- Remain Polite. Stay polite and professional when negotiating with an insurance claims adjuster, even if you believe he or she is trying to take advantage of you or is using ...

- Ask Questions. Respond to a low settlement offer with questions. Find out why the insurance claims adjuster evaluated your case the way he or she did.

- Present the Facts. Document everything. Documentation of your injuries, medical costs, lost wages and other damages can serve as evidence to support the value of your claim.

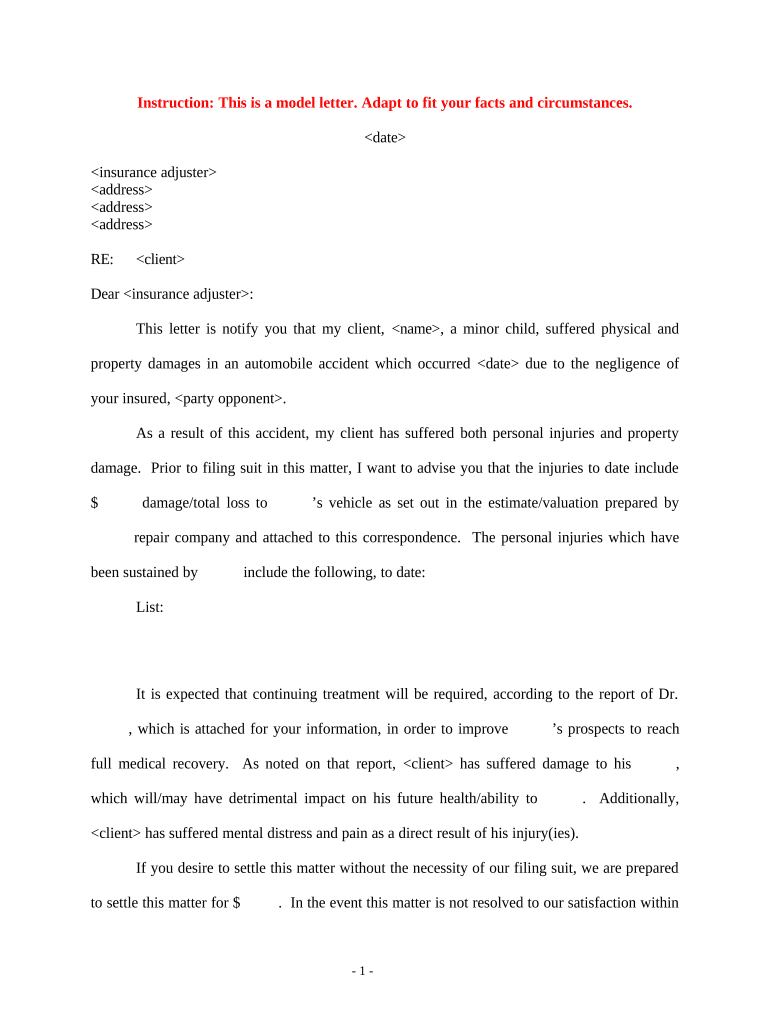

- Respond in Writing. When presented with a low settlement, respond in writing rather than over the phone. Written communication between you and the insurance company documents all correspondence.

- Do Not Fall for Common Insurance Tactics. Do not let an insurance company pressure you into accepting a low offer. ...

- Remain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ...

- Ask Questions. ...

- Present the Facts. ...

- Develop a Counteroffer. ...

- Respond in Writing.

How do I respond to a low settlement offer?

You should then write a formal letter of response in which you state that you don’t find the initial low settlement offer acceptable, listing the reasons why and concluding with a demand for a higher settlement offer.

Should I accept an insurance settlement offer?

Accepting a settlement is your choice, and yours alone. The insurance company may put a time limit on how long you have to respond, trying to ratchet up the pressure you feel. In reality, however, the insurance company probably expects you to say “no” to its opening offer.

How to accept a settlement offer from a defense attorney?

Accepting the Settlement Offer. Draft the agreement. In many legal contexts, it’s standard practice for the defense attorney to draft the agreement. However, in some situations the plaintiff may draft it, particularly if the offer was initiated with the plaintiff.

What should I expect in a settlement offer?

Since a settlement offer is essentially a contract between the parties, you can feel free to suggest -- and agree to -- terms that might not have been available if you tried your case in court. [4] For example, some settlement agreements require one party to make a formal apology to the other for the wrongs committed.

How do you decline a low settlement offer?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

Can you negotiate a settlement offer?

If the offer is reasonable, you can immediately make a counteroffer that is a little bit lower than your demand letter amount. This shows the adjuster that you, too, are being reasonable and are willing to compromise. A little more bargaining should quickly get you to a final settlement amount you both think is fair.

How do you counter offer an insurance settlement?

From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

How do you write a good settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How much should I offer in a settlement agreement?

The rough 'rule of thumb' that is generally used to determine the value of a settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

What do I do if my insurance offer is too low?

Here are five steps to take if the insurance company is lowballing you:Get Help from an Attorney. ... Make Sure It Is Actually a Lowball Offer. ... Figure Out Why the Insurance Company Is Lowballing You. ... Collect the Evidence You Need to Prove Your Claim. ... Keep Negotiating and/or File a Lawsuit in Court.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

How do I scare my home insurance adjuster?

One way to scare an insurance adjuster is to let them realize you are poised to negotiate and know your rights. Work up a settlement amount that you believe you should receive if their first offer isn't reasonable. Don't hesitate to challenge their first offer if you can substantiate that it should be higher.

Is an insurance settlement taxable?

Money you receive as part of an insurance claim or settlement is typically not taxed. The IRS only levies taxes on income, which is money or payment received that results in you having more wealth than you did before.

How do settlement negotiations work?

What Is A Negotiated Settlement? Reaching a successful settlement agreement typically involves determining an amount for the responsible party to pay in compensation. Deciding on that number typically includes a back-and-forth exchange with the two parties trading offers to reach an agreed-upon amount.

Is it good to pay settlement offers?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Should you take a settlement offer?

"If you're happy with their offer, and you should be because it's less than what you actually owe them, then you should at least consider it," he says. The alternative, according to Ulzheimer, is the creditor either outsourcing the debt to a collector or even suing you.

Should I accept first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

What do I do if my insurance offer is too low?

Here are five steps to take if the insurance company is lowballing you:Get Help from an Attorney. ... Make Sure It Is Actually a Lowball Offer. ... Figure Out Why the Insurance Company Is Lowballing You. ... Collect the Evidence You Need to Prove Your Claim. ... Keep Negotiating and/or File a Lawsuit in Court.

Lowball Settlement Offer: Why Did I Receive It?

In most cases, you will receive an undesirable settlement offer simply because that is the opposing insurance company’s job. They are capitalistic, for-profit companies that aim to maximaize their profits while reducing their payouts for car accidents.

Write a Rejection Letter

Once you understand why the other insurance company sent you less compensation than you deserve and you have thoroughly read the settlement offer, you need to respond with a rejection letter. You have a legal right, as a party in the car accident insurance claim, to dismiss the amount that the adjustor gave you and fight for a higher payment.

Make a Reasonable Counteroffer

A reasonable counteroffer is a key component of your rejection letter that you must include for the insurance adjustor to increase your settlement. Without a new compensation amount for them to consider, you have no local ground to defend obtaining a higher dollar amount.

We Have Experience Negotiating Low Settlement Offers

You, like other personal injury victims, can find yourself in a financially challenging position if an opposing driver crashes into your vehicle and compromises its functionality and your health. Feeling like a victim is difficult to avoid when you are wearing a cast or are having to catch rides from family.

Why do corporations have confidentiality clauses?

Large corporations often want confidentiality clauses to maintain positive public relations and avoid exposure to copycat suits.

How to guarantee a settlement doesn't include any terms that violate the law?

The best way to guarantee your settlement doesn’t include any terms that violate the law is to hire an attorney. Attorneys are bound by professional ethics rules and bar regulations to alert you to illegal terms and have them removed.

Why do you need a settlement?

2. Use a settlement to avoid risk. Whether you’re a plaintiff suing someone else or a defendant who’s been sued, a settlement provides the same opportunity to avoid the financial and emotional costs of litigation and create certainty in the outcome.

Why do plaintiffs prefer an open settlement agreement?

Aggrieved plaintiffs may prefer an open settlement agreement because they want the public to know about a particular injustice. Allowing a settlement’s terms to be made public also allows attorneys to adequately ascertain the value of similar cases that may arise in the future.

What is a settlement offer?

Since a settlement offer is essentially a contract between the parties , you can feel free to suggest -- and agree to -- terms that might not have been available if you tried your case in court. For example, some settlement agreements require one party to make a formal apology to the other for the wrongs committed.

How many times should you read a settlement agreement?

Carefully read terms. Whether your side or the other side drafts the settlement agreement, read it several times and make sure you understand everything in it.

What does it mean to make a settlement offer?

A settlement offer during trial might mean that the other side thinks it’s going to lose and wants a more predictable way out of the situation.