Steps

- Collect all information on your debts and sort it by date.

- Decide which debt you want to settle and the amount you can pay. ...

- Decide on a figure for your settlement. ...

- Begin your proposal by addressing your letter to the creditor and including the name on your account and/or account and invoice numbers.

Full Answer

How do I use a full and final settlement letter?

Use this letter to help you negotiate a full and final settlement offer with your lender. This is a type of offer where you ask the lender to accept part of the amount you owe and write off the rest. You can find information about how to use this letter in our fact sheet Mortgage shortfalls.

How to write a good debt settlement offer letter?

Your debt settlement letter will be most effective if it clearly expresses the detailed terms of your settlement request in writing. A settlement offer letter will contain your proposal to offer some sum of money to the creditor in exchange for forgiveness of the rest of your debt.

Can I modify a settlement offer letter?

You will be able to modify it. A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties.

What happens if a debt settlement letter is sent to wrong department?

If your letter ends up in the wrong department, it could be delayed or never read and processed. Your debt settlement letter should include the following pieces of information: Your proposed settlement amount — Make sure you state this as a dollar amount, not a percentage of your debt.

How do I write a mortgage settlement letter?

Dear Sir/Madam, I'm writing this letter in regards to the amount of debt on the account number stated above. As a result of financial hardship, I am unable to pay back the amount in full. [Here, take the time to explain your hardship so the creditor has a better picture of what's going on].

How do you write a letter asking for a settlement?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How do I write a one time settlement letter?

1) 2) I intend to settle the account under One Time Settlement Scheme. Therefore if you could offer some interest concession, I shall arrange to repay the dues on or before ________________. am agreeable to pay Rs. _____________ as one time settlement of dues.

What is a letter of settlement?

Put simply, a settlement note is a formal letter that asks your creditors if they would be willing to accept a debt settlement on your account. It specifies the amount of money that you can offer them as a settlement and explains why you cannot pay your debt in full.

How do you write a letter asking for a full and final settlement?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

How do you negotiate with a bank one time settlement?

1. Evaluate your financial situation 2. Contact your bank or lender 3. Negotiate a settlement agreement 4. Make the payment and close the loanEvaluate your financial situation.Contact your bank or lender.Negotiate a settlement agreement.Make the payment and close the loan.

What is the process of one time settlement in banking?

OTS Scheme is a one-time settlement scheme that has been very significant during the pandemic. Through this scheme, if one loan borrower fails to repay the loan to the bank, can get a 25-85% rebate on the same.

How much should I offer creditors to full settlement?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do you make a settlement?

A 6-step DIY debt settlement planAssess your situation. ... Research your creditors. ... Start a settlement fund. ... Make the creditor an offer. ... Review a written settlement agreement. ... Pay the agreed-upon settlement amount.

How do I write a demand letter for an insurance settlement?

7 Tips for Writing a Demand Letter To the Insurance CompanyOrganize your expenses. ... Establish the facts. ... Share your perspective. ... Detail your road to recovery. ... Acknowledge and emphasize your pain and suffering. ... Request a reasonable settlement amount. ... Review your letter and send it!

How do you write a demand letter for damages?

Frequently Asked Questions (FAQ)Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What information do you need to fill out on a sandbox?

Fill in your contact details, account number and any extra information you want to include in the grey shaded areas.

Do you need to include the organisation name in a resume?

You need to include the organisation name.

Do you need to include your name in a resume?

You need to include your name (s).

Can you write a letter in your own name?

You can choose to send a letter in your own name or in joint names. You may have a debt in joint names, or want to write to your creditors together because you have worked out a joint budget.

What information do you need to fill out on a sandbox?

Fill in your contact details, account number and any extra information you want to include in the grey shaded areas.

Do you need to include the organisation name in a resume?

You need to include the organisation name.

Do you need to include your name in a resume?

You need to include your name (s).

Can you write a letter in your own name?

You can choose to send a letter in your own name or in joint names. You may have a debt in joint names, or want to write to your creditors together because you have worked out a joint budget.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

What is the second step in negotiating a debt?

The second step is deciding what terms you’ll agree to. During negotiations, the biggest item to discuss will be how much of the debt you need to pay. But don’t overlook another important term: how the debt will show up on your credit report.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

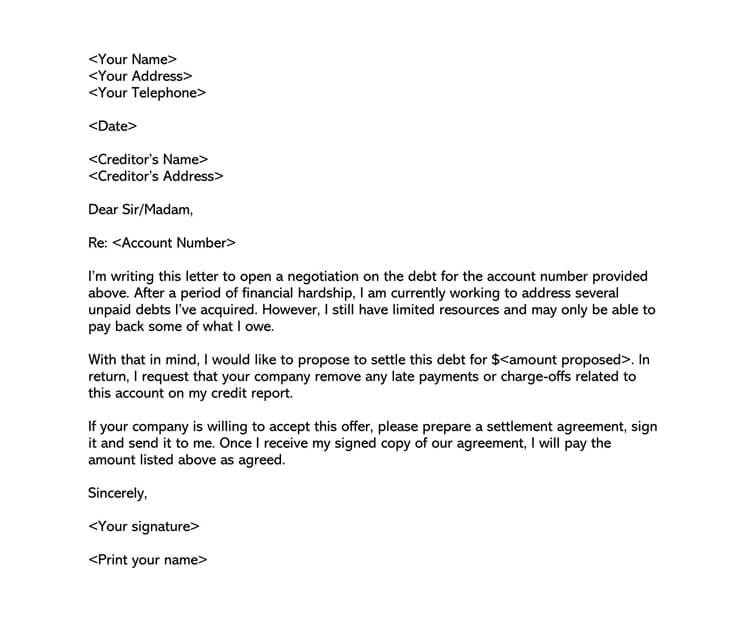

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

What should be included in a debt settlement letter?

You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right?

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right way. This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by.

How to contact PayPlan?

If you are looking for guidance when dealing with creditors and proposing a debt settlement, our team here at PayPlan can help. Speak to our experts on 0800 280 2816 or use our contact form to get in touch.

What is debt settlement?

Debt settlement is something many people consider if they are able to offer a lump sum of money up front – usually less than the total amount owed – in the hope the creditor will agree to this and accept the debt as settled.

What to do if creditor accepts offer?

If the creditor accepts your offer, ensure this is in writing before you send any money to them. Keep this written confirmation safe too in case there is any dispute in the future, so you can offer this as proof of the agreement.

What happens if you settle early on a debt?

It’s important to remember that if you settle early on your debt, this means you are not paying it in full and so it will show as partially settled on your credit report instead of settled. This can affect your ability to obtain credit in the future, as it suggests to future creditors that you may not be able to pay back the full amount borrowed.

Can creditors use your credit report to find out who you are?

Creditors should be able to use these to find all your relevant information and confirm who you are when they receive your debt settlement proposal.

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.

What is a settlement demand letter?

A settlement demand letter is a letter in which the writer expresses their willingness to settle a case out of court and offers a settlement. You might write a settlement demand letter if you have received a claimant’s demand letter and wish to respond with a settlement counteroffer. This letter is a written response to ...

How to negotiate a settlement offer?

Discuss the Terms of Your Offer. Clearly outline the terms of your settlement offer. Often settlements require confidentiality agreements and a stipulation that both parties will release any legal claims arising from the incident. Include a time frame for the claimant to accept the offer. Be sure to include the date the offer expires in your letter.

Why Offer a Settlement?

Settling a case out of court can save you money, time, and stress. Because a court case can be long-term and expensive , you might decide to settle even if you disagree with the claimant’s version of the incident that caused their loss. A settlement demand letter allows you to express your disagreement and offer a lower settlement amount.

What to do when a claimant sends a demand letter?

Offer a Reasonable Settlement. When a claimant sends a demand letter, they ask for a larger amount of money than they expect to receive. Their demand letter opens negotiation. Your settlement demand letter continues that negotiation. Offer a smaller amount than the claimant demands but large enough to tempt the claimant to settle out of court.

How to dispute a claim in a letter?

In the body of your letter, dispute the claim and offer your perspective of the incident. Backup your viewpoint with evidence, such as a police report. Enclose a copy of any evidence you discuss in your letter.

Why do you settle out of court?

Note: You might decide to settle out of court because you are not required to admit guilt to offer a settlement. You can deny responsibility for the incident and still offer to settle. Offering to settle might be preferable to a court case in which a jury determines your guilt or innocence.

What is a settlement agreement letter?

The Settlement Agreement letters are legally binding and can be used in the court of law for any dispute between the parties arises. The terms and conditions mentioned in a Settlement Agreement letter are mutually agreed upon by both the parties. Both the parties before finalizing negotiate terms and conditions given in the letter.

Who is the settlement participant?

Customarily, it is an employer and employee (or former employee) who are the contracting participants to a settlement agreement. These letters can be agreed upon by the employee and the employer so that both parties are satisfied and the perspectives of both the parties are stated.

What is a Puja Gold letter?

This letter is the settlement between the company and the client about the taking back his gold guaranteed in our company Puja Gold. A contract was prepared three years back, and the client has not been able to pay the interests of any sort till the day.

What is a transfer letter?

This letter is an agreement letter which indicates the conditions and guidelines regarding the transfer of funds from one party to the other. The important viewpoints of such a letter include the amount, time, interest, and other similar aspects.

What should a letter specify?

The letter should specify the important details.

Do you have to be logged in to post a comment?

You must be logged in to post a comment.

Elements of a Claim Settlement Letter

Insurance companies, especially large ones, deal with hundreds of claims every day. If your claim settlement letter provides insufficient information, your claim could be ignored. An effective letter should contain the following elements:

Sample Insurance Company Demand Letter

I am a policy holder at Insureds Insurance Company, policy holder ID 2990/MT for a $20,000 personal insurance protection (PIP) cover from 1 January 2025 to 1 January 2035. On 2 April 2031, I was involved in a fender bender with another vehicle on 231 Thorn St. I am writing to file a claim for financial settlement to cover my losses.

Key Takeaways

A well-written letter to insurance company for claim settlement is more than just a list of demands for your insurer. It also details exactly how the accident or event happened, the losses you suffered and continue to suffer as a result, and the amount you should receive in compensation.