- Start with the names and addresses of both the debtor and the creditor.

- Then an acknowledgment of the debt should follow.

- Mention an agreed settlement amount as well as a time frame.

- Note that the debt settlement firm will supersede the prior agreements or negotiations made in regard to the debt.

- Further assurances, rules, and recommendations are made.

- Sign of from both parties. By signing, the document is executed and becomes legal.

- Original creditor and collection agent's company name.

- Date the letter was written.

- Your name.

- Your account number.

- Outstanding balance owed on the account (optional)

- Amount agreed to as settlement.

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

How to negotiate the best possible settlement agreement?

Your solicitor will be able to advise you on factors such as:

- The amount of compensation you should be entitled to in the settlement agreement

- The most cost-effective way of drafting the document to avoid having to pay tax unnecessarily

- Whether you have any prospect of an Employment Tribunal claim against your employer and what the value of that claim would be

Is debt settlement a good option?

While there are other debt-relief options, there are instances where working with a debt settlement company may be an ideal option for you to achieve financial relief. Some of the advantages to opting to work with a debt settlement company include: Debt settlement is a good option when you want to pay off your debts fast.

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How do I write a debt settlement letter?

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What are debt settlement documents?

A debt settlement agreement is a contract signed between a creditor and debtor to re-negotiate or compromise on a debt. This is usually in the case when an individual wants to make a final payment for a debt that is owed.

What is a debt settlement contract?

A debt settlement agreement is a legal document that outlines an arrangement between a creditor and debtor where the creditor forgives part of the debt in exchange for immediate payment. It's important to note that this is not bankruptcy, it is just one more option you can use to get out of debt.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle a debt or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What are the consequences of debt settlement?

Debt settlement can cause your credit score to fall by more than 100 points, and it stays on your credit report for seven years. If your creditors close accounts as part of the settlement process, this can cause your credit utilization to increase, which also negatively affects your credit score.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What are debt agreements?

A debt agreement is a legal contract between a debtor and a creditor to settle outstanding debt. These agreements are used when the debtor cannot pay the full amount of debt and is facing bankruptcy. In a debt agreement, the creditor allows a debtor to negotiate down the total debt owed.

How do you write a settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

Can I negotiate with debt collectors?

You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney. Record your agreement. Sometimes, debt collectors and consumers don't remember their conversations the same way.

Why do debt collectors offer discounts?

Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount.

Can I settle a debt with the original creditor?

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

What does a letter to a debtor state?

The letter needs to clearly state the hardships that have caused the debtor to be unable to pay his or her debt. The person will not be successful in reducing his or her debt if they say they made too many purchases, and now they can’t pay for them.

How to find out who is in charge of a debt?

The debtor can call the creditor and find out the name of the person in charge of their debt. The letter should be sent by certified mail, and the sender should keep a copy.

What should a borrower remember when writing a letter?

When writing the letter, the borrower should remember that the creditor has the right to agree or deny a reduction in debt and accept a lower amount. Most creditors are happy to receive some payment rather than no payment.

Is a letter of settlement a good idea?

If the letter is courteous and polite, and offers a good reason for settling the debt, there is a good chance it will succeed. Some debts are past the statute of limitations and the creditor will be happy to get anything.

Can a creditor file a hardship letter in the trash?

This may cause the creditor to file the letter in the trash. If the creditor has agreed over the phone to the debt settlement, the hardships need not be mentioned in the letter.

What a Debt Settlement Agreement Must Include

After you have negotiated a debt settlement with a creditor, such as a credit card company, you will need to formalize your agreement in writing. You can write the agreement yourself and send two copies to your creditor so that they can send a signed copy back to you. Or it may be easier to have your creditor draft up a letter and send it to you.

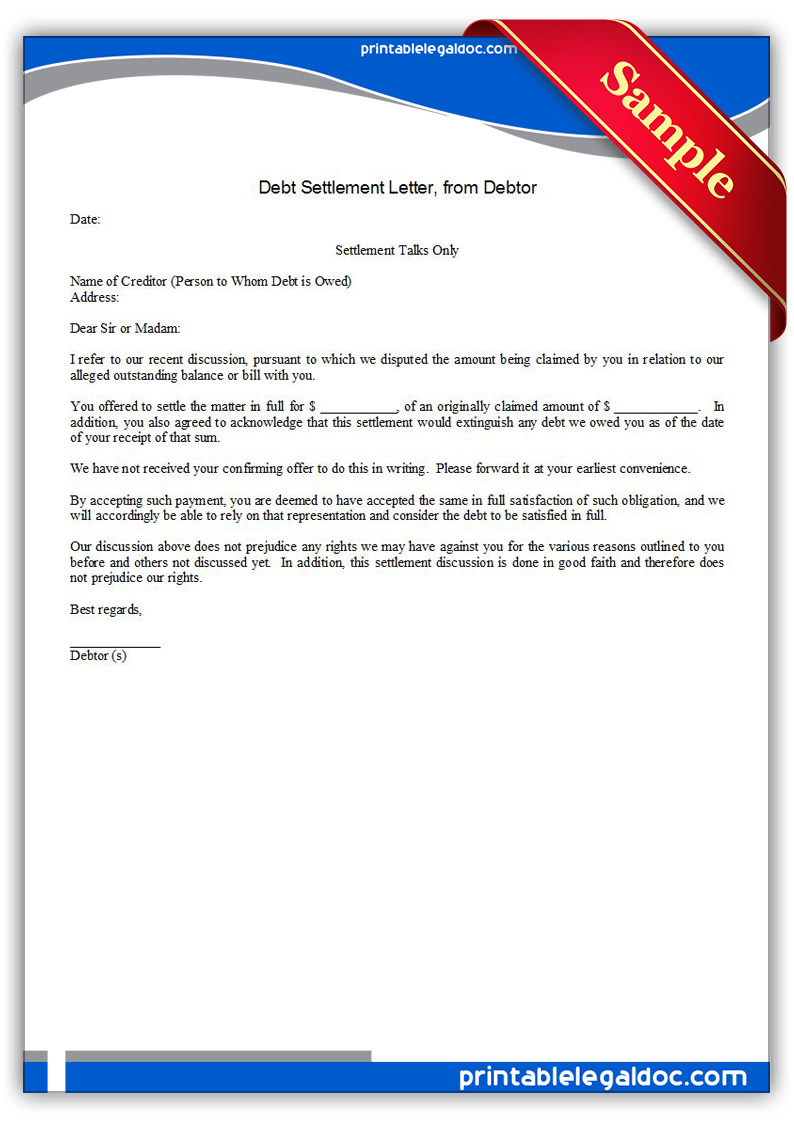

Sample Debt Settlement Letter Template

Here is a general template that you can use to draft your debt settlement agreement. You can add to, remove, or modify the information contained in this agreement to match your circumstances. The agreement letter can be either simple or complex, depending upon your specific financial situation and the type of debt that you owe.

What is debt settlement agreement?

The Debt Settlement Agreement is a contract signed between a creditor and debtor to re-negotiate or compromise on a debt. This is usually in the case when an individual wants to make a final payment for a debt that is owed. The debtor offers a payment that is less than the outstanding due (usually between 50% to 70%) if ...

What is debt settlement?

Debt Settlement. It is understood amongst the Parties that the Debtor has an outstanding debt with the Creditor. Through the mutual interest of the Parties, they agree that this outstanding debt shall be marked as paid if Debtor shall make payment of $______________ by ______________, 20___.

What happens after a debt payment is made?

After the payment has been made by the Debtor the Creditor shall make any and all efforts to remove the outstanding debt from the Credit Reporting Agencies. Furthermore, the Creditor declares that they will not make additional information that could harm the Debtor’s credit report.

How to sign a debt agreement?

The Debtor must sign this Agreement to formally enter it. He or she will need to locate the words “Debtor’s Signature” then sign the blank line after them. Adjacent to this he or she should enter the current Date. Finally, the Debtor must print his or her Name on the blank line labeled “Debtor’s Name.” The Creditor must sign his or her Name on the “Creditor’s Signature” line, then supply the Date he or she signed this document on the empty line next to it. Below this, the Creditor must sign his or her Name. If the Creditor is a Business Entity, then an individual who is authorized by that Business Entity to sign this document on its behalf must sign his or her Name. When Printing his or her Name, the Signature Party should follow it with the Legal Name of the Business Entity as reported in the first paragraph (i.e. John Doe, 1X Corp.).

What happens after payment?

After Payment – After the last payment is complete the Creditor will agree to remove all harmful postings from the Debtor’s credit report.

What is debt settlement agreement?

1. Overview. No matter the protective measures taken, it is a simple market fact that borrowers default on loan terms or payments. In some cases, the overall amount may be too much for the debtor to manage, and continuing payments may force it into bankruptcy.

What is debt settlement?

Debt settlement is a means of reducing or eliminating unsecured debt by negotiating an agreed upon payoff amount with creditors. This usually does not occur if a debt is secured, since the lender will have the right to take the property that secures the loan in lieu of payment.

What is a Promissory Note?

Promissory notes are legal lending documents. If you're going to lend money to someone, you'll need one. You've also likely signed one in the past, if you've ever taken out a loan. Find out when you need a promissory note and how to create one.

How to lower debt?

If you're wallowing in debt, sending a debt settlement letter to creditors to lower your amount of debt might work, as it does for many people who want to eliminate debt. See what you can do to put your finances and your life back on track.

What happens if you settle a debt?

Settling a debt can result in income tax liability. Creditors must report any forgiven debt in excess of $600 to the IRS, and the debtor will receive an IRS form for the amount of the forgiven debt. Talk to an attorney or a tax professional for additional details about these consequences.

What to do if your agreement is complicated?

If your agreement is complicated, do not use the enclosed form. Contact an attorney to help you draft a document that will meet your specific needs.

How many copies of a contract do you sign?

Sign two copies of the agreement, one for you and one for the other party.

What is debt settlement agreement?

A debt settlement agreement is a legally binding document that a creditor engages with the debtor in order to repay the outstanding debts. As mentioned above, these agreements allow the debtor to make repayments in small portions which he or she can afford.

When the period stated in the debt settlement agreement elapses without any noted obligations, the creditor will use the?

Also, when the period stated in the debt settlement agreement elapses without any noted obligations, the creditor, through the security of credits, will use the opportunity to sell all the items you enlisted as security.

What is agreement form?

Usually, this form of agreement comes when the debtor isn’t in a position to make full repayment of the dues owed. Instead of defaulting the debt or chasing down payments, the Agreement Form comes in handy to help both parties to create new rules that will make it easy for the borrower to service their debts.

What is debt in finance?

Debts refer to the amount of money borrowed from another party (the creditor). Perhaps you are planning to buy a property, expand on your business, or pay other unplanned bills but don’t have the ready/sufficient capital to make such purchases or transactions.

Can you file bankruptcy if you don't honor a debt settlement agreement?

Bankruptcy. Failure to honor a debt settlement agreement can be considered as an act of bankruptcy. When rendered bankrupt, you will not be able to apply for future credits successfully. Violating a debt settlement agreement gives the creditor the right to sue you in a court of law and face charges accordingly.

What is a debt settlement agreement?

A debt settlement agreement is like a super awesome secret handshake between you and your creditor. (Okay, maybe it's not quite that chummy, but it is a chance to cut a good deal with the people asking you to cough up the cash.)

When to get a debt settlement agreement

There are some clear benefits to opting for a debt settlement agreement, especially in comparison to continuing to ignore the debt or paying the debt in full.

3 steps to making a debt settlement agreement

By opting for a settlement agreement, you'll be kissing your debt goodbye soon. Don't stress — this will all be behind you before you know it. Here's what to do when making a debt settlement agreement.

Deciding if a debt settlement agreement is right for you

Debt settlement agreements are increasingly common among today's consumers. But is it the right choice for you?

Guides on How to Beat Every Debt Collector

Being sued by a different debt collector? We're making guides on how to beat each one.

Win Against Credit Card Companies

Is your credit card company suing you? Learn how you can beat each one.

What is debt settlement agreement?

A Debt Settlement Agreement is a document used by a Debtor (the person who owes money) or Creditor (the person who is owed money) to resolve an outstanding debt that is owed. Often, a Debtor finds themselves unable to pay the full amount of a debt that they owe to a Creditor.

What are the laws of debt settlement?

Debt Settlement Agreements are governed by state-specific laws in the United States, which cover debt principles, like a necessary executed written acknowledgment, as well as general contract principles like formation and mutual understanding.

What is included in a debtor agreement?

The document then includes the most important characteristics of the agreement between the Parties, including the original amount that is owed, the new amount that the Debtor will pay to the Creditor, the manner in which the repayment will occur, and the final date when the Debtor will finish repaying the Creditor. Finally, the document can include optional details about the agreement, such as the Parties agreeing to refrain from suing each other or keep the details of their agreement confidential.

What happens when a debtor is unable to pay the full amount of a debt?

Often, a Debtor finds themselves unable to pay the full amount of a debt that they owe to a Creditor. This Agreement allows the two Parties to negotiate and come to a consensus about a lesser amount of money that the Debtor will pay to take care of the debt.

Should parties sign a document?

Once the Parties have completed the document and agreed to all of the relevant details, they (or their legal representatives) should both sign the document and then keep copies of the document in a safe place for future reference.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

What to do if your proposal is not read?

If that happens, your proposal will never be read, let alone acted upon. You should send a letter to the person you’ve been dealing with at the company. If there’s no specific individual, make a phone call and get the name of a person likely to be in a capacity to work with your proposal.