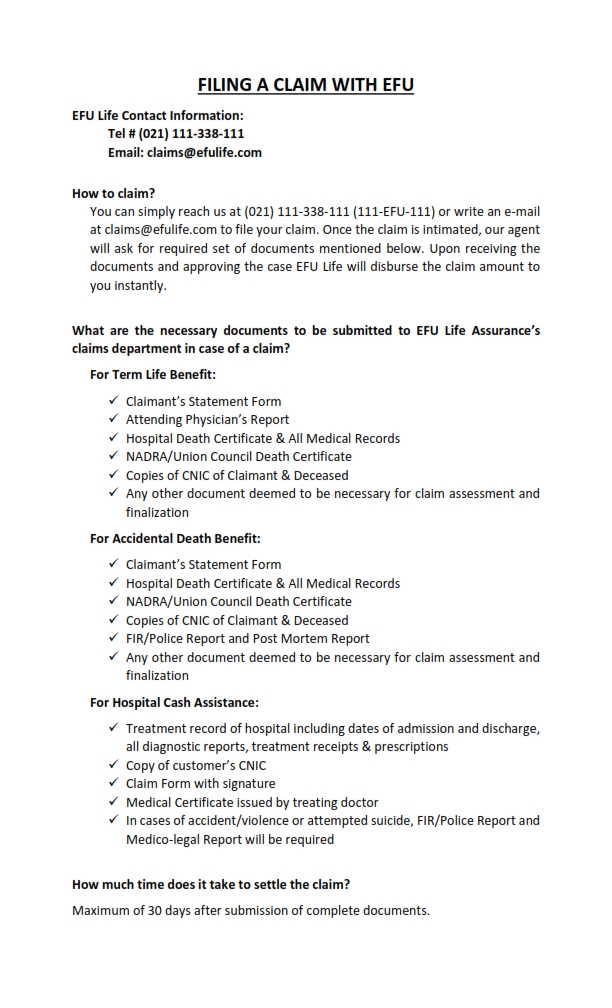

What are the documents required for claim settlement?

At the time of claim settlement, the below documents are generally asked by the insurance providers:Filled and Signed Claim Form.Original Policy Document.Death Certificate issued by the concerned authority.Police FIR (in the event of unnatural death)Age proof of Insured.More items...•

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease or eliminate payments for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

How do I make a settlement claim?

Claim settlement is one of the most important services that an insurance company can provide to its customers....Claims ProcessClaim intimation/notification. ... Documents required for claim processing. ... Submission of required documents for claim processing. ... Settlement of claim.

How do you write a good demand letter?

Ten Tips for Writing an Effective Demand LetterBe Organized. ... Submit the Letter in a Timely Manner. ... Reference Pertinent Claim Information on All Communication. ... Use Appropriate Professional Language and Tone. ... Use Subheadings. ... Be Specific. ... Set Forth Demand Amount Clearly. ... Provide Deadline for Response.More items...•

What is an insurance demand letter?

Writing a “demand letter” is one of the initial steps taken in the personal injury claims process. The demand letter is a document sent to the at-fault party's insurance company, explaining your side of the story, the losses you have incurred, and the total amount you are requesting as a settlement.

How do you respond to a low ball settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do I write a demand letter for an auto accident settlement?

The purpose of this article is to help you maximize the effectiveness of your demand letter.Request Your Medical Records. ... Document Your injury. ... Establish the Extent of Property Damage. ... Document Your Expenses. ... Be Organized. ... Do Not Exaggerate and Do Not Be Greedy. ... Calculating "Pain and Suffering" ... Seek Professional Legal Advice.

What questions do insurance adjusters ask?

But questions allow another person to speak, and they do two things: 1 One, they give you information. Where is the insurance adjuster coming from? What do they perceive to be the bad facts of your case that maybe aren’t bad facts, and that you can remedy by listening to them? Where are they off? Do they have facts that are wrong and that you can correct them? 2 And two, they also give the insurance adjuster the opportunity to speak, and in his own mind listen to what he’s saying, and maybe realize that some of his positions are untenable or unreasonable.

What is the number one tip for insurance negotiation?

Insurance negotiation tip number one is, know what the value of your claim is before you ever pick up the phone and talk to the insurance adjuster.

What is the ninth tip when negotiating your claim?

The ninth and final tip when negotiating your claim, to try to maximize your value when you’re negotiating with the insurance adjuster is knowing when to not negotiate. That’s right, it’s probably the most important tip, which is knowing when negotiation is the wrong way. Know when to step away from the table, and file a lawsuit.

Why does my insurance adjuster discount my medical bills?

Sometimes the insurance adjuster discounts your medical bills, perhaps because the insurance adjuster thinks that the medical treatment was unnecessary, or it was too much , or sometimes the insurance adjuster discounts your medical bills because the insurance adjuster believes that they’re going to be written off.

How many questions should a case manager ask?

What we trained our case managers to do when they first start working with us is to ask at least five questions. It seems a little bit difficult but it works. It gets communication flowing, and also helps to build rapport.

Can there be new facts that would emerge later that might increase your settlement range?

That’s not to say that there couldn’t be new facts that would emerge later that might increase your settlement range, or decrease your settlement range, but for purposes of your negotiation know what your framework is.

Can we guarantee future clients?

The success of any legal matter depends on the unique circumstances of each case, therefore, we cannot guarantee particular results for future clients.

What is the background of an insurance claim?

Background – The background is only a more descriptive summary of the incident that occurred. Describe where you were and what you were doing immediately before the accident, then how the accident occurred. Keep in mind, that your information must stay factual! If it didn’t happen, is irrelevant to the incident, or there is no proof to verify, then leave it out of the background. Your summary is the meat and potatoes of settlement. Anything you ask the insurance company is based on the description of the events that is listed in the demand letter. Any contradictory or wrong information could hurt your settlement.

What information should be included in an insurance claim?

Insurance Company’s Information – Make sure to include the name of the insurance company, name of the adjuster/or medical examiner, their title, and the company’s address.

What is a demand letter for insurance?

A demand letter is a factual summary of your claim, which includes all injuries (major or minor), loss of wages, emotional trauma (if applicable), and property damage.

What is insurance editorial guidelines?

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

Is Advertiser Disclosure affiliated with any insurance company?

Comparison shopping should be easy. We are not affiliated with any one insurance company and cannot guarantee quotes from any single insurance company.

Is a Demand Letter Required to Settle Your Claim?

Truthfully, a demand letter is not required to settle your claim . However, it is strongly recommended that you write one and send it to the insurance company. Why go through the trouble of writing an important letter, when you don’t have to? Good question. Imagine these two scenarios:

How to negotiate an insurance settlement for your car

Whether you feel you were properly compensated during the claims process or you and the insurance company have different ideas about what constitutes a fair settlement, there are steps you need to take so the process is as quick and painless as possible.

1. Make sure you have all the documents related to your accident

A police report is the most important document you can have after an accident. It provides you with the official documentation of the accident, so work with the police officer on the scene to make sure the report is accurate.

2. Keep track of accident-related expenses

Keep track of all of your expenses to make sure you know exactly how much you should be paid by the insurance company after an accident. This includes:

3. Work with your insurer if at all possible

One of the best things you can do when buying insurance is to make sure you purchase coverage designed to protect you even if the other driver is at fault in an accident.

4. Hire an attorney if necessary

If you are just negotiating for the value of your totaled vehicle, an attorney may not be necessary. However, if you have a newer, more expensive vehicle and the insurance company isn’t giving you enough to properly repair or replace your car, it might be worth your time to hire a lawyer.

5. Get it in writing

Once you and your insurance company have agreed to a settlement, make sure you get it in writing. Confirming everything in a written document is the best way to make sure everyone is on the same page and there is no confusion regarding the claim.

What exactly is a claim?

This means basically that you are letting your insurance provider know that an accident or unexpected disaster has fallen on you. It signals that you have suffered some sort of loss or damage that you believe falls within the policy’s coverage. Most importantly, it tells them that you want the insurance company to take action.

What should be the first priority after a distressing event?

Safety should be the first and foremost priority in your mind after a distressing event. If you have damaged property such as a building, please listen to the emergency responder’s advice and make sure that you and your family are in safety . Do not under any circumstances try to enter a damaged building without the approval of the safety personnel dispatched to the scene.

Does insurance make claims smooth?

Any reputable insurance company will try and make the process of claims as smooth as possible. There are, however, some things that the holder of the policy must take to get the claim.

What Should a Claim Settlement Letter Include?

Insurance companies deal with hundreds, even thousands of claims daily. That is why your letter to an insurance company should stand out.

How long does it take to file a claim with your insurance provider?

Should you have insurance for your property, car, health, or any other, you might be in a position to file a claim with your insurance provider one day.

What is DoNotPay insurance?

DoNotPay assists in appealing denied insurance claims from any provider, including 21st Century, Allianz, Fred Loya, or Shelter.

What to do if your insurance company rejects your claim?

In case your insurance company rejects your claim, send them an appeal letter and try to make them reconsider the decision. DoNotPay can help with this issue, too!

How to send a letter to insurance company?

Send your letter by certified mail with a requested return receipt since you will need to document the date your insurance company received it.

What to include in an accident letter?

Photographs and videos of the accident, all the damage, and your injuries. You should include any additional documentation supporting your case. Both you and the insurance provider should have copies of all the evidence.

Does DoNotPay speed up the process of filing insurance claims?

DoNotPay also speeds up the process of filing insurance claims, claiming warranties, reducing property tax, and drafting various legal docs.

What happens when you submit a claim letter to an insurance company?

When a person submits a claim letter to an insurance company, whether it’s for a car accident, medical malpractice, personal injury or other reason, the insurance company will respond with a first offer. At this point, the claimant has the right to make a counter offer, and in most cases, this is the best thing to do.

What should an insurance adjuster do if the first offer is very close to the claimant's minimum amount?

If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

Why do insurance companies make low offers?

The first offer given by the insurance company will most likely be very low and not be their last offer. They may purposefully make a low offer to see if the claimant knows what he or she is doing. This is why it is recommended to negotiate for a higher offer.

What to do if a claimant wants to lower the amount?

If the claimant wants, they can enter into negotiations and send several letters that gradually lower the amount they will accept. It is also important for the claimant to mention any emotional suffering. This will not have a dollar value, but it is strong support of a higher settlement.

Who does a letter go to when a claimant is at fault?

In most cases, the letter goes to the at-fault party’s insurance company to make it clear that the claimant suffered injuries because of the fault of the company’s insured person.

Should the claimant decide on the lowest amount they have calculated is fair for their claim?

The claimant should decide on the lowest amount they have calculated is fair for their claim and keep it in mind during negotiations, but not reveal it to the insurance company. If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

Is an insurance company required to give a fair settlement?

The insurance company is not required by law to give a claimant a fair settlement. There are some adjusters who want to treat claimants fairly and some who take advantage of the claimant’s naiveté to offer a less than fair amount.

What to ask for when filing a claim for auto insurance?

As you submit documentation for your claim, you will ask the auto insurance company for the amount of money that you feel is fair based on the property damage or personal injury suffered in the car accident.

What to do if you are in a car accident that is not your fault?

When you are in a car accident that is not your fault, you may need to file a personal injury or property damage claim. The car insurance company may offer you a settlement, but its initial offer may be lower than the amount you feel you are entitled to receive. Continue reading for tips on getting a fair deal when settling your claim.

Why is my insurance offer so low?

The first offer may be very low because the insurance adjuster is hoping you will not negotiate. Don’t rush to accept an offer that feels too low. Request explanations. Ask the insurance adjuster to identify reasons why you were given a lower offer than you had asked for in your initial claim.

Why do you need a lawyer for car insurance?

These are some reasons why you might want to consider hiring a lawyer, including: The insurance adjuster is putting pressure on you to settle quickly. You don’t think the car insurance company is offering you a fair settlement.

What happens if you can't prove your injuries were accident related?

For example, if you can’t prove your injuries were accident-related with documentation, your insurer might argue that they cannot be reimbursed. Negotiating a settlement is often necessary to receive a fair settlement if the insurance company’s first offer is low.

Do auto insurance companies offer low settlements?

Auto insurance companies typically offer low settlements on claims. Their goal is to save money by paying out the minimum that you will accept. They may make the following arguments: You were at fault (fully or partially), so they cannot compensate you to the extent you feel you deserve.

Can a statute of limitations come before a fair settlement?

Your case is dragging on and your state’s statute of limitations may come before you reach a fair settlement.

How to settle a car accident claim?

You don’t need to be a fast talker to settle your car accident claim, just follow these simple steps to learn how to negotiate a car accident settlement. 1. Know What the Car Insurance Policy Says. There’s no point in negotiating for something the insurance policy does not cover. Before you begin the process, read the insurance policy declaration ...

What factors to keep in mind when accepting a settlement offer?

Factors to keep in mind include: How far apart the offer and the demand are. How much more you are likely to receive in court. The expense of taking your claim to court. The additional time and uncertainty of a court resolution.

What is the most important part of a car accident settlement?

Your negotiation with the claims adjuster is the most important part of obtaining a fair settlement for your accident damages, so it can make a difference to have an experienced negotiator on your side. After all, insurance underwriters are highly trained negotiators. An experienced car accident attorney in your area can help you with the settlement process, and any other claims you may have.

What is an adjuster letter?

An adjuster is a highly skilled negotiator whose primary goal is to settle car accident claims quickly while paying you as little as possible.

What can you recover from a car accident?

There are basic types of damages a person injured in a car accident can recover, such as medical expenses and property damage. After you have added up all the bills, receipts, and losses you suffered because of the accident, establish a minimum and maximum payment range that works for you. This is your personal number, not to be shared with the insurance company. Remember that a claims adjuster will never give you more than you ask for, so aim high.

How long does it take to settle a car accident?

Negotiating a car accident settlement can take several months. It can feel like a lifetime if you are waiting for repairs to be made to your car or have medical bills piling up. It’s important to stay calm during the process and keep your interactions professional.

How to keep track of your insurance claim?

Let them know you are being patient but expect results. Claims can be reassigned or even misplaced so it is important to keep track of your claim.