Responding to a low settlement offer

- Remain Calm and Polite. While it may be tempting to respond quickly voicing your frustrations regarding the amount that...

- Raise Any Questions That You Have About The Offer. It is helpful to inquire with the insurance professional, ensuring...

- Respond To Their Offer In Writing. Once you have gained answers to your questions by...

Full Answer

How do I respond to a debt settlement offer?

If you receive a settlement offer and decided you’re interested, there are a couple of ways you can respond. You can accept the settlement offer and pay the settlement account in full. This is the easiest and fastest way to deal with the debt, assuming you’ve received a legitimate settlement offer.

What are my options if I receive a settlement offer?

Two Options for Taking the Settlement Offer. If you receive a settlement offer and decided you’re interested, there are a couple of ways you can respond. You can accept the settlement offer and pay the settlement account in full. This is the easiest and fastest way to deal with the debt, assuming you’ve received a legitimate settlement offer.

How do I know if a settlement offer is legally binding?

Read the settlement offer carefully or have an attorney review the offer to be sure it’s legally binding – that the creditor or collector can’t come after you for the remaining balance at some point in the future. Or, you can even try to negotiate a lower settlement.

What do you need to know about filing a settlement?

The form and terminology used in these documents must clearly, explicitly, and concisely set forth the essential facts of the settlement and the findings and determination necessary for a legal decision. A separate stipulation document is filed with the court. It will be stamped "filed" by the court.

How do you respond to a settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

What happens after you agree to a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How do you reject and respond to a low insurance settlement offer?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

What does it mean to accept a settlement?

If you accept the settlement offer, you give up your legal right to pursue any further claims related to your injury. You release all parties, known and unknown, who might have any liability for your injury claim. You cannot demand more money in the future, even if you discover additional injuries or damages.

Do I have to accept a settlement agreement?

Do I have to accept a settlement agreement offered? The short answer is no, you do not have to sign a settlement agreement.

What happens if I refuse a settlement agreement?

What happens if I refuse to sign a settlement agreement? Refusing to sign may result in the termination of your employment and you will not receive your employer's contribution (if there is one) to your legal fees.

How do you counter offer an insurance settlement?

From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

How do you negotiate an insurance settlement?

8 Auto Accident Settlement Negotiation TipsInitiate a Claim as Soon as Possible After an Auto Accident.Keep Accurate Records About the Accident.Calculate a Fair Settlement.Send a Detailed Demand Letter to the Insurance Company.Do Not Accept the First Offer.Emphasize the Points in Your Favor.Get Everything in Writing.More items...

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How do settlements work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How long does it take to receive compensation after accepting offer?

In some cases, insurers will process the compensation payout within a few days. In most cases, though, you will have to wait between two and four weeks to receive your compensation.

How does a settlement agreement work?

A settlement agreement might involve your employer promising to pay you a sum of money, stop treating you unlawfully or both. The settlement agreement is a legal contract between you and your employer - you both have to stick to it. Your employer is likely to want you to keep the agreement confidential.

How long does it take to finalize a settlement agreement?

Most Settlements Finalize Within Six Weeks Fortunately, if you know what to expect, you'll find this process a lot easier to navigate.

How do you counter a settlement offer?

State that the offer you received is unacceptable. Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim. R...

How do you respond to a low insurance settlement offer?

State that the offer you received is unacceptable. Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim. R...

What is a good settlement offer?

Most cases settle out of court before proceeding to trial. Some say that the measure of a good settlement is when both parties walk away from the s...

What is a settlement demand letter?

A settlement demand letter is used to ask for a settlement. The demand letter indicates that you are willing and ready to settle your claim related...

How do you politely decline a settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer...

What happens if I reject a settlement offer?

Scenario 3: Protect Your Legal Rights by Filing a Lawsuit The most dramatic result of a rejected settlement offer is a lawsuit against the party wh...

Should you accept first settlement offer?

To put it bluntly, no. You should not accept the insurance company's first settlement offer. Why? Because the amount of money you are awarded in yo...

How do I write a demand letter for a settlement?

Outline The Incident. You will need to start by outlining the details of the accident. Detail Your Injuries. Explain All Of Your Damages. Calculate...

How do you respond to a settlement offer?

Remain Polite. Stay polite and professional when negotiating with an insurance claims adjuster, even if you believe he or she is trying to take adv...

Lowball Settlement Offer: Why Did I Receive It?

In most cases, you will receive an undesirable settlement offer simply because that is the opposing insurance company’s job. They are capitalistic, for-profit companies that aim to maximaize their profits while reducing their payouts for car accidents.

Write a Rejection Letter

Once you understand why the other insurance company sent you less compensation than you deserve and you have thoroughly read the settlement offer, you need to respond with a rejection letter. You have a legal right, as a party in the car accident insurance claim, to dismiss the amount that the adjustor gave you and fight for a higher payment.

Make a Reasonable Counteroffer

A reasonable counteroffer is a key component of your rejection letter that you must include for the insurance adjustor to increase your settlement. Without a new compensation amount for them to consider, you have no local ground to defend obtaining a higher dollar amount.

We Have Experience Negotiating Low Settlement Offers

You, like other personal injury victims, can find yourself in a financially challenging position if an opposing driver crashes into your vehicle and compromises its functionality and your health. Feeling like a victim is difficult to avoid when you are wearing a cast or are having to catch rides from family.

1. Remain Calm and Polite

In most cases, receiving a low offer can instigate emotional reactions. However, it would help if you remained professional and polite as you negotiate with the insurance claims adjuster.

2. Table Your Questions

You can respond to a lowball settlement offer by asking several questions. It’s your right to know why the insurance provider undervalued your claim the way they did. When emailing or calling the adjuster, have clear and specific questions to ask them. Put them to task to explain precisely why they undervalued your claim.

3. Give All the Facts

If your injury documentation was incomplete, you need to fill it exhaustively when responding to a low offer. Include all your injuries, lost income, medical expenses, and any other damage. All these will act as evidence, adding support to your claim.

4. Develop a Counter Offer

Besides rejecting the low settlement offer formally, you need to come up with a counter offer. The new offer shows the reasonable amount you deserve for the damages. With the help of your attorney, this should be easy to develop.

5. Respond in Writing

Let your attorney draft a written response to the low settlement offer, indicating you rejected the offer. It’s not advisable to communicate this over the phone. Communication should be in writing.

6. Only Settle When Fully Healed

If there is one mistake you can make, it’s to accept a settlement before you complete the healing process. You shouldn't settle until you know your total past, current, and future medical bills, non-economic damages, and wage loss.

How do you respond to a settlement offer?

Remain Polite. Stay polite and professional when negotiating with an insurance claims adjuster, even if you believe he or she is trying to take advantage of you or is using bad faith tactics. Ask Questions. Present the Facts. Respond in Writing. Do Not Fall for Common Insurance Tactics.

How do I write a demand letter for a settlement?

Outline The Incident. You will need to start by outlining the details of the accident. Detail Your Injuries. Explain All Of Your Damages. Calculate Your Settlement Demand. Attach Relevant Documents. Get Help From An Attorney.

How do you respond to a low insurance settlement offer?

State that the offer you received is unacceptable. Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim. Re-state an acceptable figure. Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.

What is a settlement demand letter?

A settlement demand letter is used to ask for a settlement. The demand letter indicates that you are willing and ready to settle your claim related to your slip and fall accident, car crash, construction accident, or other injury.

How do you politely decline a settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

What happens if I reject a settlement offer?

Scenario 3: Protect Your Legal Rights by Filing a Lawsuit The most dramatic result of a rejected settlement offer is a lawsuit against the party who injured you, the insurance company, or both.

What does it mean to pay attention to the applicability of the sample?

Pay attention to the applicability of the sample, meaning make sure it's the proper sample for your state and situation.

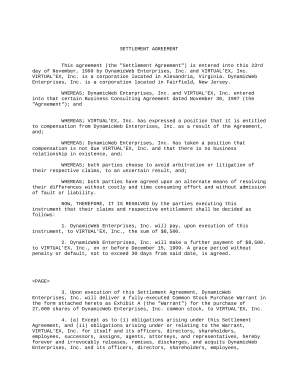

Who must execute a settlement document?

If documents to be filed with the Tax Court on behalf of both the petitioner and the respondent are not executed by the petitioner, they must be executed by an attorney or other representative admitted to practice before the court who has duly entered an appearance on behalf of the petitioner in the case. This fact must be checked by the attorney prior to forwarding the documents for execution on behalf of the petitioner. Settlement documents are not executed on behalf of the Chief Counsel until after execution on behalf of the petitioner and when they are ready for filing with the court.

What is settlement document 7436?

For most cases solely involving deficiencies or liabilities for taxes or penalties, including employment taxes in section 7436 cases, the form of the settlement document will be a combination stipulation and decision. This is one document executed by or on behalf of the parties. It is submitted to the court, and, upon execution by the judge, ...

What is a waiver paragraph in a 7436 case?

In every case in which a deficiency or a liability (including the proper amount of employment tax in section 7436 cases) is stipulated, the separate stipulation document or the stipulation part of the combined stipulation and decision document should contain a paragraph waiving the restrictions on the assessment and/or collection of the deficiency or liability, plus interest. The waiver paragraph is unnecessary and may be omitted only if no further amount, including interest, is to be either assessed or collected from the petitioner. This paragraph is a nonoperating paragraph insofar as the decision of the Tax Court is concerned. Therefore, no essential fact which must be stipulated to form the basis of the court’s decision, or which is an integral part of the court’s decision, should be included in this paragraph. The purpose of the waiver paragraph is twofold: to enable the Service to assess and/or collect the tax and penalty determined in the decision, together with interest thereon, without waiting for the decision to become final under the provisions of the internal revenue laws; and to avoid any misunderstanding at a later date as to the amounts to be collected under the terms of the settlement, whether such amounts involve a statutory deficiency or liability, a deficiency to be assessed, or unpaid portions of prior assessments. For specific rules regarding decision documents in section 7436 cases, see CCDM 35.8.5.11.

Why is a separate stipulation never served?

A separate stipulation document, however, is never served on the parties because the court merely files this document. When settlement documents are filed at trial sessions, Field Counsel will date stamp the initialed copy of the combined settlement and decision document, or the separate decision document "lodged" with the court.

When is a decision document required to include a provision that states that the petitioner is not entitled to costs under?

When the litigation or administrative costs issue has been raised in settled or litigated cases and the parties agree on the disposition of this issue, the decision document must include either a provision which states that the petitioner is not entitled to costs under section 7430 or a provision stating that petitioner is entitled to $ [amount] in costs under section 7430. For a discussion of settlement procedures and settlement authority, please refer to CCDM 35.10.1.1.2. See also requirements of T.C. Rule 232 (e).

How does a stipulation document work?

A separate stipulation document is filed with the court. It will be stamped "filed" by the court. The combined stipulation and decision document or the separate decision document, however, is not "filed" . Instead, it is executed by the judge, and it becomes "entered" as the court’s decision. In effect, the combined or separate decision documents are "lodged" with the court until the decision is entered on the court’s records. The date of the decision is the date it is entered, not the date on which a judge executes the decision document. See section 7459. One copy of the entered decision is served on the respondent. A separate stipulation document, however, is never served on the parties because the court merely files this document.

What is the TEFRA case?

TEFRA cases. Employment taxes under section 7436. Also, even though Appeals may prepare decision documents and have them executed by or on behalf of petitioners, it is the Field attorney’s responsibility to assure that only correct decision documents are filed with the court.

What to Do After a Serious Car Accident

You should fully expect that the insurance company will low ball you with their first offer. You can start preparing for that possibility immediately after your accident by:

Economic vs Non-Economic Damages

The damage from a car accident can affect multiple aspects of your daily life. Economic damages relate to a specific monetary harm such as medical expenses or lost wages. Non economic damages are more intangible losses, and as such, are much more difficult to assign a value to.

How to Respond to a Low Settlement Offer

Once you have received a settlement offer by phone or email, take the time to compare it to your records to determine if you feel the offer is fair and will properly cover your costs. Remember, you have the legal right to reject any settlement offer from an insurance company, and to present a counteroffer with the payment you believe you deserve.

How a Personal Injury Lawyer Can Help You Reject a Lowball Settlement Offer

The mere presence of a lawyer’s letterhead on a letter rejecting a lowball settlement offer can alter the way that insurance agencies handle your claim. And in the case that you wish to proceed with a lawsuit, you will have already been working with a lawyer who understands the particulars of your case.

What Is A Settlement offer?

- A settlement offer is a document produced by the insurance companyfor the driver responsible for the accident. It is an offer for a sum of money that you will receive in exchange for an agreement that you will not sue the party who was liable for your injuries. However, you may receive a settlement offer for a lower amount than you were expectingan...

Responding to A Low Settlement Offer

- How you respond to the low settlement offer will determine how successful you are in reaching a fair outcome. Despite the frustrations you may have regarding the amount that you were offered, you should respond appropriately. We have detailed how you can respond to a low settlement offer below.

How Do You Know When A Settlement Offer Is good?

- A fair settlement offer is one that provides you with compensation which ensures that you aren’t dealing with debt because of the medical treatment you have received as a result of the accident. You will often find that yourself and the insurance adjuster begin with largely differing views regarding the amount that they feel you should be paid, however as negotiations proceed you wil…

Final Thoughts

- If you have received a low settlement offer from an insurancecompany you don't have to accept it. As mentioned above there are many steps that you can follow to ensure that your concerns are received appropriately. Although you are likely to have concerns over a low amount, you mustn't let these frustrations get in the way of a more favorable offer. Negotiation is going to be key an…