After entering this info, SAP will show you the list of transactions posted to this asset in the selected company code and year. Select the transaction by clicking the left and then click on the reverse icon Enter the reversal reason and the posting date on which you want to reverse this along with other information.

How do I reverse a transaction in SAP?

After entering this info, SAP will show you the list of transactions posted to this asset in the selected company code and year. Select the transaction by clicking the left and then click on the reverse icon Enter the reversal reason and the posting date on which you want to reverse this along with other information.

How to settle an asset under construction in SAP?

3.1) To settle an asset under construction go to Navigation: SAP Easy Access -> SAP Menu -> Accounting -> Financial accounting -> Fixed Asset -> Posting -> Capitalize Asset u. Const. ->Settle.

How do I reverse an asset posting?

AB08-Reverse Asset posting AB08- Reverse Asset posting- This tcode is used to reverse an asset posting. If the posting generated from Asset accounting, you cannot use FB08 to reverse this posting. You will need to use AB08. you might have entered the wrong amount or used an incorrect asset etc. hence you need to reverse the posting.

How to simulate settlement document creation?

3.2) Fill out Field Asset with your asset under construction number already created with postings, same that you used in section 2.2.Fill out Fields Document Date, Posting date and Asset Values (it cannot be a date prior to this asset capitalization date). Press “Simulation” button to simulate settlement document creation.

Can you reverse settlement SAP?

There can be a partial or full settlement reversal. A partial settlement reversal is executed when only a part of the settlement group is reversed, which means only a few settlement units out of a group. A full reversal is the process where a credit for the entire amount of the settlement group is created.

How do I reverse a settlement order in SAP?

tcode: KO88. type in the order number and period etc. Click on the settlement menu and click reverse. This will reverse the previous settlement for that period.

How do you reverse an asset in SAP?

Use T code AB08 for reversing asset document. You can select the asset and fiscal year you want to reverse. Then select the document and reverse it.

Can you reverse settlement?

When you reverse a settlement, all transaction distributions that were involved in settling an invoice with a payment are reversed, such as general ledger postings, exchange rate gains or losses, penny differences, and cash discount transactions.

What is KO88 in SAP?

KO88 is a transaction to settle the Order (Production order, Internal order, QM order, PM order, etc). In case of Production order, if there is any balance lying in the order, it would be on account of WIP or variances.

What is KO8G in SAP?

The SAP TCode KO8G is used for the task : Actual Settlment: Int. -/Maintenance Orders. The TCode belongs to the KABR package.

How do you reverse an asset entry?

Reversal of an asset yields the following results:Reversal transactions are generated for all original fixed asset transactions in the corresponding fixed asset book.The annulled asset is displayed as Reversed on reports, with the depreciable basis and the amount of accumulated depreciation equal to zero.

How do you use Abaon in SAP?

ABAON is used when you are retiring an asset and also entering a revenue. This is used when there is no customer involved. If you want to just scrap the asset i.e. it doesn't generate any revenue, then use ABAVN. Enter the posting date, document date, asset date and any text.

How do you reverse an Abaa?

The only way I know to reverse unplanned depreciation is to create a new entry with ABSO and a transaction type which is the opposite of the one you used. Enter then the same values in depreciation areas you put for your unplanned depreciation.

How do I delete a settlement rule in SAP?

Once a settlement receiver has been used in a settlement SAPgui will not allow it to be deleted from the settlement rule. To make the change, put an end date on that settlement rule (To Period / To Fiscal Year fields) and create a second rule using the new receiver, including the From Period / From Fiscal Year fields.

How do you reverse a settlement in Ax?

Hi, Please select "Functions-Closed Transaction editing", then select one of the lines that were settled, AX will automatically select the other one and then click OK or Approve. This will reverse the Settlement.

Is a settlement agreement voidable?

Just like other contracts, settlement agreements are voidable if the agreeing party is coerced, defrauded, too young, or somehow lacks capacity to enter into the agreement. If this is the case, a court will likely hold a hearing to determine if a good-faith agreement was reached.

What are reverse payments?

A payment reversal is any situation where a merchant reverses a transaction, returning the funds to the account of the cardholder who made the payment. Payment reversals are not all created alike. Some have minimal impact on the merchant's bottom line, and others can be quite costly.

What is a reverse payment antitrust?

Reverse payment patent settlements, also known as "pay-for-delay" agreements, are a type of agreement that has been used to settle pharmaceutical patent infringement litigation (or threatened litigation), in which the company that has brought the suit agrees to pay the company it sued.

How do I enforce a settlement agreement in Ontario?

In the absence of a consent to judgment or a dispute resolution clause, if you've settled a dispute in the context of litigation, you can bring a motion to enforce the settlement under Rule 37 of the Ontario Rules of Civil Procedure.

What is AB08 in a tcode?

AB08- Reverse Asset posting- This tcode is used to reverse an asset posting.

Can you do a dropdown to look at all the reversal reasons?

you can do a dropdown to look at all the reversal reasons.

Purpose

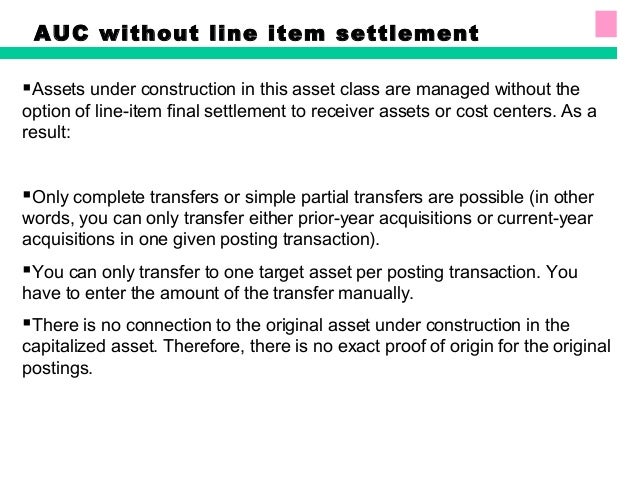

The purpose of this page is to clarify the understanding of the system logic and requirements in relation to the settlement of asset under construction through transaction codes AIAB and AIBU.

Overview

The following paragraphs and screen shots will describe an EXAMPLE in steps of a settlement of asset under construction using transaction codes AIAB and AIBU and provide an explanation of the functionality of the main fields and buttons.

Preparing scenario

1.1) Create an asset under construction using asset class that refers to AUC. and post two acquisitions to this asset with different posting date, please refer to the following link how to post acquisitions: Asset acquistion.

S etting distribution rules through transaction code AIAB

2.1) To set distribution rules to an asset under construction go to Navigation: SAP Easy Access -> SAP Menu -> Accounting -> Financial accounting -> Fixed Asset -> Posting -> Capitalize Asset u. Const. -> Distribute.

Settlement AUC through transaction code AIBU

3.1) To settle an asset under construction go to Navigation: SAP Easy Access -> SAP Menu -> Accounting -> Financial accounting -> Fixed Asset -> Posting -> Capitalize Asset u. Const. ->Settle.

Symptom

In settlement, one can settle a sender with a different period as of Release 4.0. The prerequisite for this is that the posting period is after the settlement period and that the settlement period and posting period are in the SAME fiscal year. This means that a cross-year settlement is NOT possible. Example: Current period is 1/2017.

Product

SAP ERP Central Component all versions ; SAP ERP all versions ; SAP R/3 Enterprise all versions ; SAP R/3 all versions ; SAP S/4HANA Finance all versions ; SAP S/4HANA all versions ; SAP enhancement package for SAP ERP all versions ; SAP enhancement package for SAP ERP, version for SAP HANA all versions

Keywords

KBA, KO88, CO88, KO8G, CJ88, CJ8G, RKO7KO8G, RKO7CJ8G, period end closing, year end closing, unsettled costs, posting period, settlement period, fiscal year, jahresübergreifend, periodenfremd, cross year settlement. , KBA , CO-PC-OBJ , Cost Object Controlling , CO-OM-OPA-F , Period-end Closing , How To

About this page

This is a preview of a SAP Knowledge Base Article. Click more to access the full version on SAP ONE Support launchpad (Login required).