Settlement Agreement Letter Writing Tips.

- The letter should specify the important details.

- The letter should also specify how the settlement can be tackled.

- The letter should specify the amount.

- The letter should be clear and simple.

- The letter should express the terms & conditions from the standpoint of both the parties.

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How to write a simple disagreement letter?

How to Write a Disagreement Letter. by WriteExpress Staff Writers. Consider diffusing the situation by using love and humor. Clearly describe the disagreement and explain what you want done to resolve it. Avoid accusations and threats, particularly in a first letter. (Generally, the intent is to strive to resolve the problem, not simply disagree.)

How to write a good credit dispute letter?

When writing your letter to a credit bureau, please remember these simple guidelines:

- In most cases, it’s unnecessary to mention laws, procedures, court rulings, or threaten lawsuits, etc. ...

- Similarly, remember to be kind. ...

- Include copies of information that supports your claims, but remember, anything you send them can also be used against you. ...

- Make and send copies, but always keep the originals for your records.

How to settle debt on your own?

To settle debt on your own you will need to:

- Learn the steps to settle debt on your own – What to say when negotiating, what to send to creditors in writing, and the overall order of operations.

- Obtain debt settlement letter templates, negotiating letters, counteroffers, settlement acceptance letters and much more. ...

- Understand the pros and cons when settling debt on your own. ...

How do you write a letter asking for a settlement?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

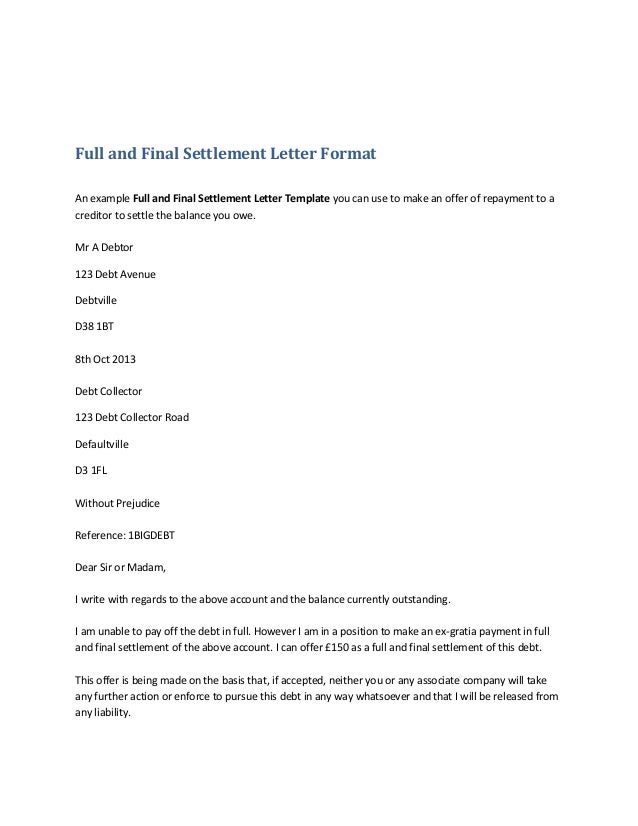

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

What is a letter of settlement?

Put simply, a settlement note is a formal letter that asks your creditors if they would be willing to accept a debt settlement on your account. It specifies the amount of money that you can offer them as a settlement and explains why you cannot pay your debt in full.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

How do I write a one time settlement letter?

1) 2) I intend to settle the account under One Time Settlement Scheme. Therefore if you could offer some interest concession, I shall arrange to repay the dues on or before ________________. am agreeable to pay Rs. _____________ as one time settlement of dues.

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do you write a letter?

These are the general rules you should follow to write a letter:Choose the right type of paper.Use the right formatting.Choose between block or indented form.Include addresses and the date.Include a salutation.Write the body of your letter.Include a complimentary close.List additional information.

What percentage should I offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do I write a debt letter?

What do you include in a debt collection letter?The amount the debtor owes you, including any interest (attach the original invoice as well);The initial date of payment and the new date of payment;Clear instructions on how to pay the debt (banking details, etc);An indication to make contact if payment has been made;More items...•

How do I write a letter to a creditor?

I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

What is a settlement letter from the bank?

A debt settlement letter is a written proposal for you to offer a specific amount of money in exchange for forgiveness of your debt. These letters address why you're unable to pay the debt, how much you're willing to pay now, and what you would like from the creditors in return.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

How do you make a settlement?

A 6-step DIY debt settlement planAssess your situation. ... Research your creditors. ... Start a settlement fund. ... Make the creditor an offer. ... Review a written settlement agreement. ... Pay the agreed-upon settlement amount.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

Why do you need to sign a letter?

Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt. If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

How to write a settlement letter?

If you do wish to write the settlement demand letter on your own, take your time and make sure it is as strongly written as possible for the insurance company to take you seriously. Keep your language clear, concise and grammatically correct. Avoid long narrations about your accident or injuries. Simply state the facts of your case.

What Is a Settlement Demand Letter?

A settlement demand letter is one of the most important pieces of communication between you and the insurance company receiving your claim. This might be your own insurance company if you caused the accident or were injured by an uninsured party, or it might be someone else’s insurance carrier if that person caused your injury. Either way, do not underestimate the importance of the settlement demand letter.

How to write a personal injury claim letter?

A strong personal injury demand letter includes: 1 The defendant’s name and address 2 Your name and contact information 3 A brief description of the accident 4 Why you believe the insurance company is liable 5 The extent of your injuries and your official diagnosis 6 A description of the medical treatments you require 7 Details of any income lost 8 A description of your pain and suffering 9 An amount you’re demanding in damages to settle the claim 10 One sentence stating that your attorney can go to trial, if necessary

What is a demand letter for insurance?

The main parts of an insurance demand letter are the introduction, description of the accident, settlement demand figure and closing statements. A strong personal injury demand letter includes: The defendant’s name and address. Your name and contact information.

What is a strong personal injury letter?

A strong personal injury demand letter includes: The defendant’s name and address. Your name and contact information. A brief description of the accident. Why you believe the insurance company is liable. The extent of your injuries and your official diagnosis. A description of the medical treatments you require.

What is a victim's request letter?

In most personal injury cases, the victim’s request is an amount of financial compensation the victim is demanding in return for dropping the lawsuit against the defendant and releasing him or her from further liability. Your demand letter is the key to obtaining the best possible outcome for your personal injury claim in Dallas.

Who is the attorney for settlement demand letter in Dallas?

For assistance drafting a successful settlement demand letter in Dallas, Texas, consult with a personal injury lawyer from the Law Firm of Aaron A. Herbert, P.C.

What is a settlement agreement letter?

The Settlement Agreement letters are legally binding and can be used in the court of law for any dispute between the parties arises. The terms and conditions mentioned in a Settlement Agreement letter are mutually agreed upon by both the parties. Both the parties before finalizing negotiate terms and conditions given in the letter.

Who is the settlement participant?

Customarily, it is an employer and employee (or former employee) who are the contracting participants to a settlement agreement. These letters can be agreed upon by the employee and the employer so that both parties are satisfied and the perspectives of both the parties are stated.

What is a Puja Gold letter?

This letter is the settlement between the company and the client about the taking back his gold guaranteed in our company Puja Gold. A contract was prepared three years back, and the client has not been able to pay the interests of any sort till the day.

What is a transfer letter?

This letter is an agreement letter which indicates the conditions and guidelines regarding the transfer of funds from one party to the other. The important viewpoints of such a letter include the amount, time, interest, and other similar aspects.

What should a letter specify?

The letter should specify the important details.

Can a party contact us if they have any doubts?

We request the party concerned to please go through this, and if they feel that they have any doubts and need clarification, then he can contact us.

Do you have to be logged in to post a comment?

You must be logged in to post a comment.

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.

How long does it take to settle a loan?

If the bank is convinced that your reason for non-payment is genuine, they may give you a one-time settlement option. Here you take upto 6 month non-repayment period and then, settle the loan in one payment. This process is called 'Loan Settlement'.

What is a loan closing certificate?

Loan Closure Certificate from Bank: It is a No Dues Certificate (legal document) provided by the banks which states that 'the loan has been settled and their is no outstanding to be paid by the borrower as on a specific date'. In case of a vehicle loan, finance company issues a RTO form 35 with an NOC.

How to send a letter to a credit card company?

Address the letter to the proper office. Find out which office of the credit card company handles settlement offers. You can usually discover this by looking up the company online or calling the customer-service number on the back of the card itself. When you reach someone at the company, say that you would like to make an offer to settle your debt, and ask what address you should use for sending a letter.

How long does it take to respond to a letter from a company?

Provide a date for a response. At the end of your letter, ask the company to respond to you by a particular date. You should allow at least two weeks for the response. However, even if you do not receive a reply by that date, do not assume that your offer has been rejected.

What to do if you owe more on credit card?

If you owe more on a credit card than you can afford to pay, you may wish to negotiate a settlement with the card company. In a settlement you agree to pay some lesser amount, and the company agrees to accept that amount. You both avoid the trouble and expense of going to court, and you can protect your credit rating at the same time.

How to settle credit card debt?

Decide what you can offer to pay. Before trying to settle your credit card debt, you need to decide what you can afford. Review all of your outstanding debts, and compare these to your regular income and any other funds you have available.

What does "in full settlement" mean?

An offer of this type could say something like, “I am able to make an immediate payment of $4,000 in full settlement of my outstanding credit card debt.” Be sure to use the phrase “in full settlement,” so it is clear that you mean this as a full and final payment and not as part of a payment plan.

How to explain why you need to settle your debt?

Explain your predicament. Avoid getting emotional about the problems in your life, but you should explain your reason for needing to settle your debt. It will help your case if you can refer to a particular cause, such as an accident, divorce, or something else that is not likely to repeat. If you've simply overspent, the company will be less inclined to settle, because they have no assurance that your spending habits will change in the future.

How to state account number in letter?

Clearly identify the account that you are discussing. At the top of your letter, below the address, you should state the account number . Especially if you have more than one account with the institution, it is important to state clearly which account you are trying to settle.

What is a medical debt settlement letter?

Sending a medical debt settlement letter is the way to start the process of reducing medical bills.

What document does a consumer need to get to settle a medical debt?

If the medical institution or caregiver agrees to the settlement, the consumer needs to get a written document that states the agreed dollar amount of the reduced debt.

How long does it take for a debt to be referred to a collection agency?

They could refer the debt in as little as 60 to 90 days, so it is important for the consumer to make a request before the debt is shifted to a collection agency. Collection agencies have been known to sue debtors for as little as $100 debt.

How many pages should a letter be?

• The letter should be as short as possible. One page should be enough, but never more than two pages. If it is too long, it may get tossed in the trash.

What information do you need to fill out on a sandbox?

Fill in your contact details, account number and any extra information you want to include in the grey shaded areas.

Do you need to include the organisation name in a resume?

You need to include the organisation name.

Do you need to include your name in a resume?

You need to include your name (s).

Can you write a letter in your own name?

You can choose to send a letter in your own name or in joint names. You may have a debt in joint names, or want to write to your creditors together because you have worked out a joint budget.