Every item on the settlement sheet needs to be analyzed separately to determine the appropriate accounting presentation. Most of these items can be grouped into the following categories: purchase price, purchase costs, prorations of expenses, escrows, and loan costs.

Full Answer

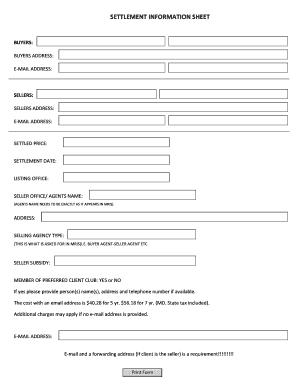

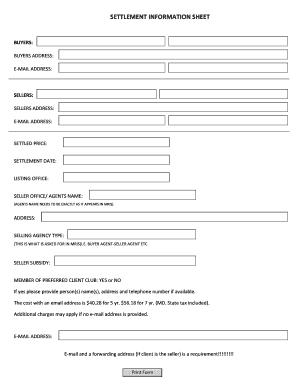

What goes on a settlement sheet?

The negotiated price or reimbursement of all these items are memorialized on a settlement sheet at the purchase date. When the transaction is complete, the buyer then needs to record the transition into their accounting system. The buyer may want to simply record the total cash spent and loans incurred as a building asset on their balance sheet.

What goes on a settlement or closing statement?

One item that normally appears on a settlement or closing statement is home mortgage interest. You can deduct the interest that you pay at settlement if you itemize your deductions on Schedule A (Form 1040). This amount should be included in the mortgage interest statement provided by your lender.

How do you list purchase price on a settlement sheet?

Purchase price: This amount is usually listed as the “selling price” or “consideration” and represents the amount negotiated with the seller less any “seller assist” or price reduction (s) associated with the transaction. Each adjustment should be listed on the settlement sheet as separate lines.

What should I do if I have a question about settlement statements?

If you have a question about your settlement statement, HomeLight always encourages you to reach out to your own advisor. It’s the moment when you can’t bear to see another piece of paper related to your home sale that you’ll receive the settlement statement — also known as a closing statement in real estate.

What items on a settlement statement are tax deductible?

The seller of a business or investment property may deduct condo fees, fees paid out of escrow (for utility bills, insurance, etc.), fire/casualty insurance premiums, interest, and real estate taxes. They can also include the same selling expense items as the seller of a principal residence.

What is deductible on a settlement sheet?

Deductible Expenses Interest on your loan paid at closing is tax deductible. Any prorated property taxes allocated as your expenses are also deductible. You can deduct loan origination fees or points, which are the fees a bank charges you for making the loan.

What can I deduct off my HUD statement?

To figure the HUD-1 tax deductions for purchasers of real estate, you will have to itemize your tax return using 1040, Schedule A. The only HUD-1 tax deductions t are mortgage interest or real estate taxes....The points paid aren't in lieu of other fees, like:Appraisal fees.Title fees.Attorney fees.

How do you read a settlement statement for taxes?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

Are closing costs depreciated or amortized?

Closings costs on a rental property fall into one of three categories: Deduct upfront in the current year. Amortize over the loan term. Add to basis (capitalize) and depreciate over 27.5 years.

Can you subtract closing costs from capital gains?

Capital Gains Tax The price you paid for the home is also called the tax basis. The closing costs associated with selling the rental property that are tax deductible, discussed above, can be used to lower overall basis (or price you paid for the home), thus potentially lowering the capital gains tax.

Is housekeeping a medical expense?

You can claim as eligible medical expenses the salaries and wages paid to all employees performing the following duties or services: food preparation. housekeeping services for a resident's personal living space.

What expenses add to basis of home?

Homeowners: A homeowner's cost basis generally consists of the purchase price of the property, plus the cost of capital improvements, minus any tax credits (like the Residential Energy Credits) that they've received.

What are considered medical expenses?

Medical expenses are any costs incurred in the prevention or treatment of injury or disease. Medical expenses include health and dental insurance premiums, doctor and hospital visits, co-pays, prescription and over-the-counter drugs, glasses and contacts, crutches, and wheelchairs, to name a few.

How do you explain a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

Are settlement expenses deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Are insurance settlements tax deductible?

Generally speaking, any settlement or judgment amount you receive as compensation for lost income is subject to income tax. The reasoning is that your original income would have been taxable had you not suffered the income loss, so any compensation intended to replace that same lost income should be taxable as well.

Are lawsuit settlements taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Are damages payments tax deductible?

Generally speaking, damages awarded for compensation for loss of profits will be taxable in the year of the receipt (note 1). In calculating those damages, income tax is deducted from the calculated losses on the assumption that the lost profits would have attracted tax (note 2).

How to order IRS forms?

Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible.

What percentage of expenditures are used for acquisition, construction, management, maintenance, or care of the corporation's property?

At least 90% or more of the expenditures paid or incurred by the corporation were used for the acquisition, construction, management, maintenance, or care of the corporation’s property for the benefit of the tenant-shareholders during the entire tax year.

Can you deduct itemized charges on real estate taxes?

An itemized charge for services to specific property or people isn’t a tax, even if the charge is paid to the taxing authority. You can’t deduct the charge as a real estate tax if it is:

What to consider when writing a settlement statement?

Either way, one needs to consider many things when writing a settlement statement. Here are some of those things: Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. If you don’t have one, don’t write it.

What Is a Settlement Statement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client.

Why do both parties need to check the contents of a document?

Both parties need to check the contents of the document thoroughly in order to avoid future conflicts and lawsuits. This will serve as one of the final agreements both parties will undergo upon the completion of their transaction. The process, however, might vary from one service provider to another, so the client also need to review the process properly.

Why do people use financial statements?

People involved in business also make use of statements in conducting their business operations. Financial statements express a company’s financial status, operations, and plans over a certain time period. This goes to show that statements are reliable even in the world of business.

How to make sure you get all your deductions?

The best way to make sure you get all of your tax deductions is to talk to your tax advisor. With the Tax Reform and tax deductions changing so drastically, it’s best to get a professional opinion. As long as you make sure you tell your advisor about your home purchase, sale, or refinance and prove payment of the tax-deductible expenses, you may be able to lower your tax liability.

Is a settlement statement tax deductible?

What Settlement Statement Items are Tax Deductible? Closing on a loan can cost you several thousand dollars. Before you let that prevent you from buying a home or refinancing, learn which settlement statement items are tax deductible. This lowers the overall cost of closing on a loan, by lowering your tax liability at the end of the year.

Can you deduct refinance costs on settlement?

Even if you refinance, you may be able to deduct some of the costs on your settlement statement.

Do you include prepaid interest on closing statement?

Don’t forget to include the prepaid interest on your Loan Closing Statement in your taxes. Points paid – Again, lenders may charge origination fees or discount points. Luckily, the IRS lets you deduct these items even if you refinance. The difference, however, is how you deduct them.

What is a seller's owe?

Any amounts the seller owes that you agree to pay, such as back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions.

What is included in basis?

Your basis includes the settlement fees and closing costs for buying property. You can't include in your basis the fees and costs for getting a loan on property. A fee for buying property is a cost that must be paid even if you bought the property for cash.

Do you add points to the basis of a mortgage?

If you pay points to obtain a loan (including a mortgage, second mortgage, line of credit, or a home equity loan), don't add the points to the basis of the related property. Generally, you deduct the points over the term of the loan. For more information on how to deduct points, see Points in chapter 4 of Pub. 535.

Do you have to pay title transfer fees to sell a house?

as the seller, the only expenses you have are all related to the disposition of the property. You don't have any expenses related to the acquisition or disposition of a mortgage. So for you, expenses related to the disposition of the property are added to your cost basis of the property. As an example, that would include title transfer fees if you the seller actually paid those fees. (typically, the buyer pays all the property acquisition fees - but not always.)

Which line items reduce line items 106, 107, and 108?

Line items 210, 211, and 212 will reduce line items 106, 107, and 108 respectively.

What is closing cost?

Closing costs can amount to a significant outlay of capital, so it’s important to understand when you can recover that capital. Closing costs may fall into one of the following three categories: Deductible as a current expense. Added to the cost basis of the property and depreciated.

What is the 804. appraisal fee?

804. Appraisal Fee: If required to obtain a loan, the cost is amortized over the life of the loan. If an appraisal is not required, the cost is added to the basis of the property and depreciated over the life of the property.

Is a 1001 escrow account deductible?

1001. Initial Deposit for Your Escrow Account: This amount will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

Is a line item amortized over the life of the loan?

All of these line items are amortized over the life of the loan.

Is 1002-1004 a current expense?

1002-1004 are deposited with your lender and will be deductible as a current expense when the funds are disbursed from your escrow account by the lender.

How to use settlement worksheet?

To use the Settlements Worksheet you simply take your settlement and enter your pay, deductions & reimbursed expenses in the appropriate sections. When you're finished click CALCULATE, enter the net amount of your check in the popup that appears and if it balances export it.

How to mark a settlement as settled?

If you have a reimbursed expense on your settlement, locate it using the data toggle and click the MARK button. That will mark it as SETTLED and will also mark the related Income & Expense entry as SETTLED with the date of your settlement.

What is the number on the SETTLED - 1008 - 10/16/2014?

The number on the SETTLED - 1008 - 10/16/2014 is the number of the transaction that settled this Reimbursed Expense and the date of the settlement.

What happens if you exit the page before exporting a settlement?

Note: if you exit the page before you export the settlement the Reimbursed Expenses will be reset to Outstanding so wait until you are finished and ready to Calculate and Export the settlement before you mark the Reimbursements as settled.

What is OTHER PAY?

OTHER PAY: This is where you'll enter load/unloading pay, stop pay, safety, bonus, detention, fuel surcharges & other payments which are not listed in the drop down.

What happens if you don't use the Trip Sheet?

REIMBURSEMENTS: Any outstanding reimbursements that you have entered in the Trip Sheet or Income & Expense section if you are not using the Trip Sheet will automatically be imported to the Settlement page when you start a new week. If you load a previous week any that were Settled in that week will be loaded.

How many boxes are there in a pay mile?

Pay Mile: with two boxes, one for each pay rate.