At A Glance:

- In your counter offer letter, you should include details of why you should be owed more compensation.

- You should consider factors of why insurance has offered you a specific settlement amount.

- A personal injury attorney may be able to help you with your counter offer for insurance settlement.

When to make a counter offer to an insurance company?

/ Insurance Letters When a person submits a claim letter to an insurance company, whether it’s for a car accident, medical malpractice, personal injury or other reason, the insurance company will respond with a first offer. At this point, the claimant has the right to make a counter offer, and in most cases, this is the best thing to do.

How do I write a letter requesting compensation from the insurance company?

In the letter, you will need to refer to the offer made by the insurance company and when it was made. You will then need to reiterate why you think you are owed damages from the other party and why you think that offer was low.

How to write an offer letter to settle a personal injury claim?

As an example, you might start your letter out by stating: “In our conversation yesterday, you relayed the message that the insurance company was willing to settle my personal injury claim for $3,000. However, this offer is much too low and is not supported by the facts of the accident.”

How do you write a counter offer letter for insurance?

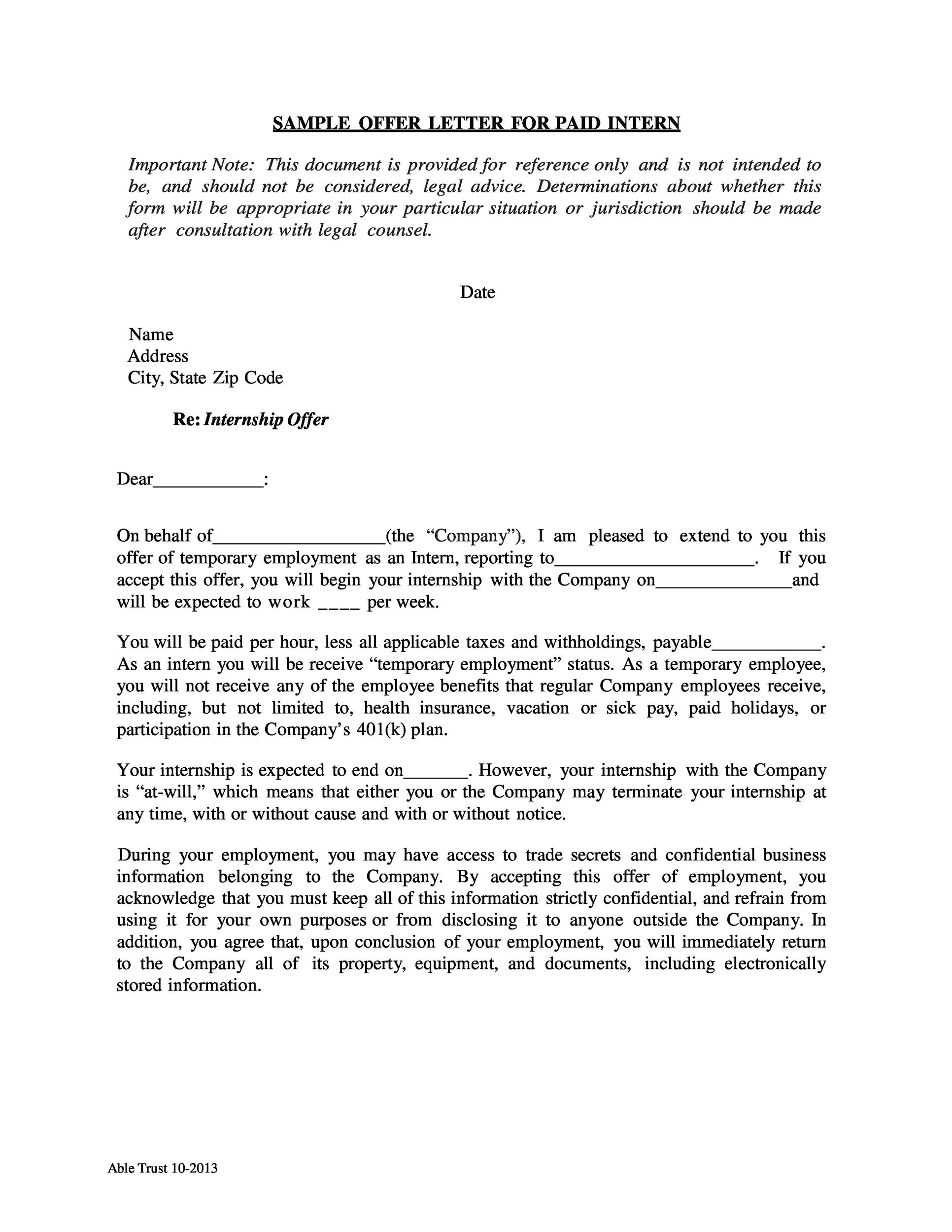

Here is a sample counter offer letter. It should be written in formal business style and sent by certified mail, so the claimant has proof of the date and time the letter was received. If any documents are enclosed, they should be copies. Original documents should not be sent unless the insurance company specifically asks for them.

How do you write a good settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How do you respond to a low ball settlement offer?

Here's a quick summary of the steps you and your attorney will follow when responding to a low settlement offer: Remain calm and analyze the offer even if you feel like the adjuster is trying to take advantage of you. Ask questions to find out how the adjuster came to the conclusion that they did.

How do you write a convincing demand letter to settle an insurance claim?

7 Tips for Writing a Demand Letter To the Insurance CompanyOrganize your expenses. ... Establish the facts. ... Share your perspective. ... Detail your road to recovery. ... Acknowledge and emphasize your pain and suffering. ... Request a reasonable settlement amount. ... Review your letter and send it!

How do you decline a low settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

What do I do if my insurance offer is too low?

Here are five steps to take if the insurance company is lowballing you:Get Help from an Attorney. ... Make Sure It Is Actually a Lowball Offer. ... Figure Out Why the Insurance Company Is Lowballing You. ... Collect the Evidence You Need to Prove Your Claim. ... Keep Negotiating and/or File a Lawsuit in Court.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

How do you explain pain and suffering?

Pain and suffering refers to the physical discomfort and emotional distress that are compensable as noneconomic damages. It refers to the pain, discomfort, anguish, inconvenience, and emotional trauma that accompanies an injury.

What should a demand letter include?

The demand letter should include the following information:the purpose of the letter.the parties involved.the date/time of the grievance.a description of any and all damages incurred by the writer.the demand for restitution2.

How do you write a letter of emotional distress?

Don't exaggerate, but use vivid language to describe the fear, embarrassment, and other forms of emotional distress you experienced from the incident. Describe your injuries using medical terms taken from the doctor's notes in your medical records.

How do insurance companies negotiate settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

Should you accept first offer insurance claim?

Once the offer is made, you have 21 days to decide whether or not to accept it. You should always take legal advice before accepting a Part 36 offer, especially if you have a conditional fee agreement or are using an insurance policy to cover your legal expenses, as you may find you invalidate your contract.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

Should you respond to a low ball offer?

Acknowledge it's a low ball offer It's important to be direct in the process, and acknowledge that you see the offer as too far under the market value. Don't respond immediately; instead, let them know you'll get back to them.

How do you negotiate a low ball offer?

What to do When You Get a Lowball Job Offer: Steps and StrategiesThank the employer for the offer. ... Ask for time to consider the offer. ... Research salary data that you can use in a negotiation. ... Decide the minimum salary you're willing to accept. ... How to respond to a lowball job offer: samples for email/phone.More items...

How do you respond to low ball offers on Facebook marketplace?

4:0912:53Facebook Marketplace Negotiation Tips - How to LOWBALL the RIGHT ...YouTubeStart of suggested clipEnd of suggested clipRemember if you see at anything that is not as they stated. That is a point for you to negotiate.MoreRemember if you see at anything that is not as they stated. That is a point for you to negotiate. Down on the price. If you see a scratch. You see a little ding here or there.

What percentage is a lowball offer?

What is considered a lowball offer? As a rule, anything below 10 percent of the initial asking price is considered a lowball offer. A lowball offer for a house listed at $500,000 would fall around $450,000. That being said, the market determines what is considered low balling.

What to say in an insurance letter?

In the letter, you will need to refer to the offer made by the insurance company and when it was made. You will then need to reiterate why you think you are owed damages from the other party and why you think that offer was low.

What to do when you receive an insurance offer?

When you receive an offer from the insurance company the letter you receive will have a low offer with some reasons given for the reduced amounts. In your response you should counter their claims and reiterate why you should receive a higher amount. A good example of a counter offer letter is: Dear [Adjuster’s name]

What to ask for in a demand letter?

But the amount of money that you ask for in the demand letter should be an honest reflection of the amount of the damages that you incurred plus compensation for pain and suffering.

What does an adjuster do in an accident?

The first thing an adjustor will do is look at the police report of the accident and your account of the accident looking for any discrepancies.

Why is the amount in a demand letter always lower than the amount you asked for?

This amount will always be lower than the amount you asked for in the demand letter because they want to negotiate a smaller amount than you asked for. Try not to react emotionally when you get the offer and keep in mind that their motivation is most likely to pay as little as possible.

What does an adjuster consider when settling a claim?

Then the adjustor will consider how much time, money, and resources would go into fighting your claim in court. If the cost of going to court is high or there is a good chance that you will win in court because you have evidence backing up your claim, then the adjustor will usually recommend a settlement amount that will be cheaper for the company than going to court.

Do you send a letter with delivery confirmation?

You will then want to send the letter with delivery confirmation, so you can be sure that the other party received it and the date on which it was received.

How do you know whether a settlement offer is too low?

By the time your settlement offer comes in, your attorney should have thoroughly explored the facts of your case, ascertained your damages, collected relevant evidence, and performed a reasonably accurate valuation of what your case is worth. Generally speaking, the settlement offer should compensate for your damages. This might include concrete damages like medical bills and lost wages, or more subjective damages like pain and suffering and a decreased quality of life. If your settlement offer does not, then the offer is likely too low to accept.

How do you calculate your counter-offer amount?

To establish your counter-offer amount, you will need to think critically about your damages, the limits of the other party’s policy, as well as their potential assets.

What to do when you get quoted a low settlement offer?

Being quoted a low settlement offer can be frustrating, especially if your injury requires extensive medical care leading to a pile of bills. Before you blow your lid and spout angry words at the adjuster, take a step back and calm down. Acting rashly or saying something harsh will do nothing for you or your claim. After you’ve taken the time to cool down, write a brief letter responding to each of the factors the adjuster mentioned.

How to accept an insurance adjuster offer?

Along with providing your information in writing, you should request any offers from your adjuster in writing too. This is especially true of your final offer. Once you have received the final offer from your adjuster, and you are satisfied with the amount, write the insurance company a letter stating that you formally accept their offer.

Why do adjusters give you a low offer?

Sometimes adjusters will give you an obviously low offer as a tactic, which they use to see if you understand the value of your claim. If this happens, don’t immediately respond with a counteroffer lower than your demand letter. Rather, ask why the adjuster has provided this extremely low figure.

What to do when discussing financial matters?

When you discuss financial matters in any way – whether it is the bills you have received or the counteroffers you send – get everything in writing and store it somewhere safe. Not only does putting this type of information in writing appear more professional, but it also provides you with a physical copy of the information you’ve provided the insurance company. Having this information can be proof if something goes awry in your case.

Is it risky to settle a case without legal counsel?

Resolving cases without legal counsel is very risky. Often times, other organizations are entitled to some of the money being paid in a settlement through subrogation liens/reimbursement rights. For example, a health insurer who pays for your medical treatment following a car accident may or may not be entitled to reimbursement out of your personal injury settlement.

Is it difficult to determine the value of a case?

Note: Keep in mind that determining the true value of your case is extremely complicated. No matter what type of case it is, there are very specific laws that discuss how the compensation you are entitled to is calculated. Any person acting without the advice of legal counsel is at a significant risk of undervaluing or overvaluing their claim simply because they don’t know how to determine the value.

Can you negotiate an insurance dispute?

In this instance, you’ll need to negotiate. While we strongly recommend contacting an experienced insurance dispute attorney near you as soon as possible to ensure the best possible settlement, there are some steps of the insurance negotiation process that can help you right now.

What happens when you make a counter offer to a debt settlement?

When making a counter offer, the borrower should be absolutely sure they cannot meet the offer given. When a counter offer is made, it voids the original offer. The creditor could withdraw the original debt settlement offer ...

What happens if a counter offer letter is arrogant?

If the counter offer letter is arrogant in tone or too full of misery, the creditor may not take it seriously and think that the borrower is just trying to pay as little as possible. It should be professional and accurate. When creditors make a debt settlement offer, they have decided to accept a lower amount.

What is debt settlement?

In general, debt settlement is usually about half of the total amount of money owed. If the original debt settlement offer from the creditor was less than this, the borrower may want to send a counter offer that is about half of what he or she owes. This amount has a good chance of being accepted by the creditor because it is still within ...

What is debt settlement counter offer?

If this is the case, the borrower may send a debt settlement counter offer of a lower amount. The letter should explain the reason the borrower cannot pay the amount offered by the creditor. In general, debt settlement is usually about half of the total amount of money owed. If the original debt settlement offer from the creditor was less ...

What happens if a creditor negotiates with a borrower?

If a creditor is willing to negotiate with a borrower for a lower amount in order to have a debt paid off, the creditor may send a debt settlement offer to the borrower. This settlement amount may still be more than the borrower can pay due to circumstances beyond his or her control. If this is the case, the borrower may send a debt settlement ...

Can a debt settlement be written in certified mail?

The borrower can send it by certified mail with a return requested. All correspondence connected to the borrower’s attempt at getting a debt settlement should be saved. Any documents sent, such as medical reports, should be copies.

Can a creditor withdraw a debt settlement offer?

The creditor could withdraw the original debt settlement offer and require the borrower to pay the debt in full. Because of this, the debt settlement counter offer should be supported by relevant statistics. Creditors often think that debts that are long overdue will not be paid.