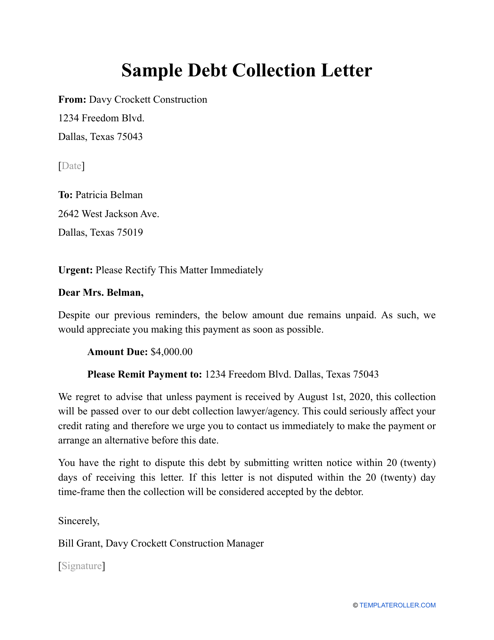

The Body of the Letter

- First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount.

- Second Paragraph. You’ll use this paragraph to present the details of your settlement offer. ...

- Final Paragraph. ...

- Your Signature. ...

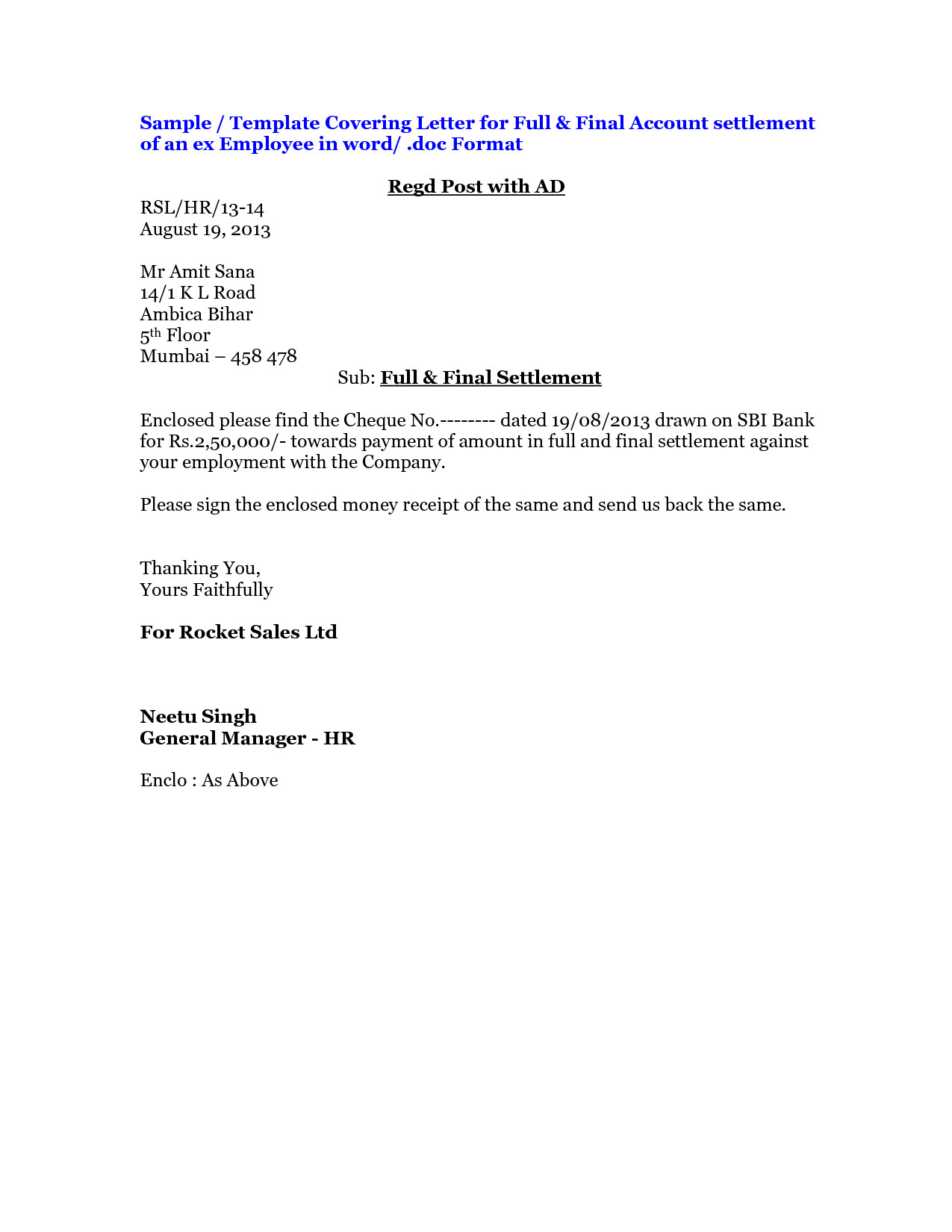

How do I write a settlement letter?

and I want to offer this as full and final settlement of the account. I am making this offer on the clear understanding that, if you accept it, neither you nor any associate company will take any other action to collect or enforce this debt in any way and that I will be released from any liability.

How do I offer a settlement to a collection agency?

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. The debt collector may still demand to collect the full amount that you owe, but in some cases they may also be willing to take a slightly lower amount that you propose.

What percentage will a collection agency settle for?

Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

Can I ask a collection agency to settle for less?

Believe it or not, though, it's possible to negotiate with a collection agent and end up paying less than you owe. Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to pay a debt in full or settle?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What should you not say to debt collectors?

9 Things You Should (And Shouldn't) Say to a Debt CollectorDo — Ask to see the collector's credentials. ... Don't — Volunteer information. ... Do — Make a preemptive offer. ... Don't — Make your bank account accessible. ... Maybe — Ask for a payment-for-deletion deal. ... Do — Explain your predicament. ... Don't — Provide ammunition.More items...

Will debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Can I pay my original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

Can debt collectors refuse an offer of payment?

Can a Debt Collector Refuse a Payment Plan? It's important to know that collection agencies aren't legally obligated to accept or agree to payment plans. Debt collectors don't have to work with you or agree to any payment schedules based on what you're reasonably able to afford.

How do you negotiate a debt settlement?

If you're considering trying it on your own, here's a rough guide to the steps you may want to take:Assess your situation. ... Research your creditors. ... Start a settlement fund. ... Make the creditor an offer. ... Review a written settlement agreement. ... Pay the agreed-upon settlement amount.

How do I get a collection removed?

You can ask the current creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

How do I write a debt settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

Will settling with a collection agency hurt my credit?

Yes, settling a debt instead of paying the full amount can affect your credit scores.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

Why do you need to sign a letter?

Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt. If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

What is the second step in negotiating a debt?

The second step is deciding what terms you’ll agree to. During negotiations, the biggest item to discuss will be how much of the debt you need to pay. But don’t overlook another important term: how the debt will show up on your credit report.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

What is a counteroffer letter?

This template letter makes a counteroffer when an original creditor offers you an initial settlement amount. The goal is to offer a lower amount and negotiate for a removal of the negative information from your credit history.

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!

How to write a settlement letter?

Make sure your letter has: 1 Header – this should include your full name and address, as well as the date that the letter has been written. 2 Body – this is where you will explain the details of your settlement offer (amount, dates of payments you will make, and how they will be made) and what you are expecting from your creditor. 3 Contact – your contact details, including a current phone, mobile, and e-mail address. 4 Closing – this is where you will sign the letter

What should a debt settlement letter include?

There are some key details that all debt settlement offer letters should have: The full name used for the credit account. Your full address. Your account numbers or a reference number from the creditor. This information is what your creditor will need to pull up all of the relevant details of your account with them.

What is a debt settlement offer letter?

This can be done using a debt settlement offer letter. This is a form that is used when the debtor and creditor want to agree to new terms in settling the outstanding debt. The letter is usually sent by the debtor to the creditor and may offer a lump sum that is not the full amount, but one that is agreeable to the creditor to accept ...

Why is it important to have a copy of an offer of acceptance from the creditor?

This is why it is important to have a written copy of an offer of acceptance from the creditor as proof, to stop them from trying to come back and claim the balance afterward.

What percentage of debt should be offered to a creditor?

Typically, an offer of between 30% of the debts outstanding balance should be made to a creditor for them to even consider it. The cre4ditor will normally come back with a counteroffer of 50%.

How long does a partial settlement stay on your credit report?

Negative marks on your credit report, such as a partial debt settlement, can stay on your report for 7 years.

What should the header of a letter include?

Header – this should include your full name and address, as well as the date that the letter has been written.

What happens when a debt collector calls in a debt that is not being paid?

When creditors need to call in a debt that is not being paid by a consumer, they may give the problem to a debt collecting agency. Sometimes, debt collectors can be extremely persistent and actually harass a consumer.

What is the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act (FDCPA) was created by congress to regulate debt collection agencies’ practices. If the debt collector is calling the consumer at work, they must stop if they receive a phone call from the consumer requesting them to stop. If the consumer is called at home, they need to write a cease ...

What to do if a consumer is called at home?

If the consumer is called at home, they need to write a cease and desist letter to get the debt collector to stop. While it is legitimate for a collection agency to collect the money owed, it is not legitimate for them to intimidate and harass the consumer.

What is a cease and desist letter?

This letter is a formal request that you cease and desist contacting me. It is also formal notification that I will file a complaint with the Federal Trade Commission in STATE Attorney General’s office, and I will pursue civil and criminal claims if you do not comply.

What is a C&D letter?

If this happens, the consumer can send a cease and desist (C&D) letter to the collection agency requesting or insisting that they stop harassing communication.

Can a C&D letter increase the chance of a collection agency sue?

For one thing, the letter could increase the chance the collection agency will sue and, since it stops all communication, the consumer may not know what other steps the collection agency intends to take. Not all creditors have to stop when a C&D letter is received.

Do all creditors have to stop a C&D?

Not all creditors have to stop when a C&D letter is received. The original creditor can still contact the consumer even if he or she has sent a letter asking them to stop. Original creditors are not bound by the FDCPA.

Why do collections agencies settle?

Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don’t have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount.

How does a collection agent work?

The collection agent is incentivized to get you to pay as much money as possible with the least amount of effort on their part. The agent works on commission and gets a portion of whatever you pay.

How does a credit bureau agent work?

The agent works on commission and gets a portion of whatever you pay. The best outcome is to get this debt off your back by paying a lump sum and getting a receipt and a commitment from the agency to update the status of your account on your credit report to reflect payment. Here’s how to do it.

What to say when an agent makes an offer?

If the agent makes an offer, for example to waive interest, reduce payments or let you skip a payment, you can respond by saying, “I see,” without committing immediately. The agent may then ask for something in exchange such as paying higher interest. Don’t give up more than you get.

What to do if an agent keeps playing hardball?

If the agent keeps playing hardball, insisting that you pay a certain amount you can’t afford, don’t let them trap you. It’s fine to politely hang up and call back a day later. Successful negotiations may take weeks. As you continue to negotiate, tell the agent you want them to report the bill as paid in full.

What to do if you don't pay your credit card bill?

If the agency doesn’t do so, send any and all written evidence that you paid the bill to the credit bureau. Be sure that you understand how much, if any, of the debt was forgiven.