How to Write

- Complete the Initial Letter. Enter the reason for the demand (referencing a settlement agreement, medical bills, etc.) and the amount that is owed.

- Send to the Insurance Company. The demand letter should be sent with appropriate details. ...

- Wait for Payment. ...

- Get an Attorney. ...

- File Legal Action. ...

- Organize your expenses. ...

- Establish the facts. ...

- Share your perspective. ...

- Detail your road to recovery. ...

- Acknowledge and emphasize your pain and suffering. ...

- Request a reasonable settlement amount. ...

- Review your letter and send it!

How do you write a letter to an insurance company?

Writing a Life Insurance Claim Letter [with Sample]

- Direct Contact With A Rep. Often being on the phone leads to several transfers and getting the runaround. ...

- Review The Policy. After the passing of a friend or loved one, the life insurance policy becomes payable to the beneficiaries who the insured listed.

- Prepare A Rough Draft. ...

- Do Not Forget The Policy Number. ...

- contact information

How long does it take an insurance company to settle?

This takes between 15 and 90 days. (We look at all the major insurance companies and take a look at the average time of how long they take to respond.) Let's take a deeper look at the three key variables to how long your case will take until your case reaches the settlement stage so you can get a better idea of what to expect in your case.

How do you write a settlement letter?

The Body of the Letter

- First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount.

- Second Paragraph. You’ll use this paragraph to present the details of your settlement offer. ...

- Final Paragraph. ...

- Your Signature. ...

Do I have to accept the insurance company settlement?

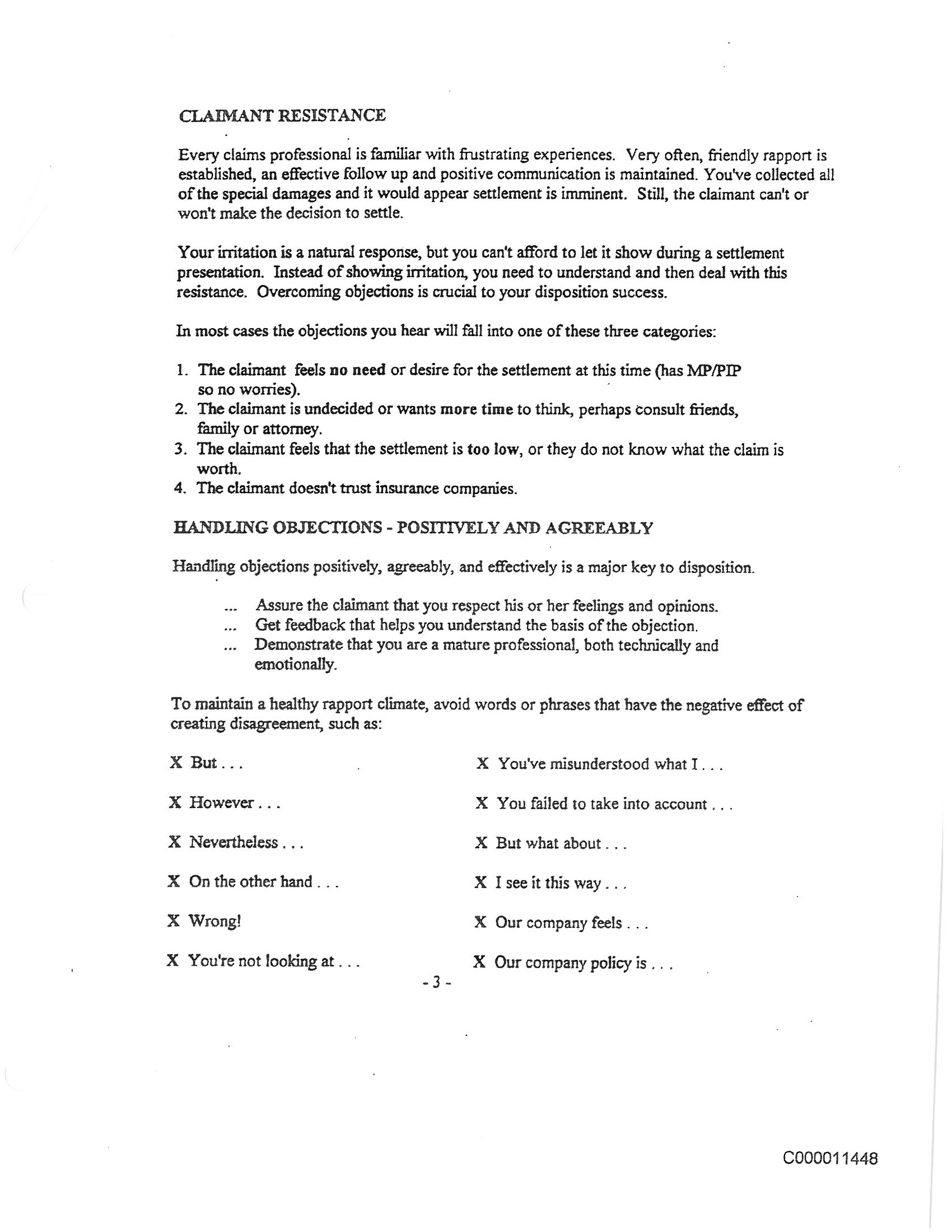

You are never required to accept a settlement offer of any kind. Some insurance adjusters try to create a false sense of urgency, making you feel like it’s a “now or never” chance to get paid. They might even make you feel like early settlement is your only option, but that isn’t the case. You may have a number of options at your disposal.

What is an insurance settlement letter?

Settlement letters should summarize the purpose of the claim and communicate to the insurance company a fair value for the claim. Insurance companies generally try to settle claims for as little money as possible, making it difficult to reach a satisfactory outcome.

How do I write a legal letter to a settlement?

Here is a list of things you need to include in your demand letter.Outline The Incident. You will need to start by outlining the details of the accident. ... Detail Your Injuries. ... Explain All Of Your Damages. ... Calculate Your Settlement Demand. ... Attach Relevant Documents. ... Get Help From An Attorney.

How do you write a good settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What are the 4 steps in settlement of an insurance claim?

Negotiating a Settlement With an Insurance Company. ... Step 1: Gather Information Needed For Your Claim. ... Step 2: File Your Personal Injury Claim. ... Step 3: Outline Your Damages and Demand Compensation. ... Step 4: Review Insurance Company's First Settlement Offer. ... Step 5: Make a Counteroffer.More items...

How do you write a letter asking for a full and final settlement?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How do I write a letter asking for compensation?

How to write a compensation letterThe date and the recipient's contact information. ... A formal salutation. ... An introductory statement. ... List of compensation items. ... The date compensation becomes available. ... Exceptions and additional compensation details. ... Closing statement and salutation. ... Your name and contact details.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

How do I scare my home insurance adjuster?

One way to scare an insurance adjuster is to let them realize you are poised to negotiate and know your rights. Work up a settlement amount that you believe you should receive if their first offer isn't reasonable. Don't hesitate to challenge their first offer if you can substantiate that it should be higher.

What are the documents required for claim settlement?

At the time of claim settlement, the below documents are generally asked by the insurance providers:Filled and Signed Claim Form.Original Policy Document.Death Certificate issued by the concerned authority.Police FIR (in the event of unnatural death)Age proof of Insured.More items...•

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease or eliminate payments for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

Can an insurance company refuse to pay a claim?

In the case of the last two, if you can show that the misleading information was unintentional your claim will still be valid, and it should be paid. However, in cases of deliberate or reckless non-disclosure, the Insurance Company can refuse to pay.

Does a settlement agreement have to be in writing?

And a settlement agreement does not need to be in writing to be enforceable. An oral settlement agreement entered into by the parties can be enforceable so long as it does not violate the statute of frauds. This oral agreement would be interpreted in the same manner as any other contract.

What is a valid settlement agreement?

The document (contract) which evidences the agreement between parties and which binds the parties following a negotiation to adhere to the terms agreed upon as a result of the negotiation.

What should be included in a settlement?

9 Things to Include in a Settlement AgreementA Legal Purpose.An Offer.Acceptance of the Terms.Valid Consideration on Both Sides.Mutual Assent.Waiver of Unknown Claims.Resignation.Confidentiality Clause.More items...•

Is out of court settlement legal?

Generally, an out-of-court settlement allows one party to pay a sum of money to the other and in return the other party will close their lawsuit. Mainly, a settlement is a lawfully binding agreement which ends the case exclusive of going to court.

What Should a Claim Settlement Letter Include?

Insurance companies deal with hundreds, even thousands of claims daily. That is why your letter to an insurance company should stand out.

How to send a letter to insurance company?

Send your letter by certified mail with a requested return receipt since you will need to document the date your insurance company received it.

What is DoNotPay insurance?

DoNotPay assists in appealing denied insurance claims from any provider, including 21st Century, Allianz, Fred Loya, or Shelter.

What to do if your insurance company rejects your claim?

In case your insurance company rejects your claim, send them an appeal letter and try to make them reconsider the decision. DoNotPay can help with this issue, too!

How long does it take to file a claim with your insurance provider?

Should you have insurance for your property, car, health, or any other, you might be in a position to file a claim with your insurance provider one day.

What to include in an accident letter?

Photographs and videos of the accident, all the damage, and your injuries. You should include any additional documentation supporting your case. Both you and the insurance provider should have copies of all the evidence.

Does DoNotPay speed up the process of filing insurance claims?

DoNotPay also speeds up the process of filing insurance claims, claiming warranties, reducing property tax, and drafting various legal docs.

What happens when you submit a claim letter to an insurance company?

When a person submits a claim letter to an insurance company, whether it’s for a car accident, medical malpractice, personal injury or other reason, the insurance company will respond with a first offer. At this point, the claimant has the right to make a counter offer, and in most cases, this is the best thing to do.

Who does a letter go to when a claimant is at fault?

In most cases, the letter goes to the at-fault party’s insurance company to make it clear that the claimant suffered injuries because of the fault of the company’s insured person.

Why do insurance companies make low offers?

The first offer given by the insurance company will most likely be very low and not be their last offer. They may purposefully make a low offer to see if the claimant knows what he or she is doing. This is why it is recommended to negotiate for a higher offer.

What should an insurance adjuster do if the first offer is very close to the claimant's minimum amount?

If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

What does a letter to an insurance adjuster do?

The letter can request that the insurance adjuster justify the low amount or provide proof that their assessment is incorrect. If the claimant wants, they can enter into negotiations and send several letters that gradually lower the amount they will accept.

Should the claimant decide on the lowest amount they have calculated is fair for their claim?

The claimant should decide on the lowest amount they have calculated is fair for their claim and keep it in mind during negotiations, but not reveal it to the insurance company. If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

Is an insurance company required to give a fair settlement?

The insurance company is not required by law to give a claimant a fair settlement. There are some adjusters who want to treat claimants fairly and some who take advantage of the claimant’s naiveté to offer a less than fair amount.