Subject: Early settlement of loan ________ (Loan Number) Respected Sir/ Madam, I would like to inform you that I am _________ (Name) and I do hold a loan account in your branch having account number ___________ (Loan Account number).

Full Answer

What to include in a debt settlement letter?

There are some key details that all debt settlement offer letters should have:

- The full name used for the credit account

- Your full address

- Your account numbers or a reference number from the creditor

How to negotiate a loan settlement?

To settle a private student loan:

- For private student loans, there is no database to see all of your outstanding loans. ...

- Contact your lender to let them know you would like to settle your student loan.

- Use a polite tone to start the conversation off on a positive note.

- Let your private student loan lender make the initial offer. ...

How to write a debt settlement proposal letter?

The Body of the Letter

- First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount.

- Second Paragraph. You’ll use this paragraph to present the details of your settlement offer. ...

- Final Paragraph. ...

- Your Signature. ...

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

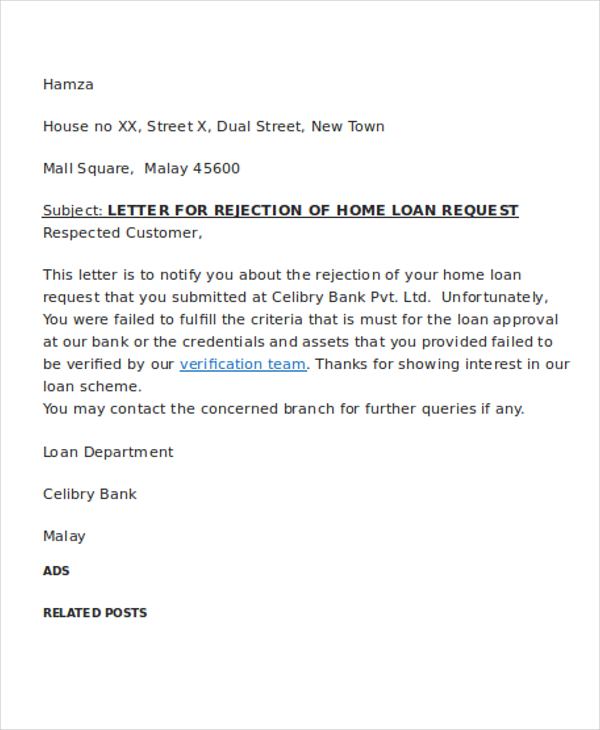

How can I write a letter to bank manager for home loan settlement?

Subject: Request for settlement of my loan. Dear Sir / Madam, I am the holder of Savings/Current Account, A/C No..... (Account Number) in your bank. I was granted a personal loan / business loan / vehicle loan of Rs 10,00,000 by your bank and the repayment period is 5 years and interest rate is 13 percent per annually.

How do you write a letter to close a loan settlement?

Dear Sir/Ma'am, I am Sudharshana Karthik, and I have a personal loan in my account in your bank. I am writing this letter to request you to close my personal loan account with the number 1526xxxxx4656.

How do I write a settlement letter?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How do I write a one time settlement letter?

1) 2) I intend to settle the account under One Time Settlement Scheme. Therefore if you could offer some interest concession, I shall arrange to repay the dues on or before ________________. am agreeable to pay Rs. _____________ as one time settlement of dues.

What is final settlement letter?

When an employee leaves a company, he must be paid for the previous working month. Full and Final Settlement refers to the process of paying or recovering during the resignation process.

What is a loan settlement letter?

A debt settlement letter is a written proposal for you to offer a specific amount of money in exchange for forgiveness of your debt. These letters address why you're unable to pay the debt, how much you're willing to pay now, and what you would like from the creditors in return.

How do you ask for a full and final settlement?

Sub: Request for Full & Final Settlement Dear Sir / Madam, This is to bring your kind notice that I ____________, have given resignation to my job on ________ and I have also cleared all the advances which I have taken during my tenure. So I am requesting you to please issue my full and final settlement amount.

What is the process of one time settlement in banking?

OTS Scheme is a one-time settlement scheme that has been very significant during the pandemic. Through this scheme, if one loan borrower fails to repay the loan to the bank, can get a 25-85% rebate on the same.

How do you negotiate with a bank one time settlement?

1. Evaluate your financial situation 2. Contact your bank or lender 3. Negotiate a settlement agreement 4. Make the payment and close the loanEvaluate your financial situation.Contact your bank or lender.Negotiate a settlement agreement.Make the payment and close the loan.

How do you write a full and final settlement letter?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

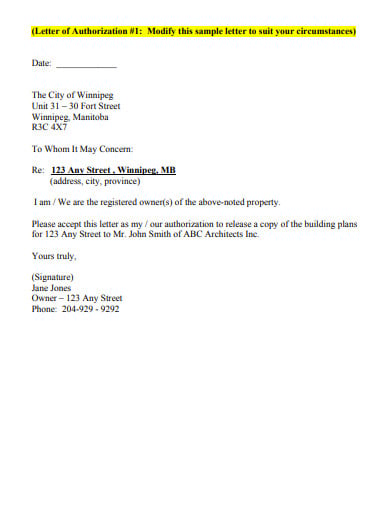

How do I write a settlement agreement?

First, give the document a title that describes the settlement. Next, write a paragraph that identifies all parties involved in the lawsuit and indicates their roles. This should also include their addresses and note that they have the authority and capacity to sign the agreement.

What should be included in a settlement?

9 Things to Include in a Settlement AgreementA Legal Purpose.An Offer.Acceptance of the Terms.Valid Consideration on Both Sides.Mutual Assent.Waiver of Unknown Claims.Resignation.Confidentiality Clause.More items...•

Does a settlement agreement need to be in writing?

A Settlement Agreement can be proposed by either an employer or employee; however, it is usually the employer who makes the first approach. To be legally valid, a Settlement Agreement must: be in writing.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

Why do you need to sign a letter?

Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt. If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

What happens if you miss a payment on a loan?

If you are facing a severe financial crisis and have missed payment of instalment for any loan taken from a bank and if the bank has been pressurizing you too to make the payment, you may request the bank for a one-time-settlement of the loan account by making a payment less than the total outstanding amount.

What to say in a proposal favorably?

I hope your goodself will appreciate my financial situation and consider my proposal favorably . I kindly request you to settle the issue for the amount suggested by me please.

What information do you need to fill out on a sandbox?

Fill in your contact details, account number and any extra information you want to include in the grey shaded areas.

Can you write a letter in your own name?

You can choose to send a letter in your own name or in joint names. You may have a debt in joint names, or want to write to your creditors together because you have worked out a joint budget.

What is a debt settlement request letter?

Writing a debt settlement request letter is a good way to negotiate your debt and to agree on a new financial agreement to either pay down or pay off your financial obligations.

Why do we need a debt settlement letter?

Writing a well-written debt settlement letter is a great tool if you’re seeking a plausible solution to protect your credit score or avoid bankruptcy.

What to do when creditor agrees to offer?

When the creditor agrees to your offer, it’s crucial that you keep up with your payment plan. Develop a budget and stick to it at all costs.

Can anything you say in a letter be held against you?

Therefore, anything you say in your letter can be held against you in the event you have to go to court and face legal action.

Is it bad to pay off a debt without a written statement?

In terms of credit reporting, debt buying, and debt collection, paying off a debt without a documented written statement could prove to be a huge mistake.