- Contact your state’s Department of Commerce to verify that you are eligible to open a debt settlement company.

- Establish your business entity through incorporating, setting up a partnership or forming a limited liability company.

- Review all state and federal laws governing debt settlement companies, including the Credit Repair Organizations Act.

- Obtain a surety bond from your Department of Commerce and liability insurance in the amounts required by your state.

- Collect financial statements from each partner or owner of your business.

- Become accredited with the Association of Settlement Companies as a credit counseling provider, if you intend to provide those services.

- Develop a standard debt settlement services agreement that you will provide to your clients. This should include a general payment plan and how you intend to collect fees.

- Apply for your debt settlement services provider license with your Department of Commerce and pay the registration fee.

- Join the United States Organizations for Bankruptcy Alternatives, which is an organization committed to ensuring that debt negotiators' voices are heard.

What is the best way to settle debt?

Part 1 of 3: Negotiating the Debt Amount Download Article

- Read the judgment. Debtors and creditors should review the court order (judgment) to determine the total amount due and any specific payment instructions ordered by the court.

- Evaluate your financial situation. Whether you are the creditor or the debtor, you should review your finances before negotiating the amount of the debt.

- Contact the other party. ...

How do I settle a debt with a debt collector?

- A debt collection agency may contact you with a settlement offer.

- You can contact the debt collection agency in writing and offer a settlement figure. ...

- You can make a counter offer if the agency's settlement offer is too high or it rejects your offer. ...

- Accept the terms of the agreement in writing.

How to settle your debts on your own?

How to do a DIY debt settlement: Step by step

- Determine if you’re a good candidate. Have you considered bankruptcy or credit counseling? ...

- Know your terms. You need to negotiate two things: how much you can pay and how it’ll be reported on your credit reports.

- Make the call. Dealing with your creditor will require persistence and persuasion. ...

- Finalize the deal. ...

Do it yourself debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent. Creditors, seeing missed payments stacking up, may be open to a settlement because partial payment is better than no payment at all.

How do I become a debt negotiator?

If you want to become a debt negotiator, you will need excellent communication and negotiation skills. You likely will need certification in debt negotiation, and you might need a college degree. Debt negotiators may work with banks on the terms of a mortgage.

Are debt settlement companies for profit?

According to the Consumer Financial Protection Bureau (CFPB), credit-counseling organizations are usually non-profit organizations whose counselors are certified and trained in the areas of consumer credit, money and debt management, and budgeting.

How do I start debt consolidation?

Here's how to get a debt consolidation loan in five steps.Check your credit score. Start by checking your credit score. ... List your debts and payments. ... Compare loan options. ... Apply for a loan. ... Close the loan and make payments.

How Much Do debt settlement companies charge?

a 15% to 25%Debt settlement companies typically charge a 15% to 25% fee to tackle your debt; this could be a percentage of the original amount of your debt or a percentage of the amount you've agreed to pay.

What is snowball effect in debts?

The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were putting toward that payment and roll it onto the next-smallest debt owed. Ideally, this process would continue until all accounts are paid off.

Is it worth it to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

Can anyone do debt consolidation?

Who can qualify for a debt consolidation loan? Anyone with a good credit score could qualify for a debt consolidation loan. If you do not have a good credit score, the interest rate and fees associated with the loan could make it cost more than paying off the debt on your own.

How much debt can I consolidate?

Success with a consolidation strategy requires the following: Your monthly debt payments (including your rent or mortgage) don't exceed 50% of your monthly gross income. Your credit is good enough to qualify for a 0% credit card or low-interest debt consolidation loan.

Do you get the money from a debt consolidation loan?

Unlike a balance transfer, where you move debt from one account to another, when you get a consolidation loan, the cash is deposited directly into your bank account that you can use to pay off all of your credit card debt at once.

Who is the best debt management company?

The 6 Best Debt Relief Companies of 2022Best Overall: National Debt Relief.Best for Debt Settlement: Accredited Debt Relief.Best for High-Interest Credit Card Debt: DMB Financial.Best for Customer Satisfaction: New Era Debt Solutions.Best for Tax Debt Relief: CuraDebt.Best Interactive Program: Freedom Debt Relief.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

How do debt restructuring companies make money?

Most of them charge a percentage of each debt they settle, based on that debt's balance when you enrolled it in the program. Some charge a percentage of the debt eliminated by the settlement. For example, say you owe $10,000 and the agency negotiates a settlement for $6,000. The agency charges 25%.

How do debt management companies make money?

Debt management companies do make money from debt management plans, which they would not make if their clients pursue other courses of action.

How does debt consolidation make money?

Most debt consolidation companies claim to be nonprofit, but they make a lot of revenue at the expense of their customers. These companies charge customers in several different ways. Some charge a percentage of the payments made to the lenders.

How Much Do debt consolidators make?

$50,169 a yearHow much does a Debt Consolidation make? As of Aug 12, 2022, the average annual pay for a Debt Consolidation in the United States is $50,169 a year. Just in case you need a simple salary calculator, that works out to be approximately $24.12 an hour. This is the equivalent of $964/week or $4,180/month.

Why is it important to be a certified debt professional?

It is important that both the debtor and the creditor trust you and your judgment for you to be able to negotiate a deal successfully. These certifications help toward building this trust.

Do you need a license to negotiate a debt?

So it is best if you tie up with a back end debt negotiator that will meet these legal requirements. These companies will then open a bank account and collect the fees to compensate you for your services. This system works best at least in the initial stages of your business. In case you want to do away with back end companies, consult an attorney and get the requisite licenses.

Is a debt settlement business recession proof?

It is a great business to be in as it is recession proof and you charge a percentage of the debt you help settle as your fee. In other words, the greater the debt, the more you earn from your clients.

What happens when a debtor misses a payment?

When debtors miss payments, or are late, the creditors raise the interest and charge late fees. If the debtor has a balance, the interest and fees drastically increase. Debt settlement services attempts to negotiate with the client’s creditors to find a better position.

How long does bankruptcy ruin your credit?

Bankruptcy not only ruins your credit for up to ten years, it can also effect a company’s decision to hire you or even endanger your current employment and status. A debt settlement program is an alternative before filing bankruptcy.

Is Chapter 7 bankruptcy a viable alternative?

Remember with the recent changes in the bankruptcy law, Chapter 7 typically is not a viable alternative for those with these circumstances. This is what The Debt Alternative Center will train you to indentify.

Is it a good time to start a debt settlement company?

Now is a good time to start a debt settlement company. With National Unemployment at 8% percent, people struggle to survive. All available balances pay for life’s necessities when there is no income source.

Can creditors file a lawsuit against a debtor?

Creditors can file a lawsuit against a debtor if the debt is not paid. Legal actions such as wage garnish, judgment, levies and liens are potential issues that can arise and where we can offer advice to our clients. Making arrangements with creditors and committing to a payment plan may avoid most legal actions against debtors. Our Debt Settlement Account Specialists consult with our clients to discuss possible options for each situation.

What is debt settlement?

Debt settlement allows for a debt management plan that aids clients to determine how much they can afford to pay each month and a time frame where the debts may be paid off if the stipulations in the plan are followed. Debt consolidation and debt counseling both create set payments and a schedule that an enrolled client must abide by.

What happens when a debtor misses a payment?

When debtors miss payments, or are late, the creditors raise the interest and charge late fees. If the debtor has a balance, the interest and fees drastically increase. Debt settlement services attempts to negotiate with the client’s creditors to find a better position.

How long does bankruptcy ruin your credit?

Bankruptcy not only ruins your credit for up to ten years, it can also effect a company’s decision to hire you or even endanger your current employment and status. A debt settlement program is an alternative before filing bankruptcy.

Can creditors file a lawsuit against a debtor?

Creditors can file a lawsuit against a debtor if the debt is not paid. Legal actions such as wage garnish, judgment, levies and liens are potential issues that can arise and where we can offer advice to our clients. Making arrangements with creditors and committing to a payment plan may avoid most legal actions against debtors. Our Debt Settlement Account Specialists consult with our clients to discuss possible options for each situation.

What is debt settlement?

Debt settlement businesses are a third party that mediates between creditors and debt owners and make it easier to repay debt to all those stuck in the process. Such services are very valuable and can make life easier for a large number of people. If you want to learn more about how to start your own debt settlement business in a few easy steps, keep reading.

Is it good to plan at the beginning?

While this process may sound tedious, the fact is that good organization and planning at the outset can go a long way. If you do everything you need to do at the beginning, everything will go much smoother later.

Do debt settlement companies need special licenses?

Also, in some situations, the state does not require special licenses, but the companies you work with do.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What are the downsides of debt settlement?

The Downsides of Debt Settlement. Although a debt settlement has some serious advantages, such as shrinking your current debt load , there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Why do credit cards keep putting you on a debt?

It is usually because the lender is either strapped for cash or is fearful of your eventual inability to pay off the entire balance. In both situations, the credit card issuer is trying to protect its financial bottom line—a key fact to remember as you begin negotiating.

Why would a credit card company drop you?

In other words, your lender may drop you as a client because of your poor track record of paying back what you owe.

How long to cut down on credit card spending?

To raise your chances of success, cut your spending on that card down to zero for a three- to six-month period prior to requesting a settlement.

How to negotiate a credit card?

Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.”. Explain how dire your situation is.

Can a credit card company seize a debt?

Credit cards are unsecured loans, which means that there is no collateral your credit card company—or a debt collector —can seize to repay an unpaid balance. While negotiating with a credit card company to settle a balance may sound too good to be true, it’s not.

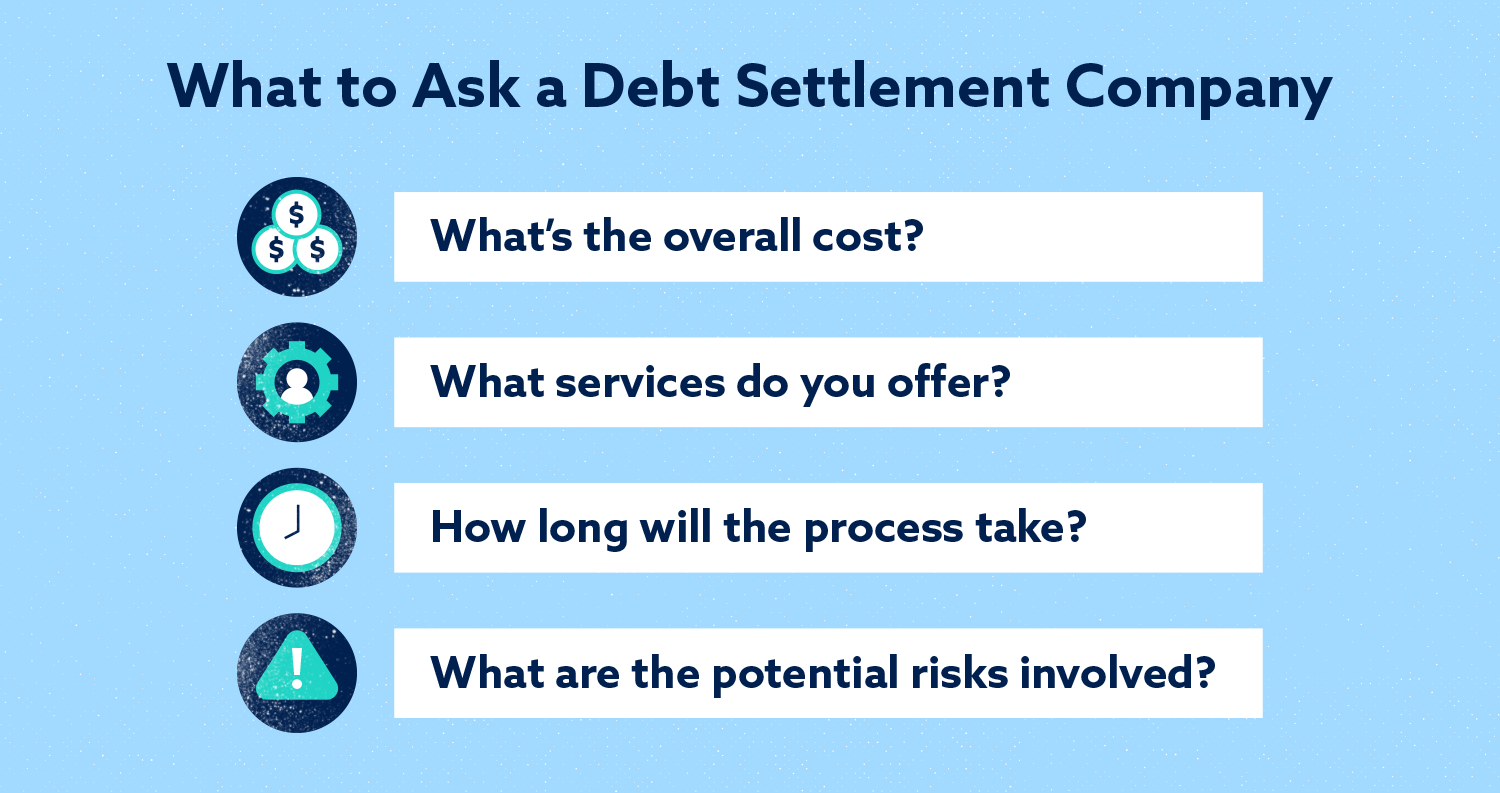

What do debt settlement companies have to explain?

Debt settlement companies must explain price and terms, including fees and any conditions on services.

Why Work with a Debt Settlement Company?

Often there’s a good reason – a layoff or reduction in pay, big medical bills, an unexpected emergency expense. No matter what the reason, it can be difficult to get out from under overwhelming debt on your own. This is particularly true for credit card debt or other revolving debt, that never seems to decrease, even if you’re paying monthly.

What is debt settlement?

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly. Get Debt Help.

How long does it take for a debt settlement to pay?

Meanwhile, the company will negotiate with your creditors to settle for a lower amount. Once you’ve paid the amount the agreement is for into the escrow account, the debt settlement company will pay your creditor. This process can take 2-3 years.

How much does a debt settlement company charge?

Debt settlement companies charge a fee, generally 15-25% of the debt the company is settling. The American Fair Credit Council found that consumers enrolled in debt settlement ended up paying about 50% of what they initially owed on their debt, but they also paid fees that cut into their savings. The report gives an example of a debt settlement client whose $4,262 account balance was reduced to $2,115 with the settlement. So, at first it would seem she saved $2,147, the different between what she owed and what the settlement amount was. But she also paid $829 in fees to the debt settlement company, so she ended up saving $1,318.

What happens when you settle a debt?

In debt settlement, the company will instruct you to stop making payments to the creditors. Your accounts become delinquent, and the debt settlement company tries to negotiate a settlement on your behalf. In the meantime, you give your money to the debt settlement company, who also is not paying the creditor with it.

How much money did a debt settlement save?

The report found that debt settlement clients settled an average of about 50% of what was originally owed, but realized savings of about 30%.