How to Write a Debt Settlement Offer Letter

- Write your address information as the header of the letter Provide your personal information and account number on the header of the debt settlement offer letter for easy identification. ...

- Outline the amount you wish to pay as settlement ...

- Give a reason why you are unable to settle ...

- Write the account you wish to pay on and the date ...

- Conclude the letter ...

How to write a good debt settlement offer letter?

Your debt settlement letter will be most effective if it clearly expresses the detailed terms of your settlement request in writing. A settlement offer letter will contain your proposal to offer some sum of money to the creditor in exchange for forgiveness of the rest of your debt.

What does it mean to write a debt settlement proposal?

Doing this means your debt can be removed earlier and that you will no longer need to worry about making repayments. Below are details on how to write a debt settlement proposal letter, which should include everything you need:

How do you ask a creditor to accept a settlement proposal?

Close the letter by reiterating that you are not able to pay off the debt, and that this settlement proposal represents your best effort to give the creditor something. Request that the creditor respond in writing to your proposal, indicating their acceptance, refusal, or request for new terms.

What should be included in a formal request to settle debt?

It should be a formal business letter, and the borrower should keep a copy of all correspondence with the lender. This is a formal request to settle my credit card debt of $2,500.

How do you write a proposal for a settlement?

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

How do I write a letter to request a settlement?

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

How do I write a debt consolidation letter?

Your debt settlement proposal letter should contain the following:Your current financial situation. ... Debt settlement offer. ... Personal information. ... What you expect in return. ... Acceptance of the proposal. ... Acceptance of the proposal upon adjusting (negotiating) the amount to be paid. ... Rejection of the proposal.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What is a settlement proposal?

Settlement proposal means a proposal for effecting settlement of a contract terminated in whole or in part, submitted by a contractor or subcontractor in the form, and supported by the data, required by this part.

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do I offer a settlement to a collection agency?

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. The debt collector may still demand to collect the full amount that you owe, but in some cases they may also be willing to take a slightly lower amount that you propose.

How do you write a payment arrangement letter?

I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

How do you write a full and final settlement letter?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How do you write a demand letter for damages?

Frequently Asked Questions (FAQ)Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How to contact a debt settlement company?

To learn more about debt settlement or to schedule a free consultation, please contact us online or call us today at 888-574-5454.

What is debt settlement?

Debt settlement occurs when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower negotiated amount is agreed to by the creditor or collection agency and must be fully documented in writing. The settlement is often paid off in one lump sum, although it can also be paid off over time.

What happens if a creditor accepts a settlement offer?

If the creditor ultimately accepts your offer for debt settlement, make certain that the acceptance is made in writing prior to sending the creditor any amount of money. A written acceptance will serve as confirmation in the event that there are any future disputes.

What does it mean when a debt settlement is negotiated?

It is also important to understand that the nature of a negotiated debt settlement implies that you will have paid less than the full amount of the debt, and that the settled account is likely to be marked on your credit report as “settled,” as opposed to “paid in full.”.

What is the importance of explaining to a creditor?

It is also very important to explain to the creditor the nature of your current circumstances (employment-related, health-related, family-related) and how they financially impact you, your cash flow, your necessary expenses, and your ability to pay the debt in full.

How long does a settlement stay on your credit report?

Accounts marked as “settled” will remain on a credit report for seven years, and often have a detrimental impact on a credit score and profile.

When proposing a full and final settlement offer to a creditor, is it important to explain?

Therefore, when proposing a full and final settlement offer to a creditor, it’s important to be thorough in conveying exactly how much you offer to pay, exactly when you offer to have it paid, and the concessions you want your creditor to grant. It is also very important to explain to the creditor the nature of your current circumstances ...

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

Why do you need to sign a letter?

Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt. If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

What is Upsolve for bankruptcy?

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

Why are creditors happy to settle a debt?

This is because it is worth getting part of a debt repaid than getting nothing.

Why do people settle debt?

The main reason many people choose debt settlement is so that they can avoid declaring bankruptcy. Filing for bankruptcy is a debt solution that stays on your credit record for 10 years, but even after 10 years, many creditors and employers will ask applicants for loans or jobs if they have ever filed for bankruptcy.

What happens if a credit card company declares bankruptcy?

If the debtor declares bankruptcy, the bank will not get any of the credit card debt because it is unsecured, which means it is not backed by assets.

How long does a debt settlement stay on your credit report?

Debt settlement will stay on your credit report for seven years, and there is no public record of debt settlement, so once a debt settlement is agreed upon by the debtor and creditor, the debtor can request that the debt be removed from his or her credit report. Creditors are Happy to Reach an Agreement.

What happens if you can't pay your debt?

Unable to Pay the Full Amount. People who are unable to pay the full amount of their debt, may be able to reduce the amount they pay by sending their creditor a debt settlement proposal letter.

Can a creditor hire a collection agency?

Worse, the creditor may have to hire a collection agency or go to court, both of which the creditor would like to avoid because these processes can be expensive. In the case of credit cards, the bank that owns the credit card has priorities. It wants to make as much money from the credit card as possible.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

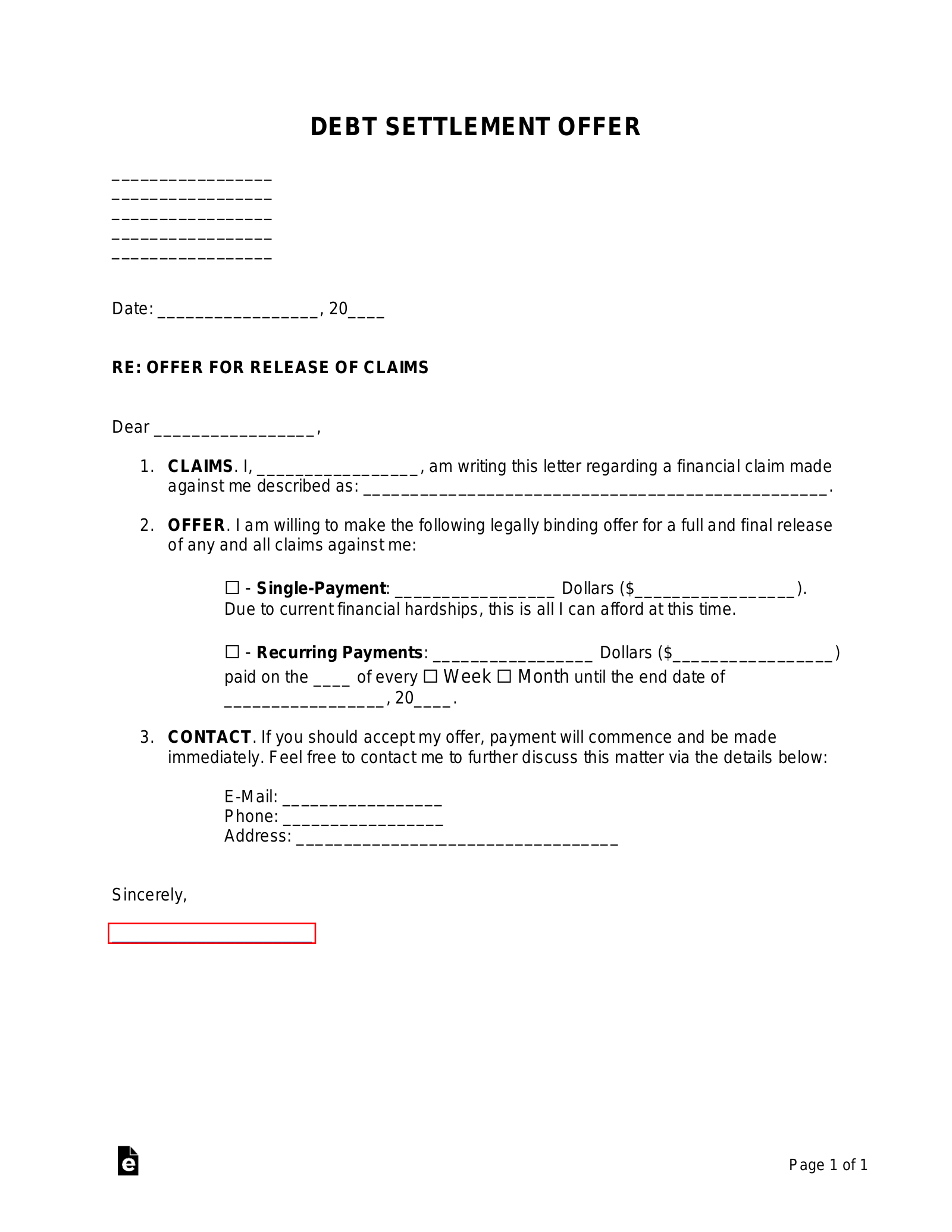

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

What to consider when writing a debt settlement letter?

It’s important to consider how you write a settlement letter. the town must be professional and polite. Remember, this is effectively a piece of persuasive writing in order to improve your financial life. It’s worth doing it right.

What is a settlement proposal letter?

A debt settlement proposal letter would often be written to suggest that in exchange for a lump sum. The debt would be written off or “settled”. In most cases, the idea is to offer slightly less than the amount outstanding in order to cut the Debt payment. This method often depends on the Goodwill of the lender accepting the settlement offer. However, a settlement proposal is surprisingly successful in many cases.

What to do when you are in debt?

One of the easiest things to do is to consider how to write a debt settlement proposal letter . This would be written to the company owed money. This can be a great idea, as you can appeal to ignore some of the debt.

Why do you need to write a settlement letter?

by writing a debt settlement letter your debt can be removed earlier meaning that you will have less worry about future payments and outgoings . This , in turn, helps to develop financial stability in recovering from debts. One thing to keep in mind is this shows as a “partially repaid” debt on your credit file.

What information do you need to settle a debt?

your complete name and those of others associated with the account, including previous names if appropriate. the number of the accounts you hold that need debt settlement.

What is a lump sum statement?

statement of the proposed amount you wish to pay as a “lump sum”.

What is a letter to settle a debt?

A request to get a response within a specified amount of time. Below is a sample letter to settle debt. It should be a formal business letter, and the borrower should keep a copy of all correspondence with the lender.

Why do people write a debt settlement letter?

When a person is having difficulty paying a debt because of unavoidable circumstances, they may write a debt settlement letter to request terms by which they can pay off the debt. This is the way to settle a debt such as credit card debt that is unsecured by property.

What does a lender need to know about a borrower?

The lender needs to know why the borrower can’t afford to pay, what his or her current financial status is and how much money they are offering as a settlement.

How to give correct financial information?

Give the correct financial information including details of the size of the debt, how much income they have and any disability or unemployment they get. Be courteous and polite. The borrower has a better chance of getting what he or she wants if they remain professional. It’s recommended to add some personal touches.

Who should write a credit card letter to?

Before writing the letter, the borrower should find out who is in charge of their account if it is a credit card company and address the letter to him or her. If the lender is an individual, the letter can be addressed to that person.

When a letter has been mailed by certified mail with return request to the responsible person, should the sender hear?

When the letter has been mailed by certified mail with return request to the responsible person, the sender should hear back within a specified amount of time. If this doesn’t happen, they can follow up with a call.

Can a lender get a percentage of what is owed?

In many cases, especially with old debt, the lender is happy to receive a percentage of what is owed rather than receive nothing and possibly going to court or taking other expensive legal steps to get the money.

What is a settlement proposal?

A settlement proposal most commonly refers to an attempt by a person in debt to reduce or eliminate their debt by proposing an alternative to paying the full debt to the creditor. Proposing a settlement is a good idea for someone who is considering bankruptcy or who feels like they can pay some, but not all, of a debt.

What to write in a debt statement?

Describe the details of the debt, including the date it was taken out, any payments you have made, interest accrued, and other details. Be extremely clear about each party's responsibilities and key dates. [6]

What does it mean to request a debt settlement?

Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

How to close a settlement letter?

Close the letter by reiterating that you are not able to pay off the debt, and that this settlement proposal represents your best effort to give the creditor something.

What is a proposal payment?

Propose payment terms, including whether you are seeking a cancellation of the debt or simply a debt reduction and offer a payment schedule. Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

How to settle a debt that is overdue?

Steps. Collect all information on your debts and sort it by date. Decide which debt you want to settle and the amount you can pay. You should choose a debt that is long overdue and which the creditor might reasonably expect will not be paid back. Decide on a figure for your settlement.

What is a request for a creditor to respond to a proposal?

Request that the creditor respond in writing to your proposal, indicating their acceptance, refusal, or request for new terms.

What is a debt settlement offer letter?

A debt settlement offer letter is a written proposal that a debtor or his attorney sends to a creditor or a debt collections agency to offer a specific amount of money to forgive a debt. A creditor may also send a debtor an offer letter. Usually, debt settlement offer letters are sent when a debt is past the due date and has probably been moved to a collection agency, and the debtor is unable to pay all the debt they’ve accumulated.

What information is needed for a debt settlement letter?

Your personal information includes your full legal name, mailing address, and current date.

Why is it beneficial to settle debt?

Settling debt is beneficial to the collector because it implies that they will get a significant part of the total amount owed. As you may already know, the odds of getting an account in collections paid are not good. It is more likely that the debtor will file for bankruptcy and the debt automatically discharged. This means that the debt collector risks getting nothing out of what they are owed. And even if the debtor does not file for bankruptcy, it will still cost a lot of time and money trying to take legal action against the debtor to collect the debt.

Is it bad to settle a debt?

Although settling a debt account is considered negative by many people, it won’t hurt you as much as not paying at all. Suppose you are planning to make a major purchase, for example, buying a home. In that case, you may be required to either settle or clear any outstanding delinquent debts before you can qualify for a loan from any financial lending institution. If paying the debt in full is not an option due to financial constraints, consider settling the account because it is more beneficial to your financial health than letting the debt go delinquent or, worse, to default.