Format your counteroffer as a formal or business letter, which includes these steps:

- Add your contact information: At the top left of your letter, include your full name, address and contact information, the date and the employer's full name, title and address.

- Use a professional greeting: Address the hiring manager using a professional greeting such as "Dear Ms. Gammond."

- Write an introduction: Begin your letter with a brief introduction (usually two or three sentences) thanking the hiring manager for the job offer and emphasizing your interest in the position. ...

- State your counteroffer: In the body of the letter, clearly state the company's offer and your counteroffer and why you think it is justified. ...

- Conclude the letter: Repeat your excitement to work with the company and why your counteroffer is appropriate. ...

- Add a closing salutation: Use a formal salutation such as "Respectfully" or "Sincerely," followed by your full name and signature.

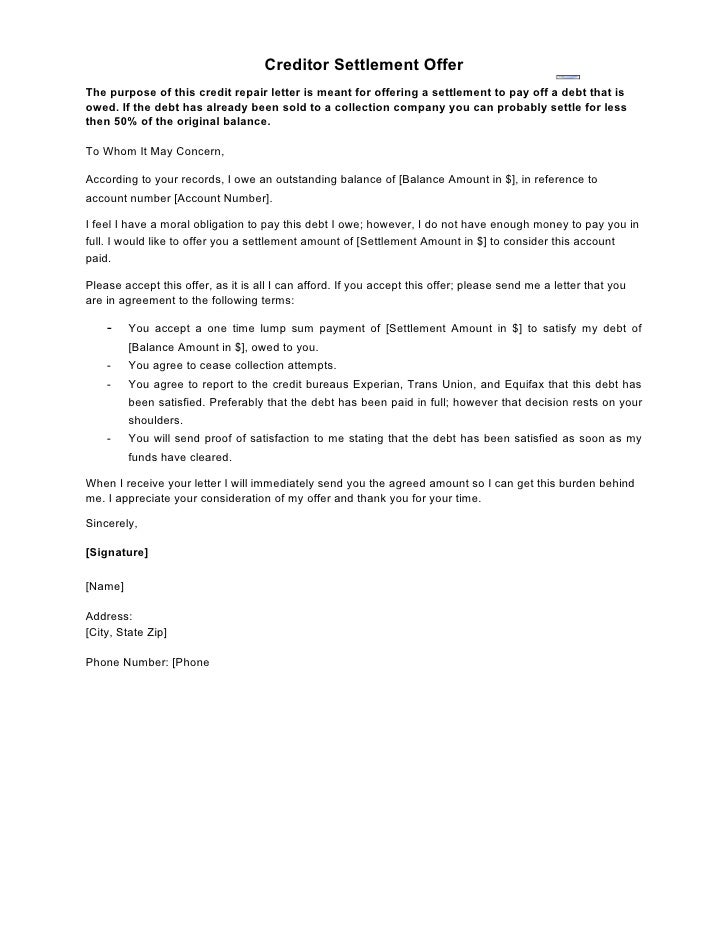

How to write a counter offer letter for debt settlement?

A sample format of a counter offer letter is given below: I appreciate that your company is willing to negotiate with me to settle my debt. This letter is to make a counter offer in response to the amount your customer service representative has asked me to pay in order to repay the debt in full.

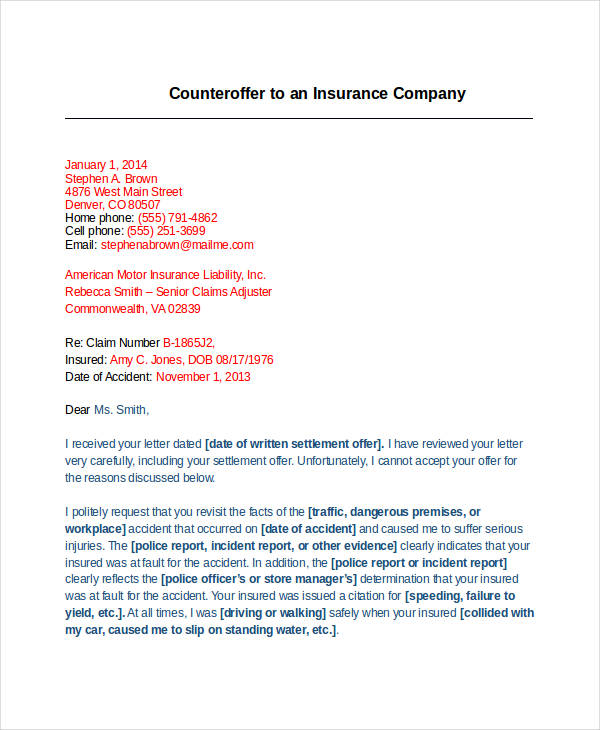

How do you write a counter offer letter for insurance?

Here is a sample counter offer letter. It should be written in formal business style and sent by certified mail, so the claimant has proof of the date and time the letter was received. If any documents are enclosed, they should be copies. Original documents should not be sent unless the insurance company specifically asks for them.

How do I submit a counteroffer to an employer?

Job applicants can submit a counteroffer to an employer in a few ways: 1 Meet with the employer for an in-person negotiation. 2 Speak with the employer over the phone. 3 Write a counter offer letter. More ...

How do I respond to a low settlement offer?

You should then write a formal letter of response in which you state that you don’t find the initial low settlement offer acceptable, listing the reasons why and concluding with a demand for a higher settlement offer.

How do you write a good settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What is a counter offer in a settlement?

Come Up with a Counteroffer Your attorney will send your formal rejection of the initial offer and a counteroffer to reflect the fair settlement amount you deserve in compensation for things like future medical expenses, pain and suffering, and other damages.

How do I write a counter offer for a car accident?

From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

How do you respond to a low ball settlement offer?

Here's a quick summary of the steps you and your attorney will follow when responding to a low settlement offer: Remain calm and analyze the offer even if you feel like the adjuster is trying to take advantage of you. Ask questions to find out how the adjuster came to the conclusion that they did.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

How do you negotiate a better settlement agreement?

How to Negotiate the Best Deal on Your Settlement AgreementPrepare Well for the Settlement Agreement Negotiation. ... Decide which negotiation tactics to use. ... Ask for a Protected Conversation with your Employer. ... Don't ask for too much. ... Don't ask for too little. ... Find out how the settlement payments will be taxed.More items...

How do you negotiate a settlement with an insurance claims adjuster?

Begin the Settlement Negotiation Process (5 Steps)Step 1: File An Insurance Claim. ... Step 2: Consolidate Your Records. ... Step 3: Calculate Your Minimum Settlement Amount. ... Step 4: Reject the Claims Adjuster's First Settlement Offer. ... Step 5: Emphasize The Strongest Points in Your Favor.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

Can you negotiate a car settlement figure?

Even if the offer seems reasonable at first glance, you should always negotiate. After you research the value of your car, come up with a number that you feel is fair for a settlement. It should be the absolute minimum you are willing to accept.

How do you decline a low settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

What do I do if my insurance offer is too low?

Here are five steps to take if the insurance company is lowballing you:Get Help from an Attorney. ... Make Sure It Is Actually a Lowball Offer. ... Figure Out Why the Insurance Company Is Lowballing You. ... Collect the Evidence You Need to Prove Your Claim. ... Keep Negotiating and/or File a Lawsuit in Court.

How long does an insurance company have to respond to a counter offer?

In the best-case scenario, the insurance company will respond to your demand letter within 30 days. However, you generally have to wait anywhere from a few weeks to a couple of months because no law sets a deadline.

How much should I offer in a settlement agreement?

The rough 'rule of thumb' that is generally used to determine the value of a settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary.

How long does an insurance company have to respond to a counter offer?

In the best-case scenario, the insurance company will respond to your demand letter within 30 days. However, you generally have to wait anywhere from a few weeks to a couple of months because no law sets a deadline.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How do you turn down a settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

Why do you write a counter offer letter?

There are a few reasons why a job applicant may want to make a counteroffer through a letter rather than meeting or calling an employer, including: It can put you at ease: Writing a counter offer letter is ideal for applicants who feel nervous about negotiating in person.

What should the subject line of a counter offer letter be?

Subject line: If you send the counter offer letter as an email, the Subject Line of your message should be your name and the reason you are writing in the format "Your Name - Job Offer."

What is a Counteroffer?

A counteroffer is a proposal made by a job applicant to an employer in response to an unsatisfactory job offer. Job applicants can submit a counteroffer to an employer in a few ways:

How to negotiate compensation package?

Or, state the specific changes in the letter itself. If you go the latter route, include a short paragraph for every part of the compensation package that you want to negotiate. In each paragraph, clearly state the original offer, your counteroffer, and why you believe the counteroffer is appropriate. For example, after you state the original salary and your desired salary, explain that their offer was below the national average salary for the job.

How to keep a job from going with another job?

Communicate other job offers. If you have a competing job offer, convey it to the employer to incentivize them to up the ante and offer a better compensation package to keep you from going with the other job. Emphasize your sought-after skills.

What to say in a Witten interview?

I feel that with the skills, experience, and contacts in the industry that I would bring to Witten, further discussion of my compensation would be appropriate.

What is an example of a letter requesting additional compensation?

Here's an example of a letter requesting additional compensation. The writer makes a counter salary offer with claims to back up the request.

What happens when you make a counter offer to a debt settlement?

When making a counter offer, the borrower should be absolutely sure they cannot meet the offer given. When a counter offer is made, it voids the original offer. The creditor could withdraw the original debt settlement offer ...

What is debt settlement counter offer?

If this is the case, the borrower may send a debt settlement counter offer of a lower amount. The letter should explain the reason the borrower cannot pay the amount offered by the creditor. In general, debt settlement is usually about half of the total amount of money owed. If the original debt settlement offer from the creditor was less ...

What happens if a counter offer letter is arrogant?

If the counter offer letter is arrogant in tone or too full of misery, the creditor may not take it seriously and think that the borrower is just trying to pay as little as possible. It should be professional and accurate. When creditors make a debt settlement offer, they have decided to accept a lower amount.

What is debt settlement?

In general, debt settlement is usually about half of the total amount of money owed. If the original debt settlement offer from the creditor was less than this, the borrower may want to send a counter offer that is about half of what he or she owes. This amount has a good chance of being accepted by the creditor because it is still within ...

What happens if a creditor negotiates with a borrower?

If a creditor is willing to negotiate with a borrower for a lower amount in order to have a debt paid off, the creditor may send a debt settlement offer to the borrower. This settlement amount may still be more than the borrower can pay due to circumstances beyond his or her control. If this is the case, the borrower may send a debt settlement ...

Can a debt settlement be written in certified mail?

The borrower can send it by certified mail with a return requested. All correspondence connected to the borrower’s attempt at getting a debt settlement should be saved. Any documents sent, such as medical reports, should be copies.

Can a creditor withdraw a debt settlement offer?

The creditor could withdraw the original debt settlement offer and require the borrower to pay the debt in full. Because of this, the debt settlement counter offer should be supported by relevant statistics. Creditors often think that debts that are long overdue will not be paid.

How to request a counteroffer?

Make a request: Politely request your desires rather than demand them. Use a firm tone without sounding aggressive or using absolutes. Some companies might not be able to accept your exact counteroffer, but may be willing to negotiate.

What is a counteroffer letter?

A counteroffer letter is a formal letter a job candidate writes to a hiring manager when they're unsatisfied with the initial job offer. The individual usually states their interest in accepting the job but wants to negotiate its terms. A counteroffer letter can be a physical letter or an email. You might write a counteroffer letter if:

How to counter offer a job?

Follow these tips to ensure you communicate your counteroffer to the hiring manager clearly: 1 Perform research: Research the market, industry, similar positions and the area's cost of living to make sure your counteroffer is reasonable. Use data and examples to support your request. You are more likely to get a positive response if you provide evidence for why you deserve a higher salary or more benefits. 2 Include your skills: Increase your chances of getting more money by emphasizing your most in-demand skills. If you have sought-after skills that are hard to find, such as being proficient in a complex computer programming language, remind the hiring manager of this valuable skill. 3 Make a request: Politely request your desires rather than demand them. Use a firm tone without sounding aggressive or using absolutes. Some companies might not be able to accept your exact counteroffer, but may be willing to negotiate. 4 Include information about other offers: If you have received multiple job offers, share this information with the hiring manager to increase your chances of receiving a more competitive salary. 5 Review your letter: Proofread or have someone else proofread your counteroffer letter carefully before sending it to avoid spelling or grammar errors. 6 Prepare for the response: Be prepared for the employer's response, and know how you will react to the company accepting, rejecting or countering your counteroffer. Set a minimum amount you plan to accept to take the job.

How to write a letter to a hiring manager?

Write an introduction: Begin your letter with a brief introduction (usually two or three sentences) thanking the hiring manager for the job offer and emphasizing your interest in the position. State why you believe you are the perfect candidate for the job so the employer understands your value to the company and why you are worth more compensation.

How to avoid spelling errors in counteroffer letter?

Review your letter: Proofread or have someone else proofread your counteroffer letter carefully before sending it to avoid spelling or grammar errors.

How to conclude a letter of compensation?

Conclude the letter: Repeat your excitement to work with the company and why your counteroffer is appropriate. Offer to meet the hiring manager to discuss your compensation in person, and thank them for their time.

What to do when you and the hiring manager agree on a new offer?

If you and the hiring manager agree on a new offer, get it in writing so you have a record of your communications and expectations.

What to do when you get quoted a low settlement offer?

Being quoted a low settlement offer can be frustrating, especially if your injury requires extensive medical care leading to a pile of bills. Before you blow your lid and spout angry words at the adjuster, take a step back and calm down. Acting rashly or saying something harsh will do nothing for you or your claim. After you’ve taken the time to cool down, write a brief letter responding to each of the factors the adjuster mentioned.

How to accept an insurance adjuster offer?

Along with providing your information in writing, you should request any offers from your adjuster in writing too. This is especially true of your final offer. Once you have received the final offer from your adjuster, and you are satisfied with the amount, write the insurance company a letter stating that you formally accept their offer.

Why do adjusters give you a low offer?

Sometimes adjusters will give you an obviously low offer as a tactic, which they use to see if you understand the value of your claim. If this happens, don’t immediately respond with a counteroffer lower than your demand letter. Rather, ask why the adjuster has provided this extremely low figure.

What to do when discussing financial matters?

When you discuss financial matters in any way – whether it is the bills you have received or the counteroffers you send – get everything in writing and store it somewhere safe. Not only does putting this type of information in writing appear more professional, but it also provides you with a physical copy of the information you’ve provided the insurance company. Having this information can be proof if something goes awry in your case.

Is it risky to settle a case without legal counsel?

Resolving cases without legal counsel is very risky. Often times, other organizations are entitled to some of the money being paid in a settlement through subrogation liens/reimbursement rights. For example, a health insurer who pays for your medical treatment following a car accident may or may not be entitled to reimbursement out of your personal injury settlement.

Is it difficult to determine the value of a case?

Note: Keep in mind that determining the true value of your case is extremely complicated. No matter what type of case it is, there are very specific laws that discuss how the compensation you are entitled to is calculated. Any person acting without the advice of legal counsel is at a significant risk of undervaluing or overvaluing their claim simply because they don’t know how to determine the value.

Can you negotiate an insurance dispute?

In this instance, you’ll need to negotiate. While we strongly recommend contacting an experienced insurance dispute attorney near you as soon as possible to ensure the best possible settlement, there are some steps of the insurance negotiation process that can help you right now.