How to Write a Debt Settlement Offer Letter

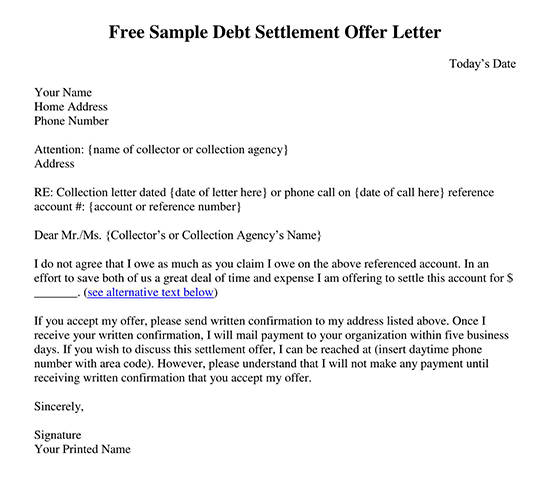

- Write your address information as the header of the letter. Provide your personal information and account number on the header of the debt settlement offer letter for easy identification.

- Outline the amount you wish to pay as settlement. ...

- Give a reason why you are unable to settle. ...

- Write the account you wish to pay on and the date. ...

- Conclude the letter. ...

How should I respond to settlement offer?

How Should I Respond to the First Workers Comp Settlement Offer? Here are some tips for handling the insurer’s opening offer: #1: Ask the Insurer How it Calculated the Offer . A reasonable workers comp settlement should include fair amounts for: Unpaid medical expenses. Future medical bills. Lost wages. The potential for lost earnings in the ...

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How to get money while waiting for a settlement?

- Family. In many cases, family should be the first place you look for financial assistance. ...

- Friends. Sometimes a nearby friend is better than a far away relative. ...

- Church or other Religious Organization. If you have a regular place of worship, make them aware of your need. ...

How to build a settlement offer?

How to Build A Settlement Offer

- Prioritize the Issues. : Make a list of all the issues and organize them by order of priority. ...

- Determine Settlement Ranges. : For each issue, identify what would be your ideal settlement and what is the lowest offer you would accept.

- Filter Your Tone and Arguments. ...

How much should I offer for settlement?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

How do I offer a settlement to a collection agency?

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. The debt collector may still demand to collect the full amount that you owe, but in some cases they may also be willing to take a slightly lower amount that you propose.

What is a settlement proposal?

Settlement proposal means a proposal for effecting settlement of a contract terminated in whole or in part, submitted by a contractor or subcontractor in the form, and supported by the data, required by this part.

How do I write a one time settlement letter?

I am willing to opt for one time settlement in order to close the loan account. I can make the all dues in one payment by ......... (Date). Even though it will be very hard in arranging this money, I am still willing to do it.

Are settlement offers good?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

How do you ask for settlement offer?

6 Tips for Getting the Best Possible Settlement Offer from an Insurance AdjusterHire an attorney. ... Provide your attorney with extensive documentation and evidence. ... Seek care for emotional distress. ... Do not take the first offer. ... Make the adjuster justify the offer. ... Confirm accepted offer in writing.

What is a settlement letter?

This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by. Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors.

What is final settlement letter?

What is Full and Final Settlement (FnF)? When an employee leaves a company, he must be paid for the previous working month. Full and Final Settlement refers to the process of paying or recovering during the resignation process. The last working payroll month, or subsequent months, can be used for final settlement.

How do you write a payment arrangement letter?

I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

What is a debt settlement agreement?

Debt settlement is a means of reducing or eliminating unsecured debt by negotiating an agreed upon payoff amount with creditors. This usually does not occur if a debt is secured, since the lender will have the right to take the property that secures the loan in lieu of payment.

What is calculated in your debt to income ratio?

To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out.

How can a debt lawsuit be dismissed?

In a motion to dismiss, you can ask the judge to throw out any or all of the claims in the lawsuit. The judge will review your claims and issue a ruling. Use SoloSuit to respond to a debt collection lawsuit and win your case.

What is a settlement proposal?

A settlement proposal most commonly refers to an attempt by a person in debt to reduce or eliminate their debt by proposing an alternative to paying the full debt to the creditor. Proposing a settlement is a good idea for someone who is considering bankruptcy or who feels like they can pay some, but not all, of a debt.

How to close a settlement letter?

Close the letter by reiterating that you are not able to pay off the debt, and that this settlement proposal represents your best effort to give the creditor something.

What does it mean to request a debt settlement?

Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

What is a proposal payment?

Propose payment terms, including whether you are seeking a cancellation of the debt or simply a debt reduction and offer a payment schedule. Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

How to settle a debt that is overdue?

Steps. Collect all information on your debts and sort it by date. Decide which debt you want to settle and the amount you can pay. You should choose a debt that is long overdue and which the creditor might reasonably expect will not be paid back. Decide on a figure for your settlement.

Why are creditors open to settlement?

Creditors are often open to settlement proposals as they offer an alternative to settling a debt that might otherwise go unpaid. The steps below will guide you on how to write a settlement proposal and seek good terms for a partial or full debt reduction.

What is a request for a creditor to respond to a proposal?

Request that the creditor respond in writing to your proposal, indicating their acceptance, refusal, or request for new terms.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

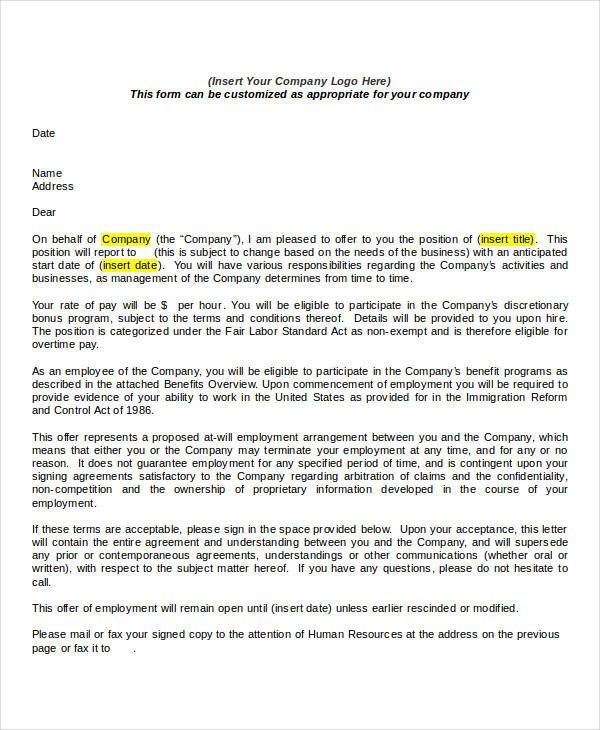

What should be hammered out before writing a settlement agreement?

For example, payment arrangements and logistics should be hammered out before you write the settlement agreement.

What are the situations where a settlement agreement is used?

Some of the most common situations in which a settlement agreement is utilized include: disputes over damaged property; employment disputes between employers and employees; marriage disputes; and medical malpractice disputes.

How to resolve a claim in a settlement agreement?

Negotiate the scope of the release. You must negotiate the scope of the release in the agreement to determine which claims will be resolved, and whether any future claims are also resolved by this settlement agreement. You can negotiate a provision stating that the settlement agreement applies to all claims arising out of the dispute, whether they are current or not yet realized, or the settlement may resolve just one aspect of a suit or a single claim. This will depend on your needs.

How to settle a dispute between two parties?

1. Decide whether you have the need for a settlement agreement. A settlement agreement is a legally enforceable contract. They can be used in a variety of situations where two parties are in dispute about something and they wish to compromise on how that dispute will be resolved.

What is a settlement agreement?

A settlement agreement is a legally binding contract meant to resolve a dispute between yourself and another party so you do not have to go through the judicial process (or extend the judicial process if you are already in court).

How to settle a dispute with a mediator?

1. Agree on a statement of the dispute. Both parties are likely to have a differing view of the dispute. Before writing your settlement agreement, you must come to an agreement of the factual terms of the dispute. A mediator may be helpful in determining this.

What does "unconscionable" mean in a settlement agreement?

A settlement agreement must also not be "unconscionable.". This means that it cannot be illegal, fraudulent, or criminal. For example, you could not agree to settle a lawsuit in exchange for six pounds of cocaine, because the sale of cocaine is illegal in the United States. [11]

What happens if an offer of settlement is not accepted?

If the offer of settlement is not accepted, and the dispute continues , then laws relating to evidence and civil procedure may also apply.

What does "sender" mean in a settlement letter?

Once a party (the "Sender") decides they want to make a settlement offer , they can prepare this letter, setting out the various terms which they are proposing. Within the letter, they can specify how long the offer is open for, meaning that the offer expires on that specified date.

What are some examples of dispute resolution?

For example, let's imagine that Andrew and Beth are involved in a minor car crash, and both allege that the other person caused it.

Why settle a dispute early?

Achieving an early settlement may benefit both parties, by reducing their overall costs, and enabling them to leave the dispute behind them.

What is a deed of release?

Many parties that actually reach an agreement about how the matter will be settled, then prepare a Deed of Release (Mutual) or a Deed of Release (General One Way) to ensure that each party is released from any further obligations in relation to the matter.

What is an offer to settle?

. An offer to settle is a written document that is sent by one partner to the other partner that says what they are willing to agree to in order to settle all or part of the issues. You can make an offer to settle at any time, even if you do not have a court case.

How to take away an offer to settle?

You can take away your offer to settle by giving your partner written notice that you are withdrawing your offer to settle. You can do this at any time before they have accepted your offer to settle. You can also do this whether or not your offer to settle had a time limit.

How to settle a divorce?

1. Decide if you should negotiate 2. Learn about your rights 3. Negotiate fairly 4. Make a written offer to settle 5. Sign your separation agreement. 4. Make a written offer to settle. , it can help if you ask your partner to consider a formal proposal to resolve your issues.

How much money can you settle for 10 years?

of $500 per month for 10 years. But in your offer to settle, you said you would accept less money for a shorter period of time. If your offer is marked “without prejudice”, your trial judge won't know what you said in your offer to settle until after they make their decision. After the trial, the trial judge only looks at offers to decide ...

What happens if you don't include a time limit on an offer?

If you don't include a time limit, the offer is open for your partner to accept until a judge decides your issues. This applies even if you hadn't started your court case when you made your offer. You must sign the offer to settle.

Can you make an offer to settle if you don't have a case?

You can make an offer to settle at any time, even if you do not have a court case. If you later decide to go to court, the judge looks at any offers to settle to help you reach an agreement before you go to a trial. You can put in a time limit. For example, your offer can say that it isn't valid after a certain date and time.

How to write a settlement letter?

Make sure your letter has: 1 Header – this should include your full name and address, as well as the date that the letter has been written. 2 Body – this is where you will explain the details of your settlement offer (amount, dates of payments you will make, and how they will be made) and what you are expecting from your creditor. 3 Contact – your contact details, including a current phone, mobile, and e-mail address. 4 Closing – this is where you will sign the letter

What is a debt settlement offer letter?

This can be done using a debt settlement offer letter. This is a form that is used when the debtor and creditor want to agree to new terms in settling the outstanding debt. The letter is usually sent by the debtor to the creditor and may offer a lump sum that is not the full amount, but one that is agreeable to the creditor to accept ...

What should a debt settlement letter include?

There are some key details that all debt settlement offer letters should have: The full name used for the credit account. Your full address. Your account numbers or a reference number from the creditor. This information is what your creditor will need to pull up all of the relevant details of your account with them.

Why is it important to have a copy of an offer of acceptance from the creditor?

This is why it is important to have a written copy of an offer of acceptance from the creditor as proof, to stop them from trying to come back and claim the balance afterward.

What percentage of debt should be offered to a creditor?

Typically, an offer of between 30% of the debts outstanding balance should be made to a creditor for them to even consider it. The cre4ditor will normally come back with a counteroffer of 50%.

How long does a partial settlement stay on your credit report?

Negative marks on your credit report, such as a partial debt settlement, can stay on your report for 7 years.

Does settling a debt show up on your credit report?

Be sure to keep this confirmation in a safe place because it is your proof of the agreement should a dispute should arise. Note: Settling a debt early (not paying it in full), will show up on your credit report as a partially settled debt, and not a fully settled one.

How to negotiate a settlement offer?

Discuss the Terms of Your Offer. Clearly outline the terms of your settlement offer. Often settlements require confidentiality agreements and a stipulation that both parties will release any legal claims arising from the incident. Include a time frame for the claimant to accept the offer. Be sure to include the date the offer expires in your letter.

Why Offer a Settlement?

Settling a case out of court can save you money, time, and stress. Because a court case can be long-term and expensive , you might decide to settle even if you disagree with the claimant’s version of the incident that caused their loss. A settlement demand letter allows you to express your disagreement and offer a lower settlement amount.

What to do when a claimant sends a demand letter?

Offer a Reasonable Settlement. When a claimant sends a demand letter, they ask for a larger amount of money than they expect to receive. Their demand letter opens negotiation. Your settlement demand letter continues that negotiation. Offer a smaller amount than the claimant demands but large enough to tempt the claimant to settle out of court.

What is a settlement demand letter?

A settlement demand letter is a letter in which the writer expresses their willingness to settle a case out of court and offers a settlement. You might write a settlement demand letter if you have received a claimant’s demand letter and wish to respond with a settlement counteroffer. This letter is a written response to ...

Why do you settle out of court?

Note: You might decide to settle out of court because you are not required to admit guilt to offer a settlement. You can deny responsibility for the incident and still offer to settle. Offering to settle might be preferable to a court case in which a jury determines your guilt or innocence.

How to dispute a claim in a letter?

In the body of your letter, dispute the claim and offer your perspective of the incident. Backup your viewpoint with evidence, such as a police report. Enclose a copy of any evidence you discuss in your letter.